Countersign Profit Sharing Agreement Template For Free

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Countersign Profit Sharing Agreement Template

The Countersign Profit Sharing Agreement Template provides a structured and clear framework for profit-sharing arrangements. It helps parties outline their responsibilities and ensure fairness in profit distribution.

Key Features

Potential Use Cases and Benefits

This template can solve common issues like unclear expectations and disputes over profit distribution. By providing a clear structure, it helps you avoid misunderstandings and fosters a collaborative environment. Choose the Countersign Profit Sharing Agreement Template for secure and effective profit management.

Countersign Profit Sharing Agreement Template in minutes

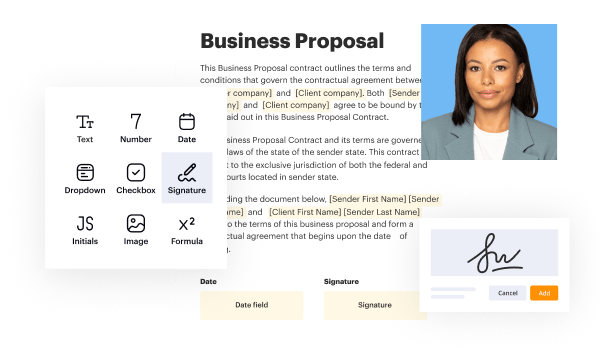

pdfFiller allows you to Countersign Profit Sharing Agreement Template quickly. The editor's convenient drag and drop interface allows for quick and user-friendly signing on any device.

Signing PDFs electronically is a quick and secure method to verify documents anytime and anywhere, even while on the fly.

Go through the step-by-step instructions on how to Countersign Profit Sharing Agreement Template electronically with pdfFiller:

