Convert On Statistic Settlement For Free

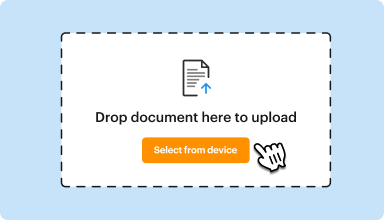

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

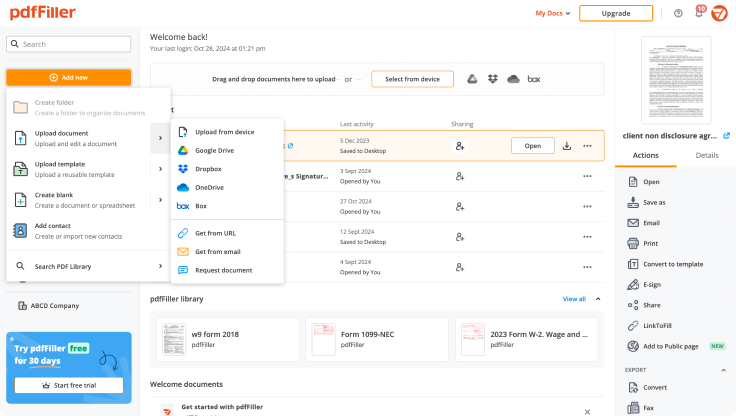

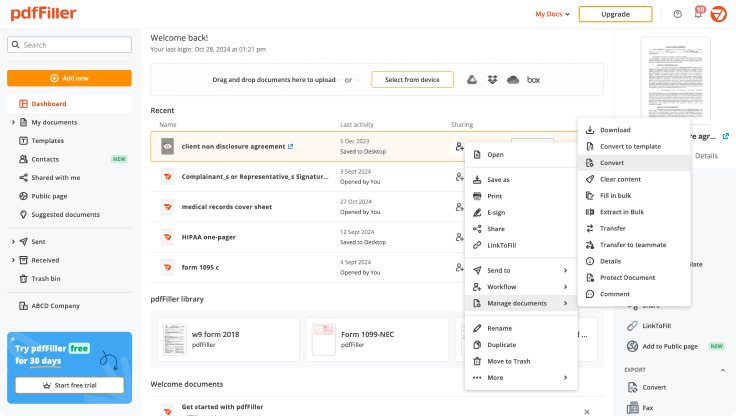

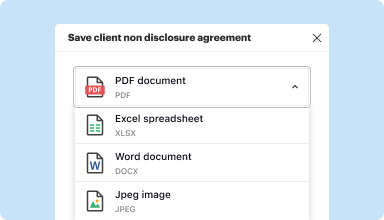

Edit, manage, and save documents in your preferred format

Convert documents with ease

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

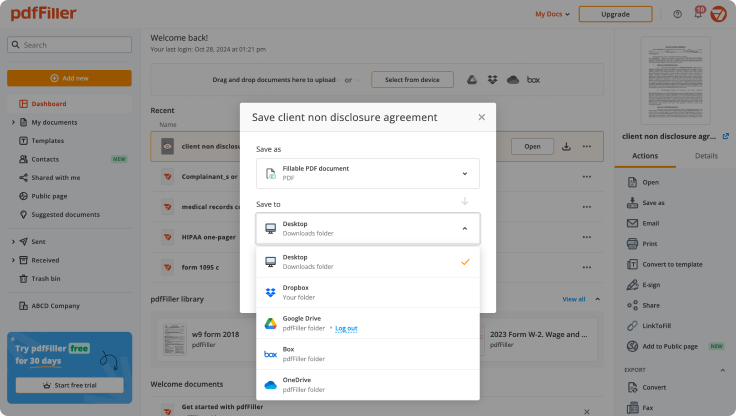

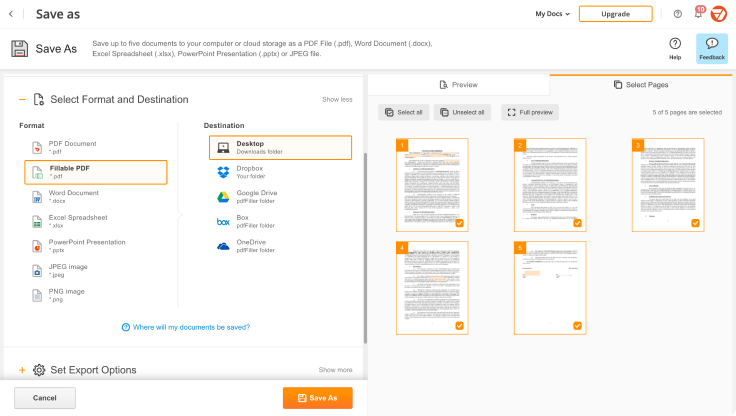

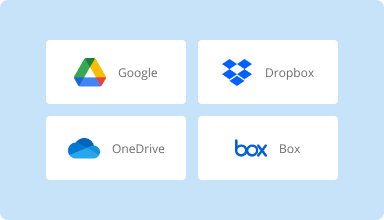

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

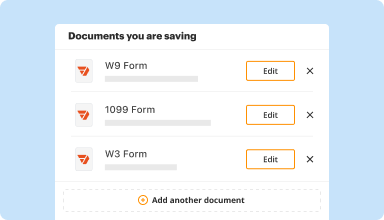

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

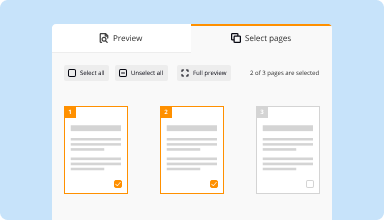

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

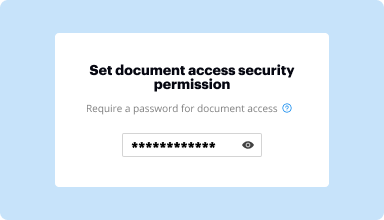

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

In grad school, much of my reading comes from pdf files my professors post. Prior to PDFfiller, I would print out hundreds of papers in order to annotate. Now, I can annotate while conserving resources and I have access to the files no matter where or what device I use.

2017-02-20

It's been very pleasant as a university student. One thing that is quite annoying is the scrolling feature - when I scroll on my macbook pro it doesn't really work well. Overall, this is perfect for annotating my lecture slides and readings. As a student, I find it a bit expensive ($72/year) - maybe there can be some incentive for students?? :)

2017-04-19

I wanted to get the discount and pay for the whole year, not sure, it wasn't clear weather I actually paid that way or am paying for a month at a time? Need to make that easier to understand and make sure you are paying the way you want for the discount. You can do a follow up survey only if you are on the line when you call -

2017-10-12

Great software for the money

Great software for the money. Has helped tremendously with our business needs. The only thing I would change is the LinktoFill. This gets confusing due to saving a file when you make updates to it and then you end up with having the two files. there should be an option to update exsiting file. Besides that, great program.

2022-03-14

Just like last year!

I must file my church's taxes for our employees every year. I found this site last year. I love it! I prints the information I need. I can make copies and send it. I could send directly to IRS but chose not to do that route!!

2022-01-19

User Friendly and Effective Audit Trail

Found it very user friendly when using it to get signatures. The audit trail is also simple and understandable in terms of tracking.

2021-10-18

Great stuff

Great stuff. Easy to use. Used it once and then cancelled free trial without any issues. Would recommend if you need to fill a document.

2021-03-10

I am a relatively new user to pdffiller, but have found the platform user friendly and does exactly what I need it to. Helping me modernise a lot of statutory requirements for e-signatures and template creations.

When I experienced issues loading documents due to permissions through my work network, the support team at pdffiller responded quickly and continued assisting myself and co-ordinated with my employers IT support function to resolve it within 24 hours, allowing me to get on with my job.

2020-09-25

What do you like best?

Ease of use and continual improvements product

What do you dislike?

