Customize and complete your essential Loan Agreement template

Prepare to streamline document creation using our fillable Loan Agreement template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

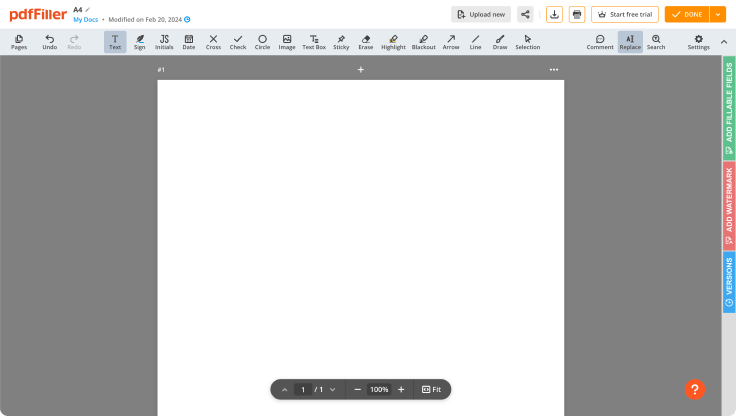

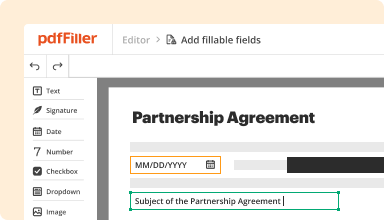

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

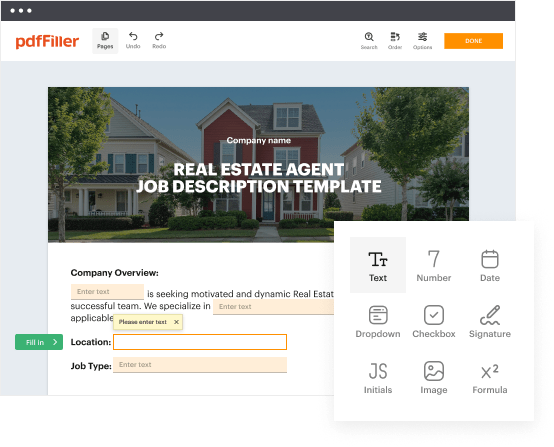

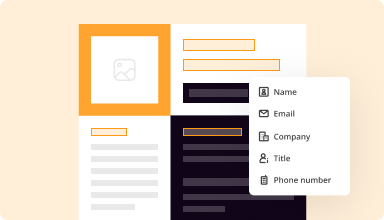

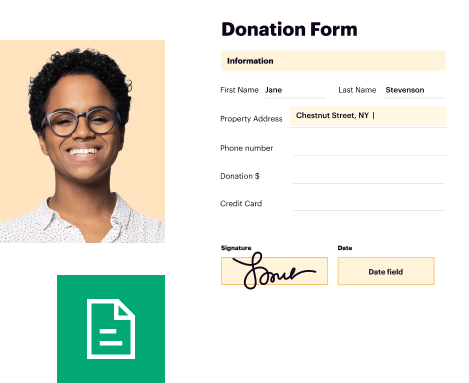

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

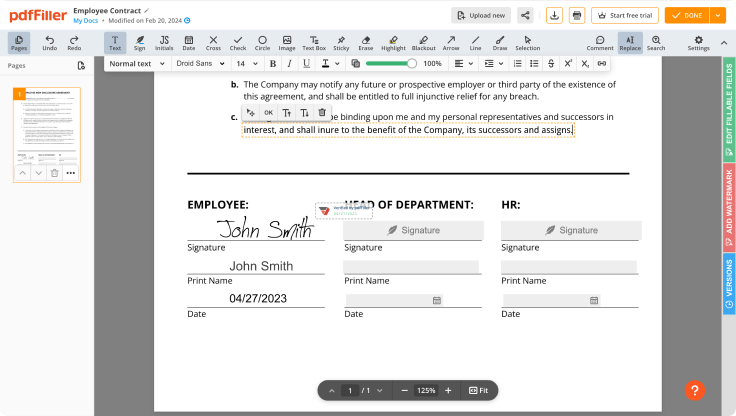

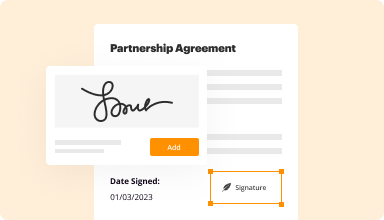

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