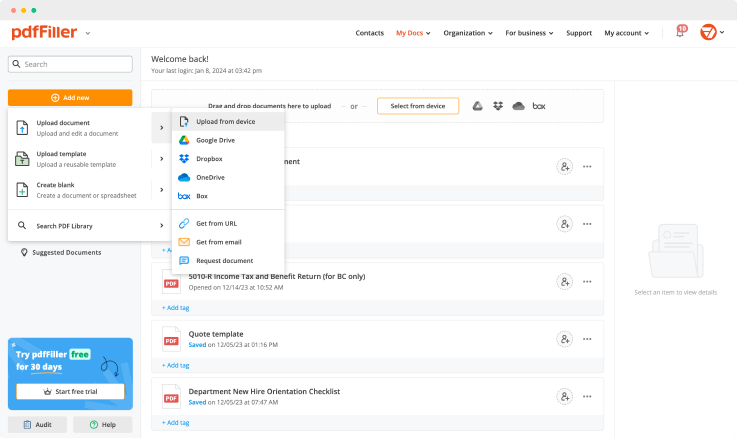

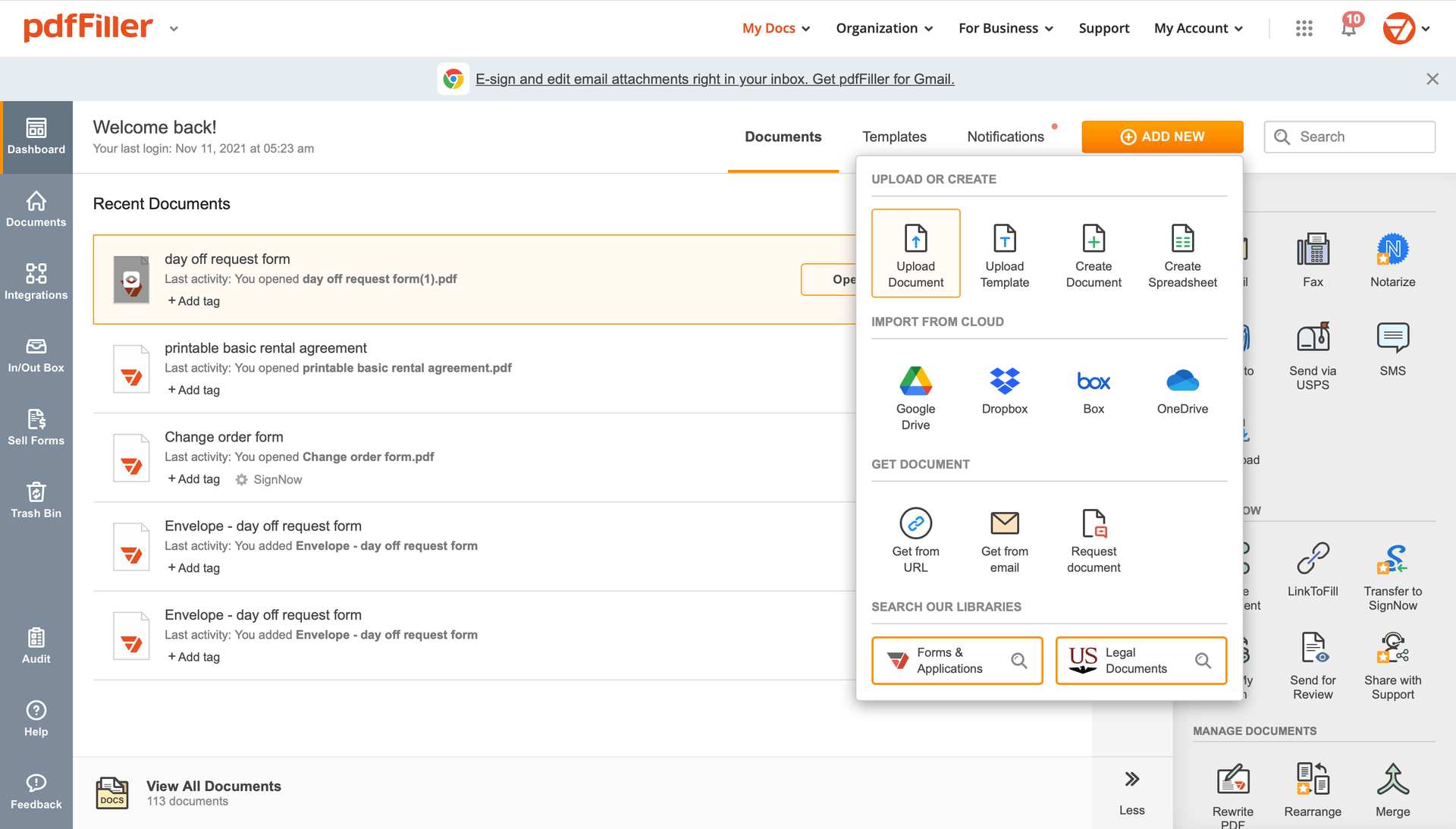

Add the document for eSignature to pdfFiller from your device or cloud storage.