Sometime difficult to align characters in a field.

Recommendations to others considering the product:

Make aligning characters easier to do

What problems are you solving with the product? What benefits have you realized?

Create form fill documents with ease and can use again in future

2020-08-30

Convert On Statistic Settlement Feature

The Convert On Statistic Settlement feature offers a seamless way to manage your data and optimize your decision-making process. With its user-friendly interface and powerful capabilities, it addresses key challenges you may face in your operations.

Key Features

Real-time data conversion for immediate insights

Customizable settlement parameters to fit your needs

Easy integration with existing systems

User-friendly dashboard for tracking performance

Automated reports for streamlined analysis

Potential Use Cases and Benefits

Enhancing data accuracy for better decision-making

Improving reporting efficiency for management teams

Facilitating compliance with industry regulations

Enabling quick adjustments based on market trends

Reducing manual workload through automation

This feature helps you overcome the challenges of data handling by providing clear, actionable insights. You can trust that your data is accurate, timely, and relevant. By adopting the Convert On Statistic Settlement feature, you can streamline your operations, make informed decisions, and gain a competitive edge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How can I avoid paying taxes on a lawsuit settlement?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

How much tax do you pay on a lawsuit settlement?

Taxes on Lawsuit Settlements. The tax liability for recipients of lawsuit settlements depends on the type of settlement. In general, damages from a physical injury are not considered taxable income. However, if you've already deducted, say, your medical expenses from your injury, your damages will be taxable.

How much taxes do I pay on a settlement?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

Do you pay taxes on a lawsuit settlement?

Notably, any amount of a settlement payment for damages with respect to personal injury or death is exempt from tax. However, if an amount awarded for damages is held in a deposit account and interest accrues on that amount before it is paid out, that interest is taxable as income.

Is emotional distress settlement taxable?

Emotional distress even though it includes physical symptoms such as insomnia, headaches, and stomach disorders is not considered a physical injury or physical sickness. Therefore, settlement and award payments arising from claims for emotional distress are generally taxable.

Do you have to pay taxes on money from a lawsuit?

If you receive money from a lawsuit judgment or settlement, you may have to pay taxes on that money. After you collect a settlement, the IRS typically regards that money as income, and taxes it accordingly. However, every rule has exceptions. The IRS does not tax award settlements for personal injury cases.

How much tax do you pay on settlement money?

If you sue someone for a claim not involving personal injury for example, a discrimination suit or a suit to collect back pay any award or settlement you receive is generally taxable as ordinary income. This means you'll pay tax on the amount at your personal income tax rate.

#1 usability according to G2

Try the PDF solution that respects your time.