Convert On Currency Lease For Free

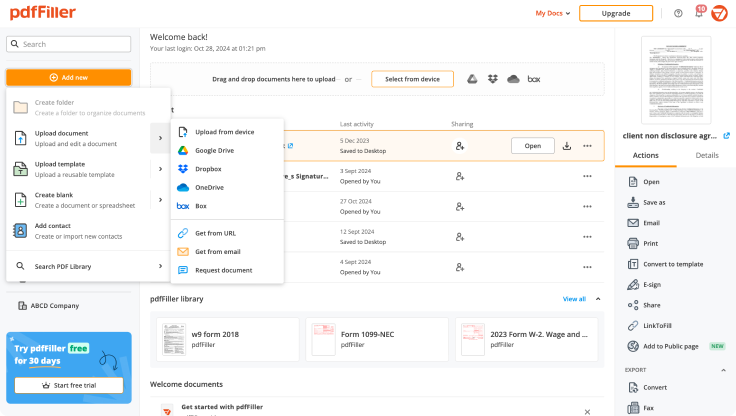

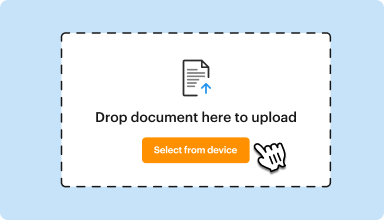

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

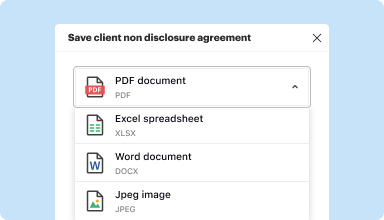

Edit, manage, and save documents in your preferred format

Convert documents with ease

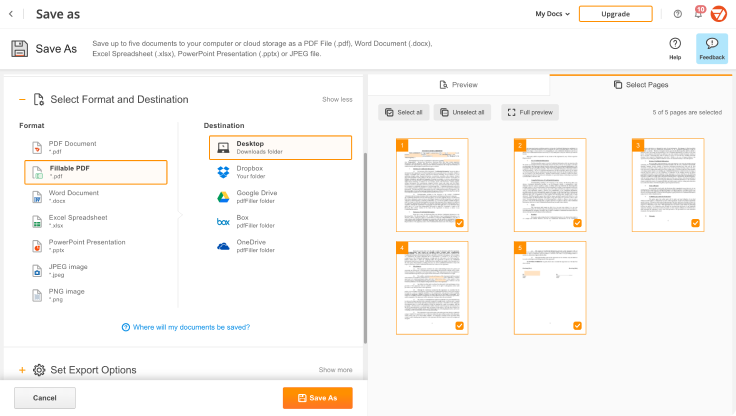

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

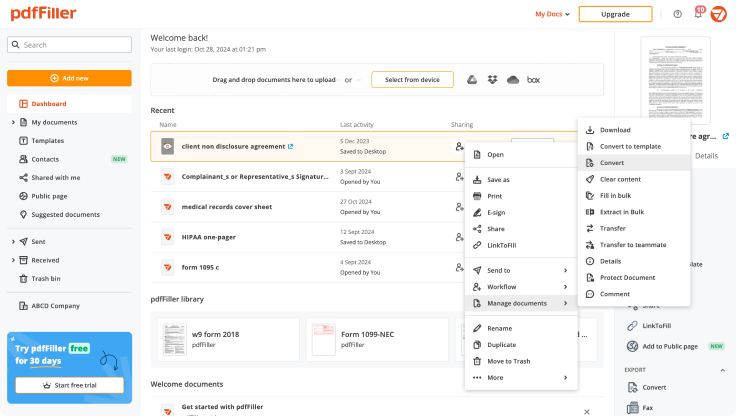

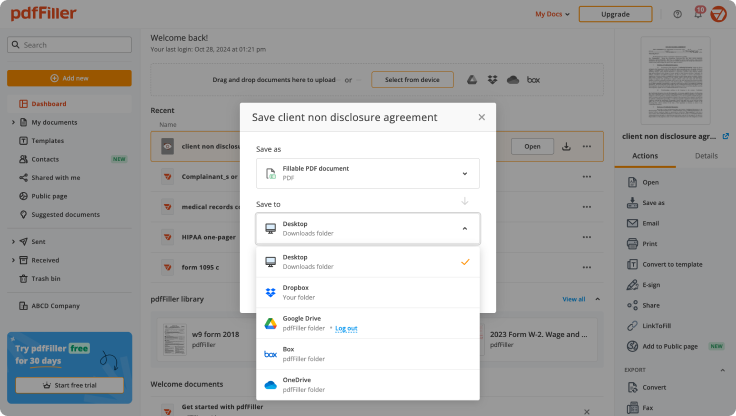

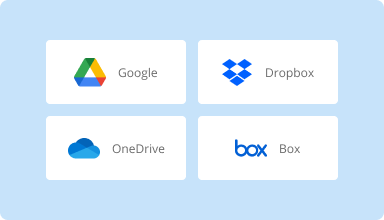

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

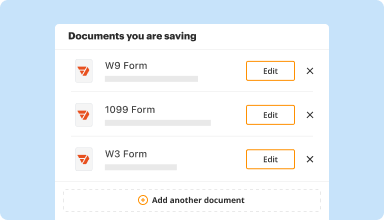

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

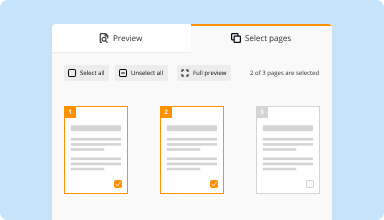

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

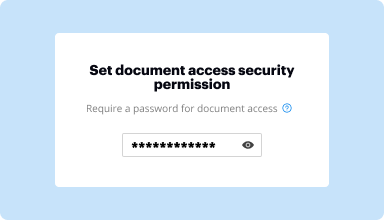

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

It was a life saver for me as I transitioned my insurance business. It looks so much more professional to import supplemental applications and forms and complete them with a keyboard. In the past, I did them by hand even though I worked for one of the largest insurance agencies in the country. In the past, I was unaware of your product, or I would have bought it myself to use.

2015-08-17

Found the "filler" just in time, as I had mussed up the forms sent to me. From then on I just used the forms from the site Had never used it before. Needed government forms, and they were there by form number. Saved me from performing scanning and downloading, then uploading. Neat job.

2015-11-05

I had problems using this program. Customer support helped me to figure out what was causing the problem and fixed it. I appreciate their time and effort.

2016-07-26

4 starts because of great chat support but some features I would change. Like when filling out fillable form, I don't like how the instruction window follows you through the entire document. Most other online forms don't have this because they assume the form is self-explanatory. The feature is cumbersome, like dragging around dead weight. Anyways, that is my input.

2017-06-20

Very useful service. Trying to create a fillable pdf is made simple. Although when it's downloaded, one or two areas are not fillable anymore so have to do it again.

2019-02-11

Was a little cumbersome at first, but was able to figure out on own which says a lot about a computer program minus an instruction booklet. Yeah, I'm a little on the geek side.

2020-01-09

Saves so much time

I like this software because it is so easy to use. It saved me time and allowed me to quickly complete the necessary document

The only con I have with this software was that when printed it did not print all of the words typed in

2019-07-26

Easy to use

Best thing about PDF Filler is ease of use. Very user friendly and have good support staff.

Could offer more options for customizing but that is being picky.

2019-01-29

this is amazing, I am a real custoner who cannot be...

this is amazing, I am a real custoner who cannot be bothered to write.a long review. But I can honestly say that this is it! Pay for it, absolutley worth it

2020-06-17

Convert On Currency Lease Feature

The Convert On Currency Lease feature streamlines your leasing process by allowing you to convert lease payments into your preferred currency with ease. This feature is designed to simplify transactions and enhance your financial flexibility.

Key Features

