Excise Comment Text For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

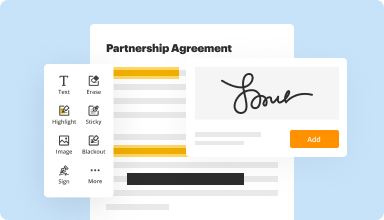

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

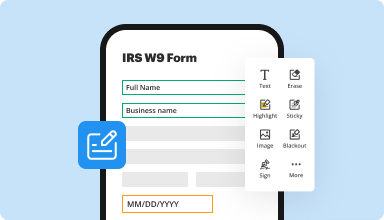

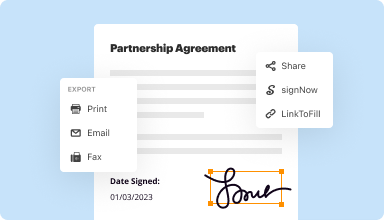

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

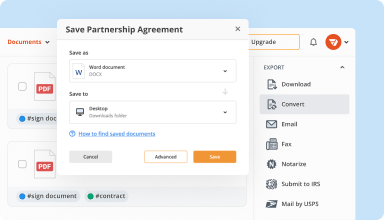

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

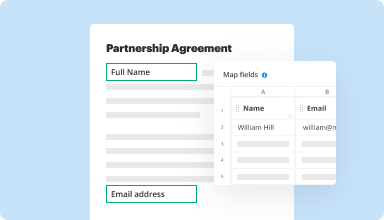

Collect data and approvals

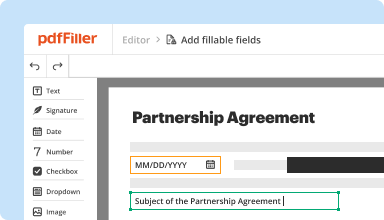

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

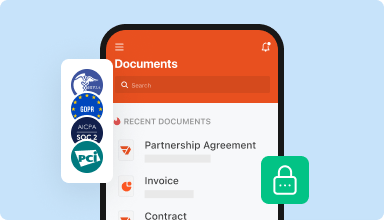

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Pdf filler is user friendly, efficient, and secure. It syncs well with different platforms and easily uploads forms from email, your computer files, or online. Useful in everyday life,college apps, insurance forms, contracts, government forms.Can't do business without it!

2016-06-07

Its good, except that it saves the document automatically without allowing a Save as function when printing, so it overwrites the previous file, which is not so good.

2017-09-15

Its good for the most part - the downside is it doesnt open for me on the first try and it asks me to sign in everytime i need to print or save a doc. even though I pay for the service. Annoying that it doesnt recognize me when I use the app.

2017-10-04

This service is a lifesaver. If, like me you don't have original adobe software and only occasionally have to fill in PDf's, PDFfiller has made life easier. So simple to use - brilliant!

2018-10-16

I was asking them for a refund as I…

I was asking them for a refund as I don’t need the subscription to get through as I am on maternity leave which means I will no longer use it. Bruce through online support helped me smoothly.

2024-09-02

I am very happy with the services of…

I am very happy with the services of pdfFiller.com

Their customer service is excellent. A payment was automatically made from my credit card. However, after talking to the customer service, I got my refund which I never thought would be possible.

2024-04-27

It was super easy to copy/paste fields

It was super easy to copy/paste fields. I've tried others and this has by far been the best experience! It's helped me save time and headaches!

2023-02-06

By far the most functional PDF editor i have used... Not that i have used that many, but this one was a breath of fresh air considering the other broken standalone PDF editing apps

2021-12-31

Works perfectly.

I like this app and after looking at several similar app. I choose this one. Its so powerful and helped me to do my task with out too much effort.

2021-02-18

Excise Comment Text Feature

Introducing the Excise Comment Text feature, designed to enhance your document management experience. This tool allows you to add clear comments directly to your texts, improving collaboration and making discussions more effective. With this feature, you can stay organized and make your feedback easily accessible.

Key Features

Add real-time comments to documents

Edit and delete comments as needed

Organize comments by sections or topics

View comments from all collaborators in one place

Receive notifications for comment updates

Potential Use Cases and Benefits

Enhance teamwork on project documents

Clarify ideas during brainstorming sessions

Provide constructive feedback on drafts

Streamline communication in remote work settings

Easily track changes and responses over time

By using the Excise Comment Text feature, you can address common challenges in collaboration. No more confusion from lengthy email chains or lost messages. Instead, you will have all comments neatly organized within the document, making it easier to follow discussions and implement suggestions. This tool helps you save time and improve the quality of your work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What does it mean to excise something?

An excise tax is a special tax levied on specific products sold within a country. To excise something can also mean to get rid of it. ... Interestingly, the word excise (size) used as a verb means to remove something by cutting it out. Good luck with excising the excise taxes!

What do you mean by excise?

An excise or excise tax (sometimes called a special excise duty) is an inland tax on the sale, or production for sale, of specific goods or a tax on a good produced for sale, or sold, within a country or licenses for specific activities. Excises are distinguished from customs duties, which are taxes on importation.

What is mean by excise duty?

A percentage levied on manufacture, sale, or use of locally produced goods (such as alcoholic drinks or tobacco products). 2. A percentage tax levied on a company's revenue, instead of (like income tax) on the company's income. ... Also called excise tax.

How do you use excise in a sentence?

How to use excise in a sentence. Hand tools such as spades, shovels, sickles etc, which currently attract a 16 per cent excise duty will also be fully exempt. Mr. Speaker Sir, the rates of excise duty have now been considerably moderated.

What's another name for excise tax?

Excise taxes are most often levied upon cigarettes, alcohol, gasoline and gambling. These are often considered superfluous or unnecessary goods and services. To raise taxes on them is to raise their price and to reduce the amount they are used. In this context, excise taxes are sometimes known as “sin taxes.”

What is the meaning of excise tax?

An excise or excise tax is any duty on manufactured goods which is levied at the moment of manufacture, rather than at sale. ... Excises are typically imposed in addition to an indirect tax such as a sales tax or value-added tax (VAT).

What is meant by excise tax?

Excise taxes are taxes paid when purchases are made on a specific good, such as gasoline. Excise taxes are often included in the price of the product. There are also excise taxes on activities, such as on wagering or on highway usage by trucks. One of the major components of the excise program is motor fuel.

What is the purpose of an excise tax?

Excise taxes are most often levied upon cigarettes, alcohol, gasoline and gambling. These are often considered superfluous or unnecessary goods and services. To raise taxes on them is to raise their price and to reduce the amount they are used. In this context, excise taxes are sometimes known as “sin taxes.”

What is the difference between sales tax and excise tax?

There are two basic differences between sales tax and excise tax. While excise tax is levied only on certain goods and services that are considered harmful or linked to specific health issues, sales tax is applied to just about everything. Also, sales tax is calculated a percentage of the sale price.

What items have an excise tax?

In the more narrow sense, taxes denominated as “excise” taxes are usually taxes on events, such as the purchase of a quantity of a particular item like gasoline, diesel fuel, beer, liquor, wine, cigarettes, airline tickets, tires, trucks, etc.

Video Review on How to Excise Comment Text

#1 usability according to G2

Try the PDF solution that respects your time.