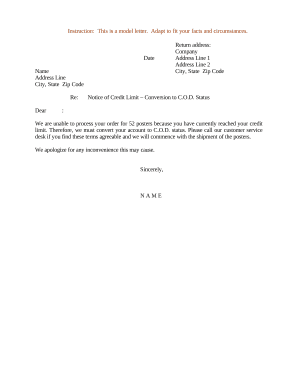

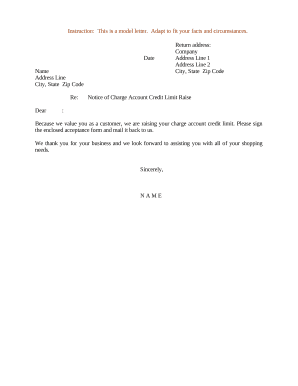

Customize and complete your essential Notice Of Credit Limit Increase template

Prepare to streamline document creation using our fillable Notice Of Credit Limit Increase template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

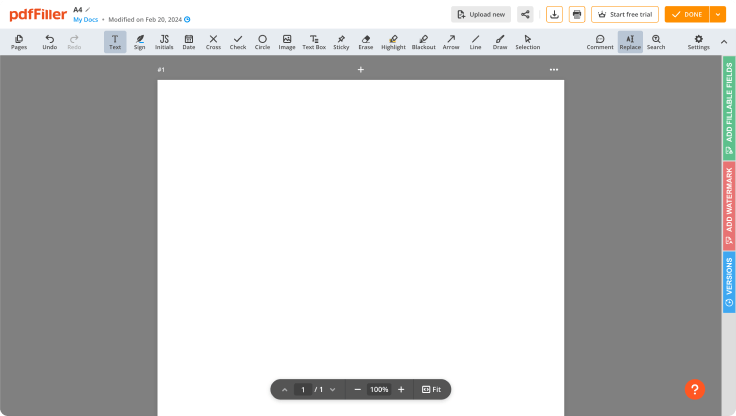

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

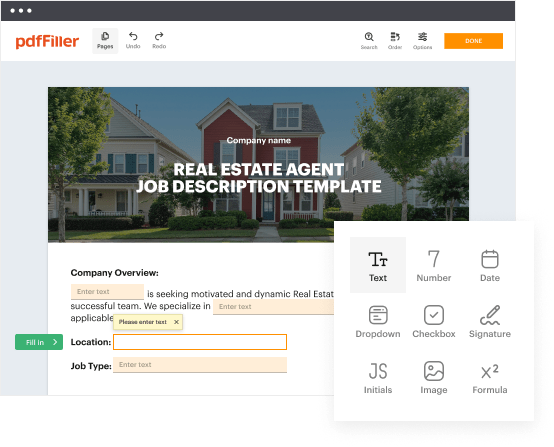

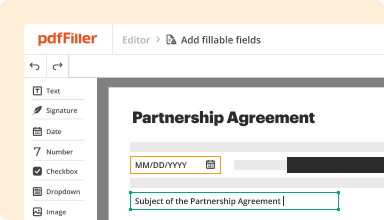

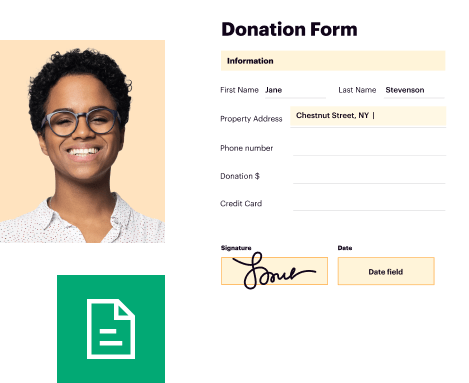

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

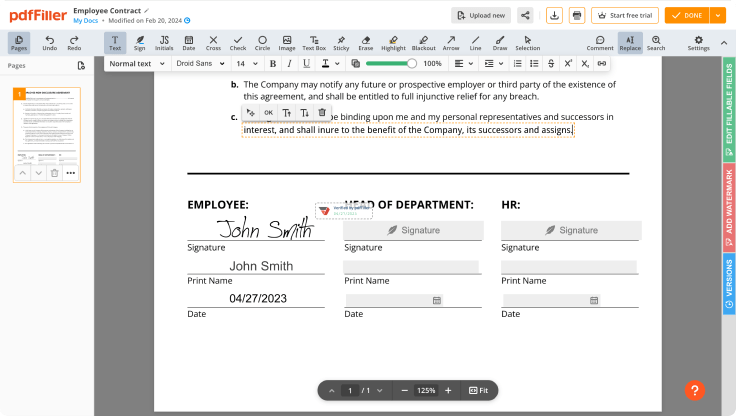

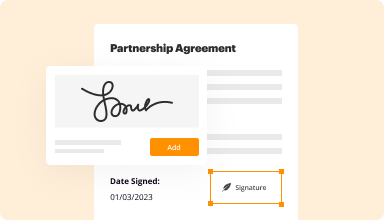

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

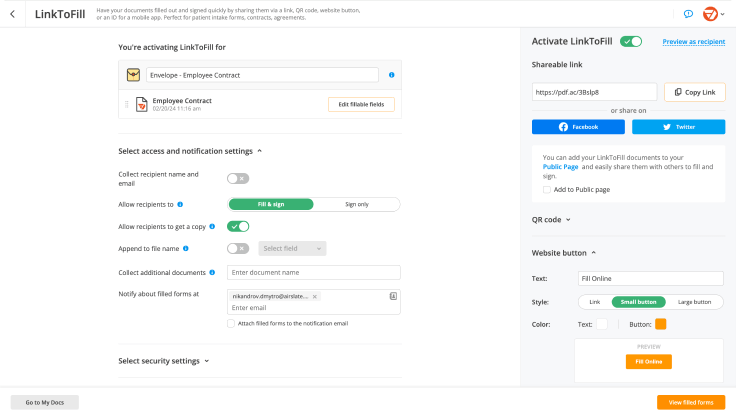

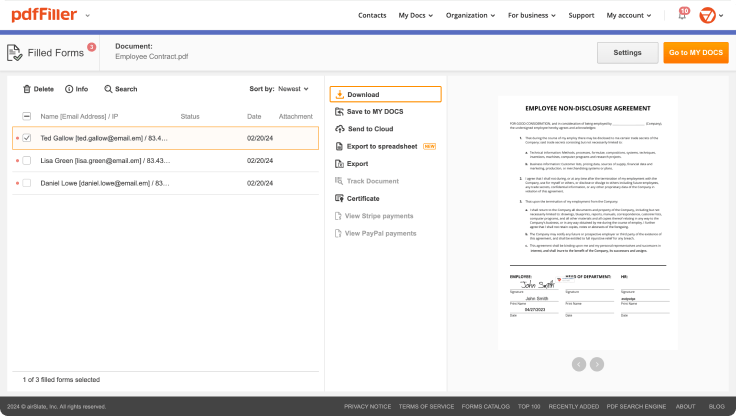

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

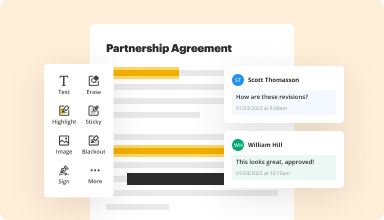

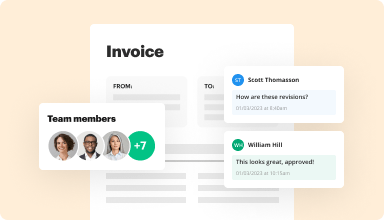

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

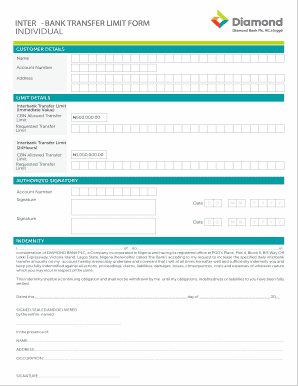

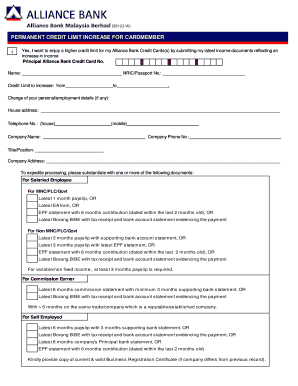

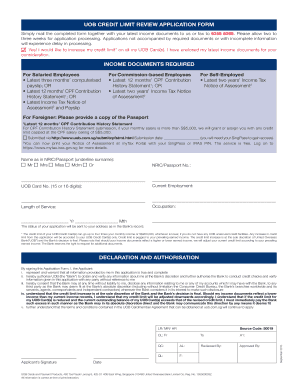

Customize Your Notice Of Credit Limit Increase Template

