Contract Management Tool for Debt Relief Companies that takes the hassle out of your agreement process

What makes pdfFiller an excellent Contract Management Tool for Debt Relief Companies?

Trusted contract management software

Streamline your tasks with Contract Management Tool for Debt Relief Companies

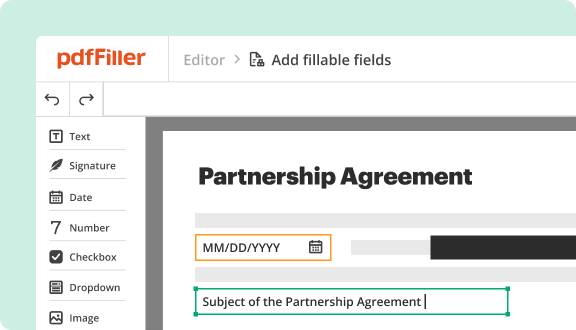

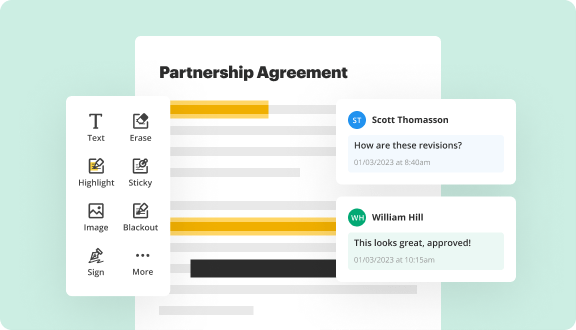

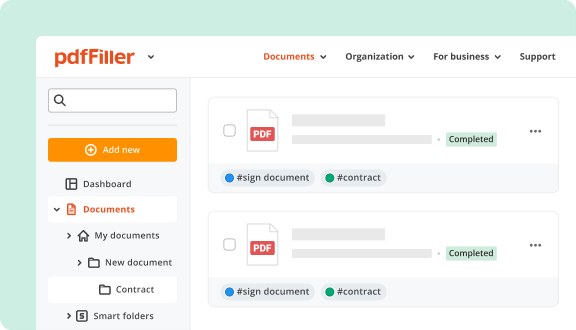

Keeping your documents organized and up-to-date is crucial for reaching the best results. Without the proper solution in your hands, you may struggle to overcome some of the most typical problems organizations face: missing or duplicated copies, manual mistakes, lost information, and many others. Our Contract Management Tool for Debt Relief Companies deals with all your document generation, editing, and storage requirements without extra or concealed costs. Improve your document management across sectors and help effortless collaboration and communication.

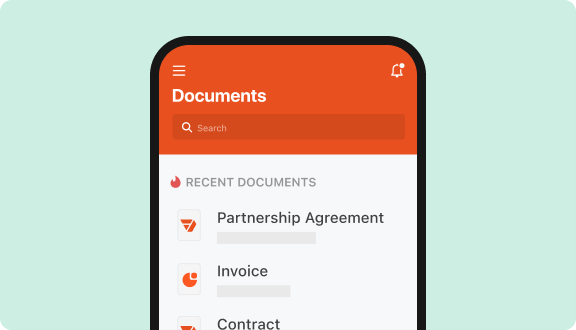

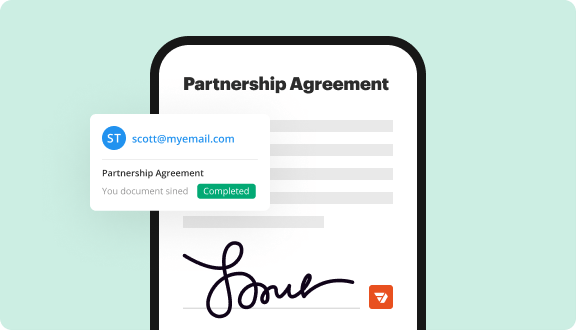

Create certified and secure resources to your regular tasks and manage even the most intricate document workflow like a piece of cake. Link your workflows with other popular software, handle your files on desktop or smartphone, and deliver your documents for notarization with ease. Reclaim working hours and redirect your team’s focus on other relevant tasks instead of struggling with document operations.

How to use our Contract Management Tool for Debt Relief Companies

Make best use of your daily processes with Debt Relief Companies Contract Management Tool. Go eco-friendly with your paper-based processes and secure your place among top businesses. Ensure your documents are precise and sent to the correct users. Obtain a free account and discover the advantages of online document management today!

Video guide about Contract Management Tool for Debt Relief Companies

Every contract management tool you need to move your business forward

Why pdfFiller wins

Cloud-native PDF editor

Top-rated for ease of use

Unlimited document storage

Unmatched cost-to-value

Industry-leading customer service

Security & compliance

Contract Management Tool for Debt Relief Companies

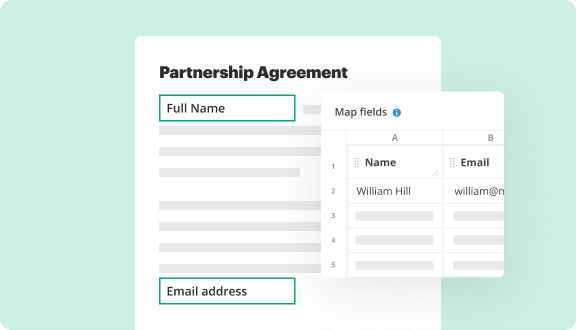

Managing contracts can be a complex task, especially for debt relief companies. Our Contract Management Tool simplifies this process, allowing you to focus on helping your clients more effectively. With our tool, you can streamline agreement workflows, reduce errors, and enhance compliance.

Key Features

Potential Use Cases and Benefits

In summary, our Contract Management Tool addresses your challenges by streamlining the contract process. You can minimize worries about missed deadlines, ensure compliant agreements, and focus on what matters most—helping your clients achieve financial freedom.