Insert Calculations Into Debenture

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

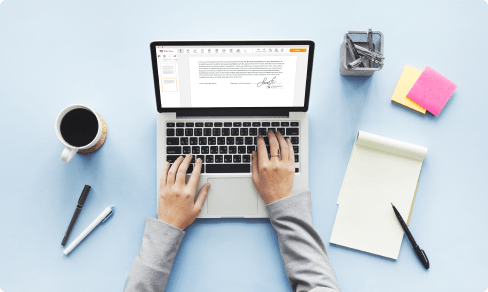

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

Introducing Debenture Insert Calculations Feature

Are you looking to streamline your financial calculations? Our new Debenture Insert Calculations feature is here to help!

Key Features:

Efficiently calculate debenture insertions

Automatically input data for accurate results

Customize calculations based on your needs

Potential Use Cases and Benefits:

Save time on manual calculations

Reduce errors in debenture insertions

Gain insights into financial data with precision

Say goodbye to complex calculations and hello to streamlined financial processes with our Debenture Insert Calculations feature!

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

How to Insert Calculations Into Debenture

01

Go into the pdfFiller site. Login or create your account for free.

02

Having a protected internet solution, you are able to Functionality faster than ever.

03

Go to the Mybox on the left sidebar to get into the list of your files.

04

Pick the sample from your list or press Add New to upload the Document Type from your desktop computer or mobile phone.

As an alternative, it is possible to quickly transfer the necessary template from well-known cloud storages: Google Drive, Dropbox, OneDrive or Box.

As an alternative, it is possible to quickly transfer the necessary template from well-known cloud storages: Google Drive, Dropbox, OneDrive or Box.

05

Your form will open inside the function-rich PDF Editor where you could change the sample, fill it out and sign online.

06

The powerful toolkit allows you to type text on the document, insert and edit photos, annotate, and so forth.

07

Use superior functions to incorporate fillable fields, rearrange pages, date and sign the printable PDF form electronically.

08

Click on the DONE button to complete the adjustments.

09

Download the newly created file, share, print out, notarize and a lot more.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Anonymous Customer

2015-01-17

please inform people it isnt a free service before they spend hours doing something that may be important and they are required to pay your ransom for printing and saving.

Sandy M

2017-10-18

very user friendly; started using right away & learning along the way which is all I have time for right now.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you calculate debenture yield?

There are two ways of looking at bond yields - current yield and yield to maturity. This is is the annual return earned on the price paid for a bond. It is calculated by dividing the bond's coupon rate by its purchase price.

What is the formula for calculating current yield?

Calculating Current Yield The current yield is equal to the annual interest earned divided by the current price of the bond. Suppose a bond has a current price of $4,000 and a coupon of $300. Divide $300 by $4,000, which equals 0.075. Multiply 0.075 by 100 to state the current yield as 7.5 percent.

How do you calculate market yield?

Money market yield is calculated by taking the holding period yield and multiplying it by a 360-day bank year divided by days to maturity. It can also be calculated using a bank discount yield.

How is yield price calculated?

Current Yield This is is the annual return earned on the price paid for a bond. It is calculated by dividing the bond's coupon rate by its purchase price.

How do you calculate capital gain yield?

The capital gains yield formula uses the rate of change formula. Calculating the capital gains yield is effectively calculating the rate of change of the stock price. The rate of change can be found by subtracting an ending amount from the original amount then divided by the original amount.

How do you calculate effective yield?

Breaking Down Effective Yield It is calculated by dividing the coupon payments by the current market value of the bond. The yield to maturity (YTM) is the rate of return earned on a bond that is held until maturity. It is a bond equivalent yield (BEY), not an effective annual yield (EAY).

How do you calculate effective annual yield?

In this example, the annual effective yield is calculated thus: Annual percentage yield = (1.03)^12 - 1 = .43 = 43%, where 1.03 is 1 plus the monthly interest and 12 is the number of times in a year interest is compounded. It is also known as the annual effective yield.

How do you calculate interest yield?

Determining Yield Over Time Annual percentage rate can be reported in one of two ways: a simple APR is determined by multiplying the interest rate by the number of payment periods. For example: 1% * 12 = 12% simple APR. But in the prior example, the actual APR is 12.68 percent, once yield calculations are measured.

How do you calculate net effective interest rate?

The effective interest rate is calculated through a simple formula: r = (1 + i/n)^n - 1. In this formula, r represents the effective interest rate, i represents the stated interest rate, and n represents the number of compounding periods per year.

How do you calculate quoted yield?

Money market yield is calculated by taking the holding period yield and multiplying it by a 360-day bank year divided by days to maturity. It can also be calculated using a bank discount yield.

Other ready to use document templates

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.