Convert On Chart Contract For Free

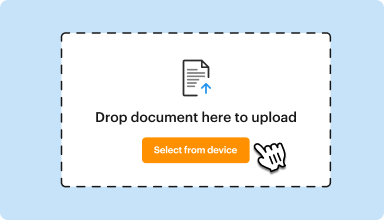

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

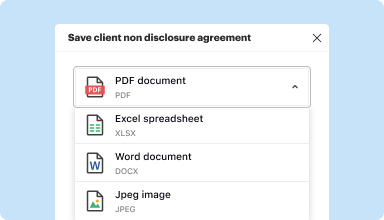

Edit, manage, and save documents in your preferred format

Convert documents with ease

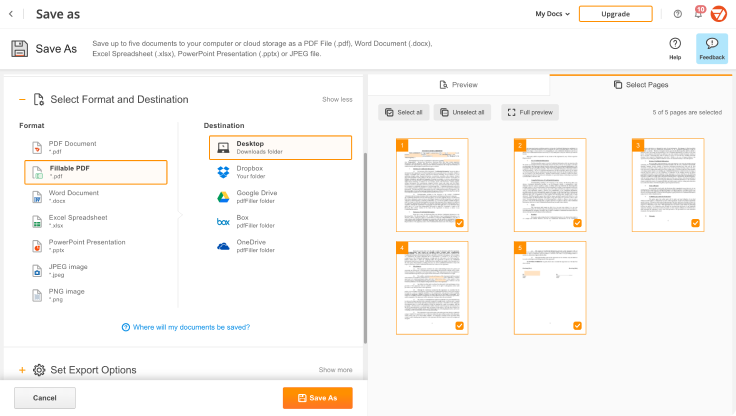

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

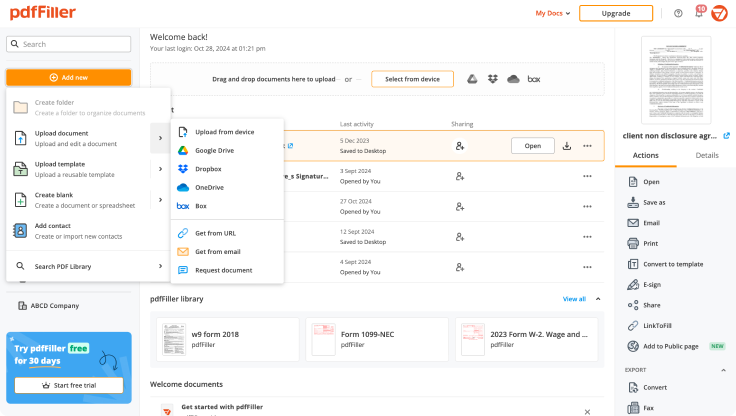

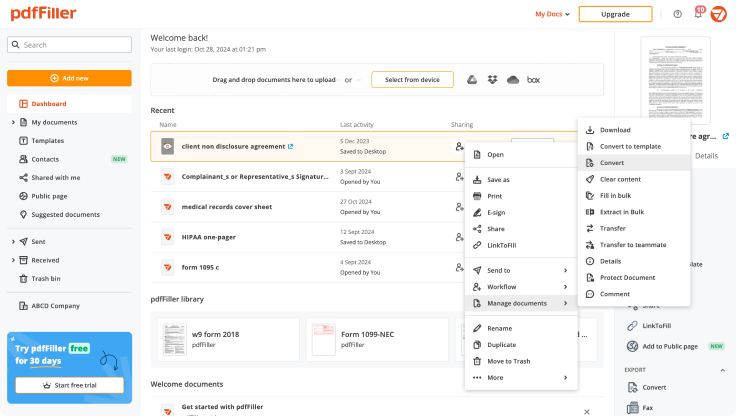

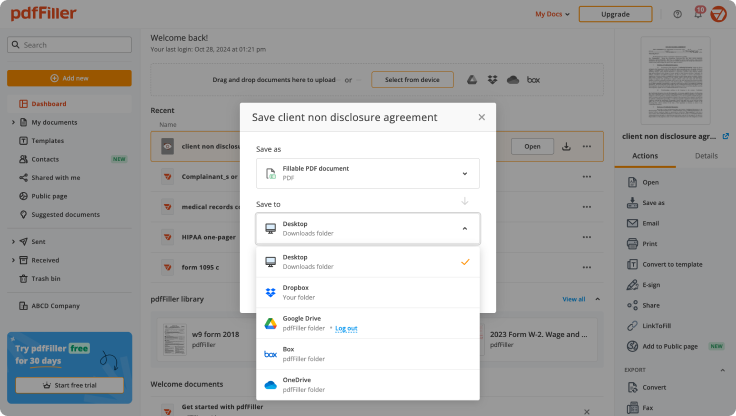

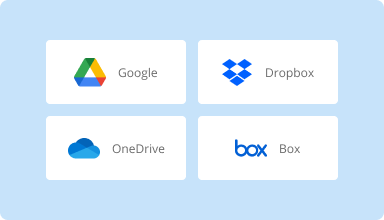

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

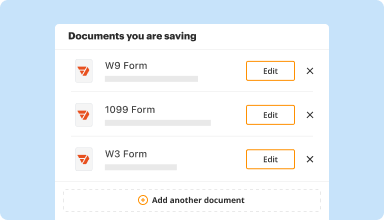

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

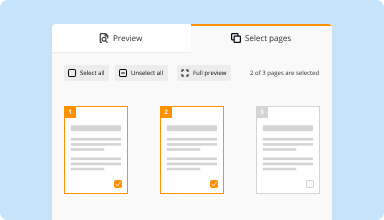

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

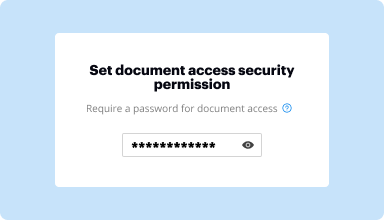

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I had a quick need to make some changes to a PDF. I found your application and it worked immediately. I want to learn more about these other features.

2016-08-07

Honestly this service was awesome the only issue I had was that it wasn't up front about the payment. I didn't realize it was a paid service until the end when I had finished editing everything and that really annoyed me. But other than that the features are simply incredible. Definitely would recommend

2018-05-03

Great product

Easy to send out fillable contracts to my clients and then be able to modify or change existing docs to suit my needs

Numerous templates of forms available. Perfect to create and modify contracts and my documents

Didn't really have any issues with them.

2019-05-21

Easy & simple to use!

