Carbon Copy Initials IRS Form 1040-ES For Free

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Carbon Copy Initials IRS Form 1040-ES

The Carbon Copy Initials IRS Form 1040-ES is designed for individuals who need to make estimated tax payments throughout the year. This easy-to-use form allows you to manage your finances more effectively by providing a clear and organized way to track your payments.

Key Features

Potential Use Cases and Benefits

By using the Carbon Copy Initials IRS Form 1040-ES, you can simplify your tax preparation process and reduce stress. It offers a straightforward way to ensure you meet your tax obligations. This form acts as a reliable tool that helps you avoid surprises during tax season, giving you peace of mind as you manage your finances.

Carbon Copy Initials IRS Form 1040-ES in minutes

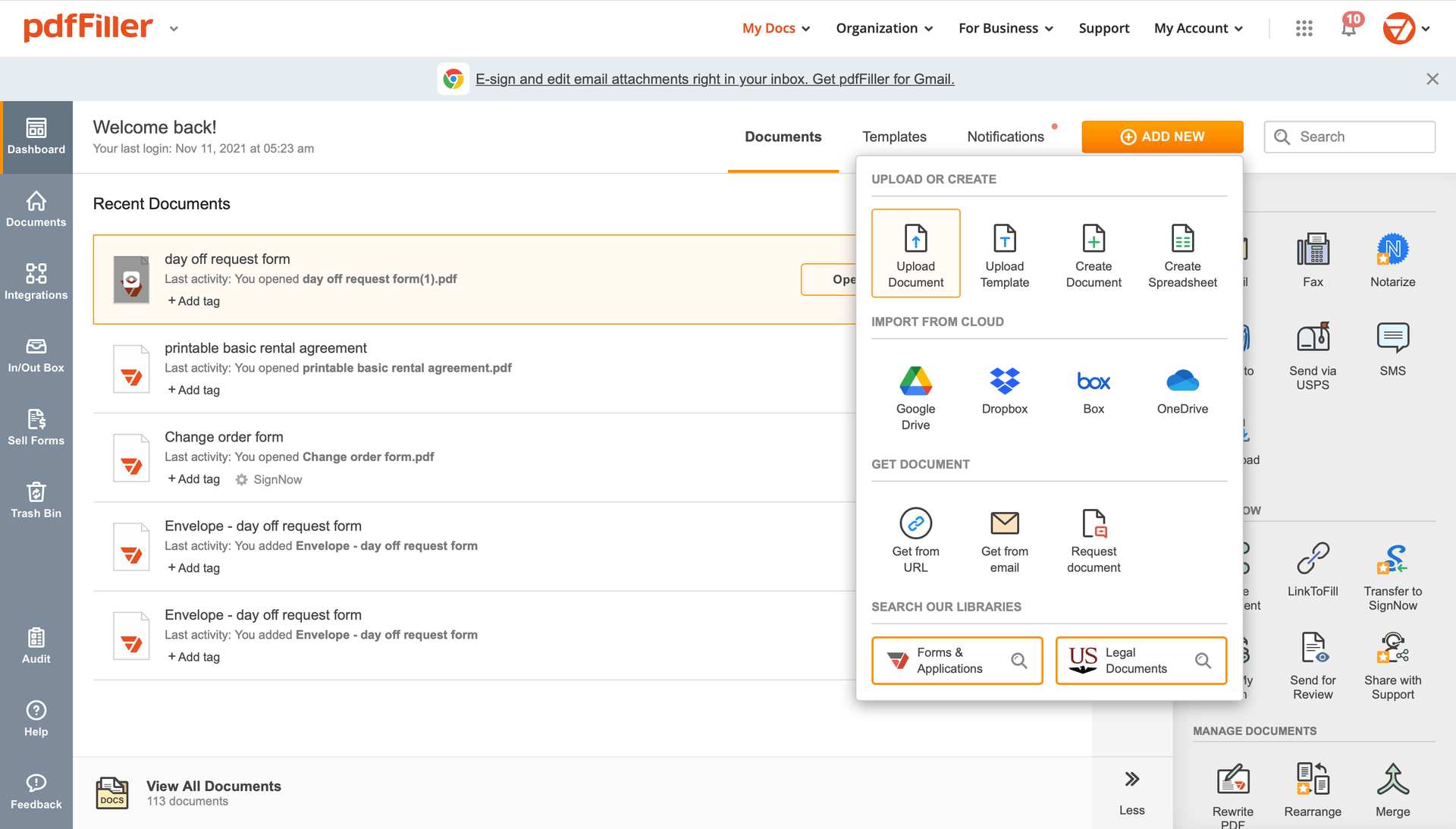

pdfFiller enables you to Carbon Copy Initials IRS Form 1040-ES quickly. The editor's handy drag and drop interface ensures quick and user-friendly document execution on any operaring system.

