Electronic Signature Tax Sharing Agreement For Free

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Electronic Signature Tax Sharing Agreement Feature

The Electronic Signature Tax Sharing Agreement feature streamlines the process of signing tax agreements. It offers a quick and efficient way for participants to review and sign documents, allowing you to focus on what matters most.

Key Features

Potential Use Cases and Benefits

This feature solves your problem of lengthy document signing processes. By allowing electronic signatures, you eliminate the hassle of printing, scanning, and mailing papers. Instead, you can complete transactions swiftly, save time, and reduce errors. Embrace this solution to enhance your efficiency and ensure compliance.

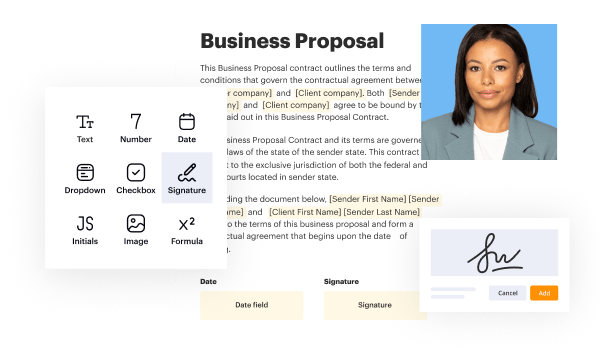

Add a legally-binding Electronic Signature Tax Sharing Agreement in minutes

pdfFiller enables you to deal with Electronic Signature Tax Sharing Agreement like a pro. Regardless of the system or device you use our solution on, you'll enjoy an easy-to-use and stress-free method of executing documents.

The whole pexecution process is carefully protected: from uploading a document to storing it.

Here's the best way to create Electronic Signature Tax Sharing Agreement with pdfFiller:

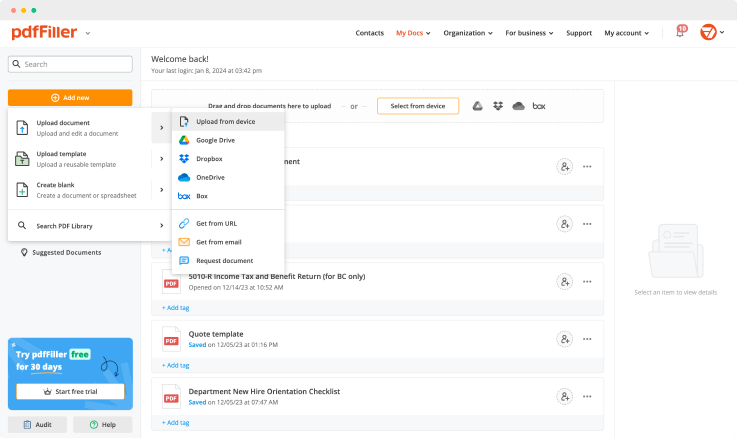

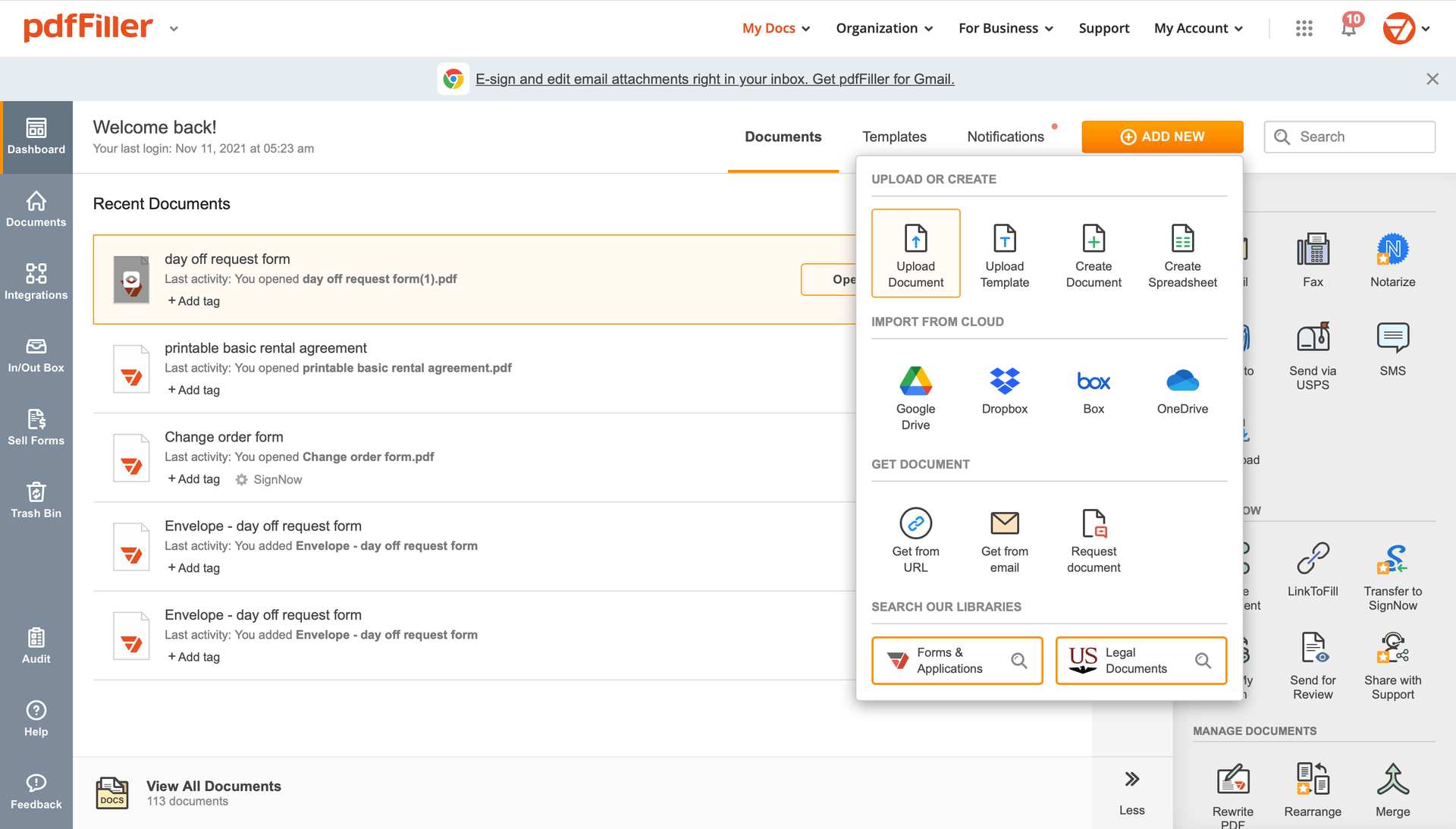

Select any available way to add a PDF file for completion.

