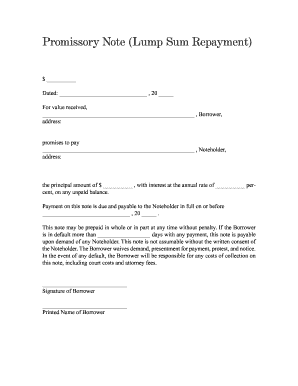

Customize and complete your essential Promissory Note template

Prepare to streamline document creation using our fillable Promissory Note template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

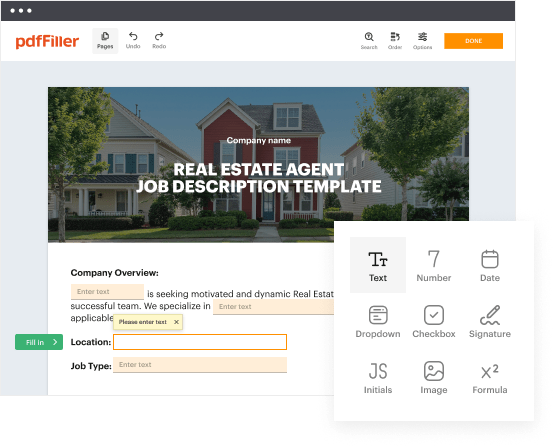

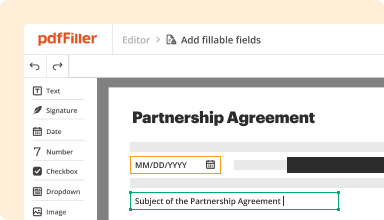

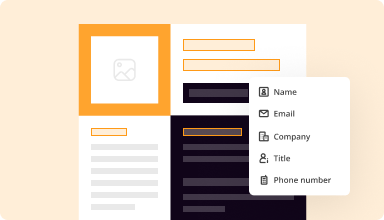

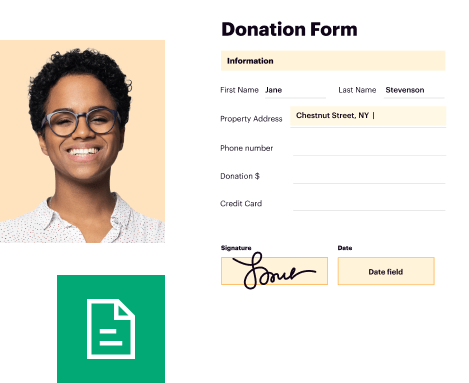

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

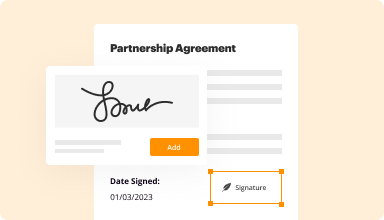

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

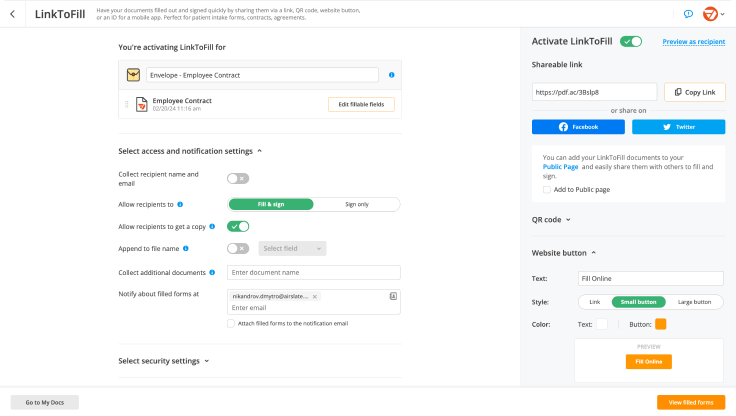

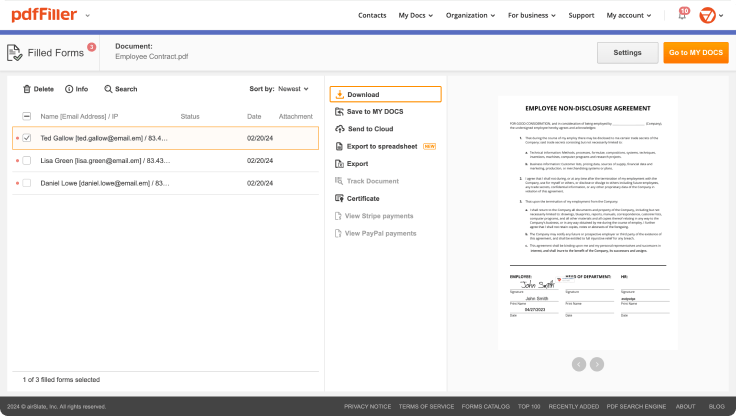

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

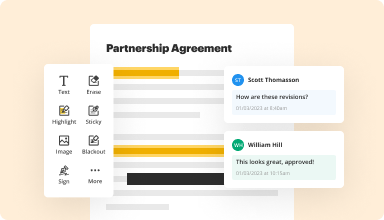

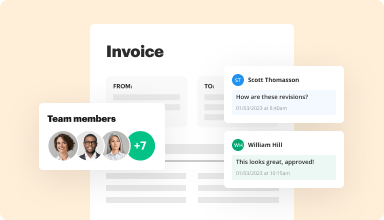

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

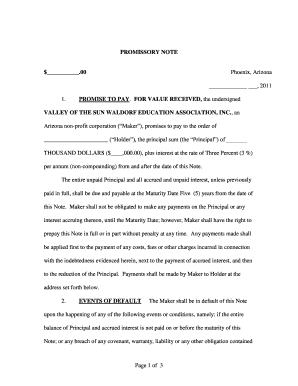

Customize Your Promissory Note Template

Create a personalized promissory note that meets your needs with our customizable template feature. This tool allows you to manage and document loans simply and effectively, ensuring clarity for both borrower and lender.

Key Features

User-friendly design for easy customization

Options for adding terms, interest rates, and payment schedules

Ability to save and reuse templates for future loans

Step-by-step guidance throughout the customization process

Compatible with various devices for access anytime, anywhere

Potential Use Cases and Benefits

Individuals lending money to friends or family

Small business owners offering credit to clients

Real estate transactions involving seller financing

Personal loans for specific purposes such as education or home improvement

By using our customizable promissory note template, you can ensure all essential details are clearly outlined. This reduces the risk of misunderstandings, enhances trust, and protects both parties involved. Take control of your financial agreements with a straightforward, professional document.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to create a Promissory Note