Ceritfying PDFs electronically is a fast and secure method to validate documents anytime and anywhere, even while on the fly.

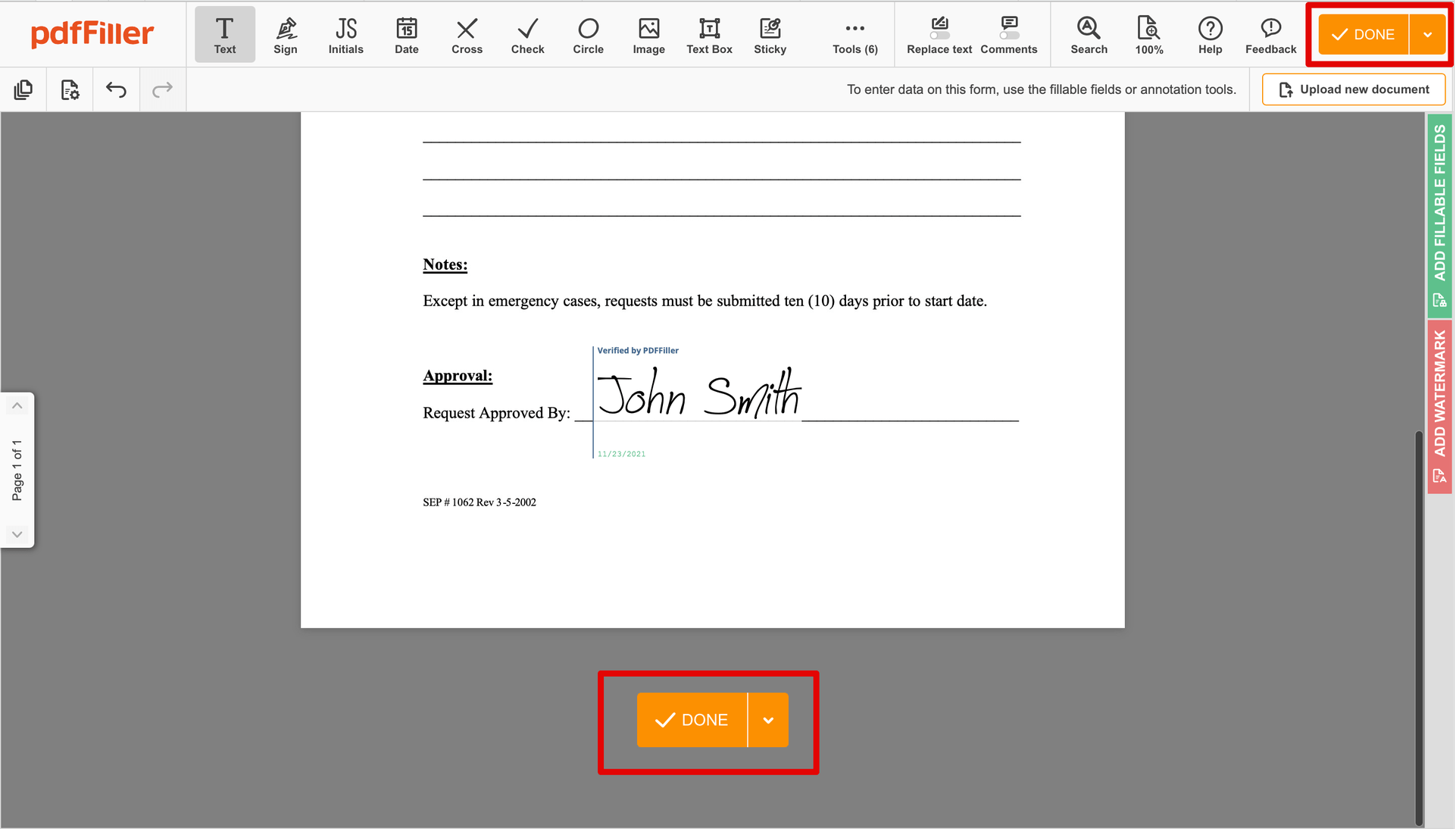

See the step-by-step instructions on how to Carbon Copy Initials IRS Form 1040-ES online with pdfFiller:

Add the form you need to sign to pdfFiller from your device or cloud storage.

