Convert On Company Form For Free

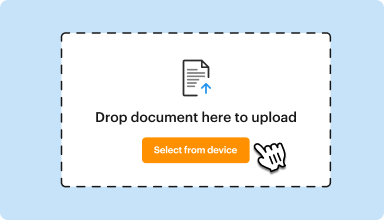

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

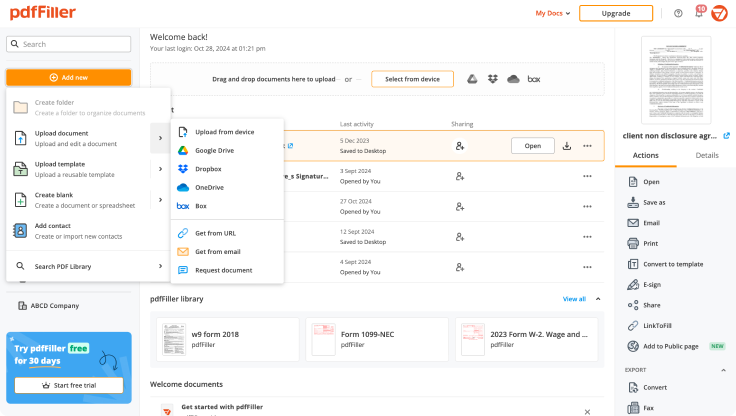

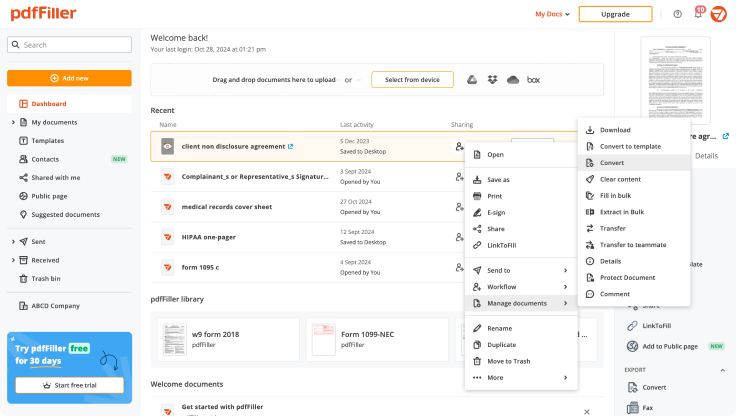

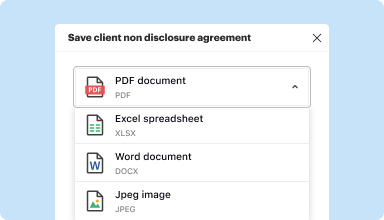

Edit, manage, and save documents in your preferred format

Convert documents with ease

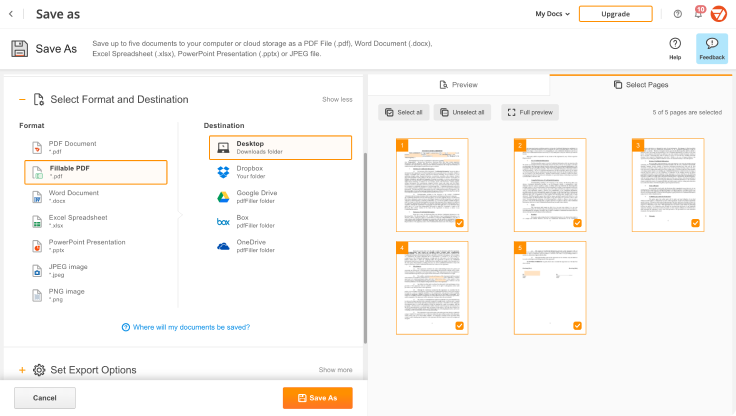

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

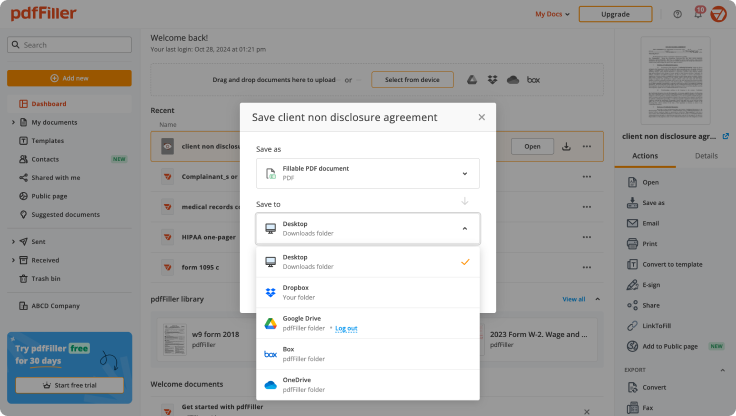

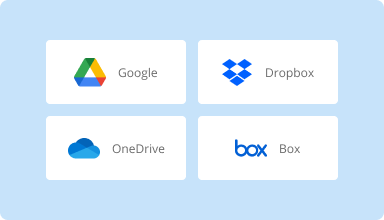

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

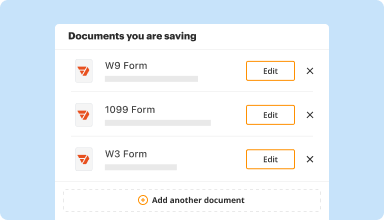

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

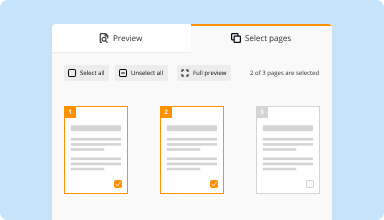

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

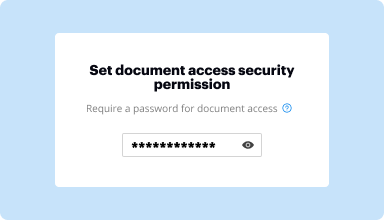

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Less than satisfactory. I filled in a document. Made a mistake with one numeral and have yet to be able to \correct it. I 've being trying for 2 hours mwith no luck