Easily create a tailored Notice of Credit Limit Increase template that meets your unique needs. This feature empowers you to communicate clearly and effectively with your customers about their credit limit adjustments.

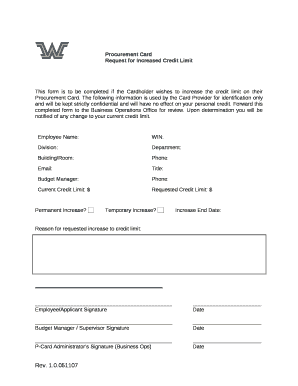

Key Features

Simple customization options for branding and messaging

User-friendly interface for quick edits

Downloadable formats for easy sharing

Pre-written sections for common scenarios

Secure cloud storage for all your templates

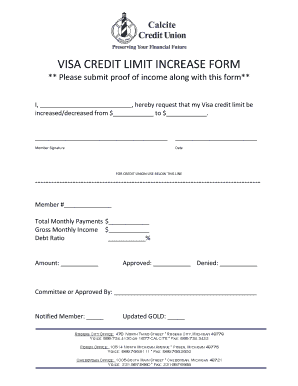

Potential Use Cases and Benefits

Financial institutions can inform clients about credit limit changes promptly

Businesses can strengthen customer relationships through clear communication

Marketers can use tailored messages to promote responsible credit use

Organizations can save time and resources with ready-to-use templates

By using our template feature, you can eliminate confusion over credit limit changes. You provide clear, consistent information, enhancing customer trust and satisfaction. This straightforward tool helps streamline your communication process, making your interactions more effective.

