Convert On Amount Transcript For Free

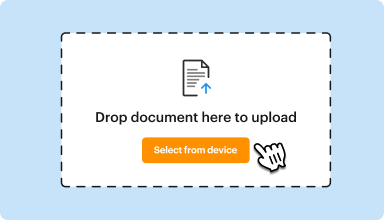

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

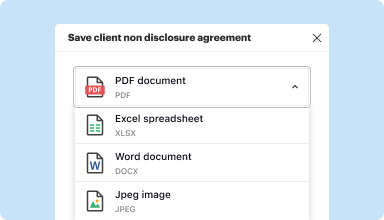

Edit, manage, and save documents in your preferred format

Convert documents with ease

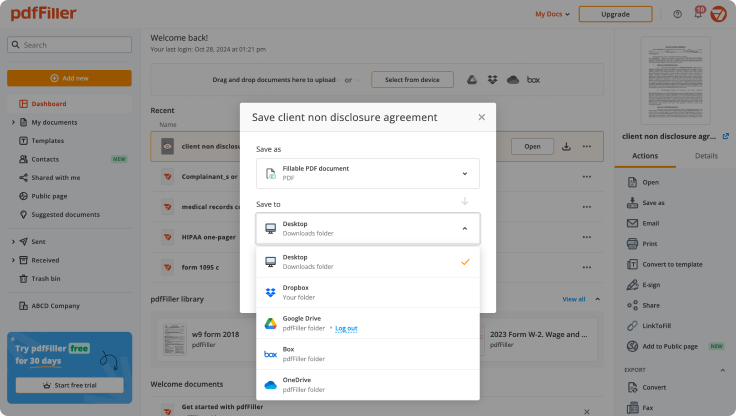

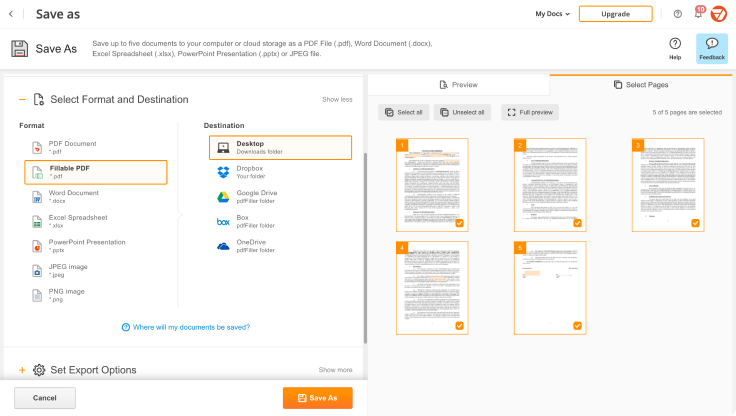

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

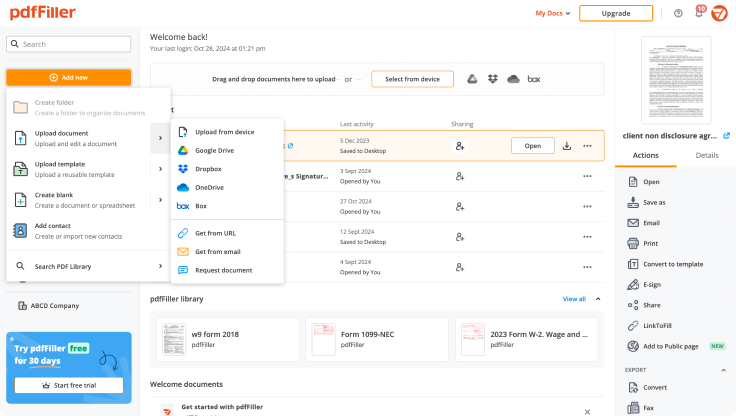

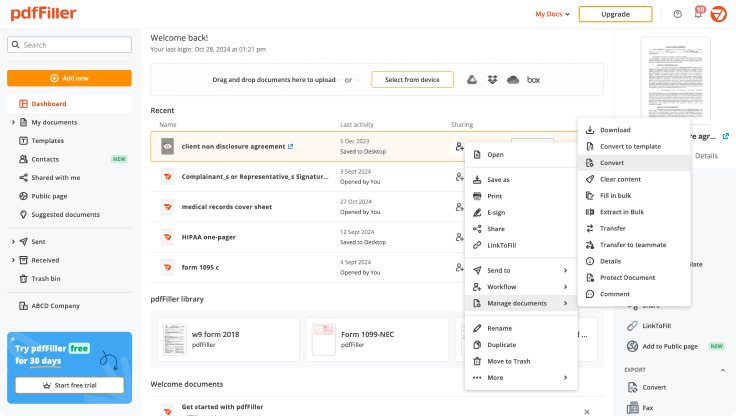

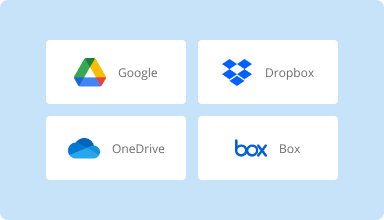

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

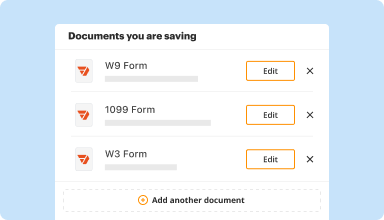

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

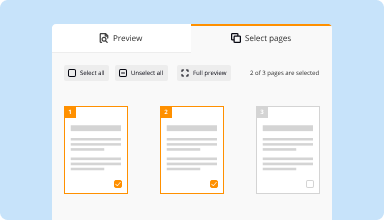

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

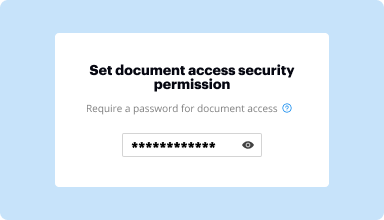

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I love PDF filler. I was delighted that I was able to import a form from my email to PDF Filler as the form was not listed as available on your program. Very easy to use. t

2017-04-07

I love this program! I am in an area where I do not have a land line or ability to fax and now I can! I also love the feature where I can erase and correct documents without having to recreate the entire document.