2016-04-11

This is a good app. It could be improved with navigation that's a bit less clunky - more intuitive. I also wish there was a way to fill out forms without having to recenter, re-size, re-font the text so it looks normal in the document.

2018-12-14

PDF Filler has made it much easier to create and edit forms and templates, and complete documents which once had to be either retyped in their entirety, or required the much outdated use of a typewriter to complete.

2019-07-09

Easy to use

I have converted from our company's old way of emailing documents to print, sign, and scan back to us to digital signatures. It has made the process much easier for me and all of our new team members

I would love to be able to consolidate multiple documents into one OR send multiple documents with one email

2017-06-07

I'm a little bit new at the process, but I'm interested in learning as much as possible about any new technologies, that will save me a little bit of time.

2024-09-17

I have to do alot of document changes in my scope of work. This was the easiest program I've used in the 28 years I've worked in the corporate world. It's everything I have always wished I had at any given point but all in one pretty little program. Usually, theres always one feature not thought of or you dont have the option for, I didnt feel that at anypoint. In fact, I was pleasantly surprised each time when there it was in all its glory, the key option I needed. Thank you

2022-08-06

User Friendly and Effective Audit Trail

Found it very user friendly when using it to get signatures. The audit trail is also simple and understandable in terms of tracking.

2021-10-18

Usage of this form was very…

Usage of this form was very satisfactory and user friendly. I would have liked to complete and print or email the form for signatures before completing this survey.

2021-08-08

Marie was nice enough to be a human but…

Marie was nice enough to be a human but not enough to tell me her favourite colour. Overall great instant service

2021-01-16

Transform Your Business with Convert On Company Form

Convert On Company Form streamlines data collection and enhances user engagement. This feature allows you to convert standard forms into interactive, user-friendly experiences. With its simple design and effective functionality, you can easily gather valuable information from your users while providing them with a seamless experience.

Key Features

Customizable form templates

Easy integration with existing systems

Real-time analytics on form performance

Mobile-friendly design for users on the go

Secure data collection and storage

Potential Use Cases and Benefits

Collect customer feedback through engaging surveys

Streamline job applications with intuitive forms

Enhance lead generation by capturing visitor information

Improve event registration and management

Gather data for research and analysis

By implementing Convert On Company Form, you tackle the common pain points of inefficient data collection and low user engagement. This tool not only simplifies the process of gathering information, but it also encourages interaction, making users more likely to complete forms. Ultimately, it helps you drive better business outcomes through enhanced user experience and actionable insights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I change from C Corp to LLC?

Asset transfer The C corporation and its shareholders transfer assets to form an LLC. The C corporation transfers its assets (subject to liabilities) to the LLC, and the shareholders transfer cash or other assets. The C corporation then liquidates and distributes its membership interest in the LLC to the shareholders.

Can I convert my C Corp to an LLC?

When you convert a C corp to an LLC, you may pay that tax at both the corporate and the individual level. When you convert an S corp to an LLC, you only pay this tax at the individual shareholder level. It's harder to transfer membership in an LLC than it is to transfer shares in a corporation.

Can a corporation be changed to an LLC?

It is possible to change an LLC to a corporation, and it's a simple process in many states. But if you only want to become a corporation for its tax advantages, you can also remain an LLC and elect to be taxed as an S corporation. LCS and corporations are types of business entities.

Why would a company go from Inc to LLC?

Inc=corporation which is a legal entity created under state laws. Generally if a business is changing from a corporation to an LLC it signals that their intention is to remain a privately held entity and desire the flow through taxation options available as an LLC that are not available to a corporation.

What are the tax advantages and disadvantages of converting AC corporation into an LLC taxed as a partnership?

Converting a C corporation to an LLC taxed as a partnership often results in a large tax bill. This is largely because the corporation is taxed in conjunction with the sale or transfer of its assets (liquidation), and the shareholders, too, are taxed on the assets distributed to them.

How can I legally get out of an LLC?

Determine if there is an LLC operating agreement provision pertaining to withdrawal. Follow the procedures of an operating agreement or the state LLC statute default provision if there is no operating agreement. Submit written notice of withdrawal to the LLC members.

Why is it necessary for a company to convert into a corporation?

There are several common reasons for changing an LLC to a corporation: To attract investors. Because LLC ownership can be difficult to transfer from one owner to another, professional investors vastly prefer to invest in corporations.

Can you switch from an LLC to a corporation?

It is possible to change an LLC to a corporation, and it's a simple process in many states. But if you only want to become a corporation for its tax advantages, you can also remain an LLC and elect to be taxed as an S corporation. LCS and corporations are types of business entities.

#1 usability according to G2

Try the PDF solution that respects your time.