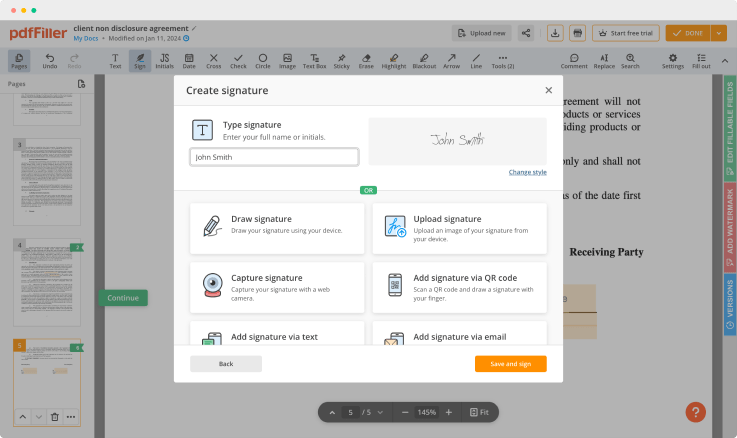

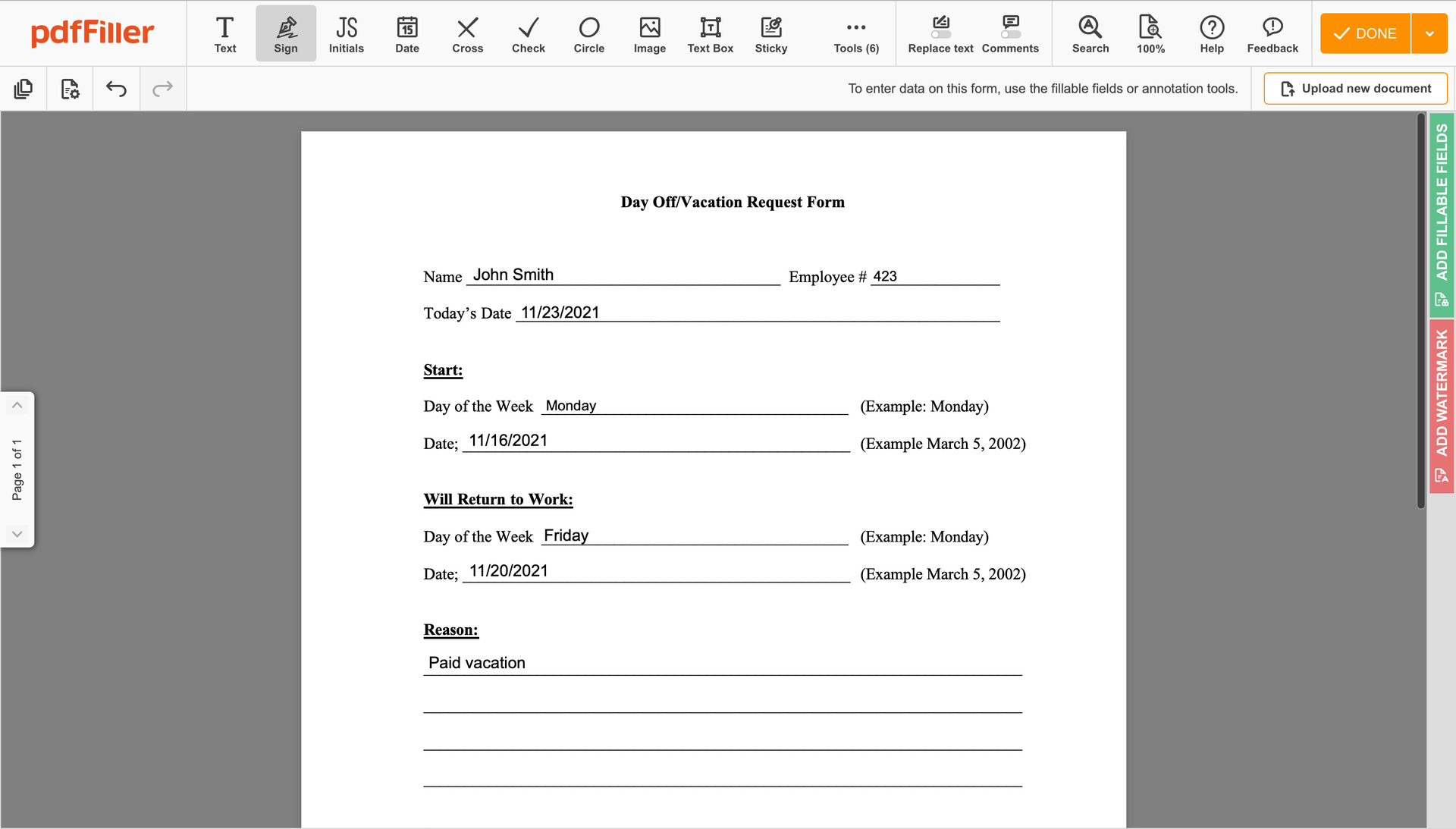

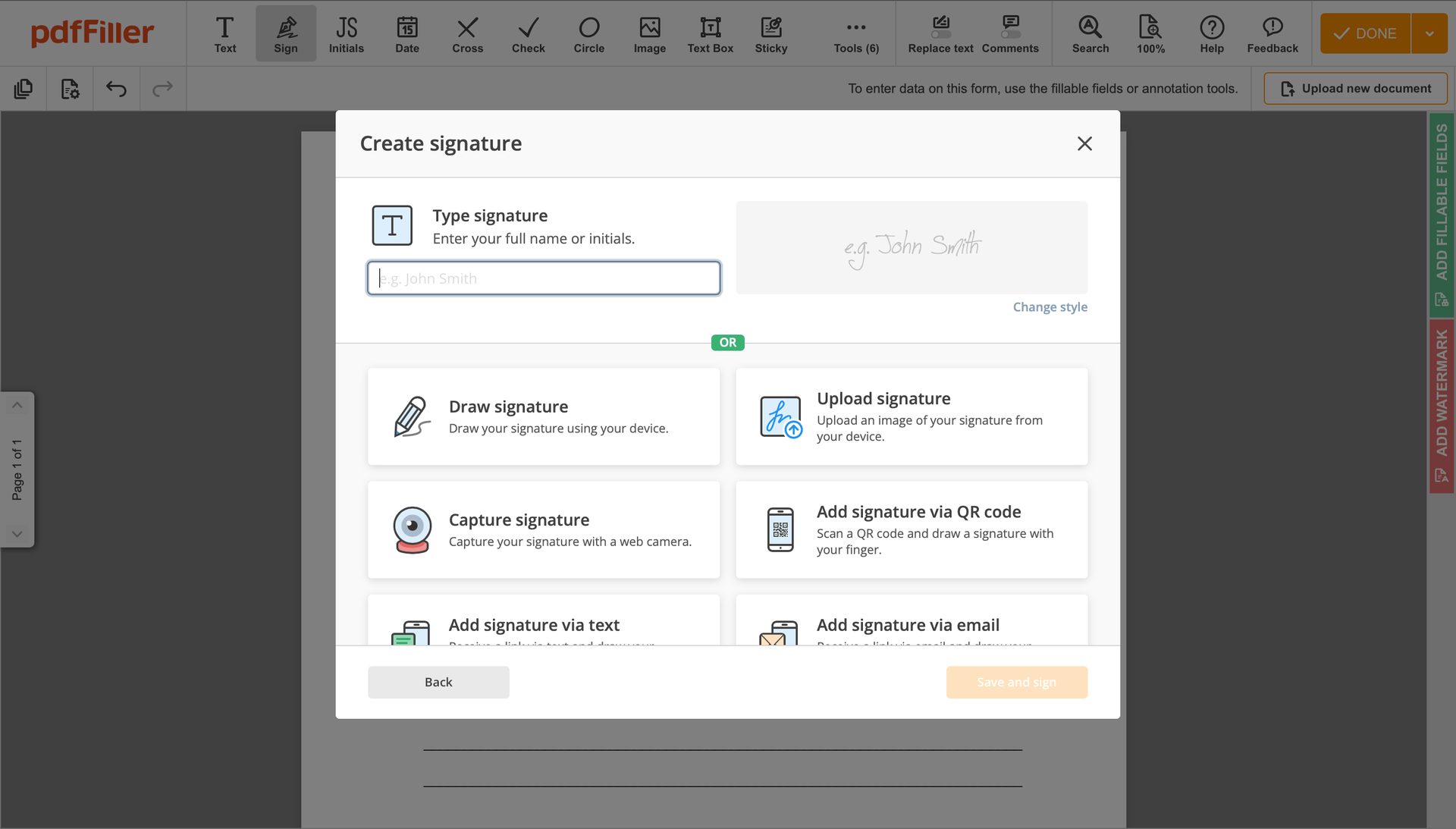

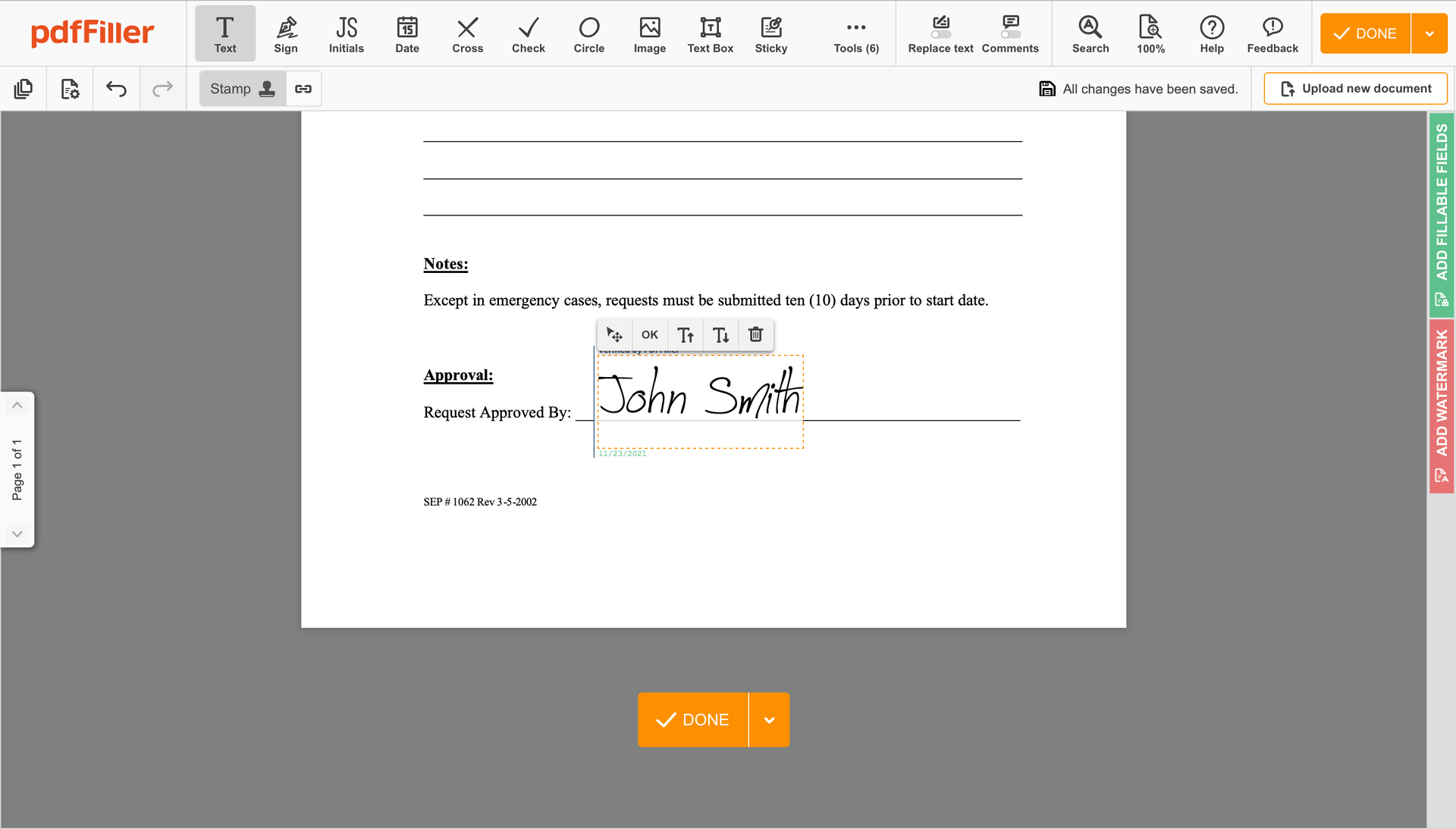

Use the toolbar at the top of the page and choose the Sign option.

