Convert On Requisite Field Charter For Free

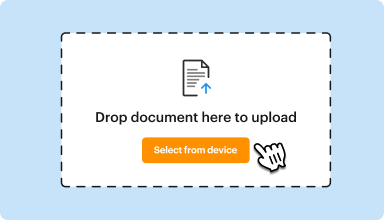

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

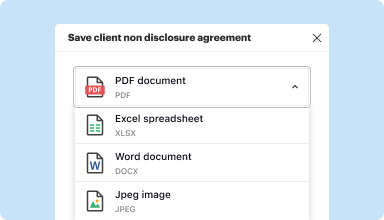

Edit, manage, and save documents in your preferred format

Convert documents with ease

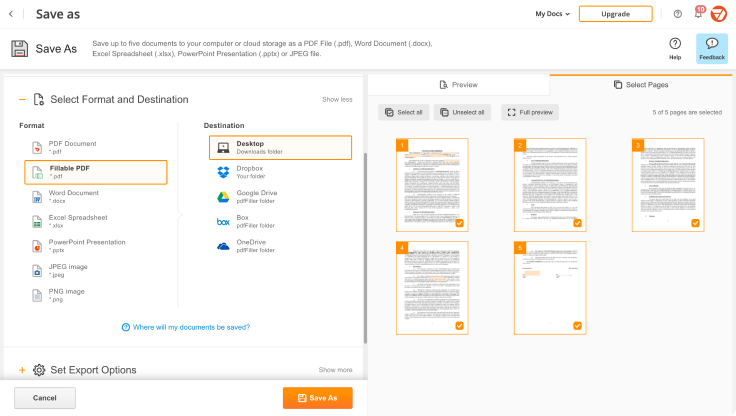

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

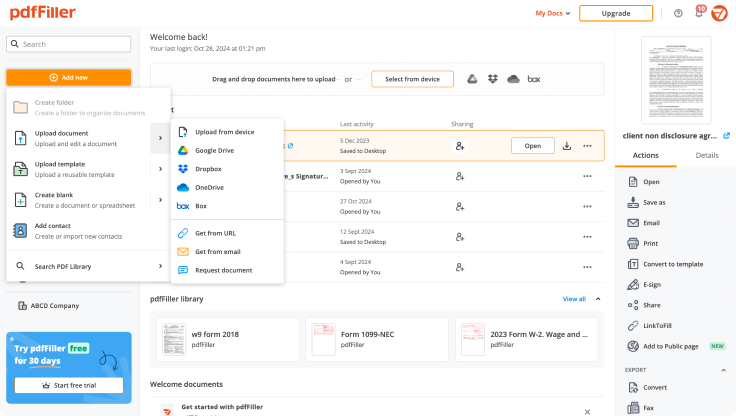

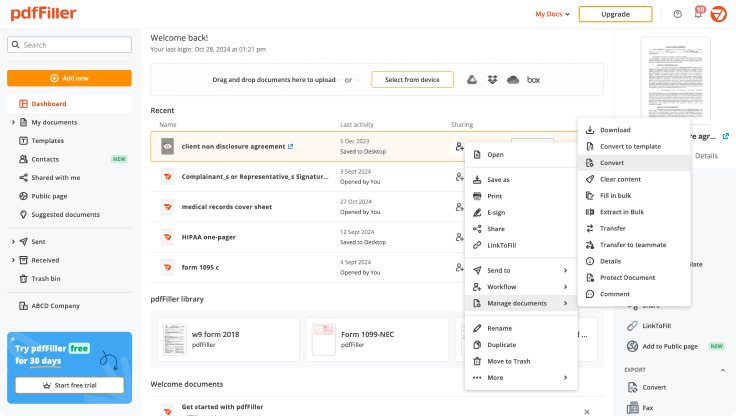

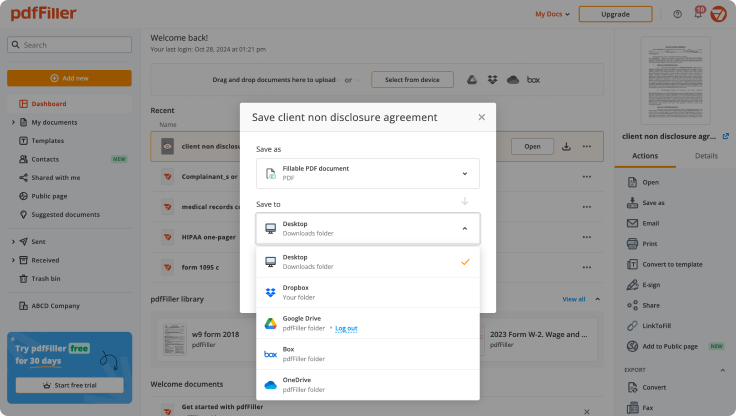

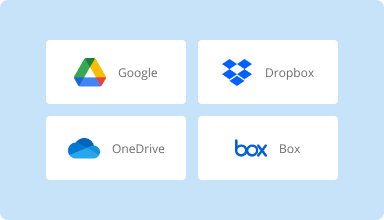

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

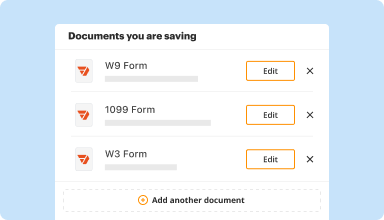

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

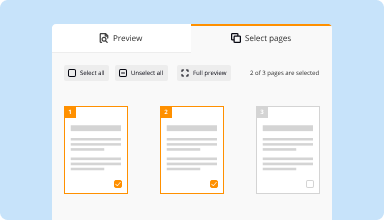

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

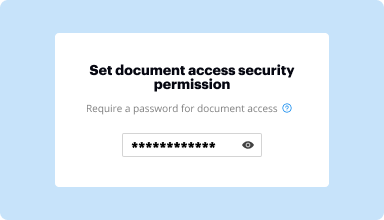

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Everything has worked great and while I honestly don't know what there are companies that still use Fax, they do exist and I need to work with them. Love PDFfiller and everything it provides.

2016-01-04

so far ease of use seams to be the direction this system is built on. I would love to see more controls to authorized users and an auto save feature from original templates after and before fill. over all I love how going paperless is very easy to use

2018-04-25

I used the service like the service, but until I got to print a copy of the SR-1 form, I thought I was using the government's free website for submitting an SR-1 form. I want to cancel it because I will not need to use it again. So, please cancel my account and service. Please also send an email to me confirming that you have cancelled the service. Thank you.

2018-10-10

What do you like best?

