Digital Sign Share Transfer Agreement Template For Free

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Digital Sign Share Transfer Agreement Template

The Digital Sign Share Transfer Agreement Template simplifies the process of transferring shares. It provides a clear structure, reducing confusion and ensuring all necessary details are included. With this template, you can manage share transfers efficiently.

Key Features

Potential Use Cases and Benefits

This template addresses your need for a straightforward and reliable method to handle share transfers. By using the Digital Sign Share Transfer Agreement Template, you avoid the hassle of complicated paperwork, ensuring that all parties clearly understand their roles and responsibilities. Streamline your share transfer process today and safeguard your business interests.

Digital Sign Share Transfer Agreement Template with the swift ease

pdfFiller allows you to Digital Sign Share Transfer Agreement Template quickly. The editor's handy drag and drop interface ensures fast and intuitive document execution on any operaring system.

Signing PDFs electronically is a quick and safe way to validate documents at any time and anywhere, even while on the go.

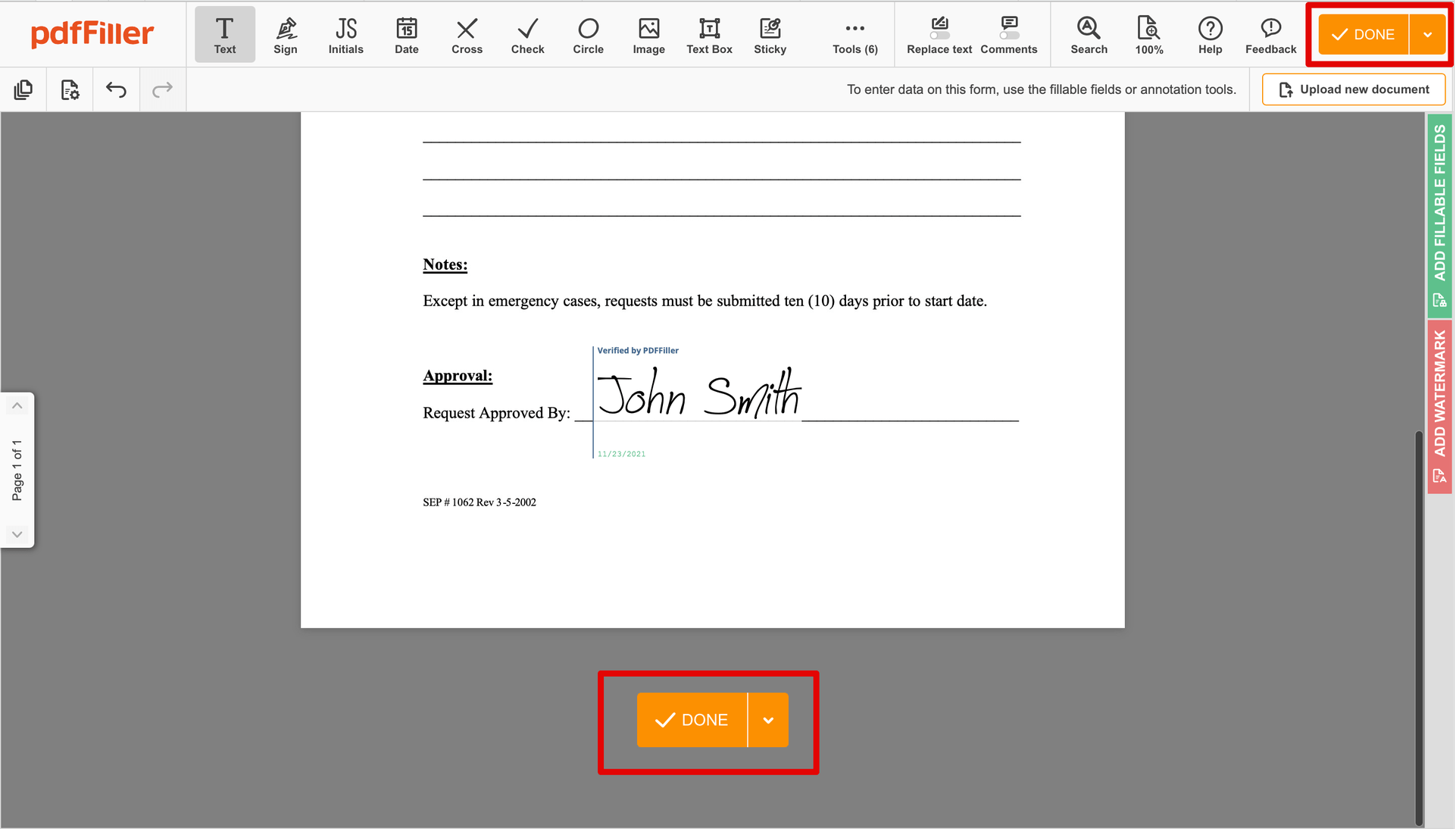

See the detailed instructions on how to Digital Sign Share Transfer Agreement Template electronically with pdfFiller:

