Convert On Salary Accreditation For Free

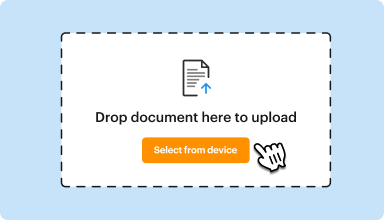

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

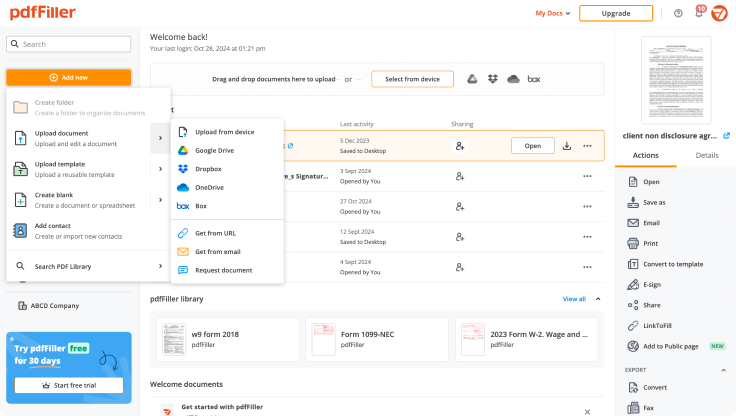

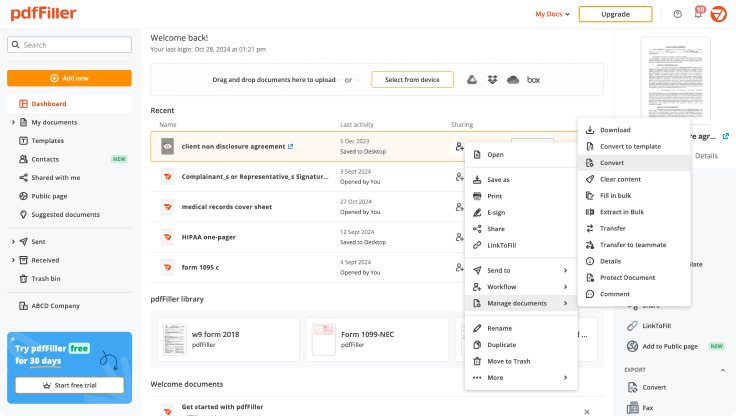

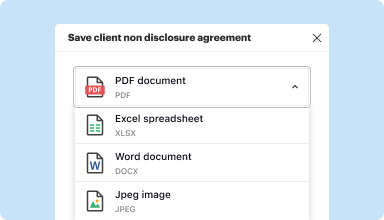

Edit, manage, and save documents in your preferred format

Convert documents with ease

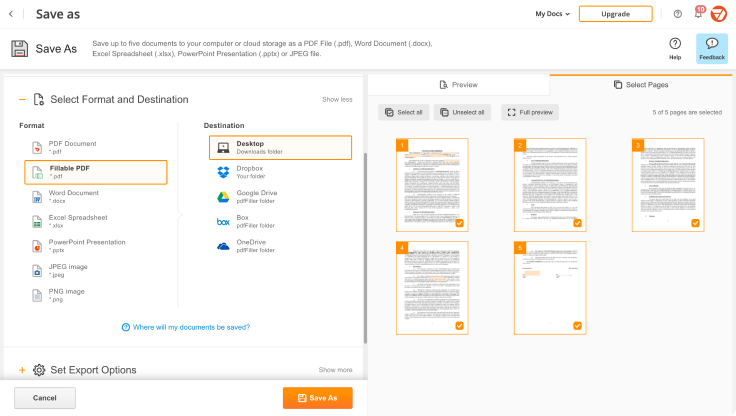

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

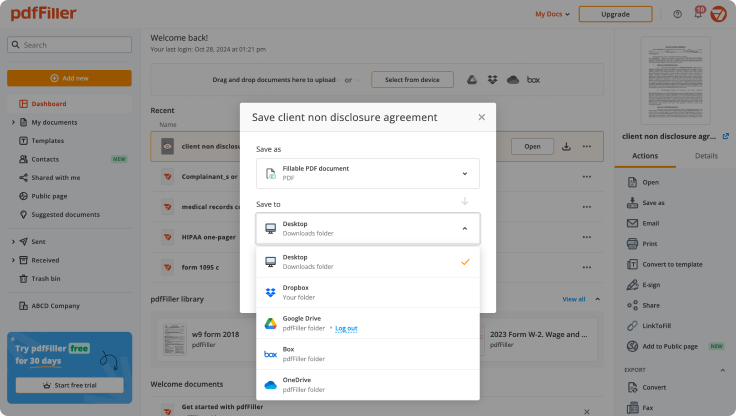

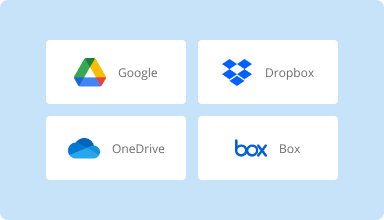

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

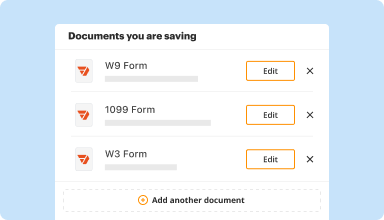

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

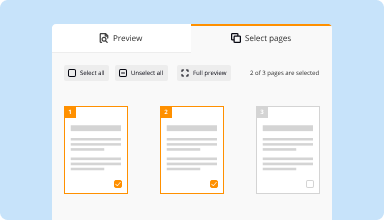

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

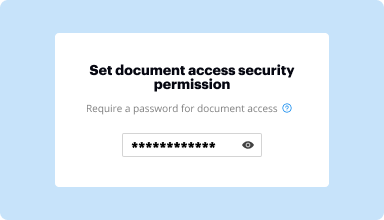

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

It took me a few minutes to figure out how to find you and to find the form I needed. But had no trouble after figuring out the ins and outs of what I needed to do. Thanks

2016-04-14

This has made my life 100x easier. I'm able to complete and sign documents. Then file them with the court & it saves ink and paper cost. Thank you!!!!

