Free Lending Word Templates - Page 7

What are Lending Templates?

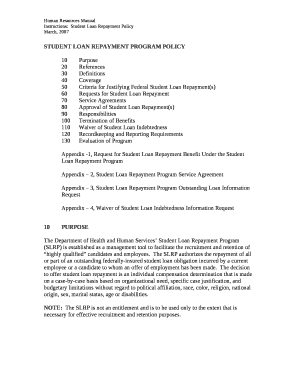

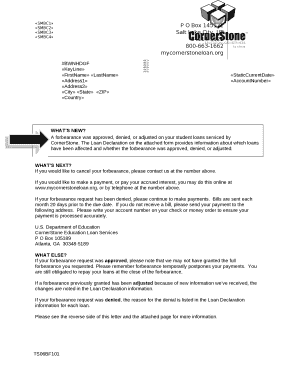

Lending Templates are pre-designed documents that individuals or businesses can use to create loan agreements, promissory notes, and other lending forms. These templates provide a convenient and efficient way to fill out and customize lending documents without the need for extensive legal knowledge or expensive lawyer fees.

What are the types of Lending Templates?

There are several types of Lending Templates available for different lending needs, including:

Loan Agreement Templates

Promissory Note Templates

Mortgage Agreement Templates

Personal Loan Agreement Templates

How to complete Lending Templates

Completing Lending Templates is a simple process that can be done in a few easy steps. Here's how:

01

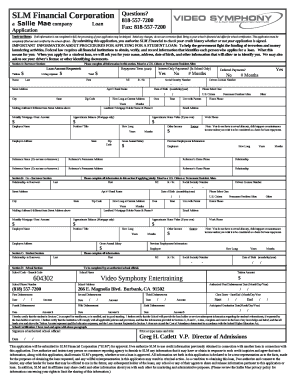

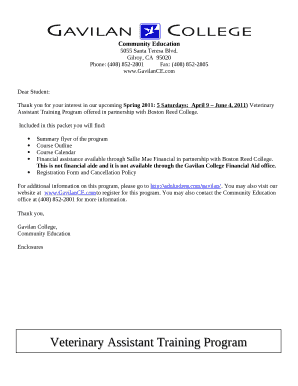

Select the appropriate Lending Template for your specific lending agreement.

02

Fill in the required information in the fillable fields of the template.

03

Review the completed document for accuracy and make any necessary revisions.

04

Save and download the finalized document to your computer or share it online.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Lending Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Which bank loan is easiest to get?

HDFC Bank customers can get Personal Loans with minimal or no documentation. In fact, if they are pre- approved for a Personal Loan, they can easily apply for it. Lower interest rates: Interest rates on Personal Loans are lower than other sources.

What are the easiest loans to get typically __________________________?

Payday and pawn shop loans can be the easiest to get approved for, but their repayment processes can turn into nightmares. Borrowers with lower credit can still get approved for personal loans, but their loans may come with higher rates.

What is the easiest loan to get right now?

Payday loans are short-term loans designed to be paid back by your next pay period or within two weeks of taking out the loan. Because most payday lenders don't check your credit, these are easy loans to get.

What apps will let me borrow money instantly?

Top money borrowing apps of 2023 AppMaximum loan amountTime to fundingAlbertUp to $250Instantly for a fee. 2-3 days free of chargeBrigit$50-$250Instantly for a fee. 1-3 days free of chargeChime$20-$200At the point of saleDaveUp to $500Instant2 more rows • Mar 9, 2023

What is an example of lending?

Personal loans, auto loans, student loans, mortgage loans, and payday loans are loans offered by lending entities.

What is the role of lending?

The lender provides credit that can be used for various purposes, such as financing working capital, student loan, or business capital. Businesses can also borrow credit to provide a backup line of credit to the business, where the cash flows generated are irregular.