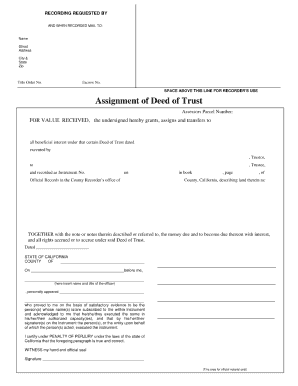

Customize and complete your essential Deed Of Trust template

Prepare to streamline document creation using our fillable Deed Of Trust template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

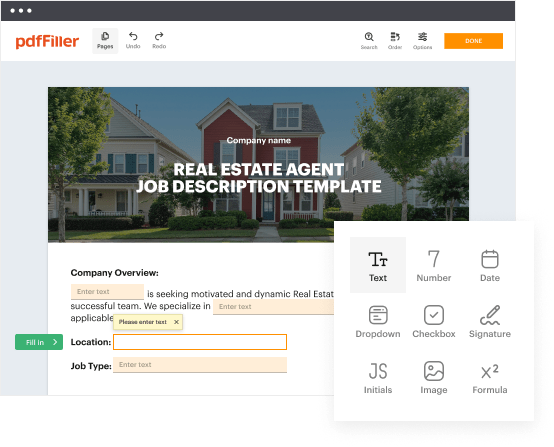

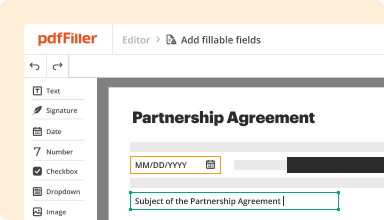

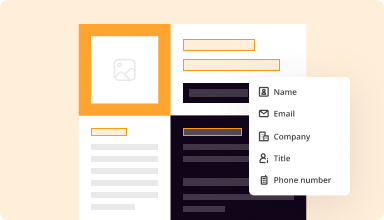

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

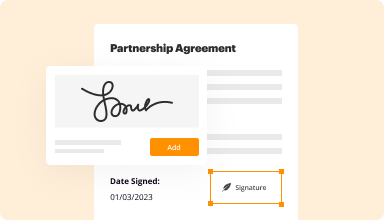

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

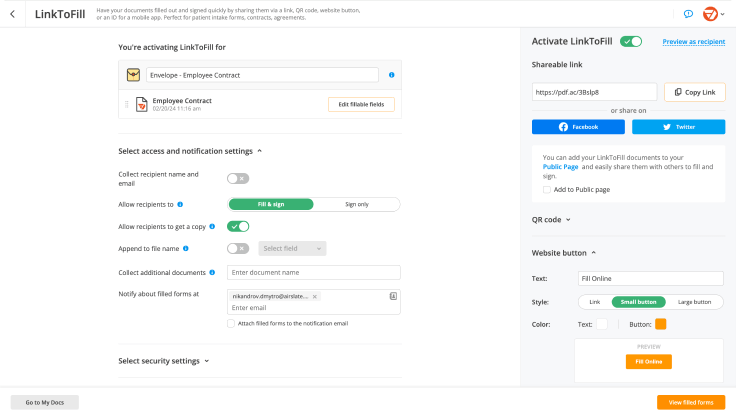

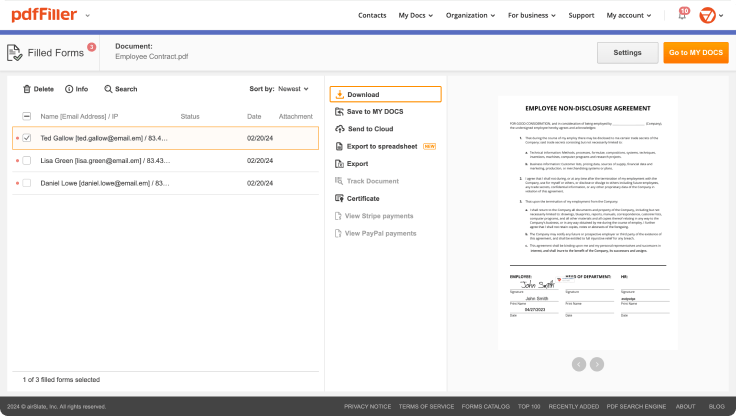

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

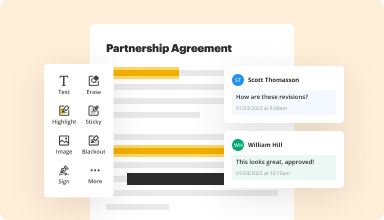

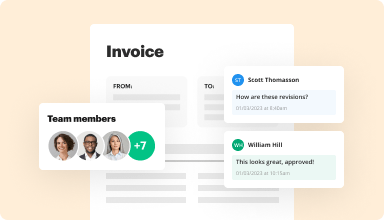

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

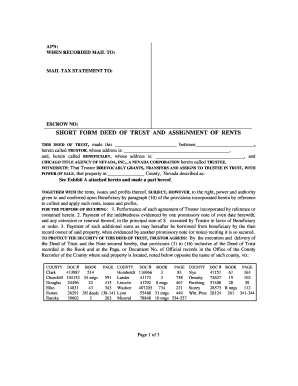

Customize Your Deed Of Trust Template

Create a Deed Of Trust tailored to your needs with our customizable template feature. This tool empowers you to handle real estate transactions efficiently. By using our template, you ensure all legal aspects are covered, giving you peace of mind.

