Switch from FormsLibrary to pdfFiller for a Create SNN Field Document Solution For Free

Use pdfFiller instead of FormsLibrary to fill out forms and edit PDF documents online. Get a comprehensive PDF toolkit at the most competitive price.

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

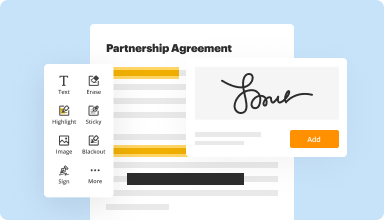

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Switch from FormsLibrary to pdfFiller in 4 simple steps

1

Sign up for free using your email, Google, or Facebook account.

2

Upload a PDF from your device or cloud storage, check the online library for the form you need, or create a document from scratch.

3

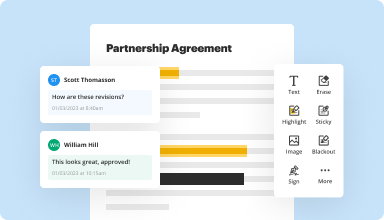

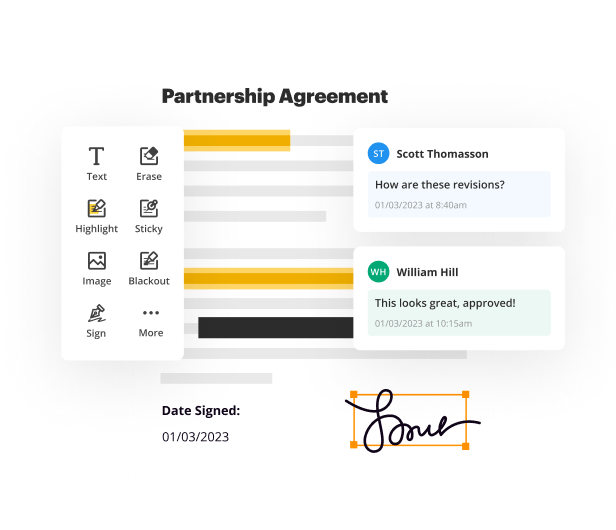

Edit, annotate, redact, or eSign your PDF online in seconds.

4

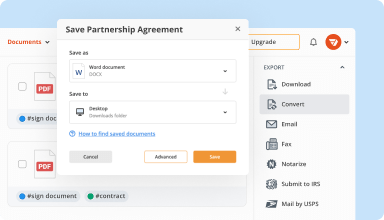

Share your document, download it in your preferred format, or save it as a template.

Experience effortless PDF management with the best alternative to FormsLibrary

Create and edit PDFs

Instantly customize your PDFs any way you want, or start fresh with a new document.

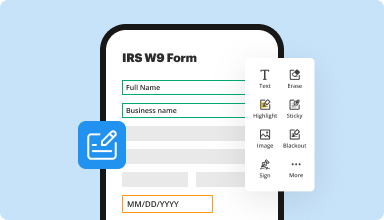

Fill out PDF forms

Stop spending hours doing forms by hand. Complete your tax reporting and other paperwork fast and error-free.

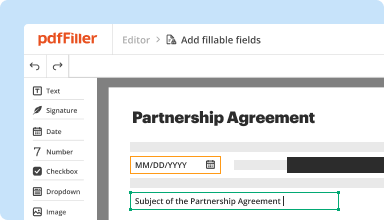

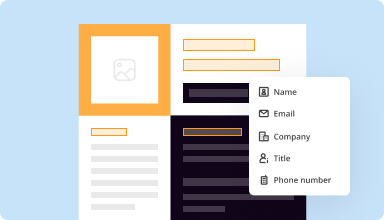

Build fillable documents

Add fillable fields to your PDFs and share your forms with ease to collect accurate data.

Save reusable templates

Reclaim working hours by generating new documents with reusable pre-made templates.

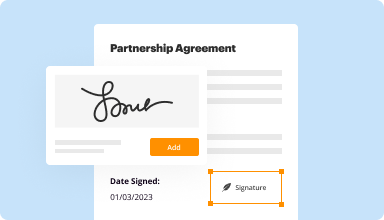

Get eSignatures done

Forget about printing and mailing documents for signature. Sign your PDFs or request signatures in a few clicks.

Convert files

Say goodbye to unreliable third-party file converters. Save your files in various formats right in pdfFiller.

Securely store documents

Keep all your documents in one place without exposing your sensitive data.

Organize your PDFs

Merge, split, and rearrange the pages of your PDFs in any order.

Customer trust proven by figures

pdfFiller is proud of its massive user base and is committed to delivering the greatest possible experience and value to each customer.

740K

active users

239

countries

75K

new subscribers per month

105K

user reviews on trusted platforms

420

fortune 500 companies

4.6/5

average user rating

Get started withan all‑in‑one PDF software

Save up to 40 hours per month with paper-free processes

Make quick changes to your PDFs even while on the go

Streamline approvals, teamwork, and document sharing

G2 recognizes pdfFiller as one of the best tools to power your paperless office

4.6/5

— from 710 reviews

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the masked SSN number?

A masked SSN is an alternative to using the complete SSN, IRS Individual Taxpayer Identification Number (ITIN), or IRS Adoption Taxpayer Identification Number (ATIN). The masked SSN displays only the last four digits of an individual's identifying number and is shown in the format -XX-1234 or ***-**-1234.

How are social security numbers assigned?

Generally, area numbers were assigned in ascending order beginning in the northeast and then moving westward. For the most part, people on the east coast have the lowest area numbers and those on the west coast have the highest area numbers. However, area numbers did not always reflect the worker's residence.

How do I unmask a Social Security number in Excel?

Display Social Security numbers in full Select the cell or range of cells that you want to format. See how to select a cell or range of cells. On the Home tab, click the Dialog Box Launcher next to Number. In the Category box, select Special. In the Type list, choose Social Security Number.

What is SSN masking on w2?

To help protect people from identity theft, the Internal Revenue Service has issued a final rule that will allow employers to shorten Social Security numbers (SSNs) or alternative taxpayer identification numbers (TINs) on Form W-2 wage and tax statements that are distributed to employees, beginning in 2021.

What is the SSN format?

Structure of Social Security Numbers information contributed by Jerry Crow (crow@anasaz.com) and Barbara Bennett A Social Security Number (SSN) consists of nine digits, commonly written as three fields separated by hyphens: AAA-GG-SSSS.

What is your Social Security number?

The nine-digit SSN is composed of three parts: The first set of three digits is called the Area Number. The second set of two digits is called the Group Number. The final set of four digits is the Serial Number.

What are the reserved SSN numbers?

Some special numbers are never allocated: Numbers with all zeros in any digit group (000-##-####, ###-00-####, ###-##-0000). Numbers with 666 or 900–999 (Individual Taxpayer Identification Number) in the first digit group.

What is a social secret number?

A Social Security number is a numerical identifier assigned to U.S. citizens and other residents to track income and determine benefits. The SSN was created in 1936 as part of The New Deal. SSNs are issued by the Social Security Administration.

Join 64+ million people using paperless workflows to drive productivity and cut costs