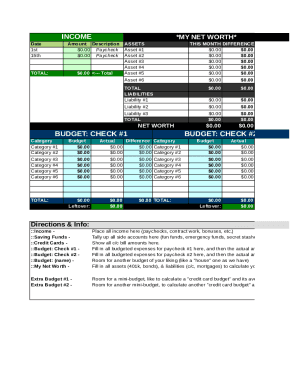

What is General Financial Model?

A General Financial Model is a comprehensive tool that helps individuals or businesses assess their financial situation, make projections, and plan for future financial goals. It involves analyzing various financial metrics, such as revenue, expenses, cash flow, and profitability, to gain insights into the financial health of an entity.

What are the types of General Financial Model?

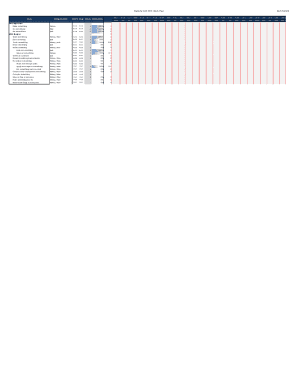

There are several types of General Financial Models used for different purposes, including:

How to complete General Financial Model

Completing a General Financial Model requires attention to detail and a clear understanding of the financial data being analyzed. Here are some steps to help you complete a General Financial Model:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.