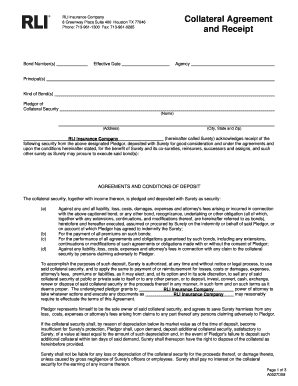

Customize and complete your essential Collateral Agreement template

Prepare to streamline document creation using our fillable Collateral Agreement template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

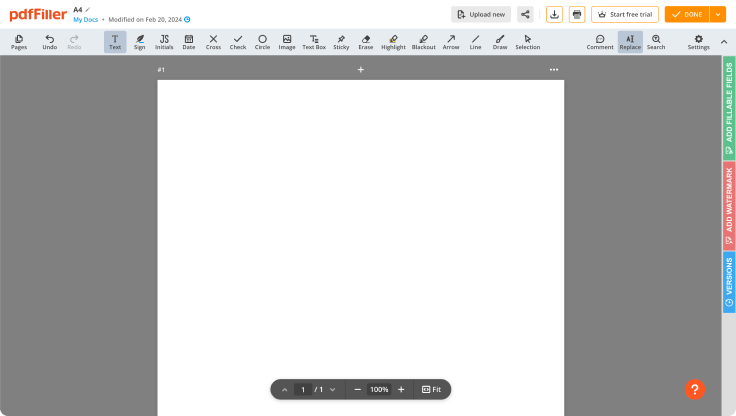

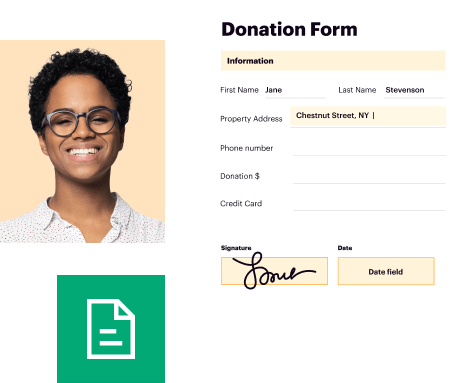

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

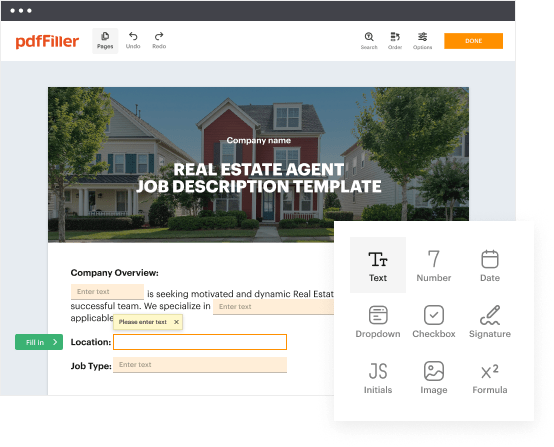

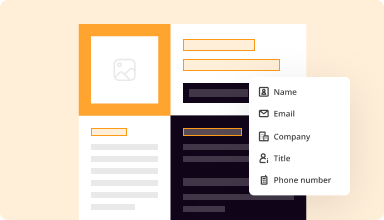

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

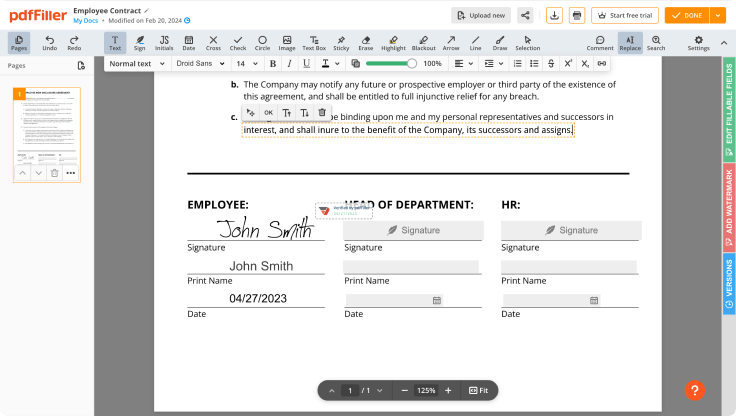

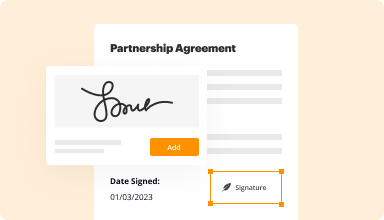

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

