How to sign a document online?

Why sign documents with pdfFiller?

Ease of use

More than eSignature

For individuals and teams

pdfFiller scores top ratings on review platforms

Watch pdfFiller eSignatures in action

Authenticate signature service 1040 form

Examples of using the authenticate signature service 1040 form

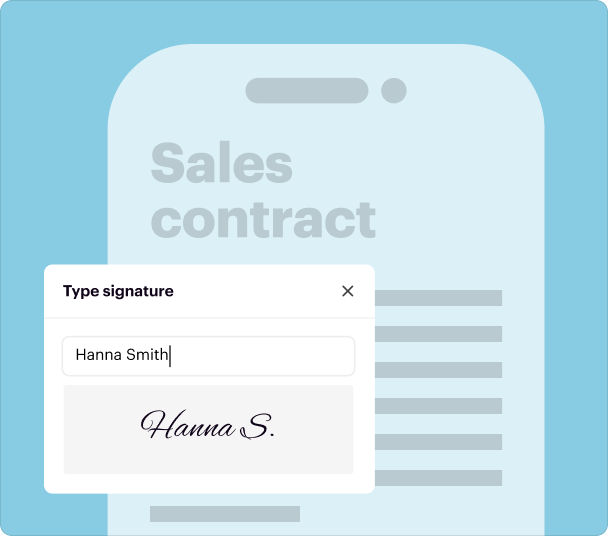

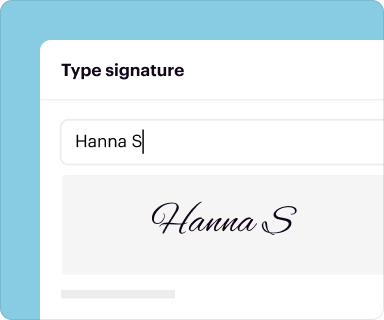

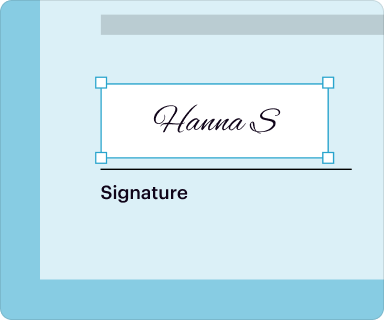

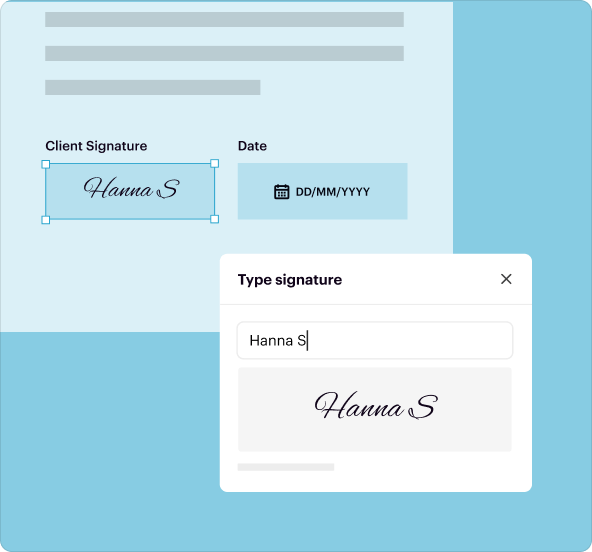

The authenticate signature service 1040 form simplifies the process of tax filing for individuals and businesses alike. By leveraging pdfFiller's eSignature feature, users can securely sign and send documents without the hassle of printing and scanning. This not only saves time but ensures that important tax documents are efficiently processed.

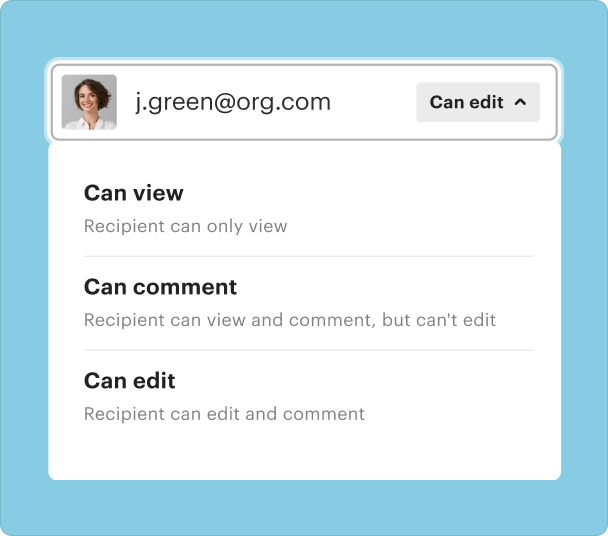

With pdfFiller's cloud-based platform, collaborating on the 1040 form has never been easier. For instance, tax preparers can share the document with clients for eSigning, allowing for real-time updates and transparent communication. This enhances reliability and accountability throughout the filing process.

Benefits of using the authenticate signature service 1040 form

-

1.100% cloud-based document management for easy access from any device.

-

2.No need for additional subscriptions or complicated workflows.

-

3.Streamlined collaboration with built-in feedback tools for quicker responses.

