Last updated on

Sep 21, 2025

Form Software - Trust Service Online For Free

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Try these PDF tools

Edit PDF

Quickly edit and annotate PDFs online.

Start now

Sign

eSign documents from anywhere.

Start now

Request signatures

Send a document for eSignature.

Start now

Share

Instantly send PDFs for review and editing.

Start now

Merge

Combine multiple PDFs into one.

Start now

Rearrange

Rearrange pages in a PDF document.

Start now

Compress

Compress PDFs to reduce their size.

Start now

Convert

Convert PDFs into Word, Excel, JPG, or PPT files and vice versa.

Start now

Create from scratch

Start with a blank page.

Start now

Edit DOC

Edit Word documents.

Start now

Discover the simplicity of processing PDFs online

Upload your document in seconds

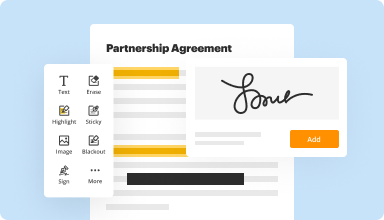

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

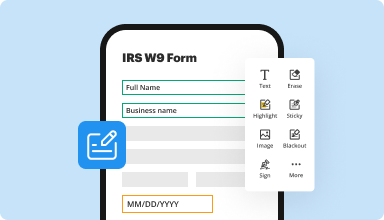

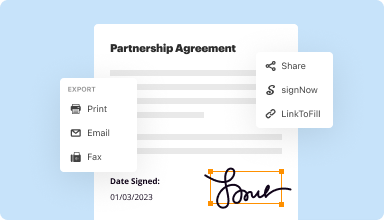

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

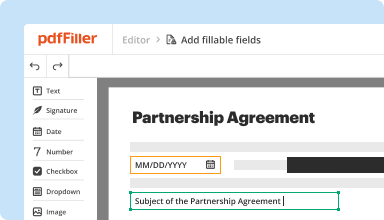

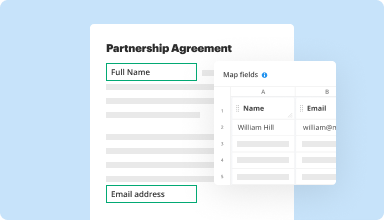

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

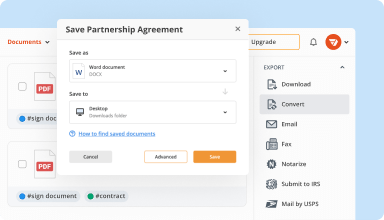

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

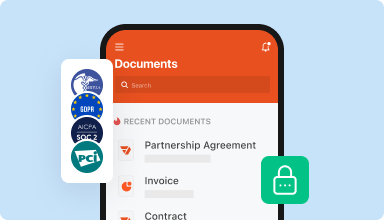

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

The program very intelligently interprets PDF images, creating fields in just the right spot for us to type our responses in, while avoiding the print-write-scan-save cycle.

2018-12-26

I like using the program the only downfall for me is unless I pay more for the subscription I'm not allowed to use the premier options. That is my opinion It's already expensive for me since I really only use it for tax returns.

2019-03-07

Had an issue with billing today (a…

Had an issue with billing today (a Saturday) however after emailing their customer service team I got a very quick response and kept getting help and support until the issue was resolved, on the same day. The person I was in contact with was very polite, understanding and genuinely wanted to help. The service itself is great and I would recommend it to any business that needs to edit and sign documents online .

2019-09-22

Excellent tool and superb customer support

The pdfFiller tool provides great functionality for data handling, it is easy to use and there is one month trial period.

Apart from that their customer support is just superb.

2023-07-02

I love that you had the form I needed…

I love that you had the form I needed now as long as you have the other forms I need then I will def keep this subscription I love the fact you give 30 days free trail also

2022-03-16

Took a little time to figure out how to…

Took a little time to figure out how to do more than one signature on a single document, but the Support Team was helpful and patient with me as I learned.

2021-02-17

Easy to use and very convenient to have for filling...

Easy to use and very convenient to have for filling out forms and other documents that I would normally need to print out before filling in my information. I really enjoy the ease of this tool.

2020-05-24

Great Customer service

Great Customer service. I didn't need the subscription and thought I had cancelled but it turns out I was charged. I contacted them about it and received an immediate response and was refunded the money.

2020-05-16

Easy to use however as a student and…

Easy to use however as a student and not a large user of this functionality, the plans are not fit for my purpose.

2025-05-25

Form Software - Trust Service Feature

Discover the Trust Service feature of Form Software, designed to enhance your document management and security needs. This feature helps you build confidence in the integrity of your documents, making it easier to manage and share important information.

Key Features

Secure document signatures to ensure authenticity

Real-time tracking of document access and modifications

Encryption to protect sensitive information

User-friendly interface for seamless navigation

Compliance with regulatory standards for document security

Potential Use Cases and Benefits

Ideal for businesses needing secure contracts and agreements

Helpful for legal firms managing client documents

Useful for healthcare providers safeguarding patient records

Facilitates remote collaboration with secure document sharing

Enhances customer trust by demonstrating commitment to data protection

The Trust Service feature addresses common challenges faced by businesses today, such as document tampering and unauthorized access. By implementing this feature, you can ensure that your documents remain secure and trustworthy. It not only saves you time and resources but also fosters a professional image by prioritizing the security of your information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Which TurboT ax do I need for a trust?

You'll need TurboT ax Business to file Form 1041, as the personal versions of TurboT ax don't support this form. TurboT ax Business is available for Windows on CD or as a download. Select Trust or Estate return (Form 1041) and proceed.

What version of TurboT ax do I need for a trust?

If you need to prepare a federal tax return for an estate or trust using Form 1041, use our TurboT ax Business product. You'll also need to use one of our personal tax products for your individual tax return. Just answer simple questions about your life, and TurboT ax Free Edition will take care of the rest.

What TurboT ax do I need for a trust?

All other trusts need to file Form 1041 (U.S. Income Tax Return for Estates and Trusts), which is supported in TurboT ax Business. TurboT ax Business also generates the trust beneficiaries' Schedule K-1 forms, which the beneficiaries then report on their personal tax returns.

Which version of TurboT ax do I need for Form 1041?

You'll need TurboT ax Business to file Form 1041, as the personal versions of TurboT ax don't support this form. TurboT ax Business is available for Windows on CD or as a download. It's not available for Mac or in our online versions of TurboT ax.

What tax form do I file for a trust?

You must file Form 1041 for a domestic trust that has: Any taxable income for the tax year. Gross income of $600 or more (regardless of taxable income) A beneficiary who is a non-resident alien.

Do you have to file taxes for a trust fund?

Trusts are subject to different taxation than ordinary investment accounts. Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust, but not on returned principal. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

Is there a TurboT ax for trusts?

If it's a living trust, you can use whichever TurboT ax personal program that suits your tax situation. There is no special tax form for living trusts; the trust's income and deductions are reported on your personal tax return. TurboT ax Business is a Windows-only software program available as a CD or download.

Can you use TurboT ax for trusts?

If it's a living trust, you can use whichever TurboT ax personal program that suits your tax situation. There is no special tax form for living trusts; the trust's income and deductions are reported on your personal tax return. TurboT ax Business is a Windows-only software program available as a CD or download.

#1 usability according to G2

Try the PDF solution that respects your time.