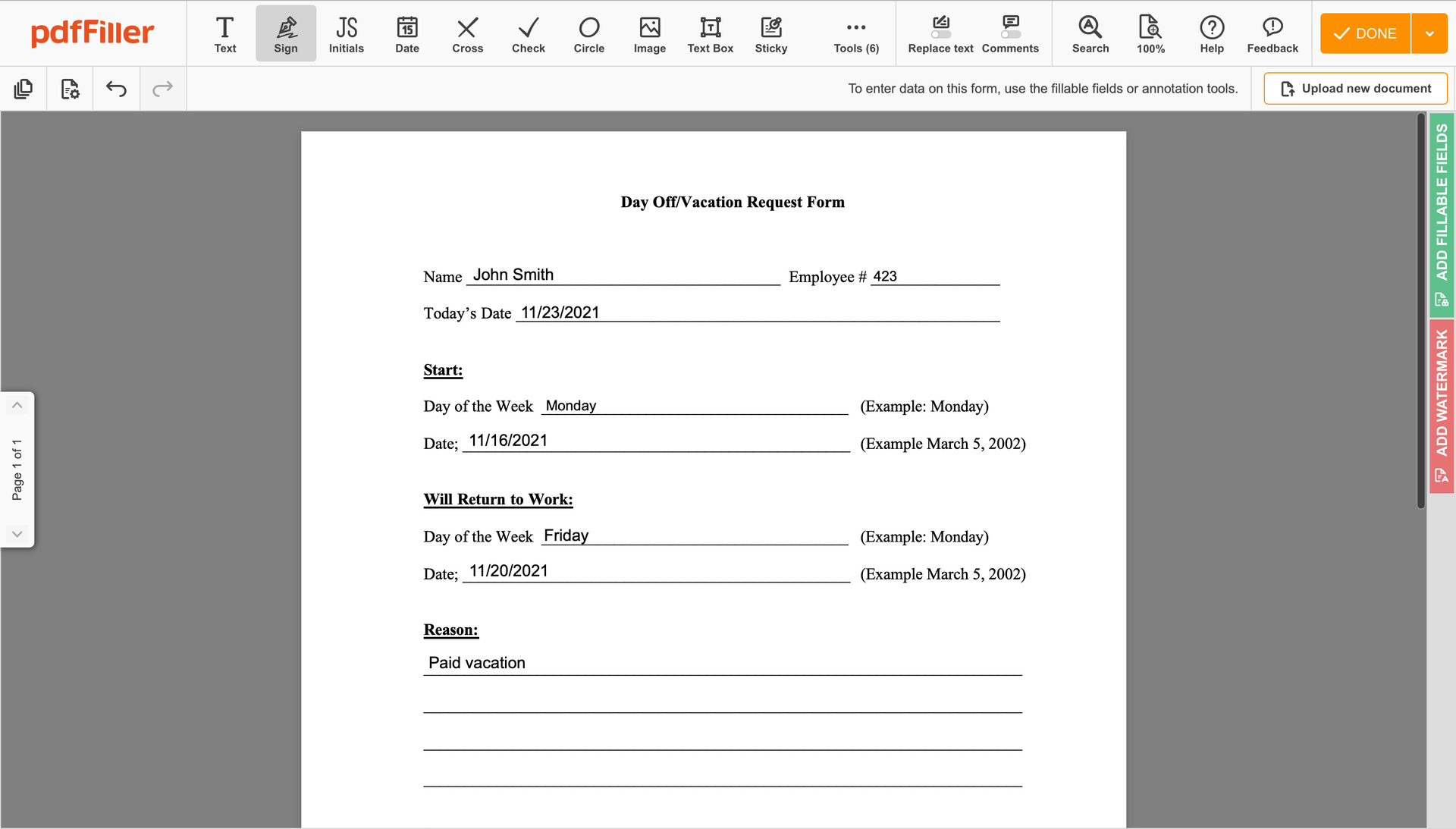

As soon as the file opens in the editor, hit Sign in the top toolbar.