Real-time currency conversion for accurate lease payments

Support for multiple currencies, ensuring global accessibility

User-friendly interface for quick and easy transactions

Automated calculations to eliminate manual errors

Customizable settings to align with your business needs

Potential Use Cases and Benefits

Businesses operating in multiple countries needing consistent lease payments

Individuals leasing equipment or properties in different currencies

Organizations looking to simplify financial reporting and budgeting

Sectors requiring agile financial operations, such as international trade

Customers wanting a seamless payment experience across borders

With the Convert On Currency Lease feature, you can tackle common challenges such as currency fluctuation, complicated payment processes, and inaccuracies in financial calculations. This solution not only simplifies your leasing transactions but also empowers you to focus on your core operations without the worry of currency-related obstacles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can you negotiate the price of a leased vehicle?

In short: Yes, you can definitely negotiate a lease price. When it comes to negotiating, leasing is just like buying, and that means that you should feel free to negotiate just as you would when buying a car.

Can you negotiate the residual value of a car lease?

In fact, every lease where buyout is available will specifically include the residual value of the vehicle. But you typically can't negotiate it like you can with other lease terms (although you can try). So less depreciation (or higher residual value) can mean lower monthly payments over the lease term.

Is the residual value on a car lease negotiable?

The residual value is simply an estimate of the wholesale value of the car at the end of the lease term. They are an expert guess as to what the car will be worth when the lease ends, and they are typically not negotiable.

What is the typical residual value on a lease?

So when you're shopping for a lease, the first rule of thumb is to look for cars that hold their value better the ones that have high residual values. Residual percentages for 36-month leases tend to hover around 50 percent but can dip into the low 40s or be as high as the mid-60s.

What is the best way to negotiate a car lease?

Know Your Numbers. Know What You Want. Get Quotes Ahead of Time. Test-Drive the Dealership (and the Salesperson) Check Dealership Inventory. Go on a Good Day. Bring Backup. Keep Your Phone Out.

Can you negotiate the money factor on a lease?

Negotiate the interest rate (money factor) on the lease to a level appropriate to current market interest rates. Also, when the lease ends you typically have the right to buy the car at the residual value.

What is a good money factor on a lease?

A lease deal with a money factor of less than. 0017 is a good deal. Anything higher, means less of a good deal. Of course, the best lease deals are made with a combination of low lease PRICE, high RESIDUAL value, and low MONEY FACTOR.

How much can you negotiate on a leased car?

To get the best deal, negotiate the cap cost first, as though you intend to purchase the car outright. In fact, don't even mention leasing until you and the dealer agree on a price. Once that's settled, then you can bring up financing options (which include leasing).

#1 usability according to G2

Try the PDF solution that respects your time.