Perfect for e-signing docs. Navigating the documents is easy & doesn't take you into weird places of the doc that don't need attention.

I don't see any improvements that need to be made, I really like this product.

2023-01-13

Although I accidentally subscribed to…

Although I accidentally subscribed to the service for a long time (forgetting that I did) and the subscription was taking money out of my account, gilbie sorted this out straight away for me and made sure all the money from previous months was refunded to my account. Very kind and helpful customer service.

2022-09-25

Everything was very easy to follow and…

Everything was very easy to follow and to make a great health record form out of one that you had!! I will never go back to writing each one out by hand!! Plus, it looks so much more professional!! Thank you for this great addition to this kennel's business and looking forward to using it for other self employment plans in the near future!!

2022-06-23

Practical

PDFfiller makes finding and editing a document easy, useful, and practical. It also keeps these important documents in one location for a trouble free experience.

2021-07-15

What do you like best?

That I can mark up any pdf or create 1 new document from several. Also digital signatures, I work remotely and need this! Being remote, I need to be able to create or sign a form from anywhere and I can easily with pdf filler. I love the share feature as well, I can work on my end and my co-workers will have it almost instantly without having to print, scan and email. I work remotely, almost all from my laptop with no printer. This allows me to work from my phone or tablet seamlessly as well.

What do you dislike?