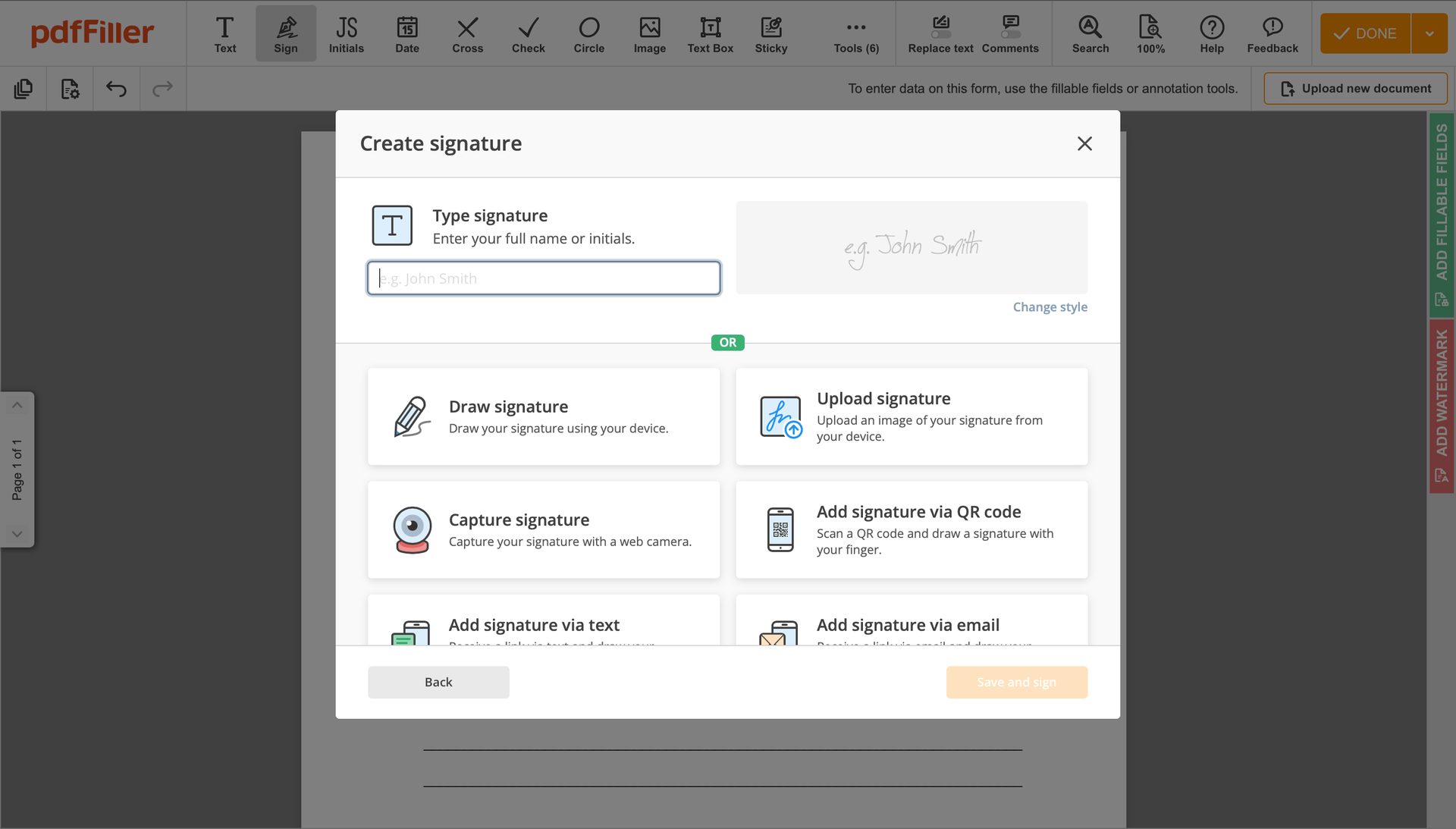

Generate your electronic signature by typing, drawing, or uploading your handwritten signature's image from your laptop. Then, hit Save and sign.

