Free Accountant Job Description Word Templates - Page 2

What are Accountant Job Description Templates?

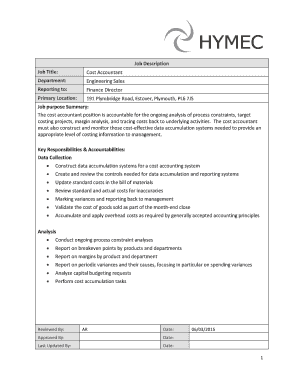

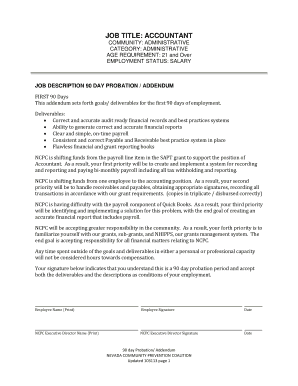

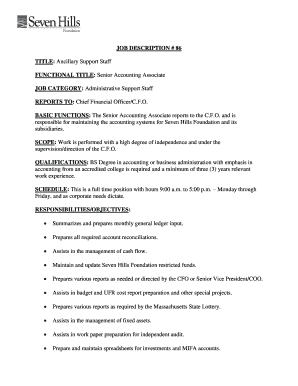

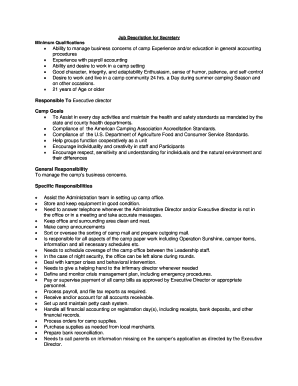

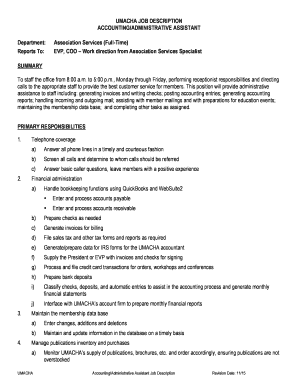

Accountant Job Description Templates are standardized documents that outline the duties, responsibilities, and requirements of a specific accounting position. These templates help employers clearly communicate expectations to potential candidates and streamline the hiring process.

What are the types of Accountant Job Description Templates?

There are various types of Accountant Job Description Templates based on the specific role and industry. Some common types include: 1. Senior Accountant Job Description Template 2. Staff Accountant Job Description Template 3. Financial Accountant Job Description Template 4. Tax Accountant Job Description Template

How to complete Accountant Job Description Templates

Completing Accountant Job Description Templates is a crucial step in the recruitment process. Follow these steps to create an effective job description: 1. Start with a clear job title and summary of the position. 2. Outline the key responsibilities and duties of the role. 3. Specify the qualifications and skills required. 4. Include information about the company culture and benefits. 5. Review and edit the template for accuracy and clarity before posting it online.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.