2018-10-15

But the important thing is they indicate that it is free to use online, but they demand that we subscribe to make a charge, then we do not have the link to cancel

2019-02-02

Easy to use with all the features we need for a pdf

The way you allow to edit document is really great. Adding pages and adding images to pages works really well. Finally some application that has almost all the features we need to create or edit pdf.

2024-07-19

Outstanding customer service, communication and efficiency!! I highly recommend. They are one of the best, if the THE best company I've ever dealt with!

2022-02-02

What do you like best?

The ease of use. A vast level of functionality

What do you dislike?

Some features like fillable links do not work with phones very well

What problems are you solving with the product? What benefits have you realized?

Still working with it

2021-11-10

What do you like best?

I like that I can pretty quickly add fillable fields and combine documents. I create printable packs for travel and RV life and this program has been so great for finishing touches on products.

What do you dislike?

When I add other documents to an existing one (combining) it renames the document and also makes a new version. This means I sometimes have to search through all the "documents" and even open them up to find what I am looking for. It can be pretty annoying when working on a large document with 20+ pages.

What problems are you solving with the product? What benefits have you realized?

I am solving the problem of needing a PDF editor. I initially needed it for signatures and filling out PDF forms for work. Then I started to use it for personal use in adding fillable fields to products I create, and bundling multiple pages together into PDF format.

2021-10-26

What do you like best?

PDF is accessible and gives me the tools I need to edit, review and send docs. I like the ability to change my signature and erase as needed.

What do you dislike?

Sometimes erasing can be problematic, but nothing a little patience can't deal with. Would be nice to be able to erase large segments, sort of like making a large text box.

Recommendations to others considering the product:

It's great.

What problems are you solving with the product? What benefits have you realized?

Basically getting and sending signatures. Saves quite a bit of time and of course, the wait for something to get thru the snail mail.

2020-08-13

This site made dealing with PDF files…

This site made dealing with PDF files so much easier. Thank you for allowing a free trial during such a trying time in teaching.

2020-04-22

Convert On Amount Transcript Feature

Discover the Convert On Amount Transcript feature, designed to simplify your data management. This tool allows you to convert financial transcripts based on specific amounts, making it easier to track and analyze your financial data. Whether you manage a small business or oversee personal finances, this feature offers a practical solution to streamline your processes.

Key Features

Convert transcripts based on specific monetary amounts

User-friendly interface for quick navigation

Supports a variety of financial formats

Export data for further analysis

Secure handling of sensitive financial information

Potential Use Cases and Benefits

Small business owners can monitor expenses effortlessly

Accountants can generate accurate financial reports with ease

Personal finance managers can analyze spending habits effectively

Auditors can verify financial transactions without cumbersome processes

Financial analysts can improve data accuracy for better insights

By using the Convert On Amount Transcript feature, you can solve problems related to data organization and accuracy. It helps you focus on important financial details, reduces the time spent on manual conversions, and ensures your financial records are clear and precise. Embrace this tool to enhance your financial management and make informed decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What does account balance mean on tax transcript?

Account Balance. The balance due amount for the tax year. Account Balance Plus Accruals. The total of the Account Balance, Accrued Interest, and Accrued Penalties. This amount may not be the payoff amount.

What does account balance mean on IRS transcript?

Account Balance. The balance due amount for the tax year. Account Balance Plus Accruals. The total of the Account Balance, Accrued Interest, and Accrued Penalties. This amount may not be the payoff amount.

How do I read my IRS transcript?

Request an account transcript by calling the IRS directly at (800) 829-1040, or by filing Form 4506T, Request for Transcript of Tax Return. Check the taxpayer identification numbers below that, as well as the taxpayer name or names, to make sure they are accurate.

What is the difference between an account transcript and a return transcript?

A tax return transcript usually meets the needs of lending institutions offering mortgages and student loans. Tax Account Transcript — shows basic data such as return type, marital status, adjusted gross income, taxable income and all payment types. It also shows changes made after you filed your original return.

What do IRS transcript codes mean?

IRS Transaction Codes and Error Codes. IRS Code 846 Refund of Overpayment is the transcript code that signals the time for a happy dance and that a refund is forthcoming. IRS Code 570 Additional Liability Pending/or Credit Hold is a code that means there is a bump in the road for some tax refunds.

What is the difference between a tax return transcript and a tax account transcript?

Difference Between Tax Return and Transcript A tax transcript is a summary of your tax return provided by the IRS. A tax account transcript contains the same information as the tax return transcript along with additional items such as marital status, taxable income and the type of tax return you filed.

What is the difference between a tax return and a tax transcript?

A tax return is used to pay taxes or request a refund. A tax transcript is a summary of your tax return that is provided by the IRS.

Can I file taxes with a transcript?

Yes, an IRS (or state) account transcript is an acceptable document to process your return.

#1 usability according to G2

Try the PDF solution that respects your time.