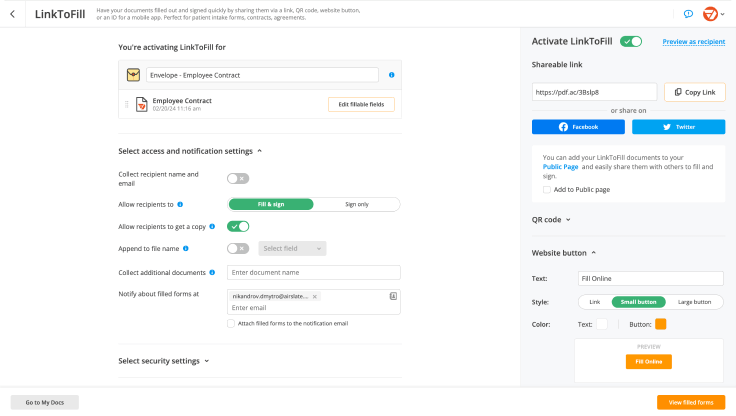

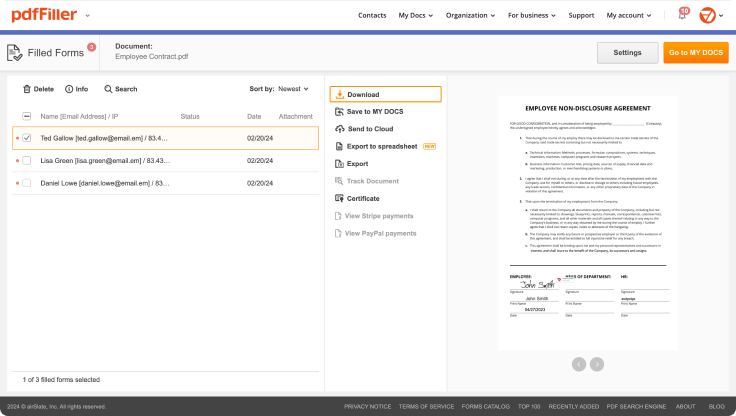

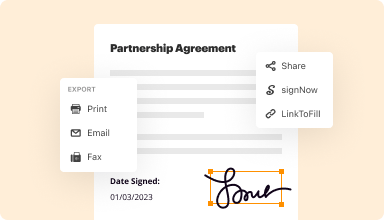

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

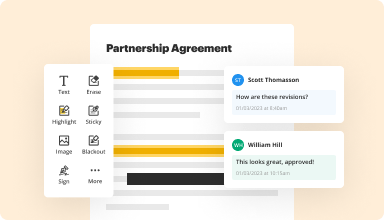

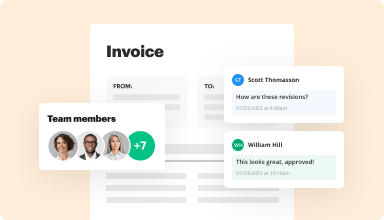

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

Customize Your Essential Collateral Agreement Template

Streamline your business transactions with our tailored Collateral Agreement template. This feature allows you to easily create agreements that meet your specific needs. Save time and reduce frustration with a customizable solution designed for you.