Crafting a Promissory Note has never been simpler with pdfFiller. Whether you need a professional forms for business or personal use, pdfFiller offers an easy-to-use solution to generate, edit, and manage your documents effectively. Employ our versatile and fillable web templates that align with your specific requirements.

Bid farewell to the hassle of formatting and manual customization. Utilize pdfFiller to effortlessly create accurate forms with a simple click. Begin your journey by following our detailed guidelines.

How to create and complete your Promissory Note:

01

Register your account. Access pdfFiller by signing in to your profile.

02

Search for your template. Browse our comprehensive collection of document templates.

03

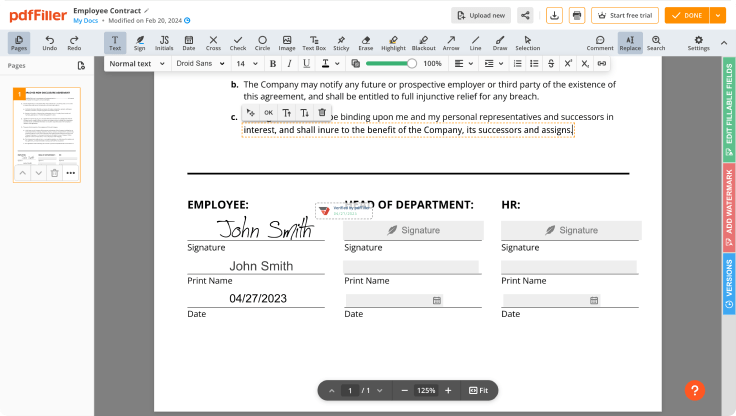

Open the PDF editor. Once you have the form you need, open it up in the editor and utilize the editing instruments at the top of the screen or on the left-hand sidebar.

04

Insert fillable fields. You can choose from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Include text, highlight information, insert images, and make any needed changes. The intuitive interface ensures the process remains easy.

06

Save your edits. Once you are satisfied with your edits, click the “Done” button to save them.

07

Share or store your document. You can send it to others to eSign, download, or securely store it in the cloud.

To summarize, creating your documents with pdfFiller templates is a straightforward process that saves you efforts and ensures accuracy. Start using pdfFiller today to take advantage of its robust features and effortless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you fill out a promissory demand note?

