Convert On Salary Settlement For Free

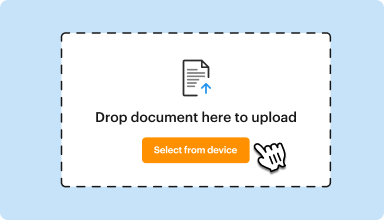

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

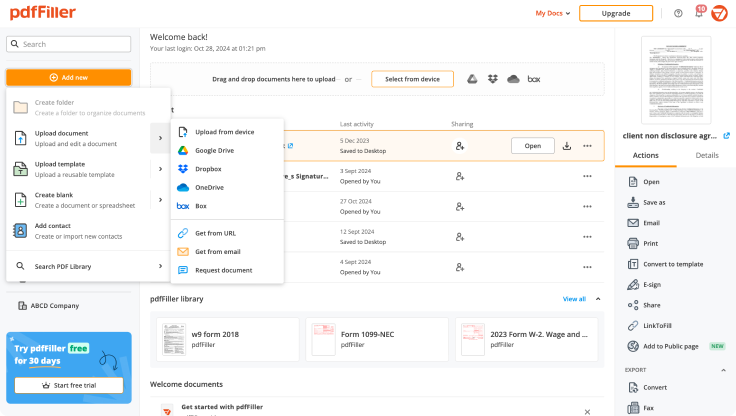

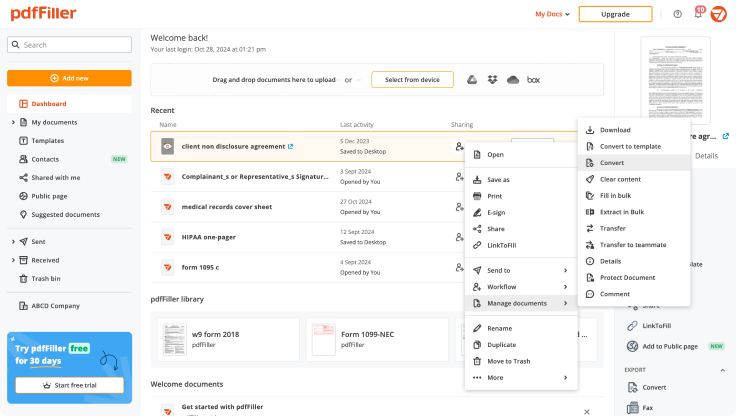

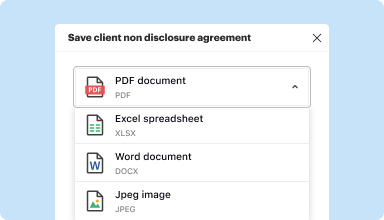

Edit, manage, and save documents in your preferred format

Convert documents with ease

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

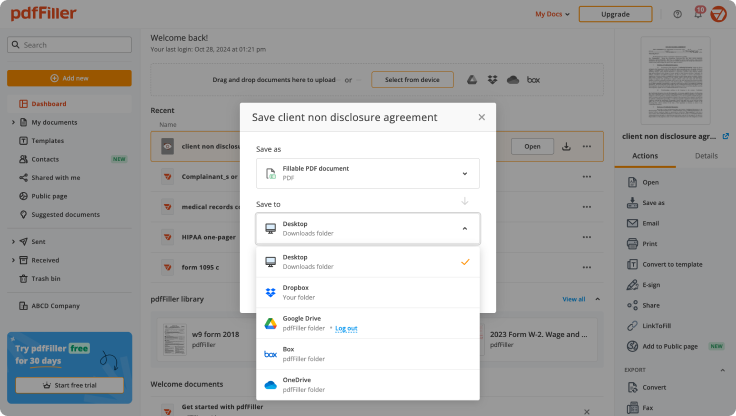

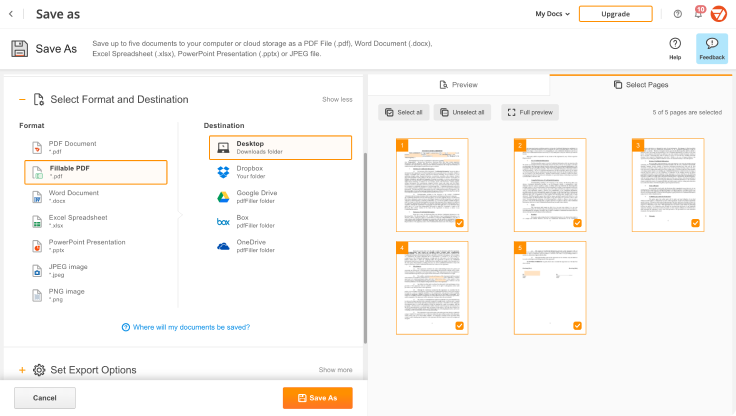

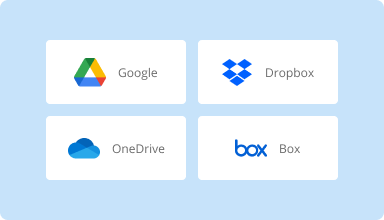

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

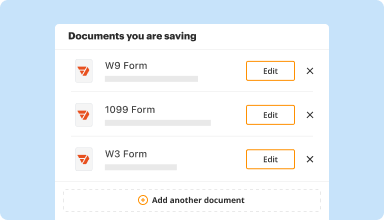

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

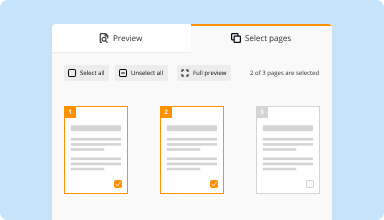

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

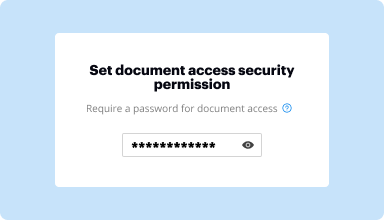

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

It was a life saver for me as I transitioned my insurance business. It looks so much more professional to import supplemental applications and forms and complete them with a keyboard. In the past, I did them by hand even though I worked for one of the largest insurance agencies in the country. In the past, I was unaware of your product, or I would have bought it myself to use.