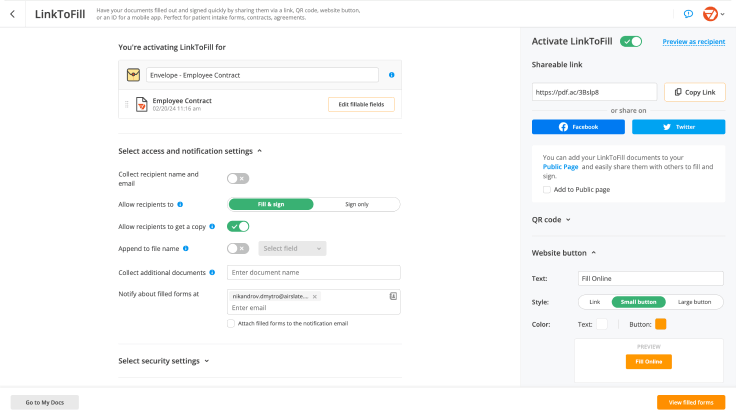

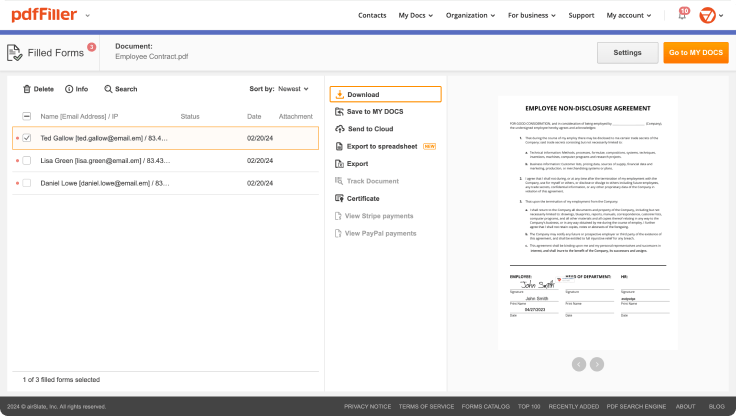

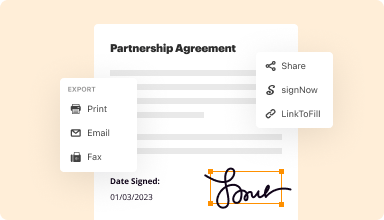

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

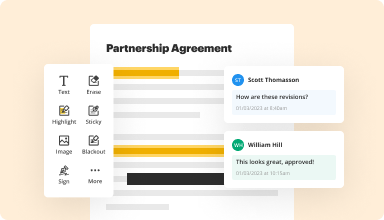

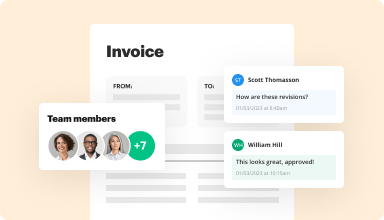

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

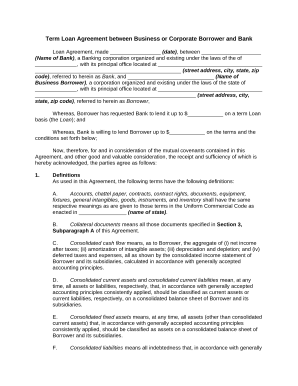

Essential Loan Agreement Template

Customize and complete your essential Loan Agreement template with ease and confidence. This feature allows you to create a tailored loan agreement that meets your specific needs. With this tool, you can address your requirements without hassle.

