Your top Document Sharing Tool for Payday Loan Companies

What makes pdfFiller an outstanding Document Sharing Tool for Payday Loan Companies?

Trusted document editing and sharing software

Create, edit, and share documents securely with an end-to-end PDF solution

Why pdfFiller wins

pdfFiller streamlines document processes across industries

How to use the most effective Document Sharing Tool for Payday Loan Companies

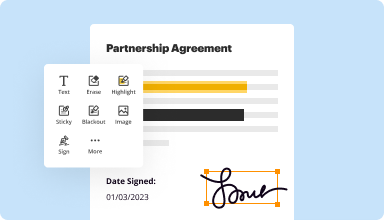

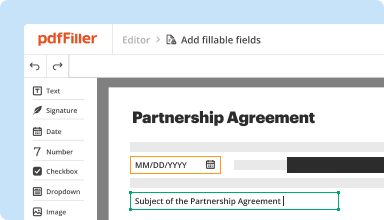

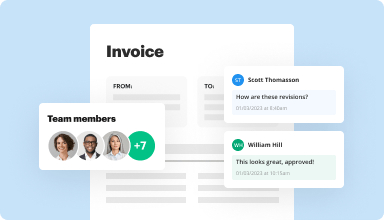

Exploit the full potential of document management with pdfFiller’s state-of-the-art capabilities for effective distribution and collaboration on files. Effectiveness and connectivity are critical for solutions like this Document Sharing Tool for Payday Loan Companies, and pdfFiller is your trustworthy partner in achieving just that. Discover the ease and convenience of being able to share important paperwork with colleagues, clients, or partners anytime, anywhere, and on any device.

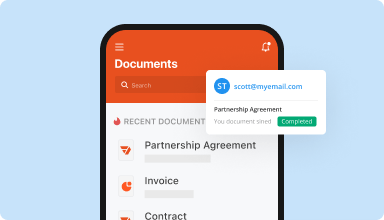

With real-time updates and notifications, you’re always in the loop, ensuring that tasks move forward seamlessly. This platform enables teams to work together better, fostering a collaborative environment that leads to great outcomes. In addition, pdfFiller ensures that your forms are distributed and stored safely. With advanced encryption and permission settings, you control who views or edits your PDFs, safeguarding your sensitive data.

Steps to get started with your Document Sharing Tool for Payday Loan Companies

Embrace the power of pdfFiller’s features and transform your document-based workflows. Increase your productivity, boost collaboration, and secure your paperwork in one platform. Start your journey towards exceptional effectiveness and connectivity by registering your account now.