Swift Document Automation Solution for Investment Banks

What makes pdfFiller an outstanding Document Automation Solution for Investment Banks?

Trusted document automation software

Eliminate manual paperwork hassles with an automated PDF solution

Why pdfFiller wins

pdfFiller automates document processes across industries

Minimize manual paperwork using this Document Automation Solution for Investment Banks

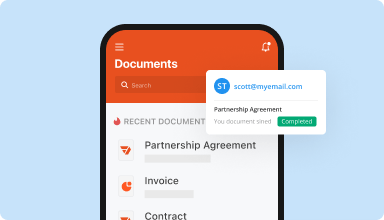

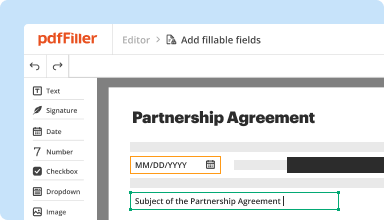

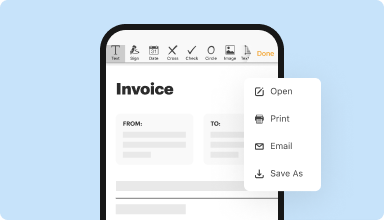

Explore the transformative potential of pdfFiller’s document automation functionality, created to take your productivity to new levels. Get more work done with intuitive document automation tools right in your PDF editor. From role distribution to document routing, each feature is made to save time and reduce manual effort.

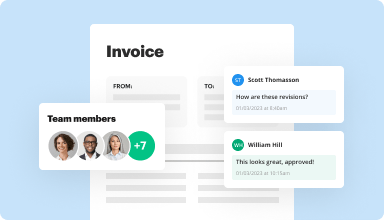

But the advantages of this Document Automation Solution for Investment Banks go beyond efficiency. Personalize document routes to fit your exclusive requirements, handle the file’s accessibility, and assign roles for activating automated actions with the form. No matter if you’re generating contracts, processing invoices, or handling client onboarding, pdfFiller adapts to you, enhancing your capability to deliver excellent results. Adhere to these steps to simplify your paperwork routine.

Getting started with your Document Automation Solution for Investment Banks

Step into a world where document management is no longer a routine but a competitive edge. Start your journey with pdfFiller today, and experience the improvement in how you work, grow, and succeed.