Switch from Sejda to pdfFiller for a Export Currency Contract Solution For Free

Use pdfFiller instead of Sejda to fill out forms and edit PDF documents online. Get a comprehensive PDF toolkit at the most competitive price.

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

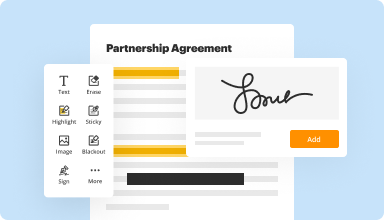

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Switch from Sejda to pdfFiller in 4 simple steps

1

Sign up for free using your email, Google, or Facebook account.

2

Upload a PDF from your device or cloud storage, check the online library for the form you need, or create a document from scratch.

3

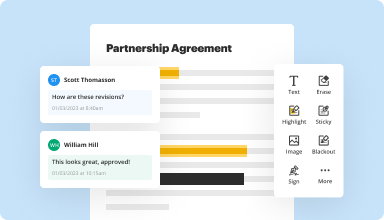

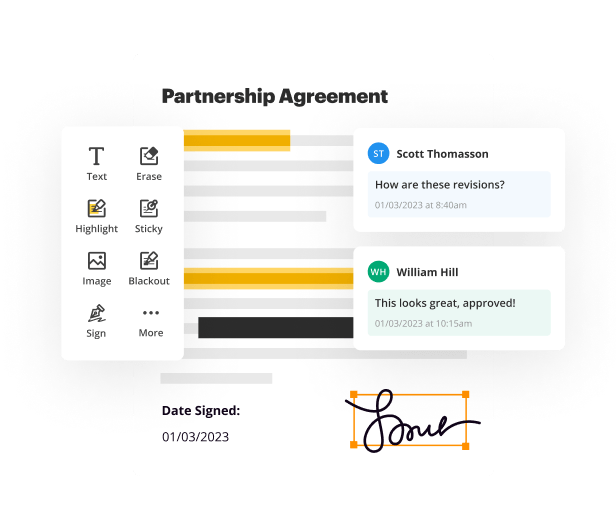

Edit, annotate, redact, or eSign your PDF online in seconds.

4

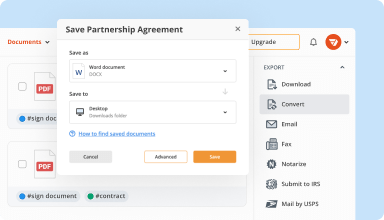

Share your document, download it in your preferred format, or save it as a template.

Experience effortless PDF management with the best alternative to Sejda

Create and edit PDFs

Instantly customize your PDFs any way you want, or start fresh with a new document.

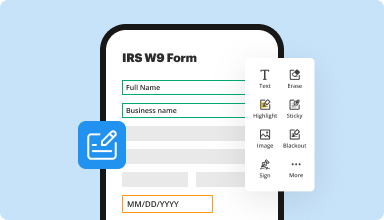

Fill out PDF forms

Stop spending hours doing forms by hand. Complete your tax reporting and other paperwork fast and error-free.

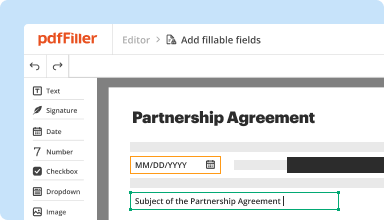

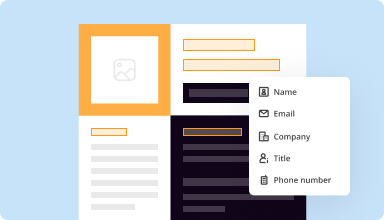

Build fillable documents

Add fillable fields to your PDFs and share your forms with ease to collect accurate data.

Save reusable templates

Reclaim working hours by generating new documents with reusable pre-made templates.

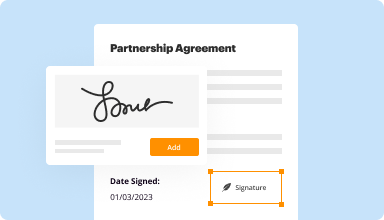

Get eSignatures done

Forget about printing and mailing documents for signature. Sign your PDFs or request signatures in a few clicks.

Convert files

Say goodbye to unreliable third-party file converters. Save your files in various formats right in pdfFiller.

Securely store documents

Keep all your documents in one place without exposing your sensitive data.

Organize your PDFs

Merge, split, and rearrange the pages of your PDFs in any order.

Customer trust proven by figures

pdfFiller is proud of its massive user base and is committed to delivering the greatest possible experience and value to each customer.

740K

active users

239

countries

75K

new subscribers per month

105K

user reviews on trusted platforms

420

fortune 500 companies

4.6/5

average user rating

Get started withan all‑in‑one PDF software

Save up to 40 hours per month with paper-free processes

Make quick changes to your PDFs even while on the go

Streamline approvals, teamwork, and document sharing

G2 recognizes pdfFiller as one of the best tools to power your paperless office

4.6/5

— from 710 reviews

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you account for foreign currency forward contracts?

The sale date when the product is sold to the customer and the foreign exchange forward contract is entered into.

The balance sheet date when the value for the accounts receivable and forward contract liability needs to be restated.

How do you account for forward currency contracts?

On the liability side, debit Contracts Payable by the forward rate, and debit or credit the Contra-Assets account by the difference between the spot rate and the forward rate. On the asset side, credit Assets Receivable by the spot rate on the date of the contract.

How do foreign currency forward contracts work?

A currency forward contract locks the exchange rate for a currency's purchase or sale at a future date. They're essentially hedging instruments with no upfront payments. Currency forward settlements are made on a cash or delivery basis. The contracts are over-the-counter instruments and do not trade on an exchange.

How does a forward contract hedge against foreign currency transactions?

Hedging is a way for a company to minimize or eliminate foreign exchange risk. Two common hedges are forward contracts and options. A forward contract will lock in an exchange rate today at which the currency transaction will occur at the future date.

How does a company determine the fair value of a foreign currency forward contract?

The fair value of a foreign currency forward contract is determined by reference to changes in the forward rate over the life of the contract, discounted to the present value. Are unavailable, the company can estimate the value of an option using the modified Black-Scholes option pricing model.

Is forward contract an asset?

A forward contract is a customizable derivative contract between two parties to buy or sell an asset at a specified price on a future date. Forward contracts do not trade on a centralized exchange and are considered over-the-counter (OTC) instruments.

What are the limitations of Sejda PDF editor?

If you are using the free Sejda PDF Desktop, it can only use 3 tasks in one day, compress files up to 100MB, images up to 5MB, and combine up to 30 files and 50 pages.

How does sejda work?

Sejda is a PDF editing software. It allows users to edit, convert, compress, merge, split, protect, and manipulate PDFs through an online service or desktop application.

Join 64+ million people using paperless workflows to drive productivity and cut costs