Free Investment Contract Word Templates

What are Investment Contract Templates?

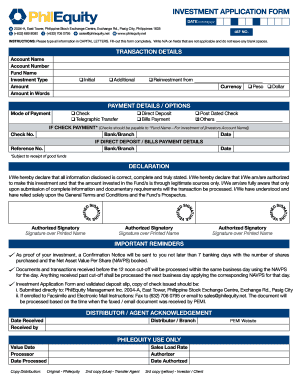

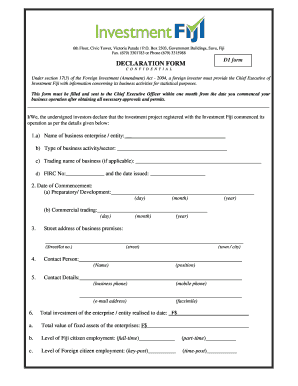

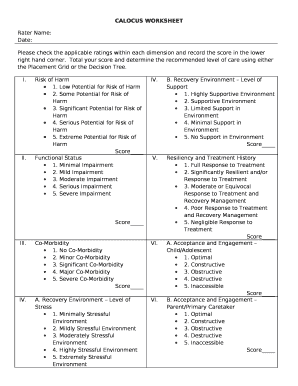

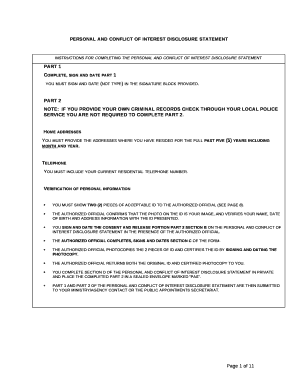

Investment contract templates are pre-designed documents that outline the terms and conditions of a financial agreement between parties. These templates help in defining the rights and responsibilities of each party involved in an investment transaction. Whether you are a small business owner seeking funding or an individual looking to invest, having a solid investment contract template is crucial.

What are the types of Investment Contract Templates?

There are several types of investment contract templates available to suit different investment scenarios. Some common types include: Partnership Agreement, Shareholder Agreement, Convertible Note Agreement, Stock Purchase Agreement, and Joint Venture Agreement.

How to complete Investment Contract Templates

Completing investment contract templates is a straightforward process that involves filling in the necessary information and customizing the template to suit your specific investment requirements. Here are some steps to complete an investment contract template:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.