You can mouse-draw your signature, type it or add an image of it - our solution will digitize it in a blink of an eye. As soon as your signature is set up, hit Save and sign.

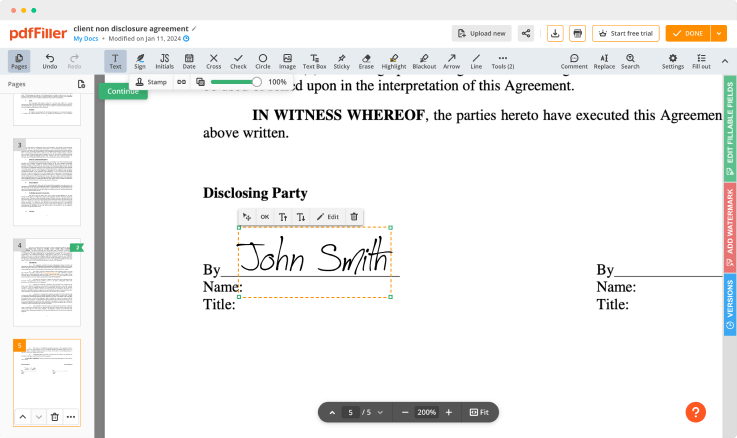

Click on the form area where you want to put an Electronic Signature Tax Sharing Agreement. You can drag the newly created signature anywhere on the page you want or change its configurations. Click OK to save the changes.

