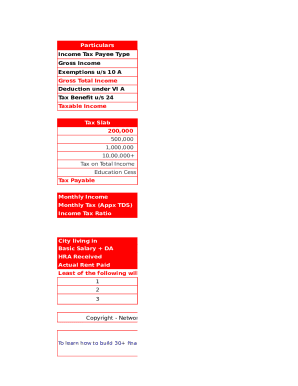

What is Tax Return Calculator 2012?

Tax Return Calculator 2012 is a tool that helps individuals or businesses calculate their tax liabilities for the year 2012. It takes into account various factors such as income, deductions, credits, and exemptions to provide an accurate estimate of the tax amount due or refund to be received.

What are the types of Tax Return Calculator 2012?

There are several types of Tax Return Calculator 2012 that cater to different needs and situations. Some common types include:

Online tax calculators that can be accessed on the internet for quick and easy calculations.

Software-based tax calculators that offer more advanced features and customization options.

Mobile tax calculator apps that allow users to calculate their taxes on the go.

How to complete Tax Return Calculator 2012

Completing Tax Return Calculator 2012 is a simple process that can be broken down into the following steps:

01

Gather all the necessary financial documents such as W-2 forms, 1099s, and receipts for deductions.

02

Enter the relevant information into the calculator, including income, deductions, credits, and exemptions.

03

Review the calculated tax amount and make any necessary adjustments to ensure accuracy.

04

Submit the completed tax return or save it for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself