Convert On Needed Field Lease For Free

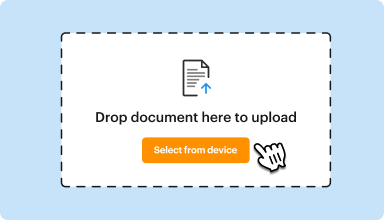

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

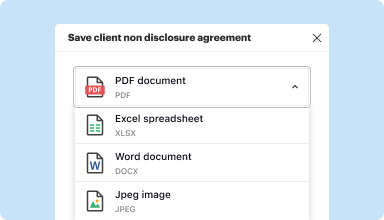

Edit, manage, and save documents in your preferred format

Convert documents with ease

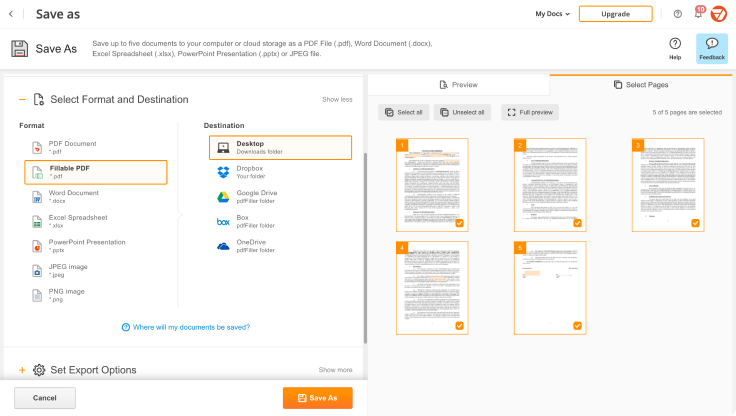

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

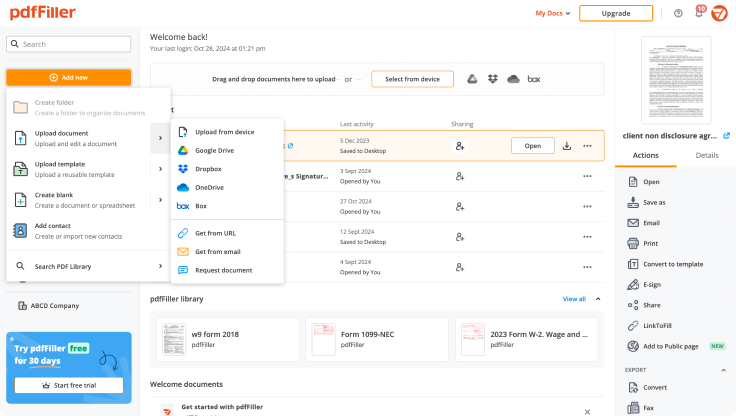

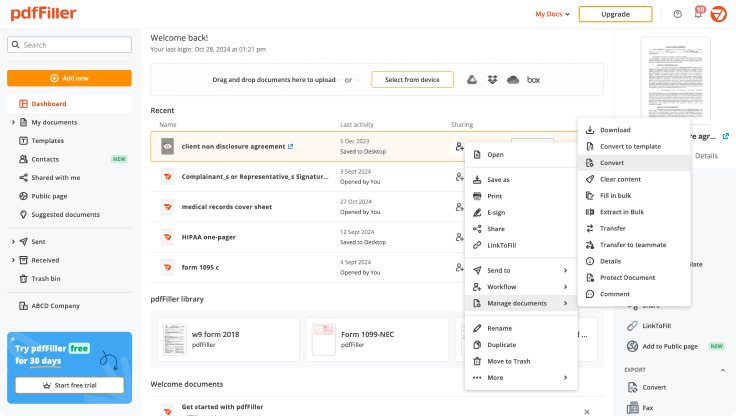

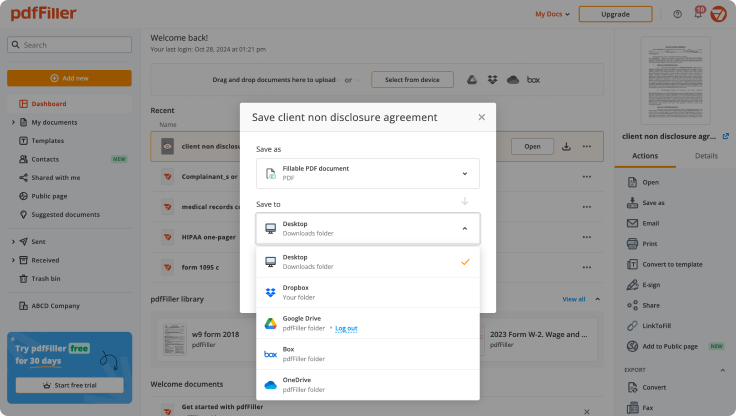

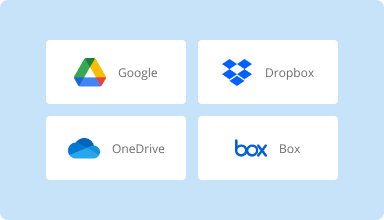

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

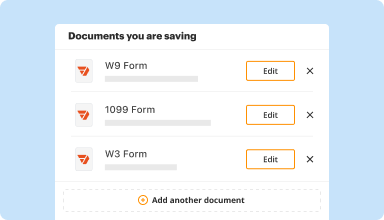

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

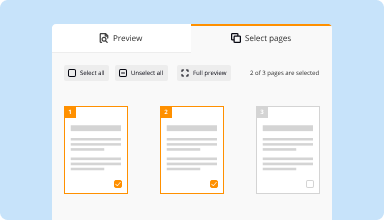

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

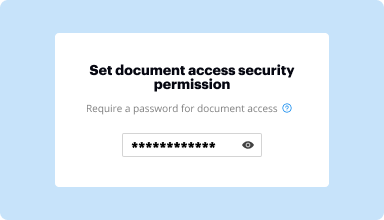

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I never used the internet to fill in forms and PDFfiller sure is a saver although I hever had any used of this type in the past, Thank you for making us illiterate users show us how to do it

2014-06-17

What do you like best?

I like the most is you can process all the documents in computer no need to print any paper, save time, save money and save our environment.

What do you dislike?

I do not like it is the soft ware does not allow to edit Chinese fonts, I wish that Chinese can be edited too. That will be greatest function.

Recommendations to others considering the product:

Already recommended to my team.

What problems are you solving with the product? What benefits have you realized?

working with global colleagues at the same time on line, no need to print any paper.

I like the most is you can process all the documents in computer no need to print any paper, save time, save money and save our environment.

What do you dislike?

I do not like it is the soft ware does not allow to edit Chinese fonts, I wish that Chinese can be edited too. That will be greatest function.

Recommendations to others considering the product:

Already recommended to my team.

What problems are you solving with the product? What benefits have you realized?

working with global colleagues at the same time on line, no need to print any paper.

2018-12-21

I tried pdffiller and was very…

I tried pdffiller and was very impressed with the platform. It was relatively simple to operate. I would recommend this site.

2020-03-24

Amazing customer support

Amazing customer support. We had account and payment issues; and contacted via online help. We received prompt and frequent communication that helped us solve the issue within a few interactions (all over the weekend too!).

2020-03-01

could be better

I feel that adobe does a better job at converting PDFs. Although PDFfiller has a good trial period that you can use all their resources. I like that it has a notary with the plan you choose.

some documents don't fit what you search for. Conversion to PDF could be simple.

2022-12-05

This is the best site for PDF conversion

This is the best site that I have ever come across in terms of PDF converters and I highly recommend it. I was able to work on my piece for days with no fear of losing it, something which happens with some converters making you begin it afresh. I recommend this site for anyone with a large document to work on.

