Application Wage Transcript For Free

Join the world’s largest companies

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Instructions and Help about Application Wage Transcript For Free

Application Wage Transcript: easy document editing

When moving your workflow online, it's important to get the PDF editor that meets your needs.

All the most widely used document formats can be easily converted into PDF. It makes creating and sharing most document types simple. You can create a multi-purpose file in PDF to replace many other documents. It allows you to create presentations and reports which are both detailed and easy-to-read.

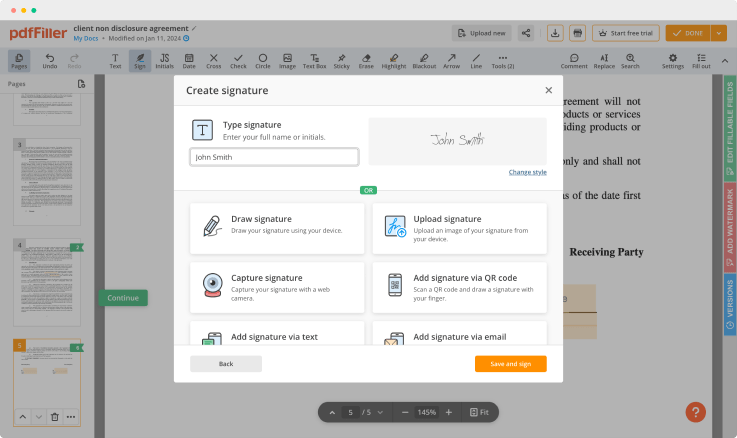

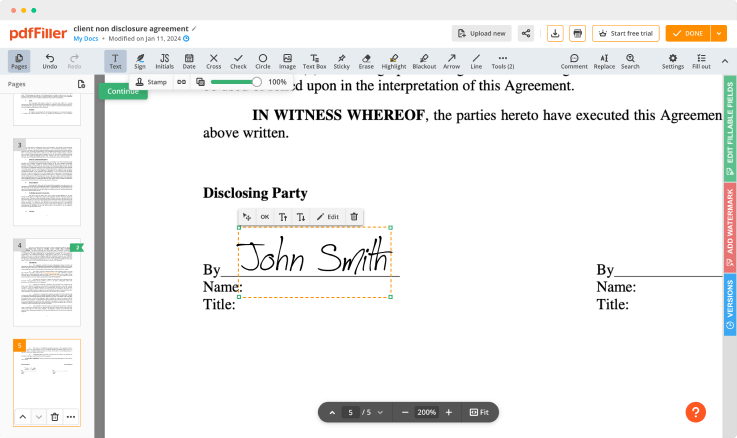

Though many online solutions provide PDF editing features, only a few of them allow adding electronic signatures, collaborating with others etc.

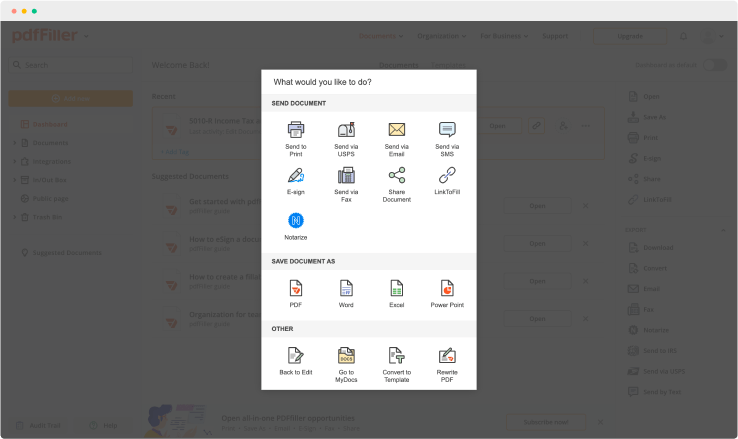

pdfFiller’s editing solution has features for annotating, editing, converting PDFs to other formats, adding e-signatures, and filling PDF forms. pdfFiller is an online PDF editing tool available in your browser. You don’t need to download or install any programs. It’s an extensive platform you can use from any device with an internet connection.

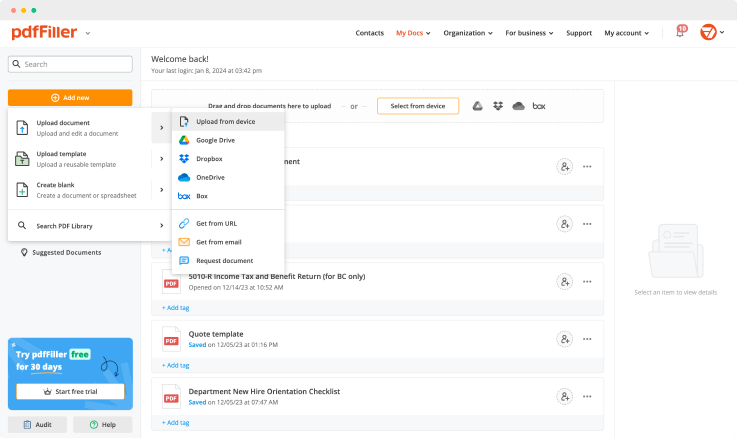

Make a document yourself or upload an existing form using the following methods:

Once you uploaded the document, it’s saved and can be found in the “My Documents” folder.

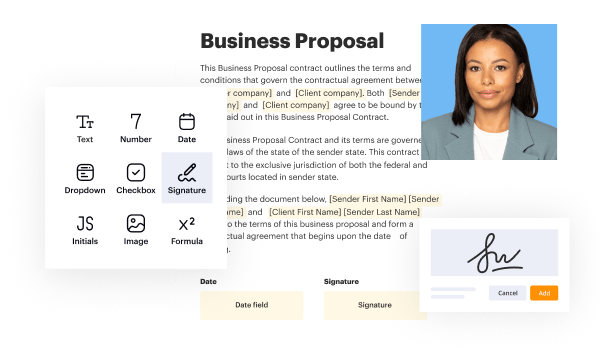

Use editing tools such as typing text, annotating, and highlighting. Add fillable fields and send documents to sign. Change a form’s page order. Add images to your PDF and edit its appearance. Collaborate with people to complete the fields. Once a document is completed, download it to your device or save it to the third-party integration cloud.

For pdfFiller’s FAQs

Ready to try pdfFiller's? Application Wage Transcript