Your top Document Sharing System for Credit Counseling Agencies

What makes pdfFiller an outstanding Document Sharing System for Credit Counseling Agencies?

Trusted document editing and sharing software

Create, edit, and share documents securely with an end-to-end PDF solution

Why pdfFiller wins

pdfFiller streamlines document processes across industries

How to leverage the best Document Sharing System for Credit Counseling Agencies

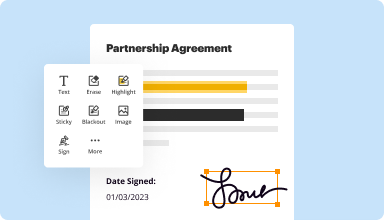

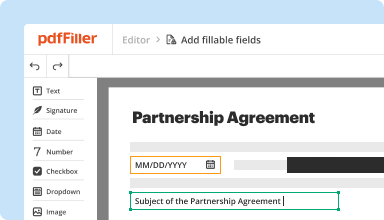

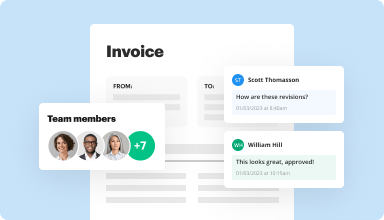

Unlock all the possibilities of document management with pdfFiller’s cutting-edge capabilities for effective distribution and collaboration on files. Effectiveness and connectivity are key for solutions like this Document Sharing System for Credit Counseling Agencies, and pdfFiller is your dependable partner in reaching just that. Check out the intuitiveness and convenience of having the ability to share important paperwork with team members, customers, or partners anytime, anywhere, and on any device.

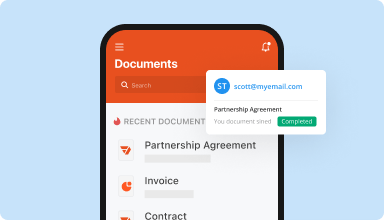

With real-time updates and notifications, you’re always in the loop, ensuring that tasks move forward seamlessly. This platform empowers teams to work with each other better, fostering a collaborative environment that brings success. Additionally, pdfFiller ensures that your documents are shared and kept safely. With advanced encryption and permission settings, you control who opens or modifies your PDFs, safeguarding your sensitive information.

Steps to get started with your Document Sharing System for Credit Counseling Agencies

Embrace the effectiveness of pdfFiller’s features and enhance your document-based workflows. Elevate your productivity, boost collaboration, and secure your paperwork in one platform. Start your journey towards unparalleled effectiveness and connectivity by registering your account today.