2022-05-07

I was having issues with billing as I don't remember when & which account I used for registration.

I was having issues with billing as I don't remember when I registered this account. CSE Dee was very helpful and managed to assist me accordingly. Keep up your good service. My issue is resolved now and really appreciate it. Thank you :)

2021-11-29

Pdf-Filler was the best solution to work on Pdf files I have to fill out and edit.

I use Mac computers and I could not find any other Pdf product working so good on IOS.

2021-04-08

pdfFiller is user-friendly and the site is easy to navigate. I love the fact that a function stays the same until you change it, eg. a font size and format. However, I would like the option to use all the Fonts that I have installed on my own computer. When a page is duplicated, I'd love it if the 'changes' made to the original using pdfFiller, could also be duplicated rather than simply a duplication of the original document. I also can't seem to find a way to cut and paste text to apply it in a different area of the document, which means that the process of replicating a change is more time-consuming, but this could be my current unfamiliarity with the software. I was impressed that within a couple of hours of use, I was offered the option to attend a webinar to improve my understanding.

2020-07-27

Convert On Needed Field Lease Feature

The Convert On Needed Field Lease feature streamlines your leasing process. This tool helps you manage your property fields efficiently, ensuring that you maximize their potential. With this feature, you can gain better control over your leases and make informed decisions about your properties.

Key Features

Dynamic field conversion based on need

User-friendly interface for easy navigation

Real-time data updates for informed decision-making

Customizable settings to fit your leasing strategy

Seamless integration with existing systems

Potential Use Cases and Benefits

Optimize leasing strategies for various types of fields

Reduce time spent on manual leasing processes

Increase revenue through better field management

Support diverse property requirements with tailored solutions

Enhance collaboration among your leasing team

Implementing the Convert On Needed Field Lease feature can solve your leasing challenges. By automating key processes and providing real-time insights, you can respond faster to market demands. This not only improves your operational efficiency but also allows you to focus on strategic growth. Embrace this feature to elevate your property leasing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the journal entry for operating lease?

Operating Lease Accounting Journal Entries The business completes the operating lease accounting entries by recording the rental payments as an operating expense. The operating lease accounting journal shows the reduction in the asset of cash due to the operating lease rental payment.

How do you account for operating leases?

By capitalizing an operating lease, a financial analyst is essentially treating the lease as debt. Both the lease and the asset acquired under the lease will appear on the balance sheet. The firm must adjust depreciation expenses to account for the asset and interest expenses to account for the debt.

What is the journal entry for lease?

Step 3: Journal entries The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

How do you record a journal entry for a lease?

Initial decoration. Calculate the present value of all lease payments. This will be the recorded cost of the asset. Record the amount as a debit to the appropriate fixed asset account, and a credit to the capital lease liability account.

How do you account for a lease?

A lease must be accounted for as a capital lease if any 1 of the following 4 conditions are true: the lessee will gain title of the asset at the end of the lease. The lessee will be able to purchase the asset for a price below market value at the end of the lease. The term (length of time) of the lease accounts for 75

How do you account for operating leases examples?

The lessee, A, signs an agreement with the lessor, B, to lease a building on Jan. The lease period (no renewal options) is 10 years. The annual lease payment, due on Dec. The lessee's incremental borrowing rate is 10%

What is the double entry for finance lease?

The capital lease accounting journal entries are in three parts. To record the effective purchase of an asset using a loan. To record the periodic depreciation charge. To record the periodic rental payments to clear the principal and to charge the profit and loss account with the interest.

How do I record a finance lease?

Since a finance lease involves transfer of risk and rewards, the leased asset is recorded in the books of the lessee together with a corresponding lease liability. The leased asset is recorded at the present value of minimum lease payments (or fair value if it is lower).

#1 usability according to G2

Try the PDF solution that respects your time.