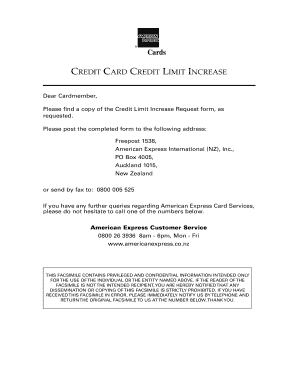

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to craft a Notice Of Credit Limit Increase

Creating a Notice Of Credit Limit Increase has never been simpler with pdfFiller. Whether you need a professional document for business or individual use, pdfFiller provides an easy-to-use platform to create, edit, and manage your documents effectively. Employ our versatile and fillable templates that align with your precise requirements.

Bid farewell to the hassle of formatting and manual customization. Employ pdfFiller to easily create accurate forms with a simple click. Begin your journey by using our detailed guidelines.

How to create and complete your Notice Of Credit Limit Increase:

01

Sign in to your account. Access pdfFiller by signing in to your account.

02

Search for your template. Browse our complete collection of document templates.

03

Open the PDF editor. Once you have the form you need, open it in the editor and use the editing instruments at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can select from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Add text, highlight information, insert images, and make any required changes. The intuitive interface ensures the process remains smooth.

06

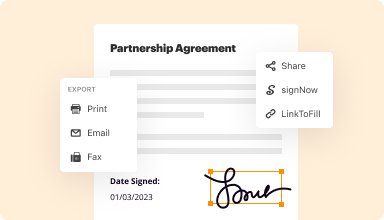

Save your changes. Once you are satisfied with your edits, click the “Done” button to save them.

07

Send or store your document. You can send it to others to eSign, download, or securely store it in the cloud.

In conclusion, creating your documents with pdfFiller templates is a straightforward process that saves you time and guarantees accuracy. Start using pdfFiller right now to take advantage of its robust features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I write a letter requesting a credit limit increase?

My current limit is insufficient to cover my monthly purchases at your firm. As you know, my credit history with you is spotless. I have always made payments on time, so I do not anticipate problems handling the increased limit. If you need any further information to grant the increase, please call.

What's a reasonable credit limit increase?

Bear in mind that you may not get the full amount requested, and have a contingency plan in place. Typically, the bank will consider increases from 10% to 25% of your current limit. Anything higher could trigger a hard inquiry on your credit report, and that can in turn lower your credit score.

How do I trigger a credit limit increase?

On-time payments, longer credit history and paying down other debts will all improve your credit. Making timely mortgage payments, paying off other debt or reducing the principal on your car loan, your credit score is likely to improve. And higher credit scores may trigger a credit limit increase.

How to request for credit card limit increase?

Request to increase Credit Limit: If you send a request to the bank to increase your credit card limit, most banks agree to do so depending on the reason you have provided for the request. You can raise a request to increase the limit through netbanking or visit the branch of the bank.

How much credit limit increase should I ask?

How much of a credit limit increase should I ask for? Most experts recommend asking for a 10% to 25% credit limit increase. But the amount you're approved for can vary by issuer. If you ask for a higher amount, the issuer may run a hard credit check.

What to say when asking for a credit limit increase?

Tips for requesting a credit limit increase Typically, you'll need to provide your total annual income, current employment status and monthly mortgage or rent payment. You may need to also provide the amount of the credit limit increase you're requesting. Be prepared to defend your request for a higher limit.

What to say when requesting a credit card increase?

Be prepared to defend your request for a higher limit. You can defend your case with information such as your history of on-time payments, frequent and responsible use of the card, a high credit score, increase of income and more.

Can you get a credit card limit increase without asking?

The second way you may get a credit limit increase is if a credit card company increases your limit without a request from you. This typically occurs after you've demonstrated responsible credit habits such as making on-time payments and paying more than the minimum payment required.

How do I trigger an automatic credit limit increase?

Make On-Time Payments and Reduce Your Balance Paying more than your minimum payment or paying off your credit card balance in full also demonstrates your ability to spend within your means. Both practices build confidence in your ability to make payments and can lead to a credit limit increase.

What qualifies you for credit limit increase?

You may be a good candidate for a credit limit increase if you've recently received a raise or changed to a job with a higher salary. You might also qualify if you have a history of making full, on-time payments to your account, as this sort of behavior demonstrates that you are a responsible borrower.

Does your credit limit increase automatically?

Card issuers are known to automatically increase cardholders' credit limits from time to time (with no effect to your credit score), especially if you keep your income information up-to-date and have a good payment history. However, not everyone will receive an automatic increase.