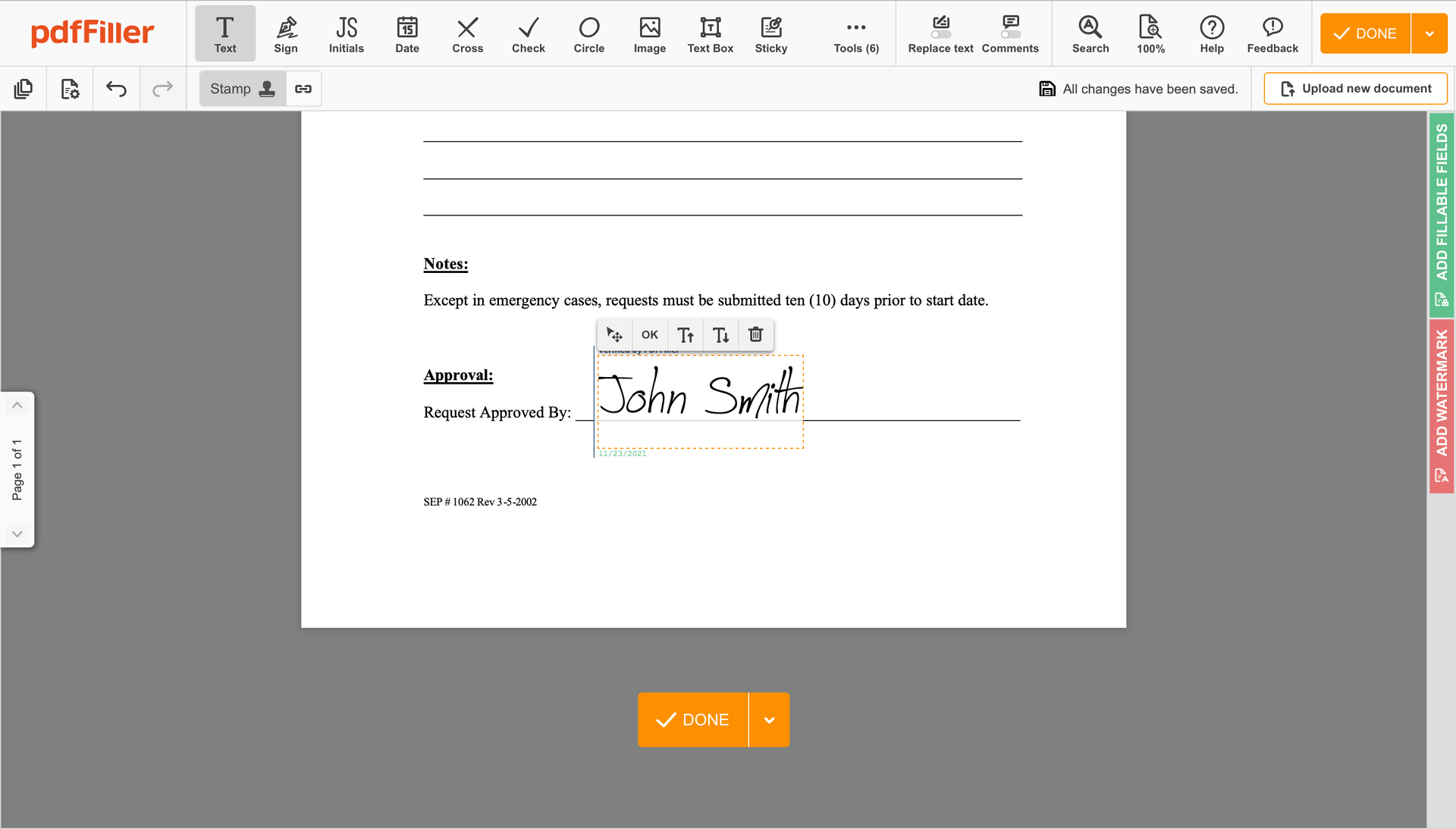

Click anywhere on a document to Carbon Copy Initials IRS Form 1040-ES. You can drag it around or resize it using the controls in the hovering panel. To apply your signature, click OK.

Finish up the signing session by clicking DONE below your document or in the top right corner.

After that, you'll go back to the pdfFiller dashboard. From there, you can download a completed copy, print the form, or send it to other people for review or validation.

Still using numerous applications to sign and manage your documents? We have a solution for you. Use our editor to make the process simple. Create fillable forms, contracts, make templates and even more useful features, within one browser tab. Plus, you can Carbon Copy Initials IRS Form 1040-ES and add unique features like orders signing, alerts, requests, easier than ever. Have an advantage over those using any other free or paid tools. The key is flexibility, usability and customer satisfaction.

How to edit a PDF document using the pdfFiller editor:

Ready to try pdfFiller's? Carbon Copy Initials IRS Form 1040-ES