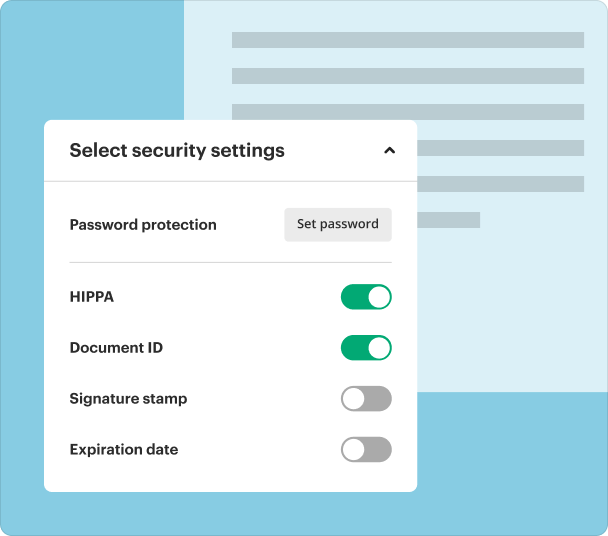

By utilizing the authenticate signature service 1040 form, users experience enhanced security features that protect sensitive information. Moreover, the ability to store signed documents securely within the platform means that you can easily retrieve them when needed, eliminating the risk of losing important paperwork.

Why choose pdfFiller for your authenticate signature service 1040 form needs?

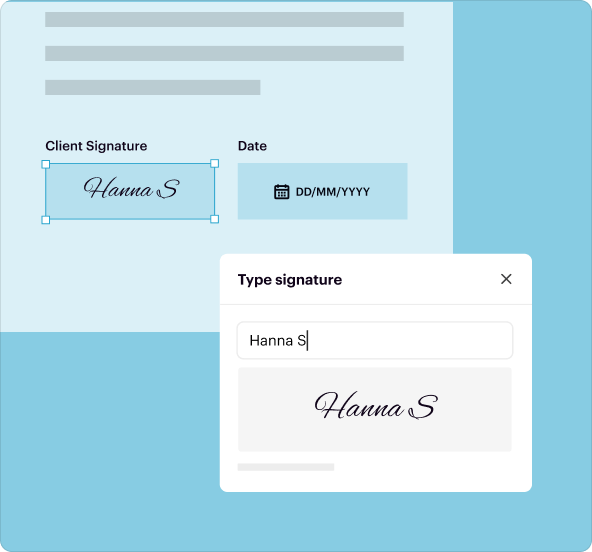

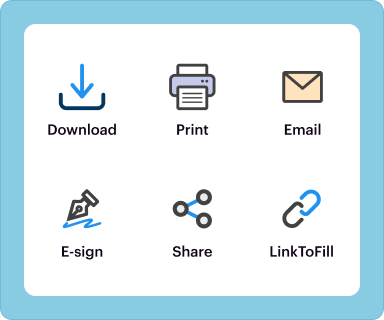

pdfFiller empowers users with seamless editing and eSigning capabilities, ensuring a smooth experience. The user-friendly interface makes it accessible for both personal and professional use. With various built-in options, users can choose the most effective way to manage their documents.

Opt for pdfFiller’s authenticate signature service 1040 form to streamline your tax-related processes and enjoy a hassle-free experience.

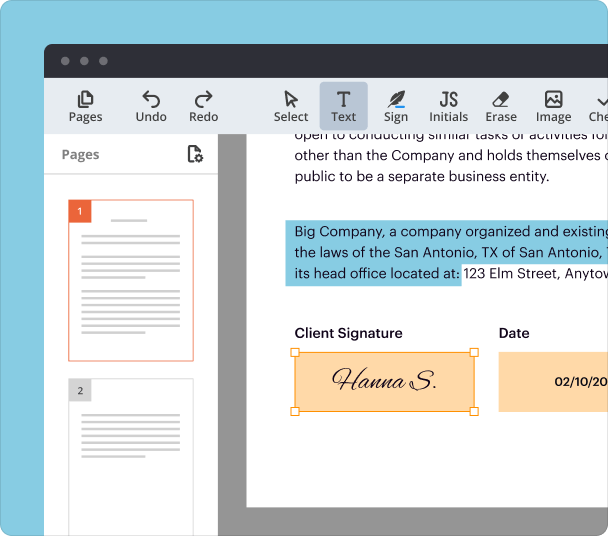

Editing a PDF document with pdfFiller

Steps to edit your PDF

-

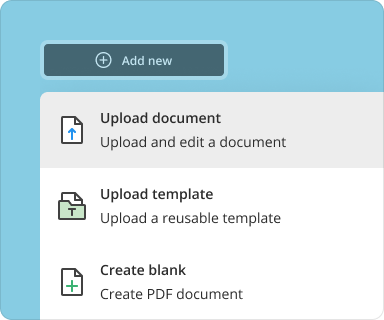

Upload your document in the designated area on the page

-

Select the Authenticate Signature Service 1040 Form option from the menu

-

Perform the necessary edits on your document

-

Click the orange 'Done' button located at the top right

-

Rename the form if required

-

Print, save, or share the edited template on your computer

Utilize pdfFiller to streamline your PDF editing process.