Document Generation System for Refinancing Companies that puts time back into your workday

What makes pdfFiller an excellent Document Generation System for Refinancing Companies?

Trusted document generation solution

User-friendly and flexible Document Generation System for Refinancing Companies

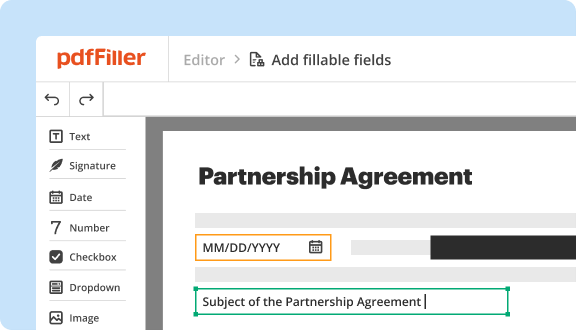

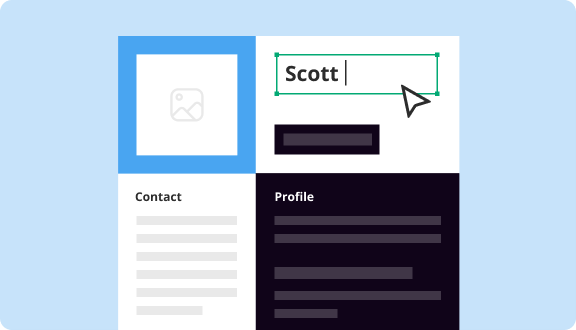

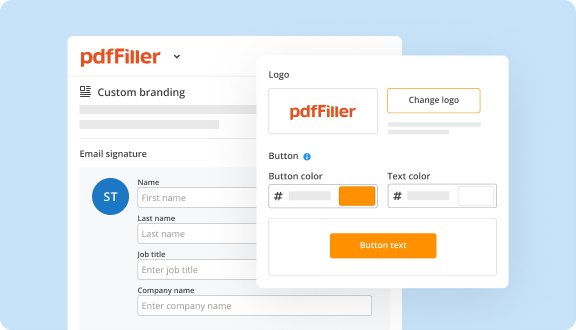

No matter whether you’re taking care of HR processes or preparing sales contracts, your documents need to be structured and professional-looking. Even the most refined expert may find it difficult to deal with paperwork and forms if they do not possess the appropriate document solution. Fortunately, pdfFiller’s Document Generation System for Refinancing Companies streamlines this process in seconds. Create, modify, eSign and safely store your documents without moving in between countless apps or spending money on obsolete features. Put your document-centered processes on the right track from day one of employing the solution.

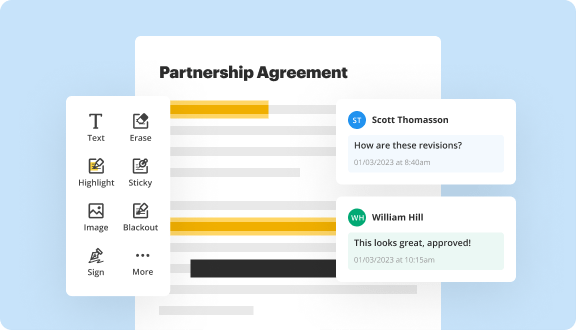

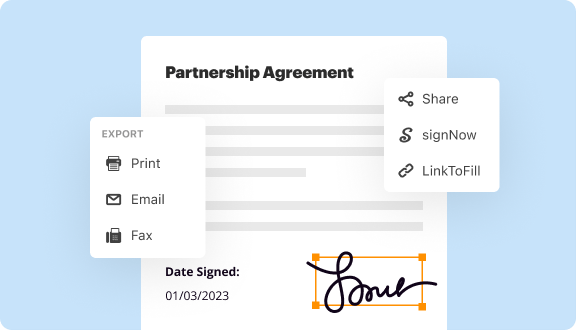

Get a superior Refinancing Companies Document Generation System. Facilitate document collaboration and communication across your company, paving the way for faster document turnaround and process transparency. Effortlessly track your document’s progress, remove manual mistakes, and enhance process quality and productivity.

Six basic steps to make use of Document Generation System for Refinancing Companies

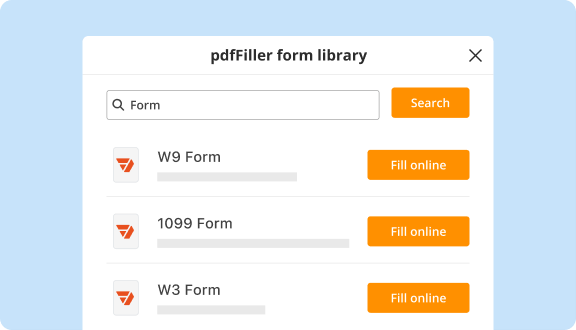

Discover the most appropriate and compliant tools and features that make PDF document managing fast, practical, and secure. Generate reusable document Templates, share them with your team, and invite people to work on high-priority documents. Start your free trial and investigate Document Generation System for Refinancing Companies today.

Video guide about Document Generation System for Refinancing Companies

Every document generation tool you need to move your business forward

Why pdfFiller wins

Cloud-native PDF editor

Top-rated for ease of use

Unlimited document storage

Unmatched cost-to-value

Industry-leading customer service

Security & compliance

Document Generation System for Refinancing Companies

Transform your workflow with our Document Generation System designed specifically for refinancing companies. This tool puts time back into your workday, allowing you to focus on what truly matters—servicing your clients and growing your business.

Key Features

Potential Use Cases and Benefits

In a fast-paced industry, time is valuable. Our Document Generation System eliminates tedious tasks, allowing you to produce documents in minutes instead of hours. By automating your processes, you reduce errors and enhance precision. Thus, you can confidently serve your clients while knowing your documentation is accurate and compliant. This system not only addresses your operational challenges but also empowers you to take control of your time, focus on client relationships, and grow your business.