2015-08-17

I was annoyed that I had to enter credit card info for a free trial. It makes me feel as if I'm being tricked into keeping your service. Very pleased with how the product works though.

2019-05-07

desde un inicio debería estar la indicación de que la aplicación es de pago para contemplarlo, en cuanto el funcionamiento es excelente, solo tengo duda acerca de la leyenda de que solo 5 documentos... al día al mes o a que se refieren? agradezco de antemano su atención.

2019-07-17

this site is awesome

this site is awesome, ive seen a lot of programs and sites like this but none compare in quality and non are as user friendly! will recommend this site to anyone working with PDF files!!

2019-07-27

I used it to copy signatures onto other documents to make signing them easier. I was pleasantly surprised by the quality of the signatures and the ability to manually clean them up easily. I appreciate this service and would recommend it to others.

2024-06-10

I have been trying to cancel my…

I have been trying to cancel my subscription for months. One of the problems is that I can't find the account. I have tried all of the email addresses that I use and can not find it. I have sent emails and wrote tickets trying to get some help but have recieved absolutely no response. I am paying $50 a month for a service I am unable to use or cancel.

I was able to finally talk to someone who helped me find the email the account was under, canceled it for me and refunded the charges. The whole thing was quick and painless and I got the best possible outcome and that gives the 5 stars in my book. Thank you pdffiller for taking the time to hear my problem and helping finally find a resolution.

2024-02-06

great for professional Doc.

this experience is great because, I have everything I need to write, edit, email, or send off via usps. so I appreciate how well it works.

2022-11-14

PDF Filler helped me when in urgent…

PDF Filler helped me when in urgent need and I have seen nothing else online that lets edit a complex PDF made from MS Publisher the same way!!

2022-09-27

It is a bit frustrating to learn how to send it to my computer to be accessed and modified as needed. Right now it serves me as a trial, but I wouldn't pay for this.

2021-02-24

Convert On Salary Settlement Feature

The Convert On Salary Settlement feature provides a seamless solution for managing salary settlements. This tool makes it easy for employees to convert their salary into different options, improving flexibility and financial management.

Key Features

Flexible conversion options for salary management

User-friendly interface for easy navigation

Real-time updates on conversion rates

Secure transaction process

Personalized notifications for users

Potential Use Cases and Benefits

Employees can manage their salary in a way that fits their lifestyle

Organizations can reduce payroll processing time

Financial planning becomes simpler for users

Increased employee satisfaction boosts productivity

Ability to invest or save based on personal goals

This feature addresses common financial challenges. By allowing your salary to be converted into preferred options, you can enhance your budget management. Whether you wish to save, invest, or spend, this feature ultimately offers a path to greater financial control and peace of mind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the formula for salary calculation?

Here the basic salary will be calculated as per follows Basic Salary + Dearness Allowance + HRA Allowance + conveyance allowance + entertainment allowance + medical insurance here the gross salary 594,000. The deduction will be Income tax and provident fund under which the net salary comes around 497,160.

What is the formula to calculate salary?

Here the basic salary will be calculated as per follows Basic Salary + Dearness Allowance + HRA Allowance + conveyance allowance + entertainment allowance + medical insurance here the gross salary 594,000. The deduction will be Income tax and provident fund under which the net salary comes around 497,160.

How monthly salary is calculated?

First, to find your yearly pay, multiply your hourly wage by the number of hours you work each week, and then multiply the total by 52. Now that you know your annual gross income, divide it by 12 to find the monthly amount. Finally, dividing by 12 reveals a gross income of $2,080 per month.

Is salary calculated for 30 days?

In some organizations, the per-day pay is calculated as the total salary for the month divided by a fixed number of days, such as 26 or 30. In the fixed days' method, an employee, whether he joins or leaves the organization in a 30 day or a 31-day month, will get the same pay amount for the same number of pay days.

How annual salary is calculated?

Calculating an Annual Salary from an Hourly Wage Multiply the number of hours you work per week by your hourly wage. Multiply that number by 52 (the number of weeks in a year). If you make $20 an hour and work 37.5 hours per week, your annual salary is $20 x 37.5 × 52, or $39,000.

What does a monthly salary mean?

Gross monthly income is the amount of income you earn in one month, before taxes or deductions are taken out. Your gross monthly income is helpful to know when applying for a loan or credit card.

How do you calculate an employee's salary?

Gross pay for salaried employees is calculated by dividing the total annual pay for that employee by the number of pay periods in a year. For example, if a salaried employee's annual pay is $30,000, and the employee is paid twice a month, the gross pay for each of the 24 pay periods is $1250.

What is the formula to calculate basic salary?

Here the basic salary will be calculated as per follows Basic Salary + Dearness Allowance + HRA Allowance + conveyance allowance + entertainment allowance + medical insurance here the gross salary 594,000. The deduction will be Income tax and provident fund under which the net salary comes around 497,160.

#1 usability according to G2

Try the PDF solution that respects your time.