Key Features

Fully customizable text to fit your specific situation

User-friendly interface for easy navigation

Downloadable and printable formats available

Legal compliance to safeguard your interests

Guidance on necessary information to include

Use Cases and Benefits

Ideal for homeowners and real estate investors

Streamlines the mortgage process

Provides protection for lenders and borrowers

Ensures clarity in the terms of the loan

Minimizes legal risks with a well-documented agreement

This customizable Deed Of Trust template solves your needs by offering a reliable, easy-to-use document that outlines the terms of your agreement clearly. It protects your investment and clarifies expectations between parties involved. You gain confidence in your transaction, knowing that you have a solid legal foundation.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to create a Deed Of Trust

Crafting a Deed Of Trust has never been so easy with pdfFiller. Whether you need a professional forms for business or individual use, pdfFiller provides an intuitive platform to create, edit, and manage your documents effectively. Employ our versatile and editable web templates that line up with your specific requirements.

Bid farewell to the hassle of formatting and manual editing. Utilize pdfFiller to smoothly create accurate forms with a simple click. Start your journey by following our detailed instructions.

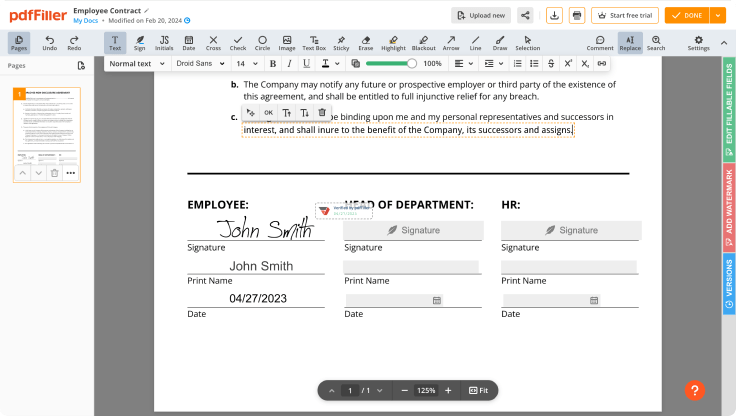

How to create and complete your Deed Of Trust:

01

Create your account. Access pdfFiller by signing in to your profile.

02

Find your template. Browse our complete collection of document templates.

03

Open the PDF editor. When you have the form you need, open it up in the editor and utilize the editing tools at the top of the screen or on the left-hand sidebar.

04

Add fillable fields. You can select from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Add text, highlight information, insert images, and make any necessary changes. The user-friendly interface ensures the procedure remains easy.

06

Save your edits. Once you are happy with your edits, click the “Done” button to save them.

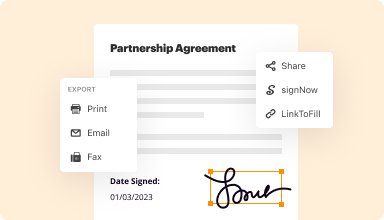

07

Submit or store your document. You can deliver it to others to sign, download, or securely store it in the cloud.

To conclude, crafting your documents with pdfFiller templates is a straightforward process that saves you efforts and guarantees accuracy. Start using pdfFiller today to benefit from its robust features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How to create a deed of trust in California?

In California, a deed of trust must come with security, typically a promissory note. To be valid, a deed of trust must be (1) in writing, (2) with a description of the property, and (3) signed by the trustor of the deed of trust.

What purpose is served by recording a deed?

Making sure that your property deed is properly recorded is one of the single most important actions you can take to protect your legal rights and assets. This is because your deed is the only way to prove that you are the true legal owner of your own house or investment property.

What is the purpose of recording documents such as a deed to provide?

The recorded document then secures a valid claim to the property and its ownership, and provides constructive notice to anyone who is interested in the property. The purpose of recording a document is to provide a traceable chain of title to the property, passed down through the years from one owner to the next.

Why should a deed be recorded?

While recording a deed does not affect its validity, it is extremely important to record since recordation protects the grantee. If a grantee fails to record, and another deed or any other document encumbering or affecting the title is recorded, the first grantee is in jeopardy.

What is the primary reason for recording a trust deed?

If the borrower defaults, a trust deed makes it possible for the lender to sell the property without having to go to court. With a mortgage, the lender has to file a foreclosure claim in court and secure a judge's approval to sell the property. This can mean a lot of expenses for both the borrower and the lender.

Can I add to my trust deed?

What can I include in a trust deed? The majority of unsecured debts can be added to a trust deed, including the most popular forms of borrowing such as credit cards, store cards, and personal loans.

What is the purpose of a deed of trust?

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

What does adding someone to the deed mean?

A person may be added to a property deed as a result of inheritance, marriage or partnership. It's crucial to understand that adding someone to a deed typically involves a transfer of ownership interest in the property. With that transfer comes potential tax consequences.

Can you add assets to an existing irrevocable trust?

Yes, you can transfer additional assets such as real estate and investments to your Irrevocable Trust prepared by the Koldin Law Center, P.C. However, the Medicaid 5 year look back period applies to each addition made to the Trust before the addition becomes protected.

What are the disadvantages of a trust deed?

Disadvantages of a trust deed If you do not cooperate with the trustee, they can try to make you bankrupt. You cannot continue to be the director of a limited company unless your trustee agrees and unless the rules of the limited company allow you to enter into a trust deed.

What is the biggest mistake parents make when setting up a trust fund?

Selecting the wrong trustee is easily the biggest blunder parents can make when setting up a trust fund. As estate planning attorneys, we've seen first-hand how this critical error undermines so many parents' good intentions.