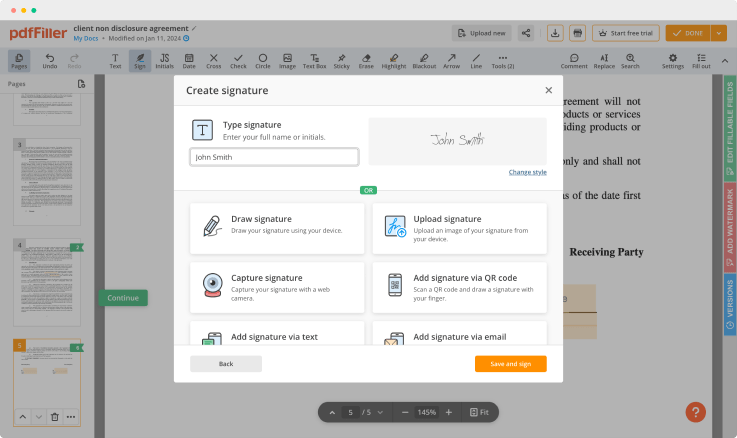

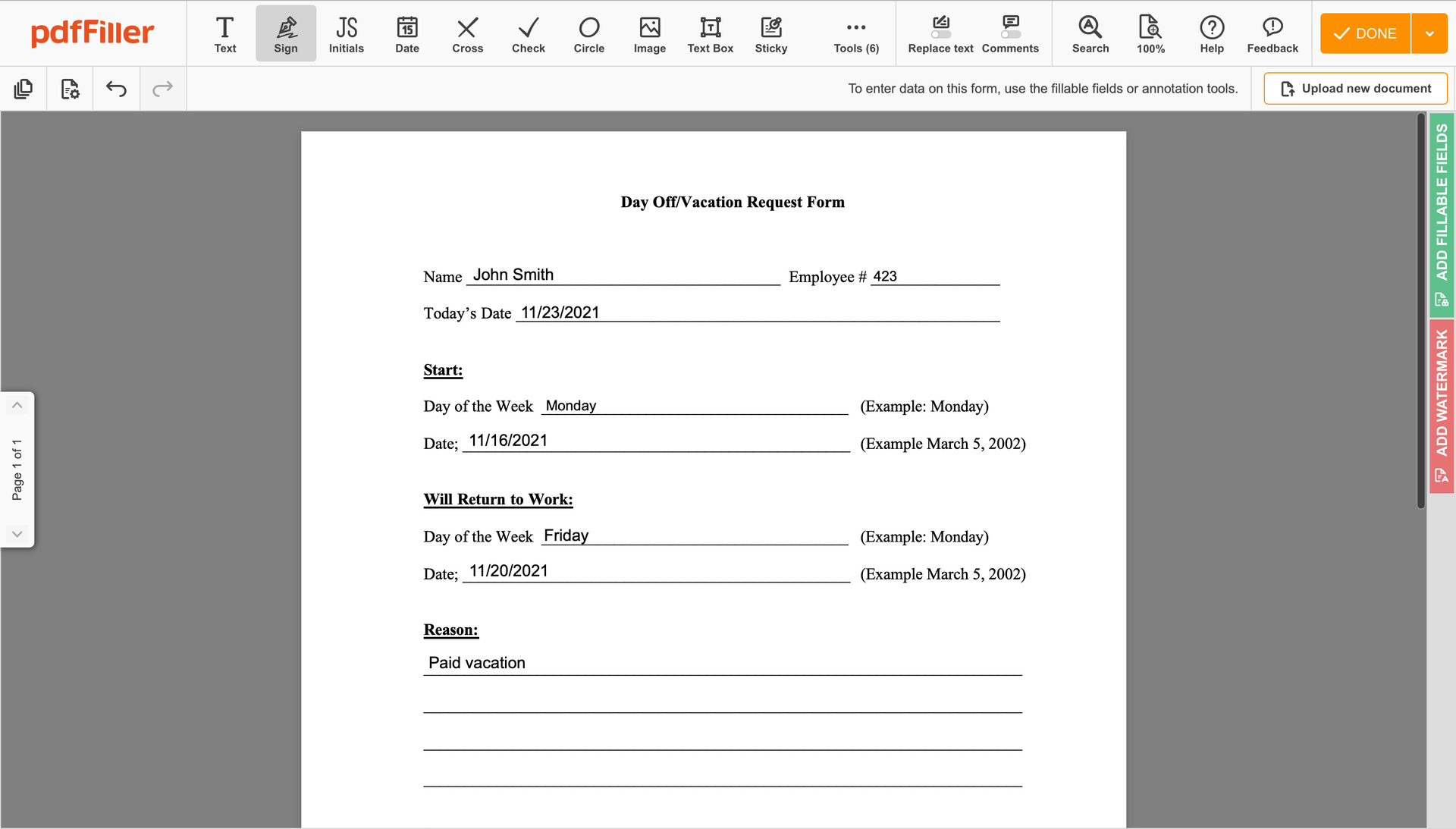

As soon as the document opens in the editor, hit Sign in the top toolbar.

