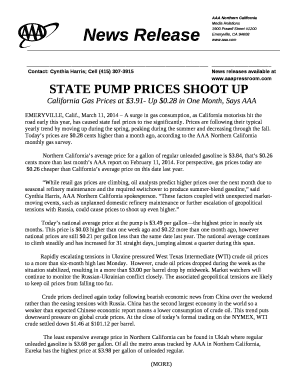

Free Oil And Gas Prices Word Templates

What are Oil And Gas Prices Templates?

Oil and Gas Prices Templates are pre-designed forms or spreadsheets used by professionals in the oil and gas industry to track, analyze, and report on price fluctuations in the market. These templates help users organize data more efficiently and make informed decisions based on current and historical pricing information.

What are the types of Oil And Gas Prices Templates?

There are several types of Oil and Gas Prices Templates available, including:

How to complete Oil And Gas Prices Templates

Completing Oil and Gas Prices Templates is a simple process that can be done in a few steps. Here are some tips to help you fill out these templates effectively:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.