Maximize your efficiency with pdfFiller's comprehensive Document Analytics Solution for Mortgage Finance Officers

What makes pdfFiller an outstanding Document Analytics Solution for Mortgage Finance Officers?

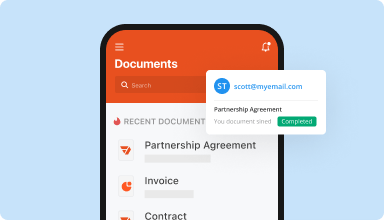

Trusted document tracking software

Automate the process of accessing, searching, and editing documents

Why pdfFiller wins

pdfFiller streamlines document management and tracking across industries

Stay on top of your paperwork with our Document Analytics Solution for Mortgage Finance Officers

Misplaced documents, safety issues, limited storage space, and inefficient document workflows - seem all too relatable for Mortgage Finance Officers, doesn’t it? Using Document Analytics Solution that can also be leveraged as a collaboration option could make a world of difference to your organization. These online production tools ultimately function like a “document assembly line” that advances your documents through your company’s teams, allowing each to add value and accuracy that perfects your final product.

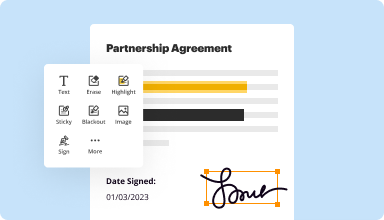

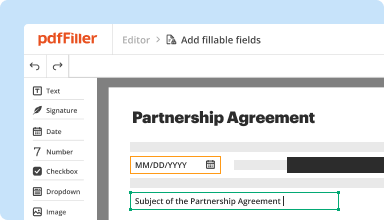

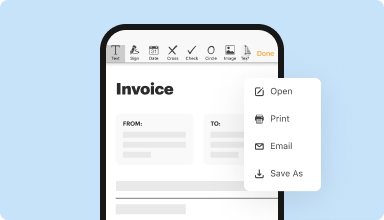

With pdfFiller, our tailor-made Document Analytics Solution for Mortgage Finance Officers, you’ll get all you need to change inefficiencies and roadblocks into more organized and orderly document-driven operations. pdfFiller combines document management, eSigning, data gathering, document approval, and so much more under one roof. Let’s take a closer look at what it offers.

How pdfFiller can improve your document-based workflows

Use our Document Analytics Solution for Mortgage Finance Officers to boost how you manage, store, and collaborate on documents. Turn your business into a more streamlined, safe, and cooperative environment. Keep up with your competition - start examining our powerful tracking and collaboration set of tools today!