Check Chart Transcript For Free

Join the world’s largest companies

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Check Chart Transcript Feature

The Check Chart Transcript feature simplifies the way you access and review your important documents. This tool offers a clear and efficient way to track changes and understand your data. With it, you can gain insights that drive informed decisions.

Key Features

Potential Use Cases and Benefits

This feature addresses the common problem of disorganized records and unclear data tracking. By utilizing Check Chart Transcript, you can keep all your important information in one accessible place. It not only saves time but also minimizes confusion, allowing you to focus on what matters most.

Instructions and Help about Check Chart Transcript For Free

Check Chart Transcript: edit PDF documents from anywhere

The PDF is a popular file format used for business records because you can access them from any device. You can open it on any computer or smartphone — it'll appear same.

The next primary reason is security: PDF files are easy to encrypt, so they're safe for sharing data from person to person. In case you're using an online solution to store documents, one can possibly get an access a view history to find out who had access to it before.

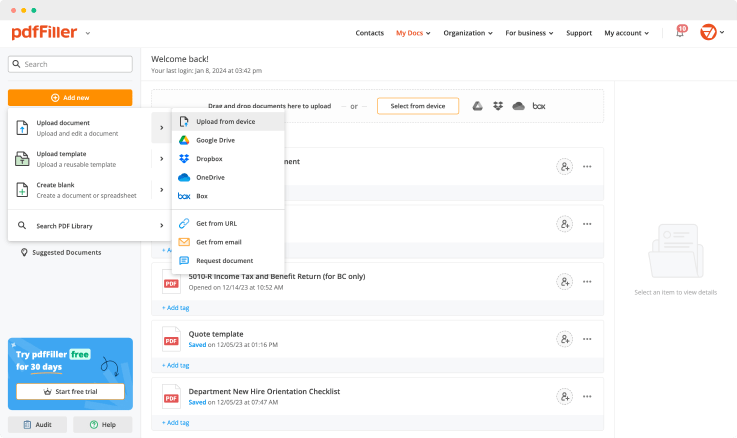

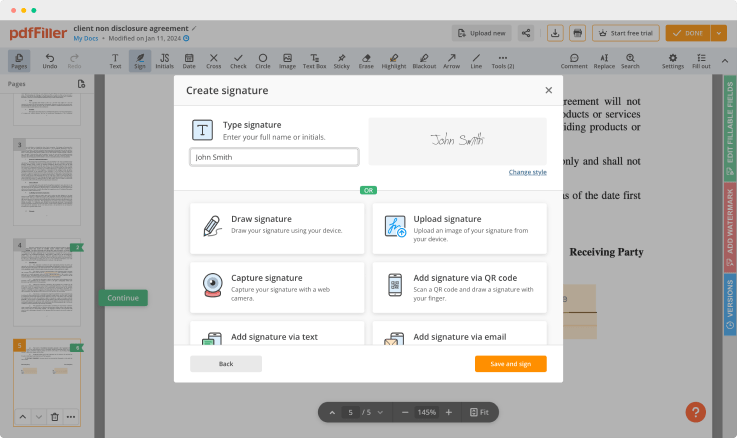

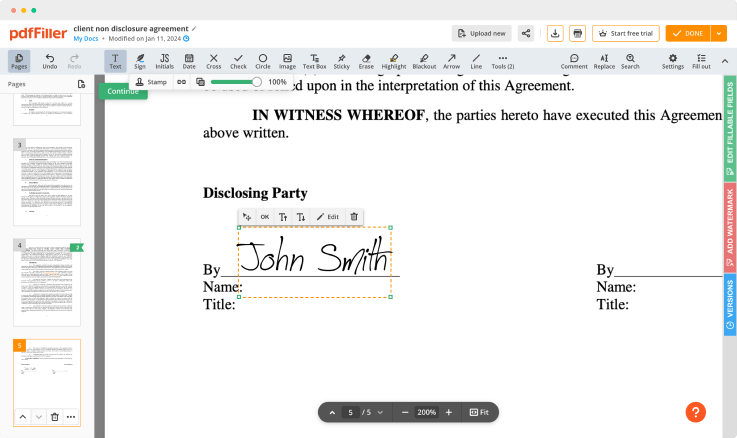

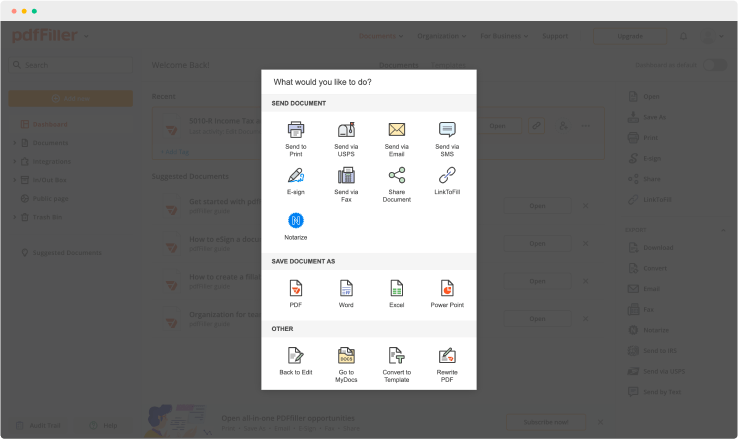

pdfFiller is an online document management and editing tool that lets you create, edit, sign, and share your PDF directly from your web browser tab. Convert MS Word file or a Google Sheet and start editing it and create some fillable fields to make it a singable document. Once you’ve finished changing a document, you can forward it to recipients to complete, and you'll get a notification when it’s completed.

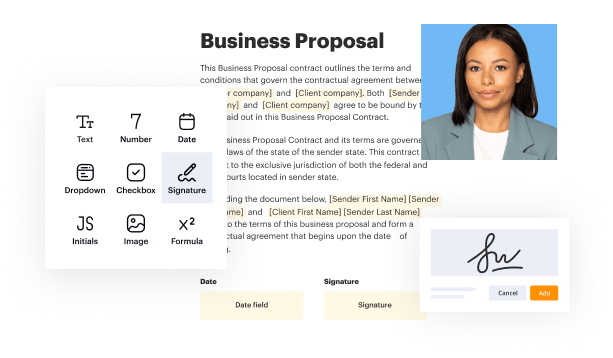

Use powerful editing features such as typing text, annotating, blacking out and highlighting. Add fillable fields and send documents for signing. Change a template’s page order. Add images to your PDF and edit its appearance. Collaborate with other users to fill out the fields and request an attachment. Once a document is completed, download it to your device or save it to cloud.

Complete any document with pdfFiller in four steps:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Check Chart Transcript