Convert On Year Article For Free

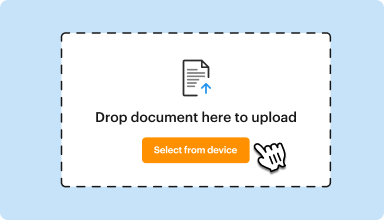

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

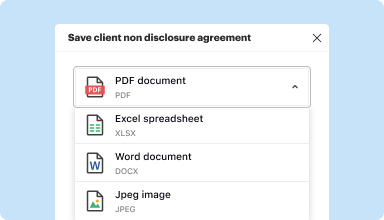

Edit, manage, and save documents in your preferred format

Convert documents with ease

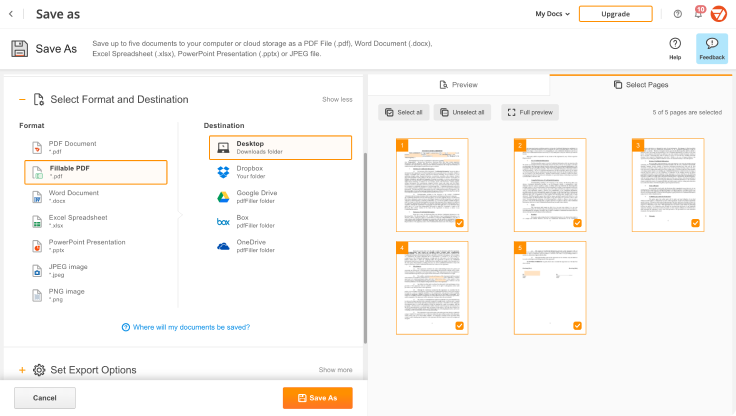

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

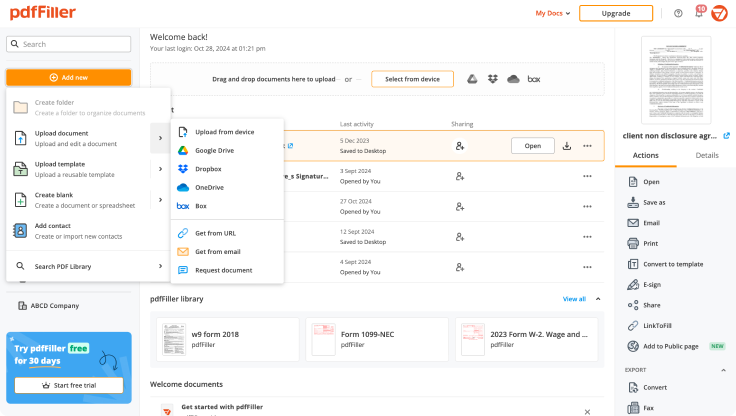

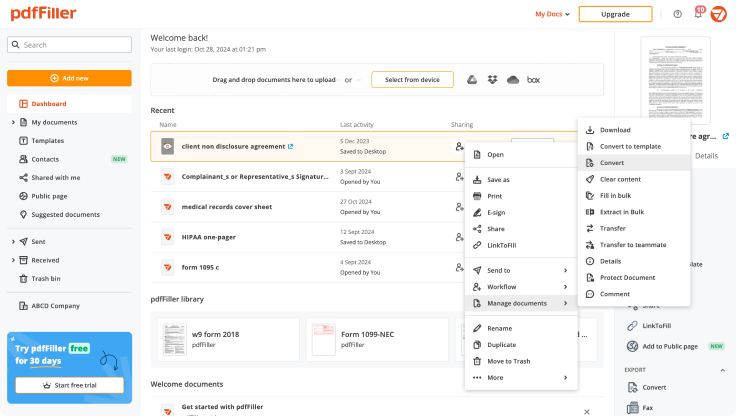

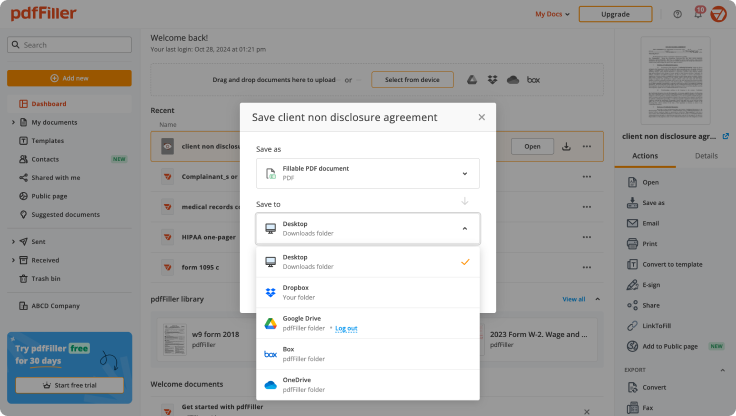

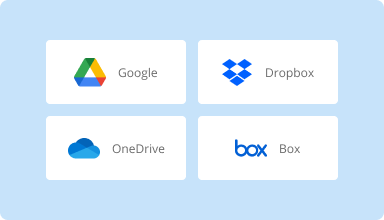

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

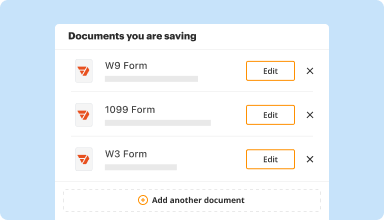

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

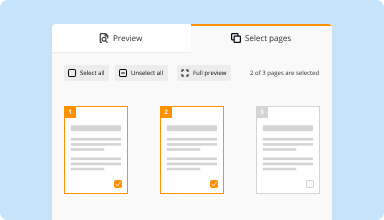

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

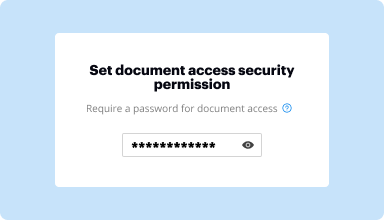

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

It worked like a charm, but although I figured it would be a paid service, but it would have been nice to know it was and how much before I got started.

2014-12-31

Easy to use.

It's good that we have this product cause we can just sign PDF's without printing.

Sometimes it's hard to place the 'typing icon' in the right place for filling in information or data.

2019-07-17

A no-nonsense PDF editor that does what it promises

PDFfiller is a straight-forward, easy to use PDF editing solution, and the greatest pro is the online drag and drop interface!

It obviously lacks the features of Bluebeam and Adobe, however if you know that going in, you won't be disappointed as it does exactly what most people need.

2018-06-07