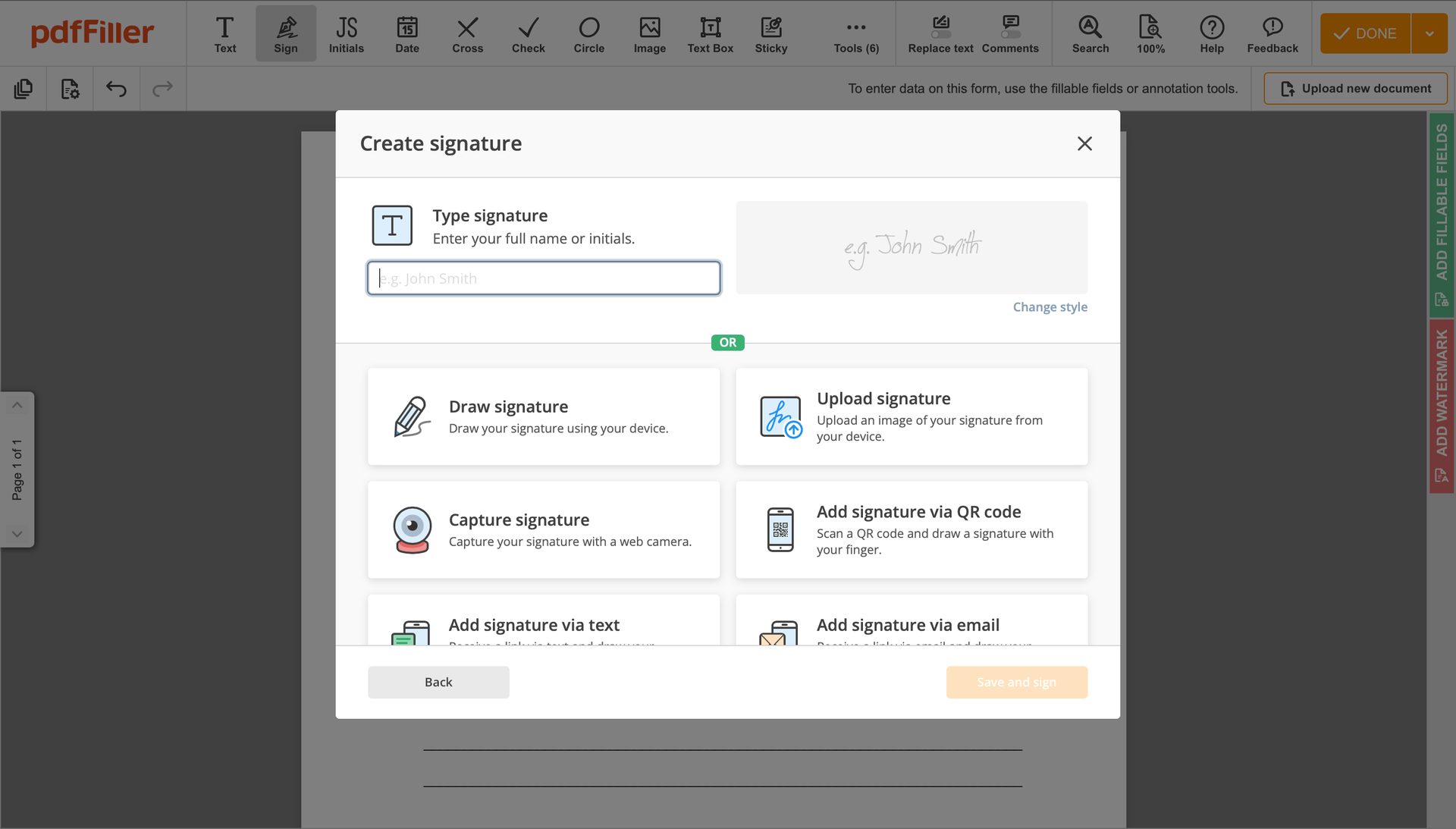

Generate your electronic signature by typing, drawing, or importing your handwritten signature's photo from your laptop. Then, hit Save and sign.

