Convert On Elect Notice For Free

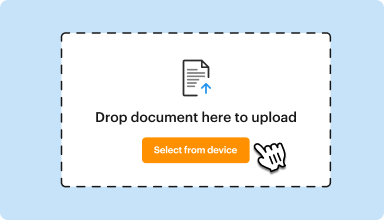

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

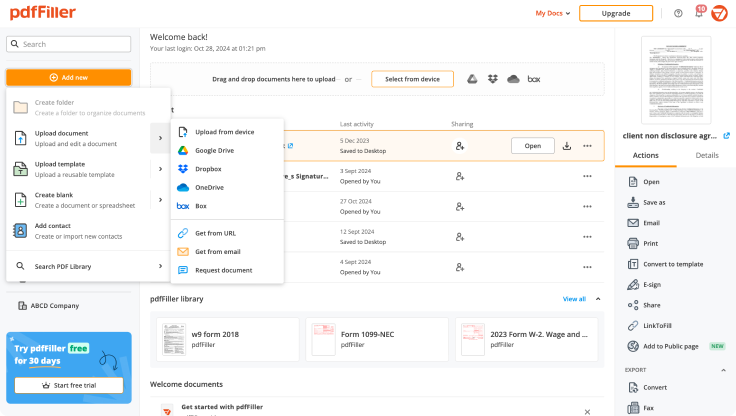

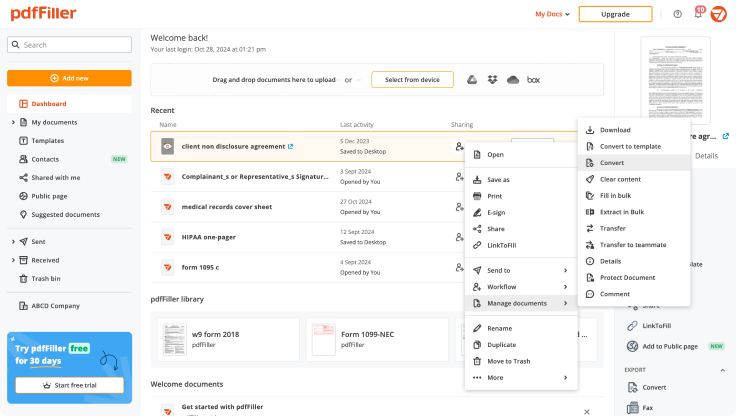

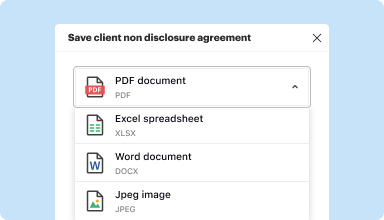

Edit, manage, and save documents in your preferred format

Convert documents with ease

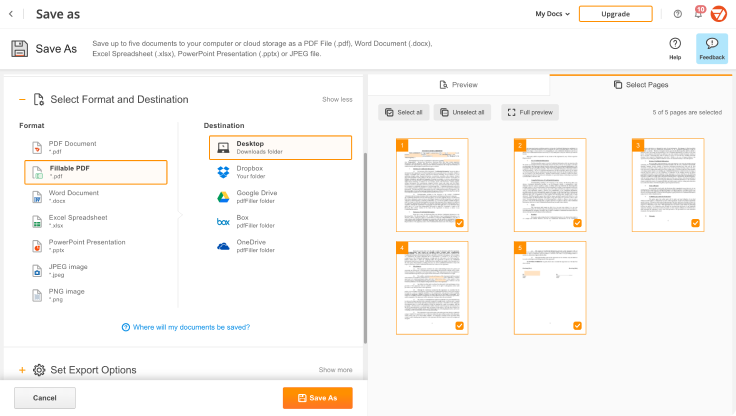

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

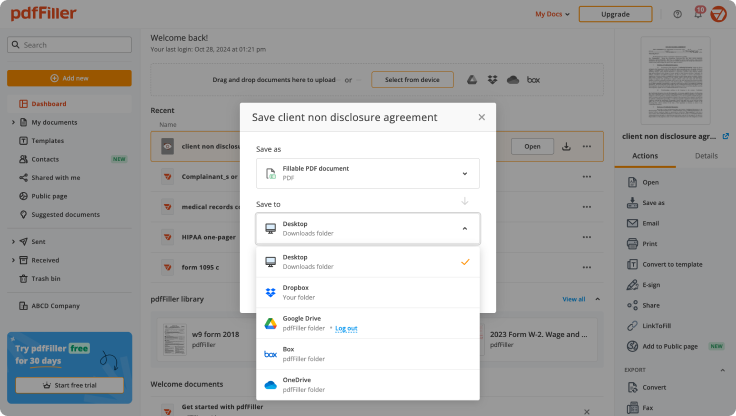

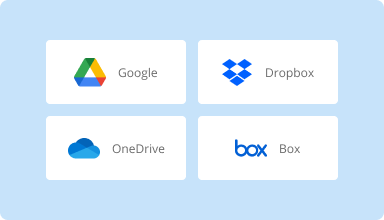

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

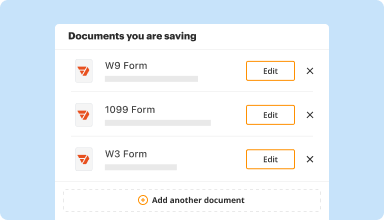

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

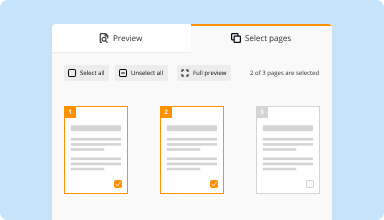

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

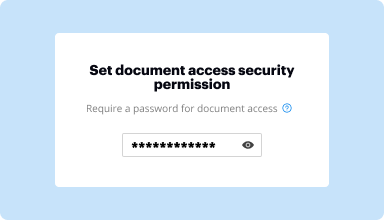

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

It works easily and I feel that people with all levels of computer experience will be able to fill out our forms and get them to us through PDFfiller.com!

2016-02-09

I’m new to PDFfiller. Like the create document feature, although have to search and search for specific forms....Not easy to access. But do find PDFfiller beneficial, useful. Will continue to subscribe to this platform. Great for personal use as well as business use.

2018-06-20

What do you like best?

Frantically searching for a way to fill out a PDF form without losing all of your work? PDFfiller works great, does just what it says on the tin, and has the best customer service I've experienced with a website.

What do you dislike?

Though I was wary of a paid service at first, their customer service was as helpful as any I've ever experienced and the product works as promised.

What problems are you solving with the product? What benefits have you realized?

Filling out forms as a graduate student working far far away from campus, PDFfiller helps me get it all in order without a struggle. It simply makes life easier.

Frantically searching for a way to fill out a PDF form without losing all of your work? PDFfiller works great, does just what it says on the tin, and has the best customer service I've experienced with a website.

What do you dislike?

Though I was wary of a paid service at first, their customer service was as helpful as any I've ever experienced and the product works as promised.

What problems are you solving with the product? What benefits have you realized?

Filling out forms as a graduate student working far far away from campus, PDFfiller helps me get it all in order without a struggle. It simply makes life easier.

2019-08-30

I needed to make editable changes to a document in a short window of time. PDF Filler did the job!

User-friendly and it saved the first draft so I had time to purchase a trial run of the software in order to save the final version on my PC.

I wish that I could've been able to log in and get right to my previously saved work faster. The intro screen and the print screen were rather busy.

2017-11-15

A solid editor with a very minor flaw imo

Other than a better scroll bar for the area of the documents being edited, the interface is pretty easy to navigate if you have used any similar programs (such as adobe acrobat reader). I wish there was a less feature oriented version that was free to use/download, perhaps with a daily/weekly task limit, similar to things like smallpdf.