Not much, no complaints yet. Maybe the layout? Like where everything is, I click on the documents and then you have to specify where something is. Maybe a more organized folder system? When I share them, they should all be in the share folder, but for some reason, they're not always there. I am a very organized person and like everything in its own folder or file. I'd like a way to save everything to its own file and be able to find them quickly and easily.

Recommendations to others considering the product:

This is a great program, especially if you work remotely, highly recommend it!

What problems are you solving with the product? What benefits have you realized?

1099 tax reports, our software only supports e-file and we are so small that we don't have that. I also love the share part, I'm able to work on my end, share it with my co-workers and they can have it almost instantly without printing and scanning, etc. I also love that I can take a few different documents and combine them to one, that is a great feature!

2021-02-11

I mislead them on my intentions for the service level that I required. Once I brought it to their attention, I answered 3 questions; and the matter was immediately resolved. Outstanding customer service comms. !!!

2020-08-27

Convert On Chart Contract Feature

The Convert On Chart Contract feature simplifies your trading experience by allowing you to adjust your contracts directly on your trading chart. You can easily visualize and modify your positions without navigating away from your charts.

Key Features

Direct contract conversion on charts

User-friendly interface with real-time updates

Multiple contracts management

Instant access to market trends and data

Seamless integration with existing trading tools

Potential Use Cases and Benefits

Traders looking for quick adjustments to positions during volatile market conditions

Investors who want to visualize potential outcomes before confirming trades

Users aiming to save time by managing contracts without complex navigation

Traders needing a clear view of market dynamics and data while making decisions

By using the Convert On Chart Contract feature, you can solve common trading challenges. Instead of wasting time switching between tools, you gain efficiency. This feature helps you respond quickly to market changes, make informed decisions, and ultimately enhance your trading success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you convert contract to salary?

Here's how I do that: Take your hourly rate and multiply it by 2,080, which is the number of hours in a year if you work 40 hours a week for 52 weeks. Or if you need to convert a salary into an hourly wage, you can divide the salary by 2,080. That way, you can compare the salary for each role to each other role.

How do you convert salary to contract rate?

52 weeks in a year x 40 hours per week = 2,080 hours. Full-time annual salary / 2,080 = contract hourly rate. (Full-time salary + burden) / 2,080 = contract hourly rate.

How do you calculate contract rate?

Add your chosen salary and overhead costs together. Multiply this total by your profit margin. Divide the total by your annual billable hours to arrive at your hourly rate: $99,000 ÷ 1,920 = $51.56. Finally, multiply your hourly rate by 8 to reach your day rate.

How do you convert daily rate to annual salary?

The rough formula I have seen here is to multiply daily rate by 100 to get to approx annual salary. Might be a little high or low in some cases but as a rough rule of thumb. The rough formula I have seen here is to multiply daily rate by 100 to get to approx annual salary.

How much more should you be paid as a contractor?

According to the latest Dice Salary Survey, the average salary for full-time employees is $93,013. Meanwhile, the average salary for contractors employed by a staffing agency is $98,079. Those contractors who work directly for an employer (i.e., without an agency as an intermediary) pull down an average of $94,011.

How do contractors negotiate salary?

Base the rate on your target income Determine how much you want to make per hour, and then negotiate the contractor's pay rate to determine the bill rate. Charge based on a direct placement fee Calculate what you would normally earn on a direct hire and divide it by the length of the contract.

Do contractors get paid more than employees?

Yes, contractors earn (on average) a bit more than full-time employees but contracting comes with its own set of issues. Contractors who aren't affiliated with a staffing agency could still have the opportunity to negotiate for benefits and perks with their clients, although this is often a trickier process.

Do contractors earn more than employees?

Contractors earn more money than employees do. It's that simple. That is because contractors charge more and can take home a lot more of their pay than employees are able to. Contractors have three major advantages: they typically charge more, they pay less in taxes, and they can deduct their expenses.

#1 usability according to G2

Try the PDF solution that respects your time.