Customize and complete your essential Credit Application template

Prepare to streamline document creation using our fillable Credit Application template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

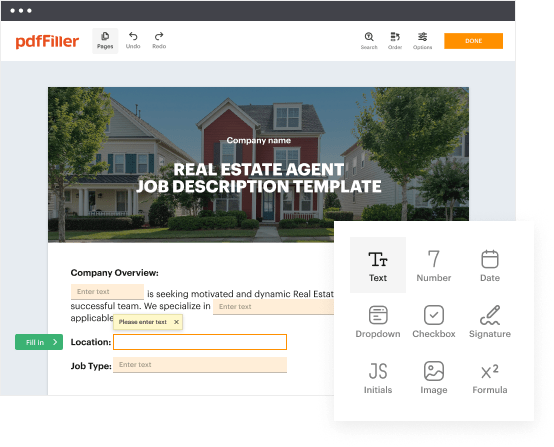

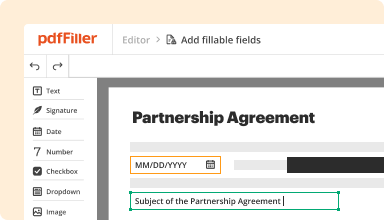

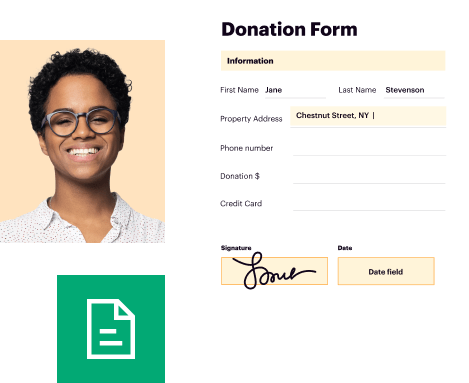

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

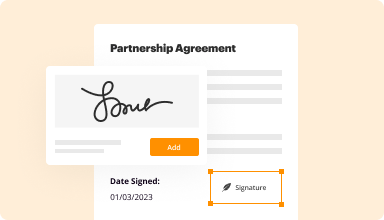

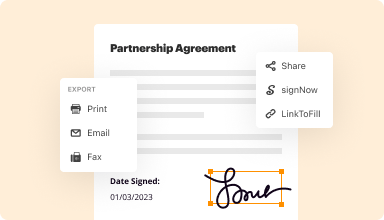

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

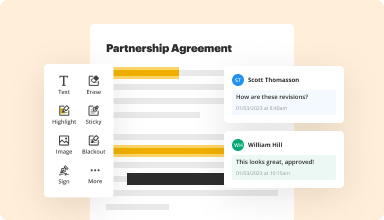

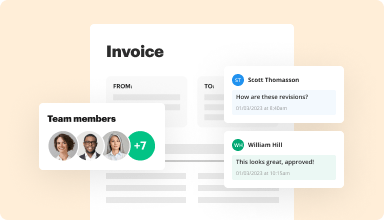

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

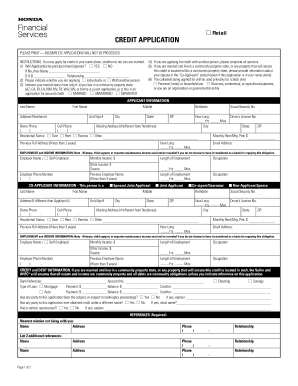

Customize Your Essential Credit Application Template

Making your credit application process smoother is essential for your business. With our customizable Credit Application template, you can tailor every aspect to meet your specific needs. This feature allows you to create an application that reflects your brand and engages customers effectively.

Key Features

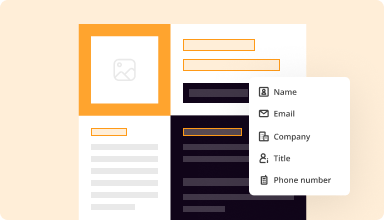

Fully customizable fields to capture all necessary client information

User-friendly layout that enhances the application experience

Integration with existing systems to streamline data collection

Instant notifications upon submission for prompt follow-up

Secure storage of sensitive information to protect customer data

Potential Use Cases and Benefits

Businesses can use the template to process loan applications quickly and efficiently

Financial institutions can accurately assess creditworthiness through tailored questions

Retailers can simplify customer financing options for purchases

Real estate agencies can manage tenant applications with ease

This Credit Application template solves the common problem of miscommunication and delays in obtaining necessary information. By allowing you to customize every element, it ensures that you gather the exact data you need to make informed decisions. As a result, this approach enhances your interaction with clients and speeds up the application process, ultimately leading to better customer satisfaction.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to build a Credit Application

Creating a Credit Application has never been easier with pdfFiller. Whether you need a professional forms for business or individual use, pdfFiller provides an instinctive platform to create, modify, and manage your documents efficiently. Utilize our versatile and fillable web templates that align with your precise requirements.

Bid farewell to the hassle of formatting and manual customization. Utilize pdfFiller to effortlessly craft accurate documents with a simple click. Begin your journey by following our detailed instructions.