2021-06-08

Professional look!

Got to know about PDFfiller because we use Salesforce at work, and these two are compatible. Taken together - tremendous time savings, at least several hours a week, i'd say!

Longer contracts might need a while to get fully visible on the screen, but no rush here

What do you think about this review?

2021-02-05

I tested the free trial and it's easy…

I tested the free trial and it's easy to use. Will definitely subscribe when I need to. Customer service is great. Very quick response.

2021-01-10

This review is primarily for the customer service. This company had extremely quality customer service. FAST responses. I would definitely recommend trying it out for that alone, they will work through and address any issues you have. You won’t be disappointed. Great job.

2020-05-09

This app is not flooded with ads and/or private tools as far as I could check

I just needed to merge stuff and this website (didn't know it, it just popped after a simple search) showed me tutorials for all the tools they have to make my documents complete and personalized as needed. I am here because we live in an era where an app that does not flood you with advertisement and charge your for each tool available calling some of them 'premium' or 'plus' or 'pro max' is RARE. I want to be explicitly thankful about this. Useful for the purpose of being useful. Didn't believe stuff like this existed anymore.

2025-04-11

Convert On Elect Notice Feature

The Convert On Elect Notice feature streamlines your communication processes seamlessly. This tool allows users to convert elect notices into actionable items quickly. You can enhance your workflow, improve efficiency, and ensure timely responses.

Key Features

Instant conversion of elect notices into tasks

User-friendly interface for easy navigation

Integration with existing project management tools

Automatic reminders for important deadlines

Customization options for alerts and notifications

Potential Use Cases and Benefits

Project managers can track tasks effectively

Teams can improve collaboration on important notices

Organizations can meet compliance deadlines with ease

Individuals can simplify their daily to-do lists

Businesses can enhance overall productivity

This feature addresses common challenges like missed deadlines and lost information. With its straightforward approach, it helps you stay organized and focused. As a result, you can respond promptly and effectively to important matters, turning potential obstacles into opportunities for success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can you undo an S election?

By filing Form 2553, the corporation made an election to be treated as an S corporation, and that status remains in effect until properly revoked or otherwise terminated. An S election for a prior tax year cannot be revoked because no provision within the Code allows late revocations of S corporation elections.

Can you revoke an S election?

To revoke a Subchapter S election/small business election that was made on Form 2553, submit a statement of revocation to the service center where you file your annual return. The statement should state: The corporation revokes the election made under Section 1362(a) The S corporation's EIN.

How do you terminate an S Corp election and revert to an LLC?

Basic Revocation Requirements Your election to have your LLC taxed as an S corporation was done by filing Election by a Small Business Corporation (Form 2553), most likely when you first formed your corporation. You may revoke your company's S corp. status for the current tax year or for a later date.

How do you stop an S Corp?

Obtain a shareholder vote to dissolve. Stop conducting business. Notify creditors. Liquidate assets. File a certificate of termination. File final government documents.

Why would an LLC be revoked?

Your corporation or LLC's status can be revoked for a number of reasons, including: Failure to file annual reports. Failure to pay franchise taxes. Failure to pay certain state fees.

Can I switch from S Corp to LLC?

Most states have an easy process for changing from an S corporation to an LLC. In some states, you must first form your LLC and then merge the S corporation into the existing LLC. This transaction can be complicated. A shareholders' resolution will need to be passed by the S corporation authorizing the conversion.

How can an S corporation be terminated?

To voluntarily terminate an S corporation's status requires a vote by the shareholders. Any combination of shareholders that make up 50 percent of the outstanding stock must be in agreement to terminate S corporation status. Each shareholder named in the statement must sign the statement.

When can you revoke an S election?

A properly completed revocation of an S election can become effective on any specified date on or after the day on which the revocation is filed. If the revocation is filed on or before the 15th day of the third month of the tax year, it can be effective retroactively to the beginning of the tax year (Sec.

#1 usability according to G2

Try the PDF solution that respects your time.