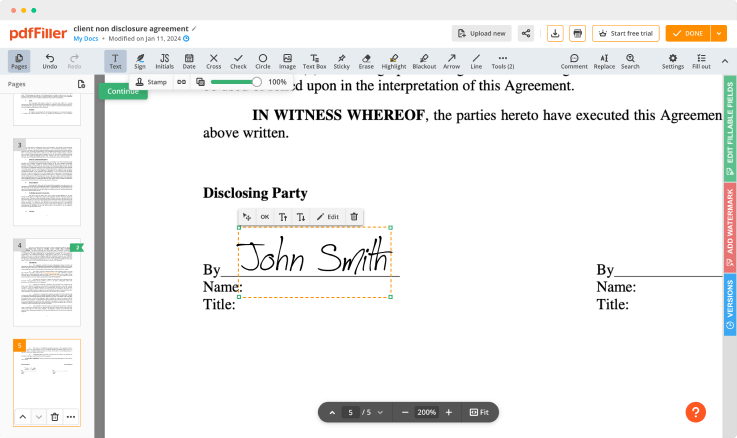

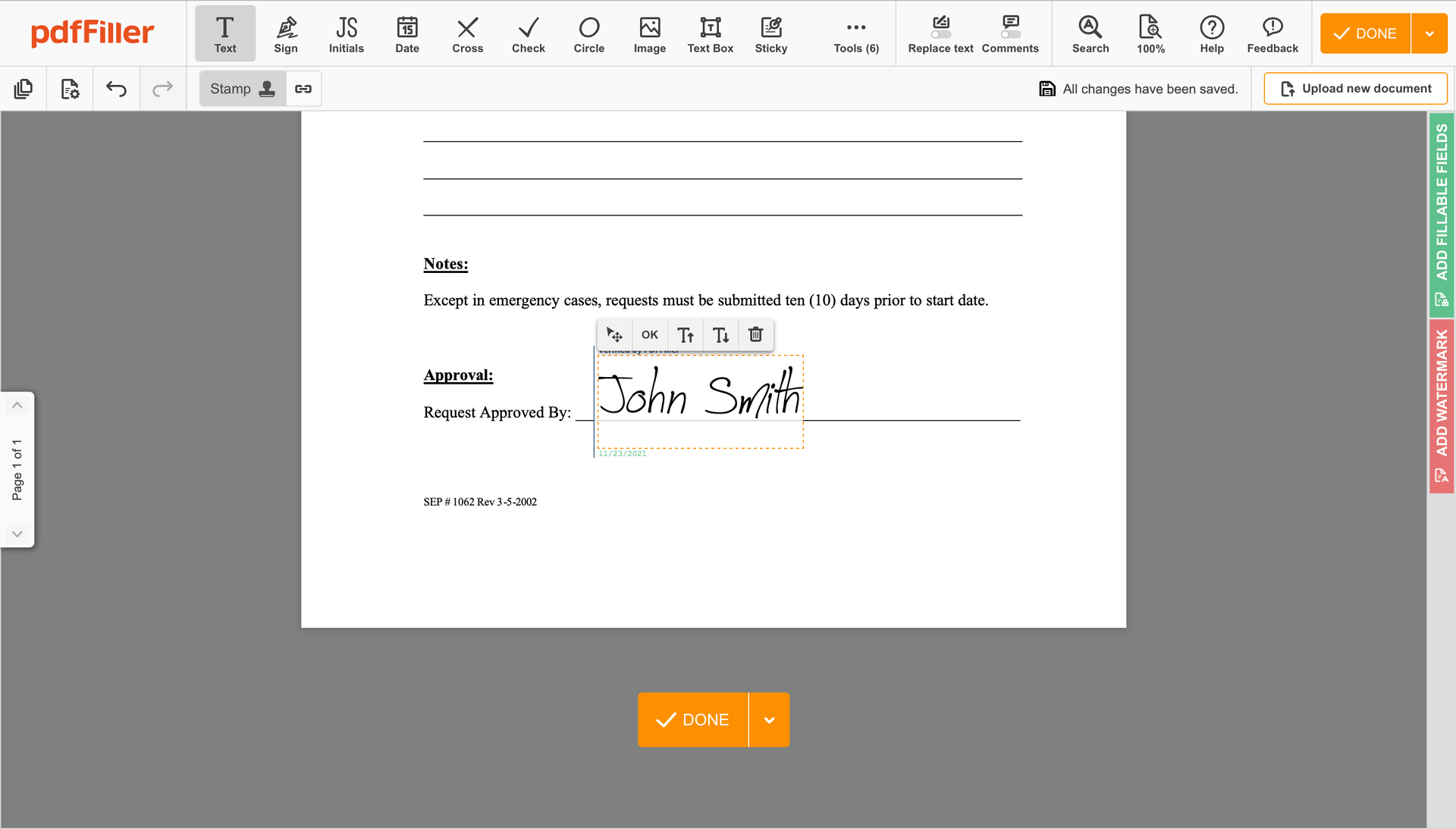

Click anywhere on a form to Countersign Profit Sharing Agreement Template. You can move it around or resize it utilizing the controls in the hovering panel. To use your signature, hit OK.