The ease of use and tremendous amount of options make this one my most frequently used tools on a daily basis.

What do you dislike?

Nothing... I could get more options by upgrading my subsctiption but I am fine as it is for now.

Recommendations to others considering the product:

Great Software. You'll use it every day!

What problems are you solving with the product? What benefits have you realized?

Editing pdf documents is a breeze and saves lots of time and paper.

The ease of use and tremendous amount of options make this one my most frequently used tools on a daily basis.

What do you dislike?

Nothing... I could get more options by upgrading my subsctiption but I am fine as it is for now.

Recommendations to others considering the product:

Great Software. You'll use it every day!

What problems are you solving with the product? What benefits have you realized?

Editing pdf documents is a breeze and saves lots of time and paper.

2019-05-28

Adobe.

,I. Really wanted to make this work for me but I’m afraid it was beyond me.However the trial period which I thought I had cancelled hadn’t gone through then resulted in me receiving a large bill.I panicked thinking they would insist it was to be paid.So I got In touch with them and explained my error.They immediately wrote back and without question refunded my money.It says a lot for a company who responds in this way.I am eternally grateful to them

2020-04-03

literally this app has changed my life and has made it so much easier and convienant for me always being on the go and now i dont really need to be on the go its just right here everything in one

2021-09-05

Took some time to get used to it's…

Took some time to get used to it's quirks after years of using Adobe Acrobat. But, I have actually found it easier to use and can do more .

