Assign Wage Transcript For Free

Join the world’s largest companies

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Instructions and Help about Assign Wage Transcript For Free

Assign Wage Transcript: make editing documents online simple

The Portable Document Format or PDF is one of the most common document format for a variety of reasons. It's accessible from any device, so you can share files between gadgets with different screens and settings. It will look the same no matter you open it on a Mac or an Android device.

The next point is security: PDF files are easy to encrypt, so it's risk-free to share any sensitive data with them from person to person. That’s why it’s important to find a secure editor, especially when working online. PDF files can not only be password-protected, but analytics provided by an editing service, which allows document owners to identify those who’ve accessed their documents and track potential security breaches.

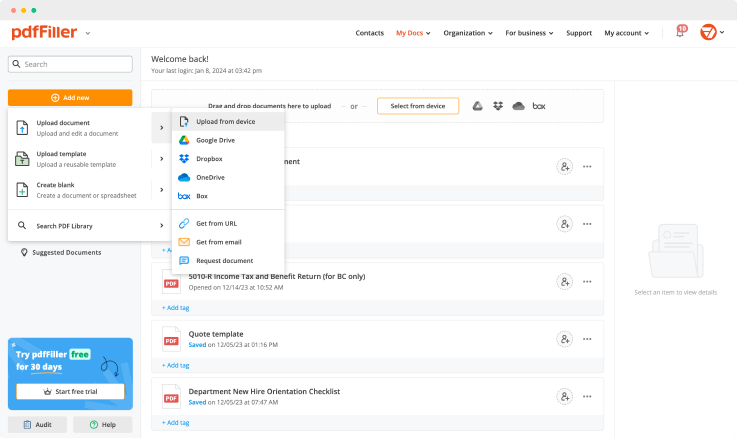

pdfFiller is an online editor that allows to create, edit, sign, and share your PDF directly from your web browser tab. Thanks to the integrations with the popular CRM programs, you can upload an information from any system and continue where you left off. Work with the finished document for personal needs or share it with others by any convenient way — you'll get notified when a person opens and fills out it.

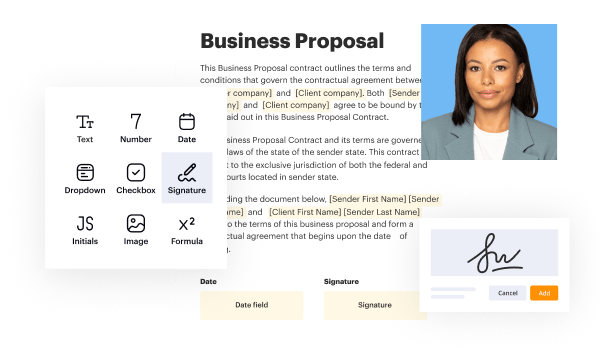

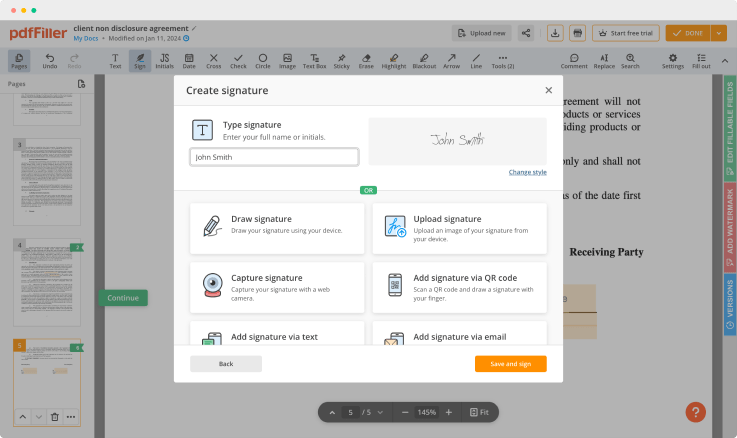

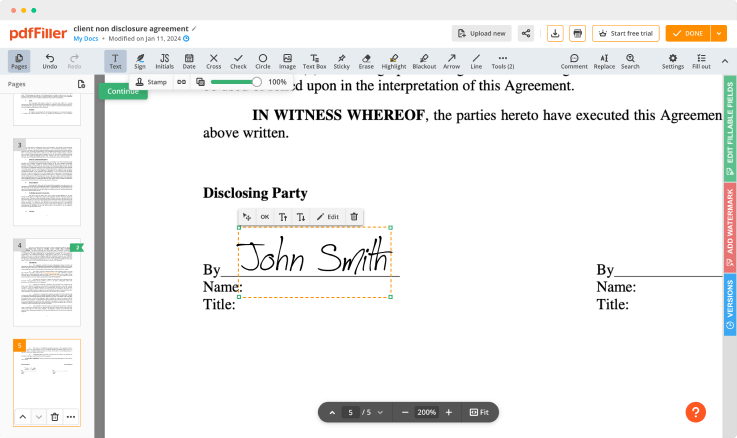

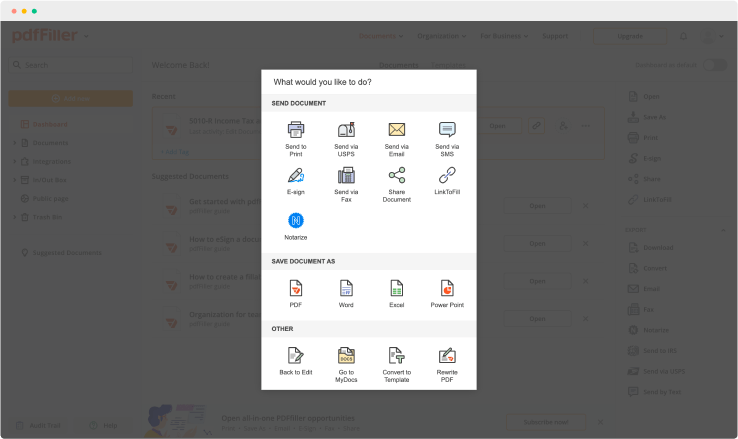

Use powerful editing tools to type in text, annotate and highlight. Add fillable fields and send to sign. Change a template’s page order. Add and edit visual content. Collaborate with users to fill out the document. Once a document is completed, download it to your device or save it to the third-party integration cloud.

Get your documents completed in four simple steps:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Assign Wage Transcript