Customize and complete your essential Declaration Of Trust template

Prepare to streamline document creation using our fillable Declaration Of Trust template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

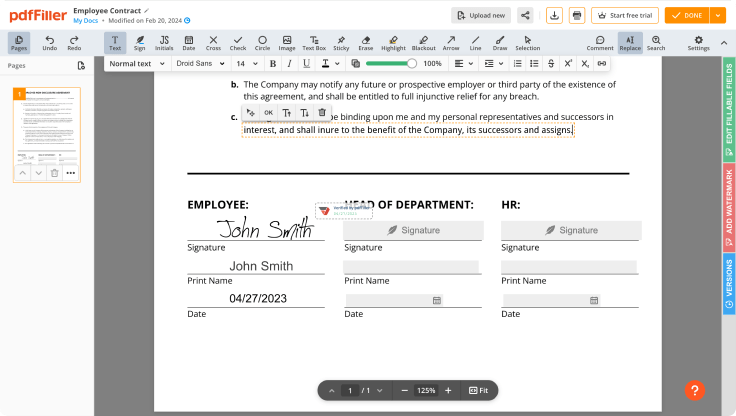

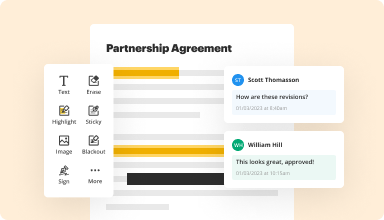

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

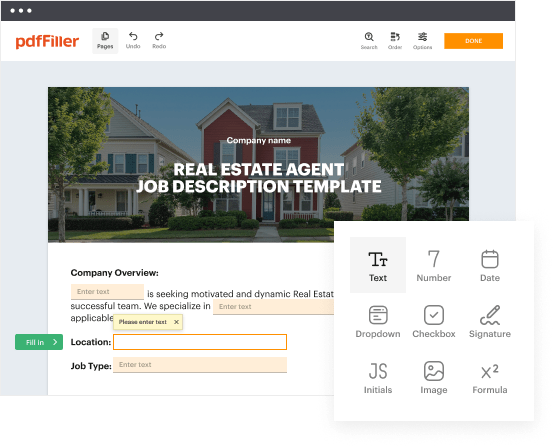

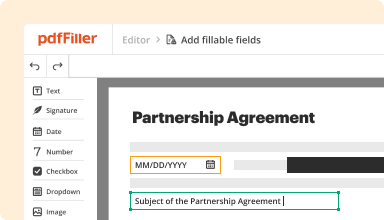

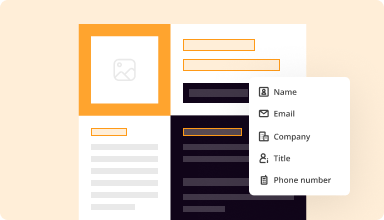

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

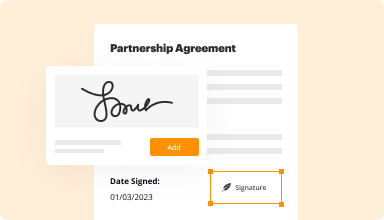

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

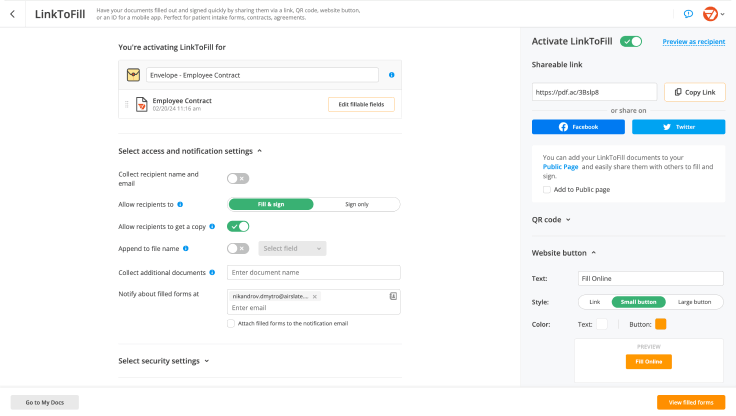

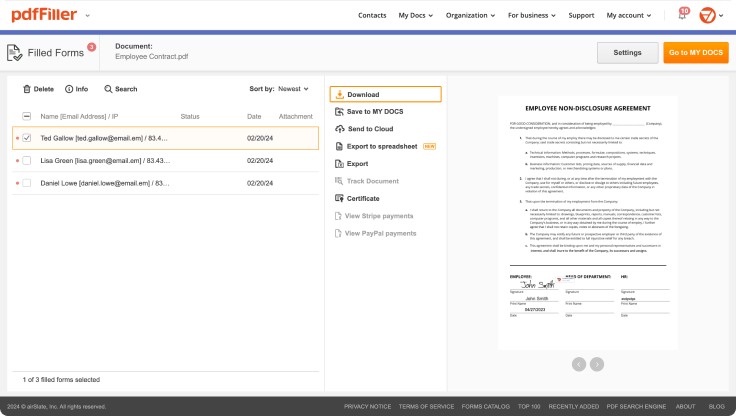

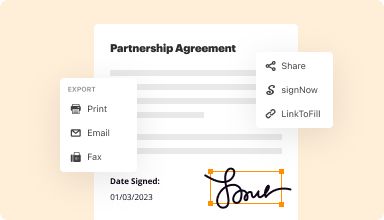

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

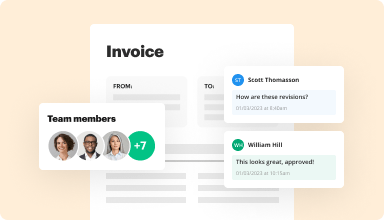

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

Customize Your Declaration Of Trust Template

Our customizable Declaration Of Trust template enables you to create a legal document that suits your specific needs. You can tailor it to reflect your intentions and protect your assets effectively.

Key Features

Easy customization for specific circumstances

Simple, user-friendly interface for seamless editing

Legally compliant format to ensure validity

Guided prompts to assist in filling out necessary details

Downloadable in various formats for your convenience

Potential Use Cases and Benefits

Establishing trust among family members or partners

Protecting assets for future generations

Clarifying the terms of property ownership

Creating a foundation for investment arrangements

Ensuring transparency in financial dealings

With our Declaration Of Trust template, you can address and resolve your asset protection concerns. This tool empowers you to create a clear, legally sound document that secures your interests and helps build trust among parties involved. You no longer need to worry about misunderstandings or uncertainties regarding asset distribution. Take control of your financial future today.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to create a Declaration Of Trust