This demand letter should include the following: The date of the letter. The names of the borrower and lender. The original amount of the loan. The date of the promissory note and any reference number or account number it contains. The payment schedule that was agreed upon.

How do you fill out a promissory note?

But what exactly do you need to write a promissory note? Include their full legal names, addresses, and contact numbers—include any co-signers if applicable. The terms of this note should specify the amount borrowed, repayment terms (including interest rate, if applicable), and the due date or schedule of payments. Promissory Note Template: Simplify Loan Agreements - Dropbox templates promissory-note templates promissory-note

What is the difference between a promissory note and a demand note?

A demand note is a promissory note that becomes payable any time the holder of the note requests payment. This differs from notes that are due by a certain date or have a repayment schedule. Sometimes, banks are willing to issue demand loans to customers they have worked with for a long time and have favorable credit. demand note | Wex | US Law | LII / Legal Information Institute - Cornell University wex demand_note - Cornell University wex demand_note

Can anyone create a promissory note?

A promissory note is a written promise by one party to make a payment of money at a date in the future. Although potentially issued by financial institutions, other organizations or individuals can use promissory notes to confirm the agreed terms of a loan.

Who writes draws a promissory note?

Maker or Drawer is the person who makes or draws the promissory note to pay a certain amount as specified in the promissory note. He is also called the promisor.

What is a promissory note with an example?

For example, a company may issue a promissory note to an investor in exchange for an investment. The promissory note will specify the amount of money that the company has borrowed, the interest rate on the loan, and the date by which the loan must be repaid. Promissory Note Overview, Elements & Examples - Lesson - academy lesson what-is-a-promi academy lesson what-is-a-promi

Should a promissory note be recorded?

A promissory note isn't recorded in the county land records. The lender holds on to the note. The note gives the lender the right to collect on the loan if you don't make payments. When the borrower pays off the loan, the note is marked as "paid in full" and returned to the borrower.

How to fill a demand promissory note?

The note should include details about the steps a lender may take to demand payment and the consequences for the borrower if they fail to pay. If there are specific procedures the lender must follow before requesting the total amount, the lender should follow them. Demand for Payment on Demand Promissory Note - templates demand-for-p templates demand-for-p

Who creates a promissory note?

A promissory note is a written promise by one party to make a payment of money at a date in the future. Although potentially issued by financial institutions, other organizations or individuals can use promissory notes to confirm the agreed terms of a loan. In short, a promissory note allows anyone to act as a lender.

Who should issue a promissory note?

The promissory note transaction involves the borrower and lender agreeing on the terms of the loan and then creating a promissory note to reflect the agreed-upon terms. The promissory note is issued by the lender, signed by the borrower, and then witnessed and initialized by the lender.

Who drafts a promissory note?

Anyone lending money (like home sellers, credit unions, mortgage lenders and banks, for instance) can issue a promissory note. But specific to real estate and the mortgage process, promissory notes serve as an agreement that the borrower will repay their mortgage loan by the maturity date.

Who is primarily responsible for promissory notes?

It is the maker who is primarily liable on a promissory note. The issuer of a note or the maker is one of the parties who, by means of a written promise, pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

Do you have to record a promissory note?

The security in these cases would be the car or the house or land. These loans are secured because they are recorded along with a land deed, a mortgage, or other deed and these are often recorded by government entities. Unsecured promissory notes, however, are not officially recorded. Promissory Notes - Legal Counsel PA Legal Counsel PA Business Contracts Legal Counsel PA Business Contracts

Do promissory notes need to be registered?

Do the Notes Need to Be Registered? Most promissory notes must be registered as securities with the SEC and the states in which they're being sold. But remember that some promissory notes, such as those that have nine-month or shorter terms, may be “exempt.” That means that they don't have to be registered. Promissory Notes - Secretary of the Commonwealth of Massachusetts Secretary of the Commonwealth of Massachusetts download brochures P Secretary of the Commonwealth of Massachusetts download brochures P

Where are promissory notes recorded?

Record the Signed Documents at the County Recorder's Office Take the original signed and notarized Deed of Trust and Promissory Note to the County Recorder's Office for the county where the property is located. Deed of Trust and Promissory Note Sacramento County Public Law Library resource_library deed-of-trust-and Sacramento County Public Law Library resource_library deed-of-trust-and

Do you have to report promissory note?

Usually, income from a promissory note comes in the form of interest, which is subject to taxation and needs to be reported on your tax return. Promissory Note Tax Implications | SOLVABLE solvable tax-help promissory-note- solvable tax-help promissory-note-