How to create and complete your Credit Application:

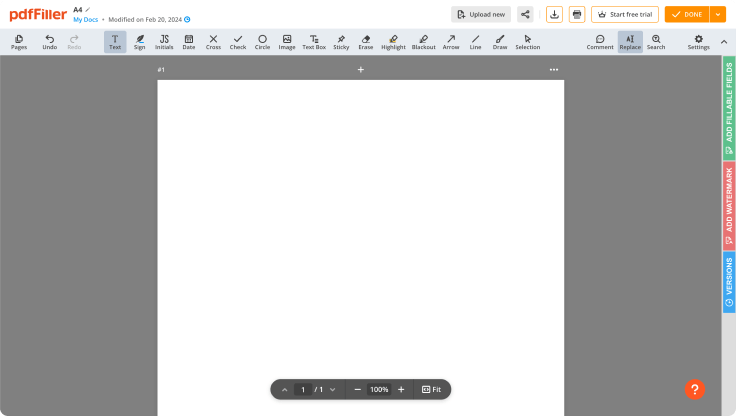

01

Create your account. Access pdfFiller by signing in to your profile.

02

Find your template. Browse our complete collection of document templates.

03

Open the PDF editor. When you have the form you need, open it in the editor and use the editing tools at the top of the screen or on the left-hand sidebar.

04

Add fillable fields. You can pick from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Adjust your form. Add text, highlight information, insert images, and make any required modifications. The user-friendly interface ensures the process remains easy.

06

Save your changes. Once you are satisfied with your edits, click the “Done” button to save them.

07

Send or store your document. You can send out it to others to eSign, download, or securely store it in the cloud.

To summarize, crafting your documents with pdfFiller templates is a straightforward process that saves you time and ensures accuracy. Start using pdfFiller right now to take advantage of its robust features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How much will your credit score drop when you apply for a credit card?

Your credit score will normally go down by fewer than five points when you apply for a credit card. FICO reports that for most people, one credit inquiry takes off fewer than five points under its credit scoring system. The impact can vary based on your own unique credit history.

Do credit applications hurt your credit?

It's important to know that there are 2 types of credit inquiries. Soft inquiries such as viewing your own credit report will not affect your FICO Score. Hard inquiries such as actively applying for a new credit card or mortgage will affect your score.

Is it safe to fill out a credit application online?

Generally speaking, it's safe to apply for a credit card online. Credit card issuers often use security features on their websites and mobile apps to protect your personal information.

Does applying to a credit card hurt your credit?

Applying for a new credit card can trigger a hard inquiry, which involves a lender looking at your credit reports. ing to credit-scoring company FICO®, hard inquiries can cause a slight drop in your credit scores. Keep in mind that hard inquiries usually stay on your credit reports for two years.

Does filling out a credit application hurt your credit?

When you apply for a new card, the credit company may perform a hard pull of your credit report for review as part of the approval process. The inquiry on your credit history may lower your FICO Score but generally the impact is low (for most, this means fewer than 5 points).

How to fill a credit application?

Here's what is typically included on a business credit application form: Business name, address, phone, and email numbers. Identifying details of principals or owners. Business structure. Industry type. Number of employees. Bank and trade payment references. Credit history.

How do I create a credit application?

A customer credit application form should typically include fields for personal information, financial information, employment details, references, and authorization for credit checks. Additionally, you can customize the form to include specific fields that are relevant to your credit application process.

How do you process a credit application?

Application submission: The borrower submits the credit application to the lender, either online, by mail, or in person. Therefore, the application will typically include the borrower's personal and financial information and other required documentation, such as proof of income and identification.

How to fill a credit application form?

The application will ask for the: Name of your employer. Your position. Length of employment - Start date and end date. The type of business - Education, financial, food service, etc. Address and phone number of business. You may have to provide information for your last few employers.

How to fill out a credit card application?

You'll need to provide your personal information and copies of certain documents to apply for a credit card, including your: Legal name. Social Security number (SSN) or Individual Tax Identification Number (ITIN) Mailing address. Birthdate. Employment status. Income information. Debt information.

How to fill a letter of credit application form?

Fill in your personal details accurately, including your full name, contact information, and any required identification numbers. Provide the necessary information about the purpose of your lc application, such as the type of lc you are applying for and the desired duration.

How do I create a new credit profile?

Open store charge card or credit cards to build credit Open a secured credit card. Have someone cosign your account or installment loan. Ask a family member or friend about becoming an authorized user on one of their accounts. Don't abuse the privilege. Pay bills on time.

How do I create a credit application form?

A customer credit application form should typically include fields for personal information, financial information, employment details, references, and authorization for credit checks. Additionally, you can customize the form to include specific fields that are relevant to your credit application process.

How do I create a new credit file?

How to establish credit Open a bank account. Having a bank account helps you establish a credit history in a number of ways: Use a credit card. Once you've been using your bank account sensibly for a while you could apply for a credit builder credit card. Register to vote. Get a mobile phone contract.

How do you create credit creation?

All commercial banks create credit by advancing loans and purchasing securities. They lend money to the individuals as well as to the businesses out of deposits accepted from the public. Commercial banks are not allowed to use the entire amount of public deposits for lending purposes.