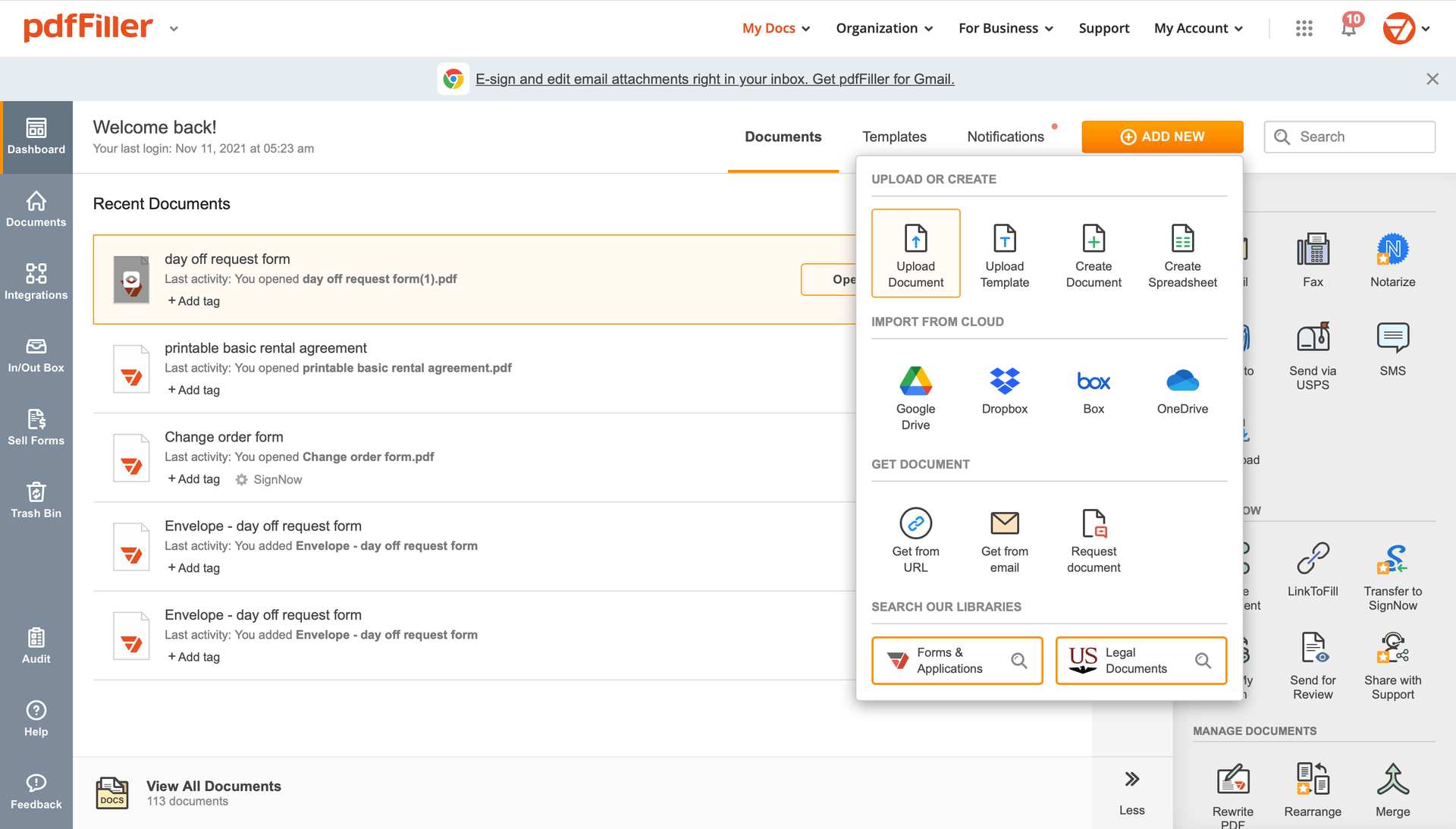

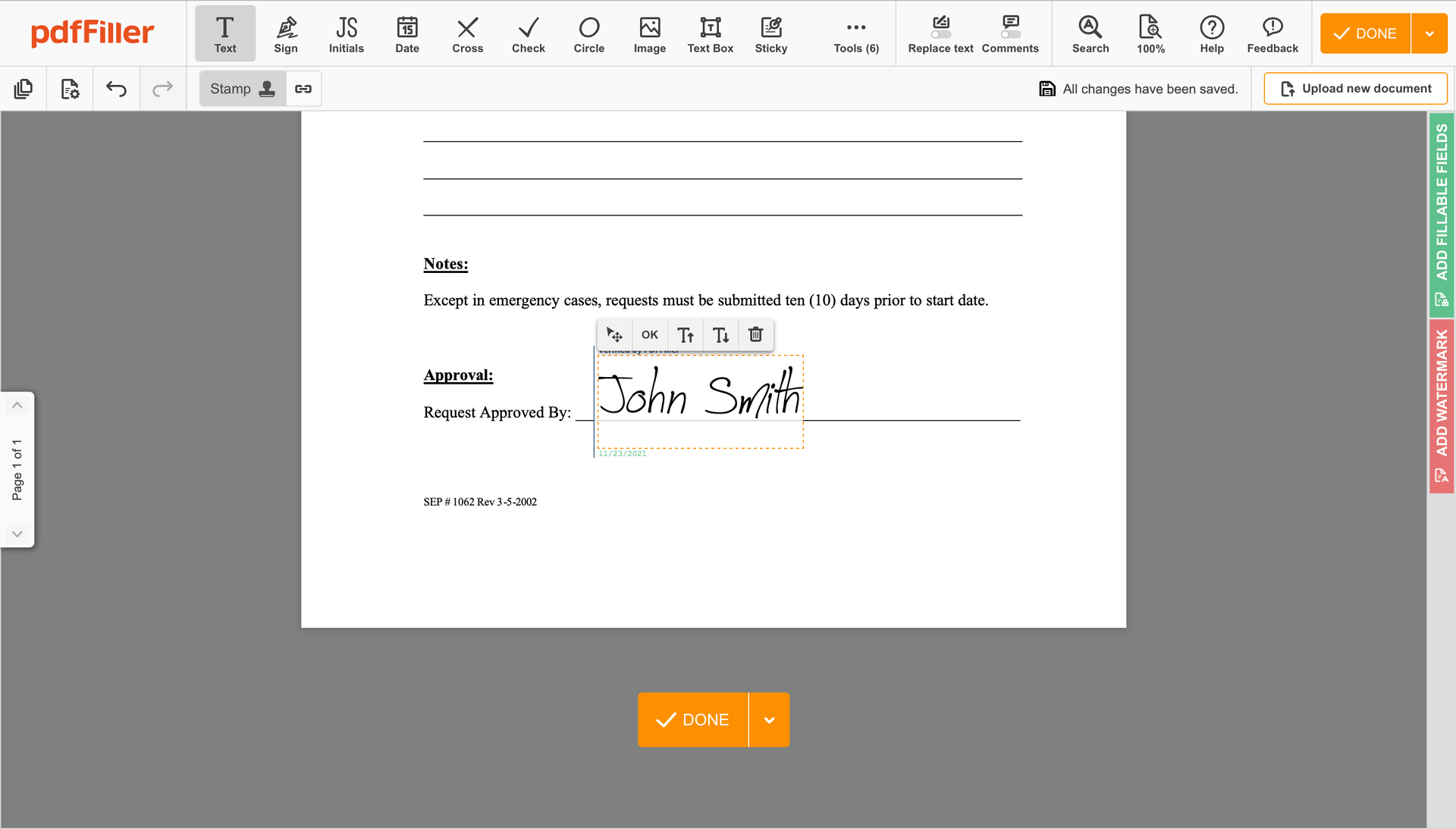

Add the document for eSignature to pdfFiller from your device or cloud storage.