Creating a Declaration Of Trust has never been simpler with pdfFiller. Whether you need a professional document for business or individual use, pdfFiller offers an instinctive solution to build, modify, and manage your paperwork effectively. Utilize our versatile and fillable web templates that align with your precise needs.

Bid farewell to the hassle of formatting and manual editing. Utilize pdfFiller to effortlessly craft accurate documents with a simple click. your journey by following our detailed guidelines.

How to create and complete your Declaration Of Trust:

01

Sign in to your account. Access pdfFiller by signing in to your profile.

02

Search for your template. Browse our complete catalog of document templates.

03

Open the PDF editor. When you have the form you need, open it up in the editor and use the editing tools at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can select from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Include text, highlight areas, add images, and make any needed adjustments. The intuitive interface ensures the procedure remains smooth.

06

Save your changes. Once you are satisfied with your edits, click the “Done” button to save them.

07

Share or store your document. You can send out it to others to sign, download, or securely store it in the cloud.

In conclusion, crafting your documents with pdfFiller templates is a straightforward process that saves you efforts and guarantees accuracy. Start using pdfFiller today to benefit from its powerful capabilities and effortless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Is a declaration of trust the same as a trust?

A declaration of trust is a legal document used to create a new trust or to confirm the terms of an existing trust. The declaration of trust acts as the legal contract between the trustee and the beneficiary regarding the administration of the trustee's assets.

Who is the best person to set up a trust?

Sometimes the best solution is a combination of a professional or corporate Trustee and a family member Trustee working together as co-trustees. The family member brings knowledge of the family situation, and the corporate trustee knows how to invest and maintain records.