2021-01-19

I initially thought that PDFfiller was a free tool. Even though they asked me for my credit card information with a free 30 Day trial I forgot about the same. When I got an email a month later stating I had been charged for the whole year I logged in and chatted with Customer Service. They were so kind as to immediately understand, cancel my subscription, and agree to issue me a refund. At the time of writing this, I am still awaiting my refund as I just requested the cancellation today - but I must say that this gesture was amazing by PDFfiller and this review is the very least I can do. Thank you for brightening up 2020 a bit! Amazing business ethic and professional courtesy.

2020-11-20

This program is amazing. It is so easy to add images and text to existing pdf files not to mention how fast it is. I needed to add my logos and information to my suppliers product pdfs and this saved me a lot of time and got the job done! Thanks!

2020-10-16

Convert On Requisite Field Charter Feature

The Convert On Requisite Field Charter feature simplifies data management and enhances productivity. By enabling seamless conversions in required fields, this tool provides clarity and control in your workflows. You can reduce errors and improve efficiency with a solution that meets your specific needs.

Key Features

Automatic conversion of requisite fields

User-friendly interface for easy navigation

Customizable settings for tailored use

Real-time data validation to minimize errors

Comprehensive support and resources available

Potential Use Cases and Benefits

Streamlining data entry processes in various industries

Enhancing project management with accurate data tracking

Improving customer relationship management through precise information

Facilitating compliance with necessary regulatory requirements

Supporting data analysis and reporting with reliable input

With the Convert On Requisite Field Charter feature, you can tackle common data challenges effectively. By ensuring accurate data entries, you not only prevent mistakes but also save time and resources. This feature empowers you to focus on what truly matters—driving your business forward with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can a credit union convert to a bank?

The federal mutual savings institution charter offers capital and corporate structure advantages and removes limits on certain products, potential customers and marketing effectiveness. Credit unions convert to a bank charter because of pain or opportunity.

Can a bank own a credit union?

While more than 20 banks have been sold to credit unions since 2016, it has been years since a bank bought a credit union, and there's no precedent for a stock-owned bank doing so. Still, a process and framework for credit union sales to banks exists.

Can a credit union buy a bank?

WASHINGTONCredit unions are buying small banks in record numbers, a trend that is prompting pushback from the banking industry. Credit unions have acquired 21 U.S. banks since 2018, according to S&P Global Market Intelligence, compared with 12 purchases in the prior five years.

Who owns a credit union explain?

A credit union is a member-owned, not-for-profit cooperative financial institution owned and operated by its members. These members who are united by a common bond of employment, association, or community democratically operate the credit union under state and federal regulation.

What makes a credit union different from a bank?

The bottom line is that banks are for-profit institutions, while credit unions are non-profit. Credit unions typically brag better customer service and lower fees, but have higher interest rates. Both banks and credit unions provide similar services such as checking and savings accounts, loans and business accounts.

Do credit unions have stock?

There are No Stockholders. Unlike most other financial institutions, credit unions do not issue stock or pay dividends to outside stockholders. Each credit union member has equal ownership and one vote regardless of how much money a member has on deposit. At a credit union, every customer is both a member and an owner.

Can a credit union merge with a bank?

Because banks cannot merge into credit unions, the most common whole-bank P&A transactions involve acquisitions of bank branches and other related bank assets, assumption of deposit and other identified bank liabilities, and the dissolution of the underlying bank charter.

What happens when credit unions merge?

The credit union that will be merged into the surviving credit union is referred to as the dissolving, merging, or acquired credit union. A credit union can enter into an agreement to purchase branches from another credit union. In this case the credit union is acquiring loans and assuming liabilities.

#1 usability according to G2

Try the PDF solution that respects your time.