Key Features

Fully customizable templates for various collateral agreements

User-friendly interface that simplifies the editing process

Option to include specific terms and conditions

Downloadable formats including PDF and Word

Guided prompts to assist in completing your agreement

Potential Use Cases and Benefits

Secure loans with a clear, mutual understanding of terms

Facilitate real estate transactions with precise agreements

Enhance business partnerships by outlining collateral details

Aid in risk management by clearly defining asset ownership

Reduce legal disputes through well-documented agreements

This customizable template solves your problem by providing clarity and consistency in your agreements. You can focus on your business while ensuring that the legal aspects are handled efficiently. This feature simplifies the process, saves you time, and enhances your professionalism.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to build a Collateral Agreement

Creating a Collateral Agreement has never been easier with pdfFiller. Whether you need a professional forms for business or individual use, pdfFiller offers an intuitive platform to generate, edit, and manage your paperwork efficiently. Employ our versatile and editable web templates that align with your precise requirements.

Bid farewell to the hassle of formatting and manual editing. Utilize pdfFiller to easily craft polished documents with a simple click. Begin your journey by using our detailed guidelines.

How to create and complete your Collateral Agreement:

01

Sign in to your account. Access pdfFiller by signing in to your account.

02

Find your template. Browse our complete catalog of document templates.

03

Open the PDF editor. When you have the form you need, open it up in the editor and take advantage of the editing tools at the top of the screen or on the left-hand sidebar.

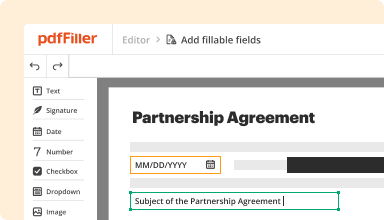

04

Insert fillable fields. You can choose from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Include text, highlight areas, add images, and make any necessary changes. The intuitive interface ensures the procedure remains easy.

06

Save your edits. When you are happy with your edits, click the “Done” button to save them.

07

Submit or store your document. You can deliver it to others to sign, download, or securely store it in the cloud.

To summarize, creating your documents with pdfFiller templates is a straightforward process that saves you efforts and guarantees accuracy. Start using pdfFiller right now to benefit from its powerful features and effortless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is an example of a collateral document?

Examples of collateral documents are a security agreement, guarantee and collateral agreement, pledge agreement, deposit account control agreement, securities account control agreement, mortgage, and UCC-1s.

What is the meaning of collateral agreement?

A collateral agreement transfers all or some of the rights of the owner of personal property (including a life insurance policy) to another party (the assignee) as security for the repayment of an indebtedness.

How to include collateral in a contract?

A contract for a collateral loan should clearly state what asset(s) are being used to secure the loan and include a clause on what could happen to the asset if the borrower defaults. It should also clearly outline the circumstances under which the collateral could be forfeited to the lender.

How do I write a loan agreement with collateral?

A contract for a collateral loan should clearly state what asset(s) are being used to secure the loan and include a clause on what could happen to the asset if the borrower defaults. It should also clearly outline the circumstances under which the collateral could be forfeited to the lender.

How do I fill out a loan agreement?

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

What is the formation of a collateral contract?

A collateral contract is one where the parties to one contract enter into or promise to enter into another contract. Thus, the two contracts are connected and it may be enforced even though it forms no constructive part of the original contract.

What is an example of a collateral contract?

For example, if Johnny Clean agrees to wash Ms. Robinson's car for 100 dollars, and then he washes her car, she is obligated to pay the $100. Why? Because they agreed to each give up something and get something.

How to create a collateral contract?

Elements of a Collateral Contract the statement or document must have been promissory; the parties did not intend for the statement or document to be part of the main contract; the statement or document must be consistent with the main contract; you must provide consideration for the promise; and.

What is the collateral of a loan agreement?

Collateral is something a borrower promises to a lender in case they can't repay the loan. For home, personal, or business loans, lenders usually require collateral. If the borrower defaults on the loan, the lender can claim the assets offered as collateral. This claim is called a lien.

How do I write a simple loan agreement?

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

How to write a letter of loan agreement?

How to Write a Loan Agreement Step 1 Name the Parties. Step 2 Write Down the Loan Amount. Step 3 Specify Repayment Details. Step 4 Choose How the Loan Will Be Secured (Optional) Step 5 Provide a Guarantor (Optional) Step 6 Specify an Interest Rate. Step 7 Include Late Fees (Optional)