Last updated on

Sep 21, 2025

Export Currency Contract For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Try these PDF tools

Edit PDF

Quickly edit and annotate PDFs online.

Start now

Sign

eSign documents from anywhere.

Start now

Request signatures

Send a document for eSignature.

Start now

Share

Instantly send PDFs for review and editing.

Start now

Merge

Combine multiple PDFs into one.

Start now

Rearrange

Rearrange pages in a PDF document.

Start now

Compress

Compress PDFs to reduce their size.

Start now

Convert

Convert PDFs into Word, Excel, JPG, or PPT files and vice versa.

Start now

Create from scratch

Start with a blank page.

Start now

Edit DOC

Edit Word documents.

Start now

Discover the simplicity of processing PDFs online

Upload your document in seconds

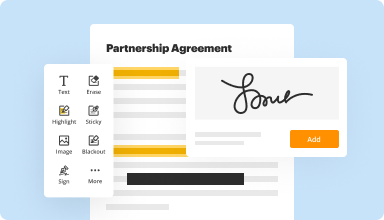

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

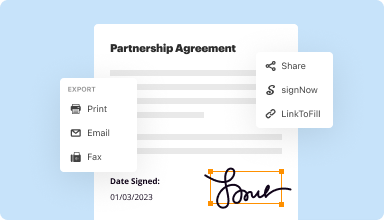

Fill out & sign PDF forms

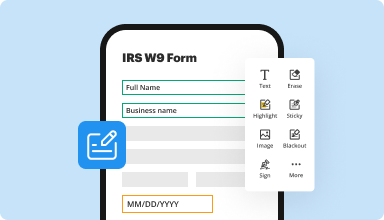

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

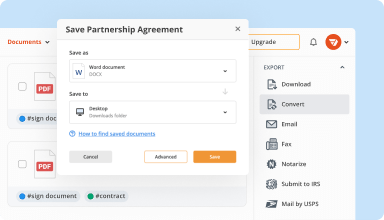

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

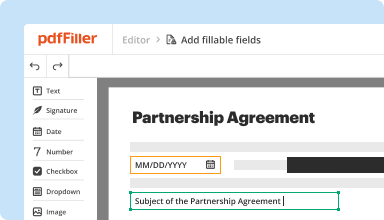

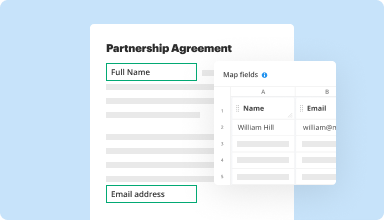

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

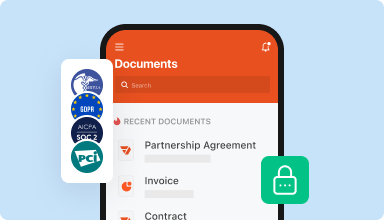

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I did not know there was a charge for using this until I got to the very end. I had spent too much time filling out the form to end and start over. I want to cancel at the end of one month.

2014-08-19

easy software to use and afords most of the functions that I need

the ease of use and the price, availability of pdf acord forms on line, and ability to revise forms with the pdf fromat

does not have some of the functions that would make it even more useful to an insurance agent, i.e. the ability to attach emails and the ability to document conversations for reference and use of other team members

2017-11-20

good enough but I am being billed $30…

good enough but I am being billed $30 and $30 for this month October alone and I only have one license. Just me. I need this corrected immediately.

Aaron McCartney

(561)336-8012

2022-10-19

I have noticed that this is

I have noticed that, although this subreddit has 1,000,020 readers, I am not receiving 1,000,020 upvotes on my posts. I'm not sure if this is being done intentionally or if these "friends" are forgetting to click 'upvote'. Either way, I've had enough. I have compiled a spreadsheet of individuals who have "forgotten" to upvote my most recent posts. After 2 consecutive strikes, your name is automatically highlighted (shown in red) and I am immediately notified. 3 consecutive strikes and you can expect an in-person "consultation". Think about your actions.

2022-09-03

I've been using PDFfiller regularly for over 2 years now, and it works wonderfully. I'm able to upload documents, add fillable lines, and get electronic signatures seamlessly. Customer service is also great - prompt and friendly in attending to any questions or issues. Makes running my business that much easier.