2017-06-16

I like the service just wish the process of saving and/or printing docs wasn't as cumbersome - two or three pop up windows before action is completed and not automatically redirected to doc list.

2017-11-26

It was a huge help on a critically important document. It was a downloaded pdf that I had to annotate, but Acrobat Pro was unable to edit it because Livecycle Designer was required. PDFfiller allowed me to do it entirely online and then print out. the required hard copy It was a godsend!

2018-05-16

As a freelancer I use PDF Filler to complete W9 forms - it's great!

PDF Filler is simple, easy to use, and creates professional documents that are easily accepted by employers and large corporations.

The exporting workflow is a little confusing - at least for their IRS W9 Form. Instead of just pressing a button to save the file to my phone I had to email it to myself in order to obtain it. This may have just been my ignorance, however. All in all, PDF Filler is a great help!

2018-03-16

The overall experience was good, the only thing I would say is to increase the number of signatures from 10 to 100 in the case of signatures for the same document.

2024-08-08

Only issue is pricing

Only issue is pricing. This is for my job, but they can't pay for it because we are a non-profit agency, I pay for it myself because it helps me to complete my job more efficiently

2022-05-11

Needed for real estate transactions

Needed for real estate transactions. Worked great. Was able to update pdf documents multiple times. Easy to use. Easy to download completed documents. I'll definitely use pdfFiller in the future

2021-09-08

I enjoy the accessibility to a large variety of legal forms without preparing them, but the process is not that easy. For a novice user, it is cumbersome and complicated. There should be a tutorial on how to maneuver the program and all of its features seamlessly.

2021-07-22

Convert On Salary Accreditation Feature

The Convert On Salary Accreditation feature simplifies the process of managing salary-related certifications. This tool is designed for organizations that want to streamline their accreditation processes and ensure compliance effortlessly. With this feature, you can enhance your operational efficiency and improve overall productivity.

Key Features

Automated salary accreditation tracking

User-friendly interface for easy navigation

Real-time updates on accreditation status

Customizable notifications and reminders

Comprehensive reporting tools

Potential Use Cases and Benefits

Ensure timely salary accreditation for employees in various departments

Streamline audits and compliance checks with organized records

Minimize administrative tasks and lessen manual errors

Enhance employee satisfaction through efficient responses to salary inquiries

Support strategic decision-making with detailed data insights

This feature addresses your challenges by automating and organizing salary accreditation tasks. By using the Convert On Salary Accreditation feature, you eliminate the manual workload and reduce the risk of errors. Ultimately, you gain peace of mind knowing your accreditation is managed efficiently, allowing you to focus on growing your organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How is stretch pay calculated?

Multiply the daily pay rate by the number of days the teacher will be working. For the example, $222.22 multiplied by 100 equals $22,222.22. This is the prorated salary. Divide the prorated salary by the number of checks left in the contract cycle to determine the amount that will be paid out with each check.

What is stretch pay?

Stretch Pay is a line of credit of $250 or $500 to help you pay urgent bills or make an emergency purchase. This type of loan offers a lower-cost alternative to the expensive interest charges and penalties of payday lenders.

What is a non-qualified stretch?

Called the 'Non-Qualified Stretch' provision, this feature allows beneficiaries the flexibility to withdraw money from a Monument Advisor account, while continuing to benefit from the compounding power of low-cost tax deferral.

What is a non-qualified beneficiary?

In most cases, non-qualified annuities can remain tax deferred all the way until the death of the owner. Income taxes on the gain amount in excess of cost basis will eventually need to be paid by the beneficiary of the annuity after the annuity owner has died. This is known as income in respect of decedent (IRD).

What is a stretch annuity?

A stretch annuity (also known as a legacy annuity) is an annuity option where tax-deferred allowances are passed on to the beneficiaries, offering them more flexibility and control over maintaining the investment.

What can you do with an inherited non-qualified annuity?

Under the ruling, a beneficiary can perform a Section 1035 exchange on an inherited annuity, but the exchange must conform to all the other rules that apply to inherited annuities. Non-qualified annuities can't be rolled over into an individual retirement account or other qualified annuity.

Do I have to take an RED from a nonqualified annuity?

IRAs with annuity holdings are subject to the IRS rule known as required minimum distributions (Rods), which triggers when an individual reaches the age of 70 ½. RED withdrawals, however, are NOT required to be taken from a non-qualified annuity.

How is an inherited IRA RED calculated?

As a non-spouse beneficiary, you must directly roll over the inherited assets to an Inherited IRA in your own name and use your own age and the IRS Single Life Expectancy Table for calculating the first year RED. For each year after, you would subtract one year from the initial life expectancy factor.

#1 usability according to G2

Try the PDF solution that respects your time.