Maximize your efficiency with pdfFiller's comprehensive Document Analytics Solution for Hedge Fund Companies

What makes pdfFiller an outstanding Document Analytics Solution for Hedge Fund Companies?

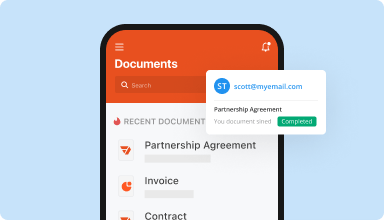

Trusted document tracking software

Automate the process of accessing, searching, and editing documents

Why pdfFiller wins

pdfFiller streamlines document management and tracking across industries

Stay on top of your paperwork with our Document Analytics Solution for Hedge Fund Companies

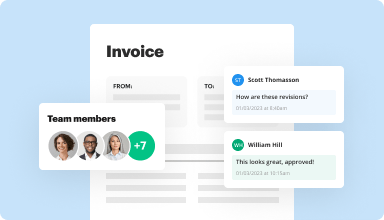

Misplaced documents, safety issues, limited storage space, and inefficient document workflows - sound all too familiar for Hedge Fund Companies? Using Document Analytics Solution that can also be leveraged as a collaboration platform could make a world of difference to your business. These online production tools ultimately work like a “document assembly line” that advances your paperwork through your company’s teams, allowing each to add value and accuracy that perfects your final product.

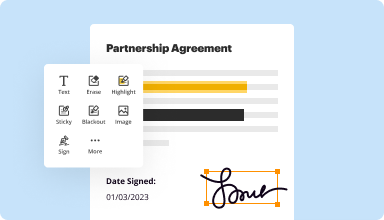

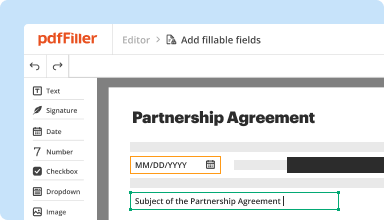

With pdfFiller, our tailor-made Document Analytics Solution for Hedge Fund Companies, you’ll get everything you need to change inefficiencies and roadblocks into more structured and orderly document-driven operations. pdfFiller brings together document management, eSigning, data collection, document execution, and so much more under one roof. Let’s take a closer look at what it provides.

How pdfFiller can transform your document-based workflows

Use our Document Analytics Solution for Hedge Fund Companies to boost how you handle, store, and collaborate on files. Transform your organization into a more streamlined, secure, and cooperative environment. Keep up with your competition - start examining our powerful tracking and collaboration suite today!