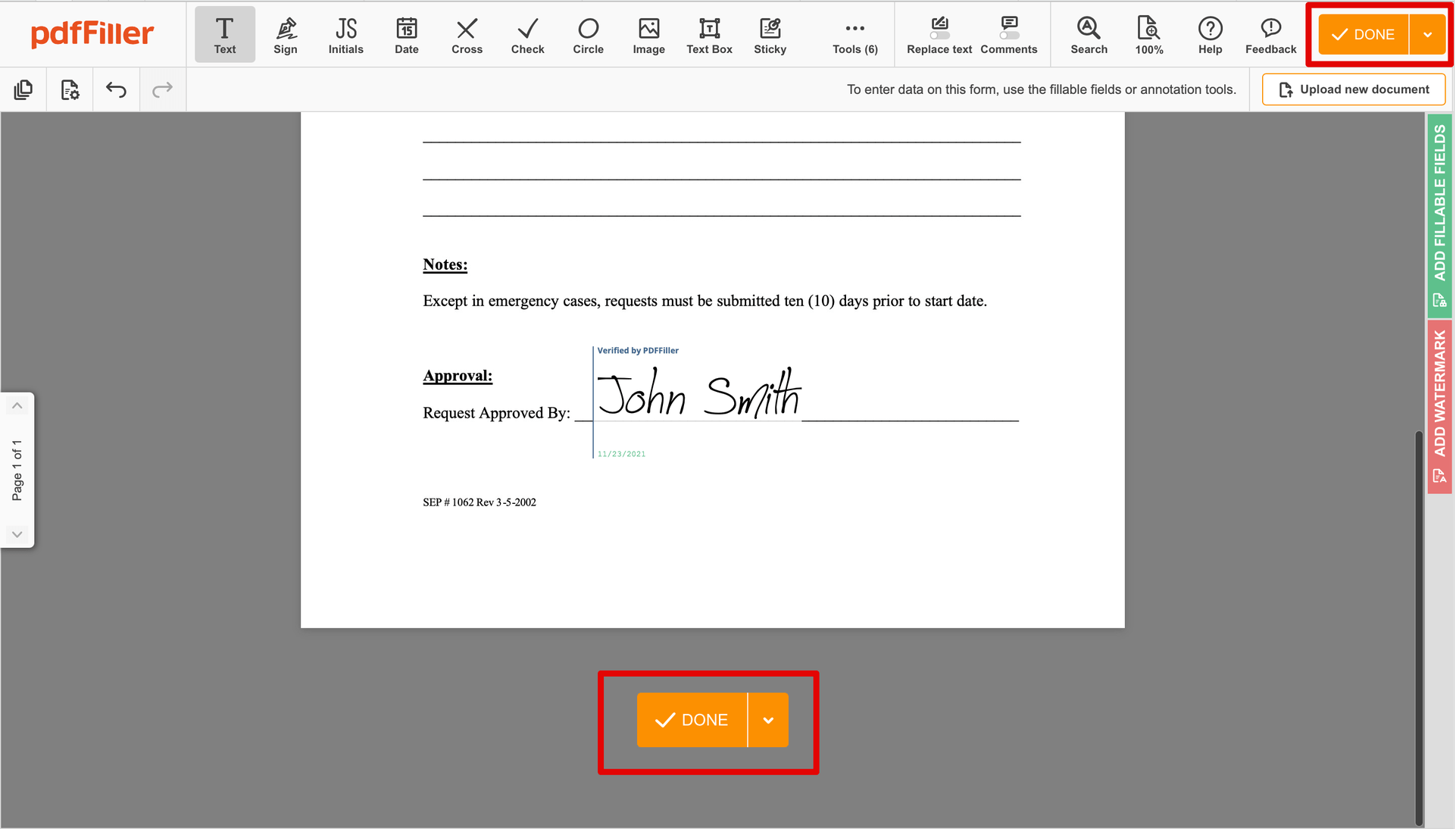

Complete the signing process by clicking DONE below your document or in the top right corner.

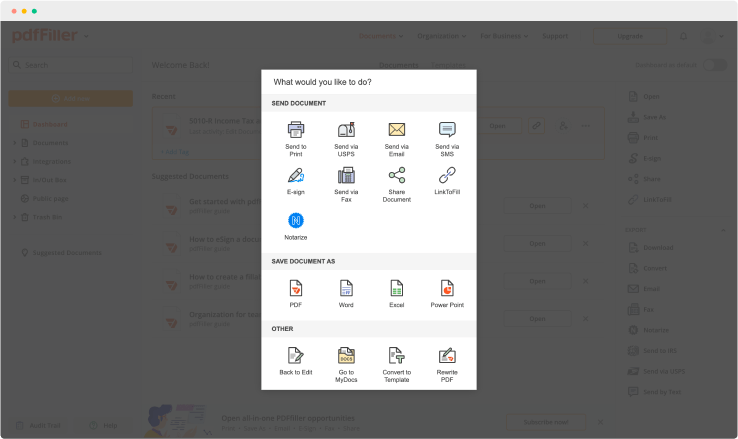

After that, you'll go back to the pdfFiller dashboard. From there, you can get a completed copy, print the document, or send it to other parties for review or approval.

Are you stuck with multiple programs for managing documents? Use this all-in-one solution instead. Use our document editing tool to make the process simple. Create document templates completely from scratch, modify existing form sand other features, without leaving your browser. Plus, it enables you to use Countersign Profit Sharing Agreement Template and add high-quality features like orders signing, alerts, attachment and payment requests, easier than ever. Pay as for a basic app, get the features as of a pro document management tools. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How to edit a PDF document using the pdfFiller editor:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Countersign Profit Sharing Agreement Template