What is the difference between a trust and a declaration of trust?

A Declaration of Trust is a legal document that declares who owns an asset or property and who will benefit from it. On the other hand, a Trust Agreement is an agreement between two parties where one party agrees to hold assets for another party's benefit.

What does self declaration of trust mean?

A self-declared trust is a situation where an individual who has both legal and equitable ownership declares that they now hold the legal title for the benefit of another individual.

What does it mean to declare a trust?

A declaration of trust, or nominee declaration, appoints a trustee to oversee assets for the benefit of another person or people. The declaration also describes the assets that are to be held in the trust and how they are to be managed.

Is a deed of trust the same as a trust?

A trust deed is not used to transfer property to a living trust (use a Grant Deed for that). Other than the terminology, trust deeds and living trusts have nothing in common. A living trust is used to avoid probate, not to provide security for a loan.

What is a declaration of trust example?

For example, a person may purchase a home with a mortgage. Some of the money towards the purchase may come from the person's parents. The parents would contribute towards the costs with the agreement that they will receive a share of any profit from the property's sale.

What is the biggest mistake parents make when setting up a trust fund?

Selecting the wrong trustee is easily the biggest blunder parents can make when setting up a trust fund. As estate planning attorneys, we've seen first-hand how this critical error undermines so many parents' good intentions.

What is a declaration of a trust?

Declaration of trust is the document used to establish the primary details of a trust. While some states allow oral declarations, many states require a written declaration of trust outlining the essential pieces of the trust in order for it to be legally recognized.

What is a simple declaration of trust?

A Declaration of Trust (also referred to as a Deed of Trust) is often considered when multiple people have a stake in a property and there are no existing legal arrangements in place between them to determine what each person is entitled to and what should happen if the property is sold.

What is the difference between a trust deed and a deed of trust?

A deed of trust, also called a trust deed, is the functional equivalent of a mortgage. It does not transfer the ownership of real property, as the typical deed does. Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan.

What is the difference between a trust agreement and a declaration?

Personal trusts are further divided into either 1) Under Declaration of Trust (U/D/T) meaning the grantor and the trustee are the same person and the grantor controls the trust assets, and 2) Trust Under Agreement (U/A) meaning the grantor and the trustee are different persons and the trustee controls the trust assets.

What is the major disadvantage of a trust?

The major disadvantages that are associated with trusts are their perceived irrevocability, the loss of control over assets that are put into trust, and their costs.

What would cause a trust to fail?

The purpose of a Trust is to manage the assets held in it. In order for the Trust to do it's job, the assets need to be in the Trust. If there are no assets in the Trust, then the Trust fails.

Should my parents set up a trust?

A Trust is preferred over a Will because it is quick. Example: When your parents were to pass away, If they have a trust, all the Trustee needs to do is review the terms of the Trust. It will give you instructions on how they distribute the assets that are in the Trust. Then they can make the distribution.

What is the downside of a family trust?

Disadvantages of a family trust Cost: Hiring an estate planning attorney to set up a family trust can be expensive. Additionally, you may have to pay court fees and compensation to your trustee. Paperwork and complexity: Creating a trust and transferring assets can require complex paperwork and recordkeeping.

What is the person who creates a trust called?

All trusts have a grantor, sometimes called a settler or trustor. This is the person who creates the trust and is the one who has the legal capacity to transfer property held under the trust. When this person dies, he is called the decedent. The assets in the trust are supplied by the grantor.

Who has the most power in a trust?

So, now you know that the Trust Maker holds the most power before the Trust is established, but the Trustee holds the most power after the Trust is established. And you also know that in many cases, during your lifetime you have both roles.

What is the best type of trust to set up?

Irrevocable trusts This can give you greater protection from creditors and estate taxes. As stated above, you can set up your will or revocable trust to automatically create irrevocable trusts at the time of your death. When you use your will to create irrevocable trusts, it's called a testamentary trust.

Who is the best trustee for a trust?

In many cases, the ideal combination is to name a professional and a family member or trusted friend who can work side-by-side as co-trustees.