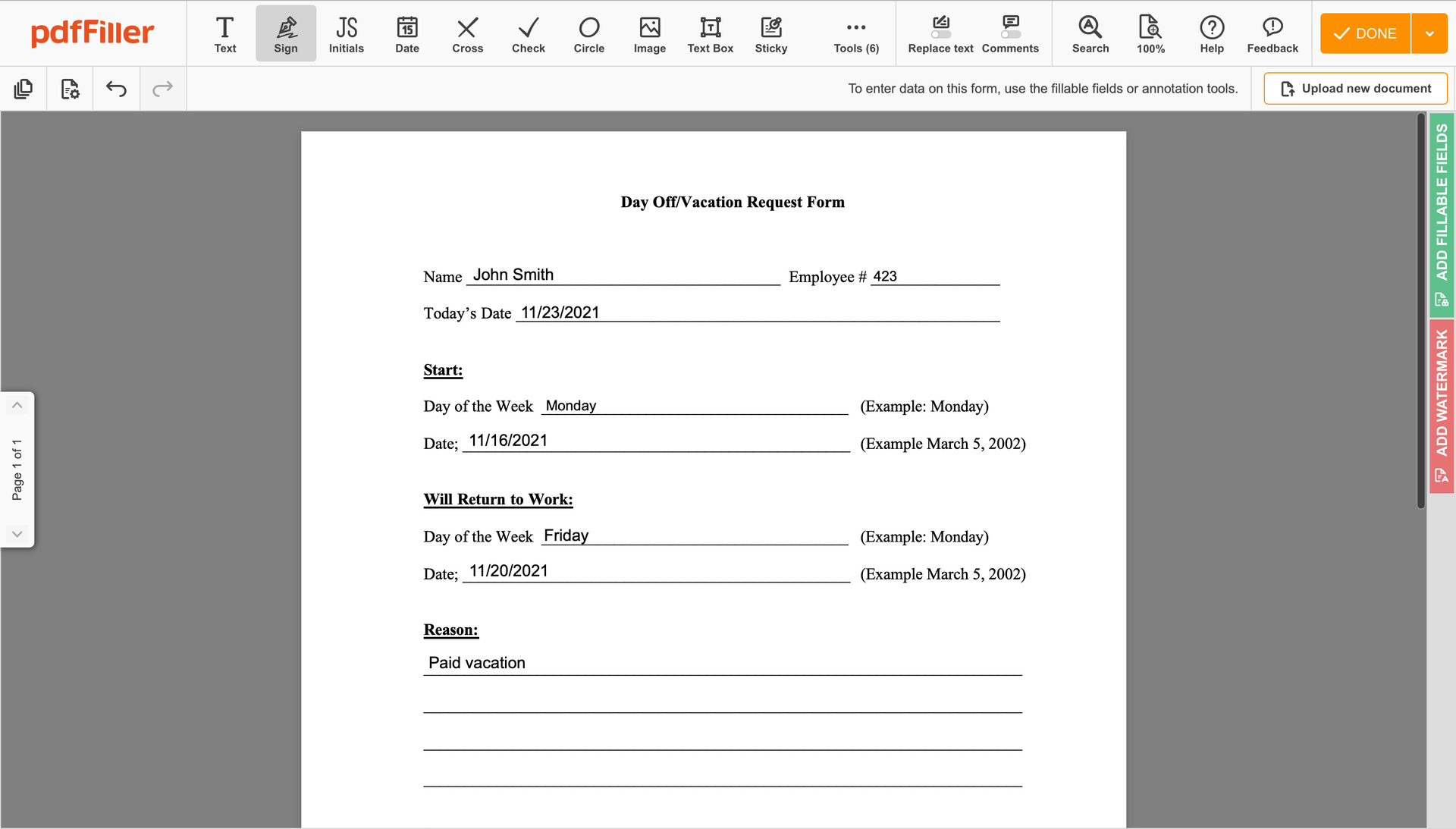

Once the file opens in the editor, hit Sign in the top toolbar.

Create your electronic signature by typing, drawing, or importing your handwritten signature's photo from your device. Then, click Save and sign.