I enjoy the accessibility to a large variety of legal forms without preparing them, but the process is not that easy. For a novice user, it is cumbersome and complicated. There should be a tutorial on how to maneuver the program and all of its features seamlessly.

2021-07-22

I HAVE JUST STARTED USING THIS METHOD AND STILL FINDING MY WAY ROUND, STILL MAKING UP MY MIND WHETHER I WILL BE UTILISING THIS PLATFORM FULL TIME. IT WILL DEPEND ON COST IN THE FINAL DECISION MAKING.

2021-01-26

Great customer experience with this company. Very responsive to technical questions and billing service cared more about our satisfaction than most companies even though it wasn't to their direct bottom line advantage. Will use them again surely.

2020-06-10

This is an excellent product/service that was very useful to me, especially because I have a ********** and can't install windows based pdf editing software. After the trial period, I had a family emergency that caused me to forget to cancel my trial (I love pdf filler but planned to subscribe later when I will need it more) so I was auto charged for the subscription once my trial ended. I contacted support to explain what happened and they responded and resolved my issue within just a few minutes. They were prompt, professional, and understanding. I feel great about the service and customer support that I recieved and plan to subscribe to pdf filler in the near future. I wild gladly recommend pdf filler to anyone who wants a great way to edit pdf files with the confidence of working with a company that has excellent customer service.

