Contract Management Software for Credit Counseling Agencies that takes the hassle out of your agreement process

What makes pdfFiller an excellent Contract Management Software for Credit Counseling Agencies?

Trusted contract management software

Simplify your tasks with Contract Management Software for Credit Counseling Agencies

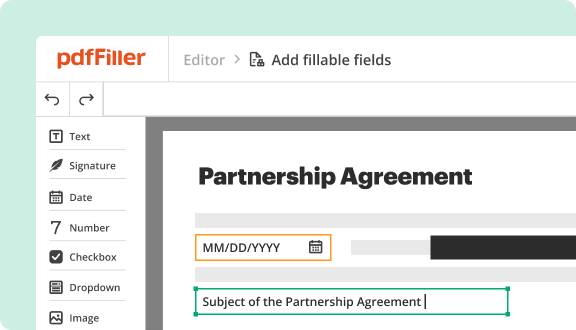

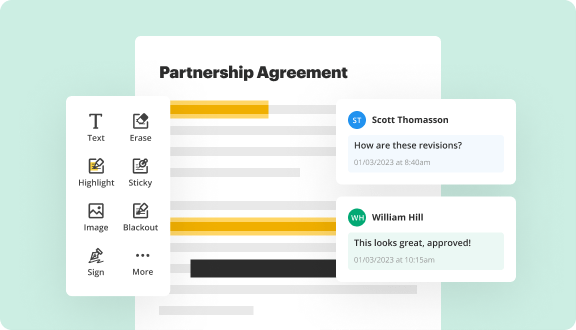

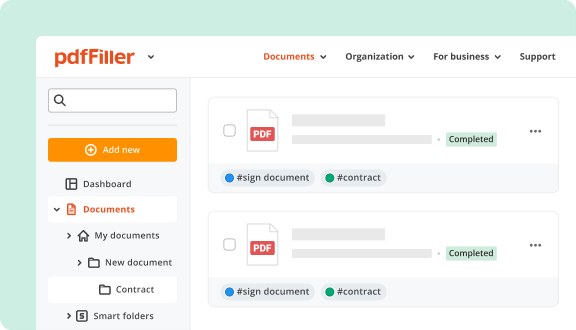

Maintaining your files organized and updated is important for achieving the best results. Without the proper software in your hands, you can struggle to overcome some of the most typical difficulties companies encounter: missing or duplicated documents, manual faults, lost data, and many others. Our Contract Management Software for Credit Counseling Agencies handles all of your document generation, modifying, and storage needs without additional or concealed charges. Simplify your document management across sectors and assist in easy collaboration and communication.

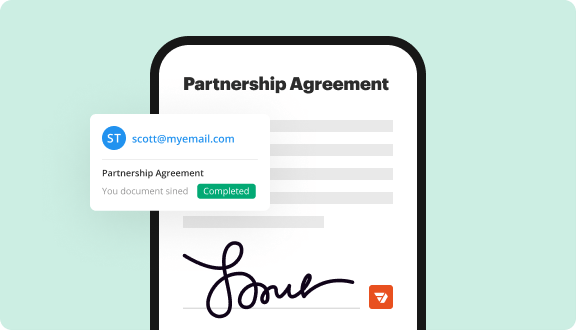

Create certified and secure tools to your routine tasks and deal with even the most intricate document workflow like a piece of cake. Link your workflows with other popular software, deal with your records on desktop or mobile, and send your documents for notarization with no trouble. Reclaim working hours and redirect your team’s focus on other relevant tasks instead of struggling with document and form management.

How to effectively use our Contract Management Software for Credit Counseling Agencies

Make best use of your day-to-day processes with Credit Counseling Agencies Contract Management Software. Go eco-friendly with your paper-dependent processes and secure your spot among top organizations. Ensure your documents are precise and delivered to the proper users. Obtain a free profile and discover the benefits of online document managing right now!

Video guide about Contract Management Software for Credit Counseling Agencies

Every contract management tool you need to move your business forward

Why pdfFiller wins

Cloud-native PDF editor

Top-rated for ease of use

Unlimited document storage

Unmatched cost-to-value

Industry-leading customer service

Security & compliance

Streamline Your Agreement Process with Our Contract Management Software

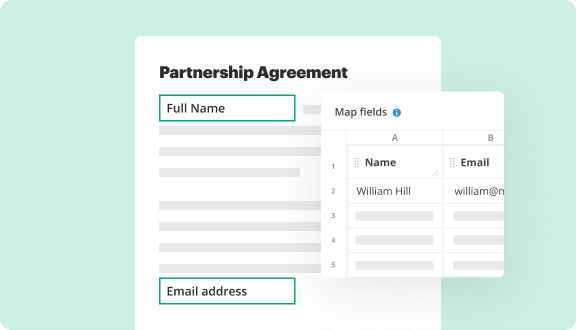

Our Contract Management Software for Credit Counseling Agencies simplifies the way you handle agreements. With its user-friendly design, you can manage contracts effortlessly, allowing you to focus on helping your clients. Say goodbye to paperwork and tedious processes; it is time to enhance your efficiency.

Key Features

Use Cases and Benefits

Our software addresses your challenges directly. By automating contract management, you can eliminate the chaos associated with manual tracking and filing. You gain peace of mind knowing that every agreement is organized and up-to-date. Ultimately, this solution empowers you to serve your clients better, ensuring that you meet their needs without unnecessary delays.