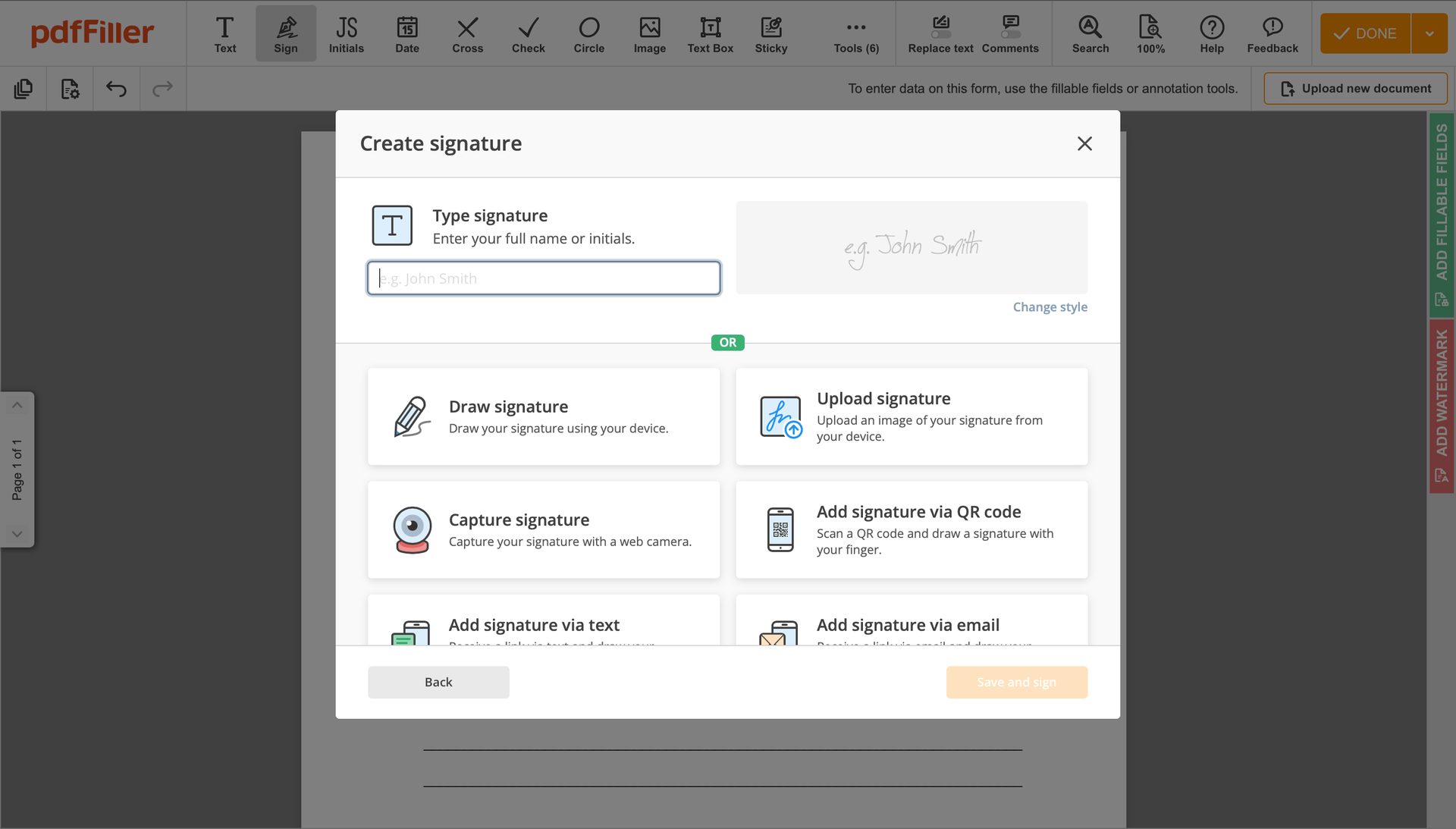

Click anywhere on a document to Digital Sign Share Transfer Agreement Template. You can drag it around or resize it using the controls in the floating panel. To use your signature, click OK.

Complete the signing session by clicking DONE below your document or in the top right corner.

After that, you'll go back to the pdfFiller dashboard. From there, you can download a signed copy, print the document, or send it to other people for review or validation.

Stuck working with different applications to manage documents? We've got the perfect all-in-one solution for you. Document management is simpler, fast and efficient using our tool. Create document templates on your own, modify existing forms, integrate cloud services and utilize even more features within one browser tab. You can use Digital Sign Share Transfer Agreement Template with ease; all of our features, like orders signing, alerts, attachment and payment requests, are available to all users. Get an advantage over those using any other free or paid programs. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How to edit a PDF document using the pdfFiller editor:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Digital Sign Share Transfer Agreement Template