2020-04-29

I was freaking out that I couldn't save…

I was freaking out that I couldn't save my work on a PDF for a scholarship app, but after finding this, I am very happy and calm.

2020-04-17

Top notch customer service!

Accidentally subscribed for an annual subscription so was shocked to see $118 come out of my account. I got in touch with the customer support team and they couldn’t have been more helpful. They refunded the money and cancelled my subscription immediately. 5* customer service - well done PDFFiller!

2025-05-02

Convert On Year Article Feature

The Convert On Year Article feature transforms your annual articles into engaging and informative content that resonates with your audience. This tool allows you to easily repurpose your existing content, ensuring it remains relevant and valuable over time.

Key Features

Seamless content transformation into various formats

User-friendly interface for easy navigation

Flexible templates tailored for different audiences

Automatic updates to maintain current information

Performance tracking to measure engagement

Potential Use Cases and Benefits

Marketers can use it to refresh content for campaigns

Businesses benefit by keeping their blog and website up-to-date

Educators can repurpose lesson plans and materials

Nonprofits can maintain visibility with renewed awareness articles

Entrepreneurs can share their annual insights with stakeholders

In today's fast-paced digital landscape, delivering relevant content is crucial. The Convert On Year Article feature helps you address this need by keeping your work refreshed and engaging. By repurposing older articles, you save time and resources while maintaining strong connections with your audience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can you still convert traditional IRA to Roth in 2020?

Like a traditional IRA, there's also a contribution limit: For 2020, it's $6,000 a year, or $7,000 for people age 50 or older. If you are contributing to both accounts, keep in mind that your total contributions to all of your traditional and Roth IRAs cannot be more than $6,000 a year, or $7,000 if you're over 50.

Can I do a Roth conversion in 2020?

As of the year 2020, there are no income limits imposed by the IRS upon Roth IRA conversions. Anyone with a Traditional IRA, 401k, 403b or other similar retirement plan can convert it into a Roth IRA no matter how much they earn in a year.

When can I convert traditional IRA to Roth?

In order for Roth IRA distributions to be made on a tax-free basis, they must be made after a five-taxable-year period of participation and occur on or after reaching age 59.5. If you're approaching retirement or need your IRA money to live on, it's unwise to convert to a Roth.

When can you convert IRA to Roth?

In order for Roth IRA distributions to be made on a tax-free basis, they must be made after a five-taxable-year period of participation and occur on or after reaching age 59.5. If you're approaching retirement or need your IRA money to live on, it's unwise to convert to a Roth.

Can I convert my traditional IRA to a Roth IRA in 2019?

Converting a $100,000 traditional IRA into a Roth account in 2019 would cause about half of the extra income from the conversion to be taxed at 32%. But if you spread the $100,000 conversion 50/50 over 2019 and 2020 (which you are allowed to do), all the extra income from converting would be probably taxed at 24%.

How many times can you convert IRA to Roth in a year?

Does the one-year rule apply for Roth conversion? There are no waiting periods for additional conversions. You can convert any portion of a traditional IRA to a Roth IRA at any time. You are probably thinking of the once a year rollover rule.

How do I convert my IRA to a Roth without paying taxes?

If you want to do a Roth IRA conversion without losing money to income taxes, you should first try to do it by rolling your existing IRA accounts into your employer 401(k) plan, then converting non-deductible IRA contributions going forward.

How much can you convert from traditional IRA to Roth IRA?

Converting a $100,000 traditional IRA into a Roth account in 2019 would cause about half of the extra income from the conversion to be taxed at 32%. But if you spread the $100,000 conversion 50/50 over 2019 and 2020 (which you are allowed to do), all the extra income from converting would be probably taxed at 24%.

#1 usability according to G2

Try the PDF solution that respects your time.