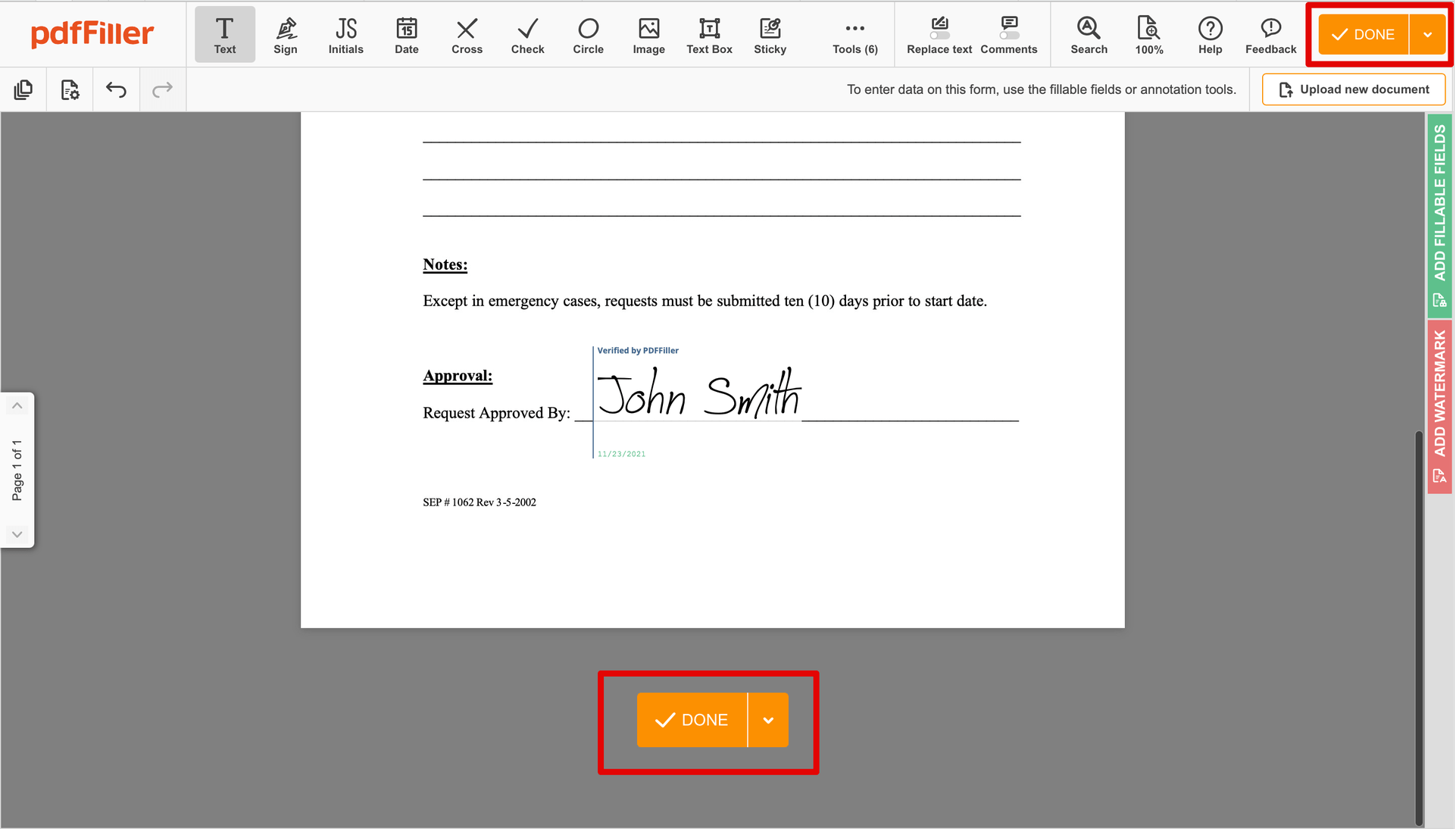

Once your form is good to go, hit the DONE button in the top right corner.

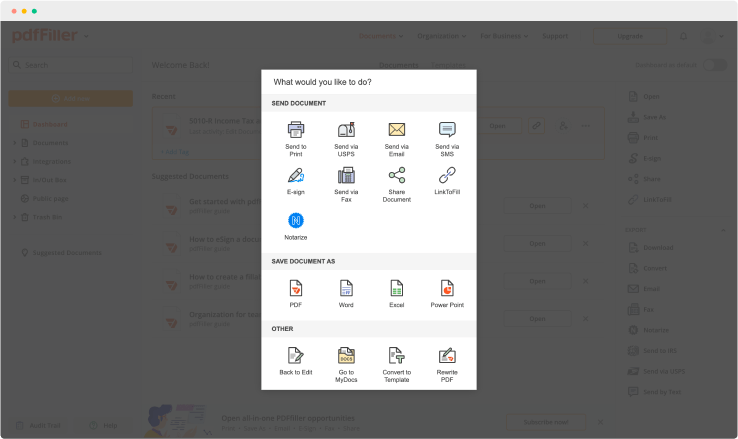

As soon as you're done with signing, you will be redirected to the Dashboard.

Use the Dashboard settings to get the completed copy, send it for further review, or print it out.

Still using multiple applications to sign and manage your documents? We have a solution for you. Use our document management tool for the fast and efficient process. Create document templates on your own, edit existing forms, integrate cloud services and other useful features without leaving your browser. You can use Electronic Signature Tax Sharing Agreement directly, all features, like orders signing, reminders, attachment and payment requests, are available instantly. Have a major advantage over other applications. The key is flexibility, usability and customer satisfaction. We deliver on all three.

How to edit a PDF document using the pdfFiller editor:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Electronic Signature Tax Sharing Agreement