2022-05-05

I thought it was a bit difficult to get a form completed. All I wanted was a statement that I paid my neighbor for a dent in his car. I had to hunt for a form that would allow me to enter that statement.

2021-06-05

Pleasant and professional customer service. ****** product which is under continuous development. Responsive to customer feedback. Highly recommended.

2021-01-12

A must have program!

PdfFiller has made things a lot easier to make or modify the forms I need for the Homeowners Association that I am Board President over. Very Thankful!Lesli K. Martin

2020-09-10

Chatted online to cancel and refund $96 that I was charged and I got a pretty friendly guy named Peter! He was sweet and fast! If I needed this particular application again, I would definitely reuse them!!!

2020-05-03

How to Export Currency Contract like a pro

Follow these steps to use the Export Currency Contract feature in pdfFiller.

01

Go to your pdfFiller account or create one in case you don’t have one.

02

Upload your document or choose one from the forms' library.

03

If you don’t have a document ready, go to the forms' library to find and pick one that you want to use.

04

Can't find the document you need? Click Create Document and generate one from scratch and save it to the Docs tab.

05

Locate the tool to Export Currency Contract and apply the needed changes to the document.

06

Click DONE if you finished editing the file and want it to be saved in your account.

07

Go over the document and check it for errors and typos.

08

Rename the newly edited document or save it as is.

09

Select Save As to save the file in a specific format. Add an extra layer of protection by setting a password.

10

Finalize the process and get started with another document.

Export Currency Contract Feature

Welcome to our Export Currency Contract feature! Are you looking to streamline your international transactions? Look no further, as this feature is designed to make your life easier.

Key Features:

Lock in exchange rates for future transactions

Automate currency conversion processes

Customize contract terms to suit your business needs

Potential Use Cases and Benefits:

Safeguard against currency fluctuations

Reduce the risk of financial losses

Improve budgeting and forecasting accuracy

With our Export Currency Contract feature, you can effectively manage your currency exposure and protect your bottom line. Say goodbye to uncertainties and hello to smooth sailing in your international business dealings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the currency exchange contract?

A foreign exchange contract, also called a “forward transaction”, is the purchase or sale of a currency at a predefined rate in the future. It allows the exchange rate for currency conversion to be set in advance, essentially eliminating the risks associated with market fluctuations.

How does an fec work?

A forward exchange contract, commonly known as a FEC or forward cover, is a contract between a bank and its customer, whereby a rate of exchange is fixed immediately, for the buying and selling of one currency for another, for delivery at an agreed future date.

What is an example of a forward rate contract?

Let's consider an example to understand how a Forward Rate Agreement works. Suppose Party A enters into a 6-month FRA with Party B. The notional amount is $1 million, and the reference interest rate is 5%. The forward rate agreed upon is 6%.

What is an example of a currency option contract?

With a contract size of 50,000 USD and a premium of 0.1 CAD, the total premium paid is 0.1*50,000 = 5,000 CAD. This amount also represents the maximum loss on the contract. The breakeven spot rate is calculated as the strike price + the premium. In this example, the breakeven = 1.2 + 0.1 = 1.3 USD/CAD.

What is the forward rate of currency example?

For example, if the spot rate for EUR/USD is 1.20, the interest rate for EUR is 0.5%, and the interest rate for USD is 1%, the forward rate for a one-year contract is: Forward rate = 1.20 x (1 + 0.005) / (1 + 0.01) = 1.1914 This means that one euro will be worth 1.1914 US dollars in one year.

How do you account for forward currency contracts?

A Forward FX contract is considered a financial derivative. Under IFRS 9, a derivative must be initially measured at fair value and subsequent value changes are recognized. Unless you are applying hedge accounting then movements must be posted to the profit or loss account.

What is an example of a currency forward contract?

The exporter is concerned that the Canadian dollar may strengthen from its current rate of 1.0500 and it would receive fewer Canadian dollars per US dollar in one year. The Canadian exporter, therefore, enters into a forward contract to sell $1 million a year from now at the forward rate of US$1 = C$1.0655.

What is export contract?

An Export Contract is a consensus document between two parties who intend to go into export trade. • It is also known as a Sales Contract.

How to Export Currency Contract - video instructions

#1 usability according to G2

Try the PDF solution that respects your time.