Key Features

User-friendly customization options

Pre-defined clauses for various loan types

Easy document editing and formatting

Secure storage and sharing capabilities

Compliance with local laws and regulations

Potential Use Cases and Benefits

Personal loans between friends or family

Business loans for startups or established companies

Real estate transactions requiring clear agreements

Peer-to-peer lending arrangements

Educational loans for students and parents

This Loan Agreement template addresses your need for clarity and security in lending and borrowing. By providing a customizable framework, you can structure your agreements to reflect the terms and conditions that suit both parties. It simplifies the agreement process while ensuring that all essential elements are included and compliant, thus protecting your interests.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to create a Loan Agreement

Creating a Loan Agreement has never been so easy with pdfFiller. Whether you need a professional forms for business or personal use, pdfFiller offers an instinctive platform to create, customize, and handle your paperwork effectively. Employ our versatile and editable templates that align with your precise needs.

Bid farewell to the hassle of formatting and manual customization. Employ pdfFiller to smoothly craft polished forms with a simple click. Start your journey by following our comprehensive guidelines.

How to create and complete your Loan Agreement:

01

Sign in to your account. Access pdfFiller by logging in to your account.

02

Search for your template. Browse our comprehensive catalog of document templates.

03

Open the PDF editor. When you have the form you need, open it up in the editor and take advantage of the editing tools at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can select from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Include text, highlight areas, insert images, and make any necessary adjustments. The intuitive interface ensures the procedure remains easy.

06

Save your edits. Once you are satisfied with your edits, click the “Done” button to save them.

07

Submit or store your document. You can send it to others to eSign, download, or securely store it in the cloud.

To summarize, creating your documents with pdfFiller templates is a straightforward process that saves you efforts and guarantees accuracy. Start using pdfFiller right now to take advantage of its robust features and effortless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I arrange a loan between family members?

What to include in the family loan agreement. The family loan agreement should include details such as a time frame for when the sum is expected to be paid back by, any interest (if applicable) and any consequences for missed payments you may choose to set a fixed penalty or an interest charge for example.

How to write a loan agreement between families?

Family loan agreement The amount of money being lent. State this in numbers and letters to avoid claims of miscommunication. The date the money is to be lent and returned. Be specific. The interest rate you're charging for the loan. The repayment schedule that the borrower must follow.

How to write a contract between families?

Guidelines for creating a family contract Your family contract will be most effective if you write it together. Keep your contract simple. Consider including the following elements: Date of agreement. Follow through with the consequences of the contract. Keep a business like approach to the contracting process.

How to write a simple loan agreement?

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

How to draw up a loan agreement between friends?

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

How to make loan agreement template word?

Hereby, the Parties agree that the Lender will lend ______________ to the Borrower as per this Agreement. The Payment is due every _______________________. The Parties hereby agree that the Borrower promises to pay the Lender ______________ and the interest within ______________.

How to write up a loan agreement between family members?

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

How to create a loan agreement?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How to write a loan agreement between two parties?

The Parties agree the Lender will loan the Borrower $_____________________ (the “Loan”). Interest Rate. The Parties agree the Interest Rate for this loan shall be ____% to be accrued monthly. Loan Term. This Loan shall be for a period of ____ years/months. Repayment.

How to structure a loan to a friend?

At a minimum, your loan contract should include: Your name and the borrower's name. The date the loan was granted. The amount of money being lent. Minimum monthly payment. Payment due date. Interest rate, if you're charging interest. Consequences for defaulting on the loan.

Can I make my own loan agreement?

While financial institutions have templates on which they base their personal loan agreements, you'll have to draw up your own if you're borrowing from another individual. Depending on how complicated your personal circumstances are, you may feel you need to hire a lawyer to guide you through the process.

How do I write a loan agreement between friends?

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

How to write loan agreement template word?

Loan Agreement Template Interest Rate. The Parties agree the Interest Rate for this loan shall be ____% to be accrued monthly. Loan Term. This Loan shall be for a period of ____ years/months. Repayment. The Parties agree the Borrower shall pay the Lender $_________ per month on the ___ day of each month.

How do I make a loan agreement between friends?

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

How do I write an agreement in Word?

How to Make a Contract on Microsoft Word? Open Microsoft Word. Create a new blank document. Add a header. Include a brief introduction. List down the terms and conditions. Edit and add the signature blocks. Save the document.

How to create a simple loan agreement?

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.