Initial Accounts Receivable Purchase Agreement For Free

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Initial Accounts Receivable Purchase Agreement Feature

The Initial Accounts Receivable Purchase Agreement feature provides businesses with a streamlined way to manage cash flow by converting receivables into immediate capital. This feature helps you maintain operations, invest in growth, and eliminate the wait for accounts to be settled.

Key Features

Potential Use Cases and Benefits

This feature solves your cash flow issues by providing quick access to funds tied up in receivables. You can focus on growing your business rather than worrying about when clients will pay. With this agreement, you improve your financial agility, freeing you to seize new opportunities.

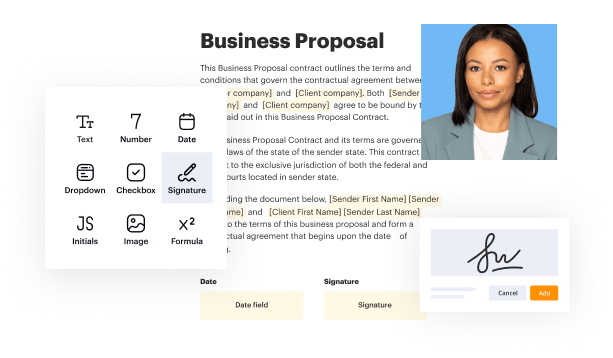

Create a legally-binding Initial Accounts Receivable Purchase Agreement with no hassle

pdfFiller allows you to manage Initial Accounts Receivable Purchase Agreement like a pro. No matter what system or device you run our solution on, you'll enjoy an instinctive and stress-free method of executing paperwork.

The entire pexecution process is carefully protected: from adding a file to storing it.

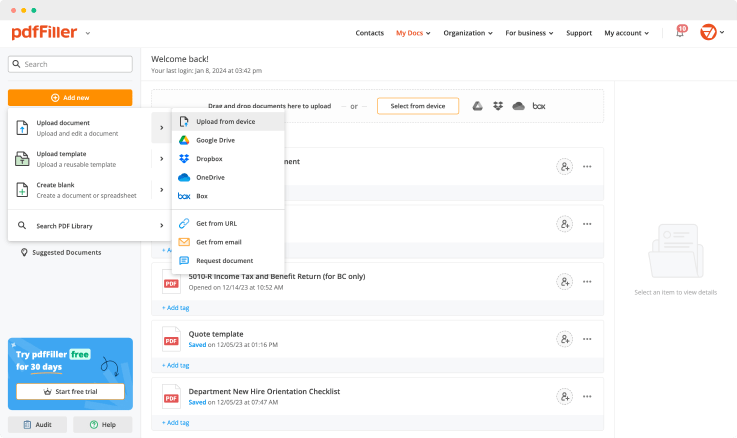

Here's how you can create Initial Accounts Receivable Purchase Agreement with pdfFiller:

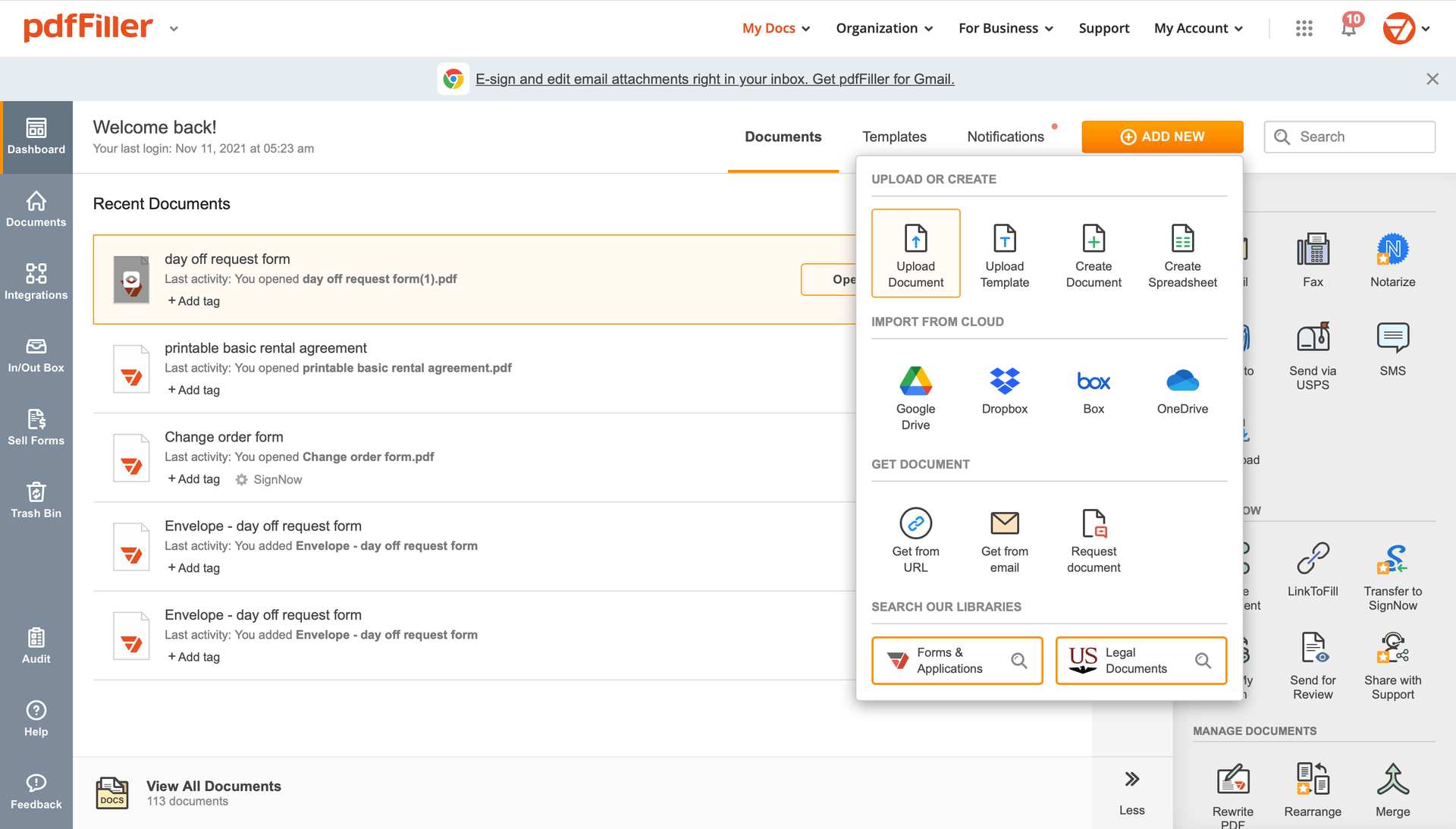

Choose any readily available way to add a PDF file for signing.

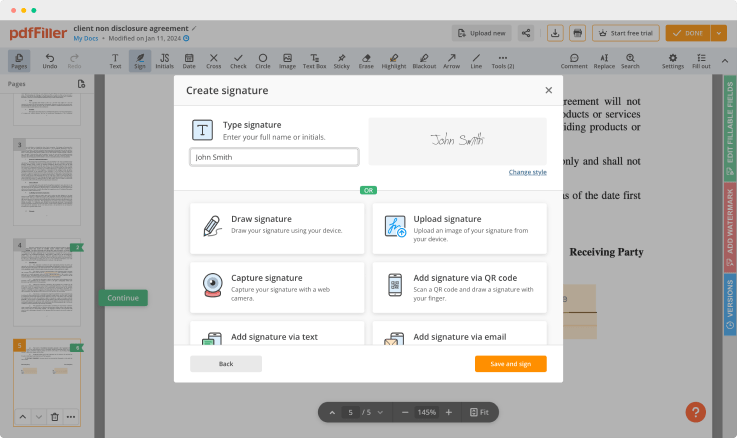

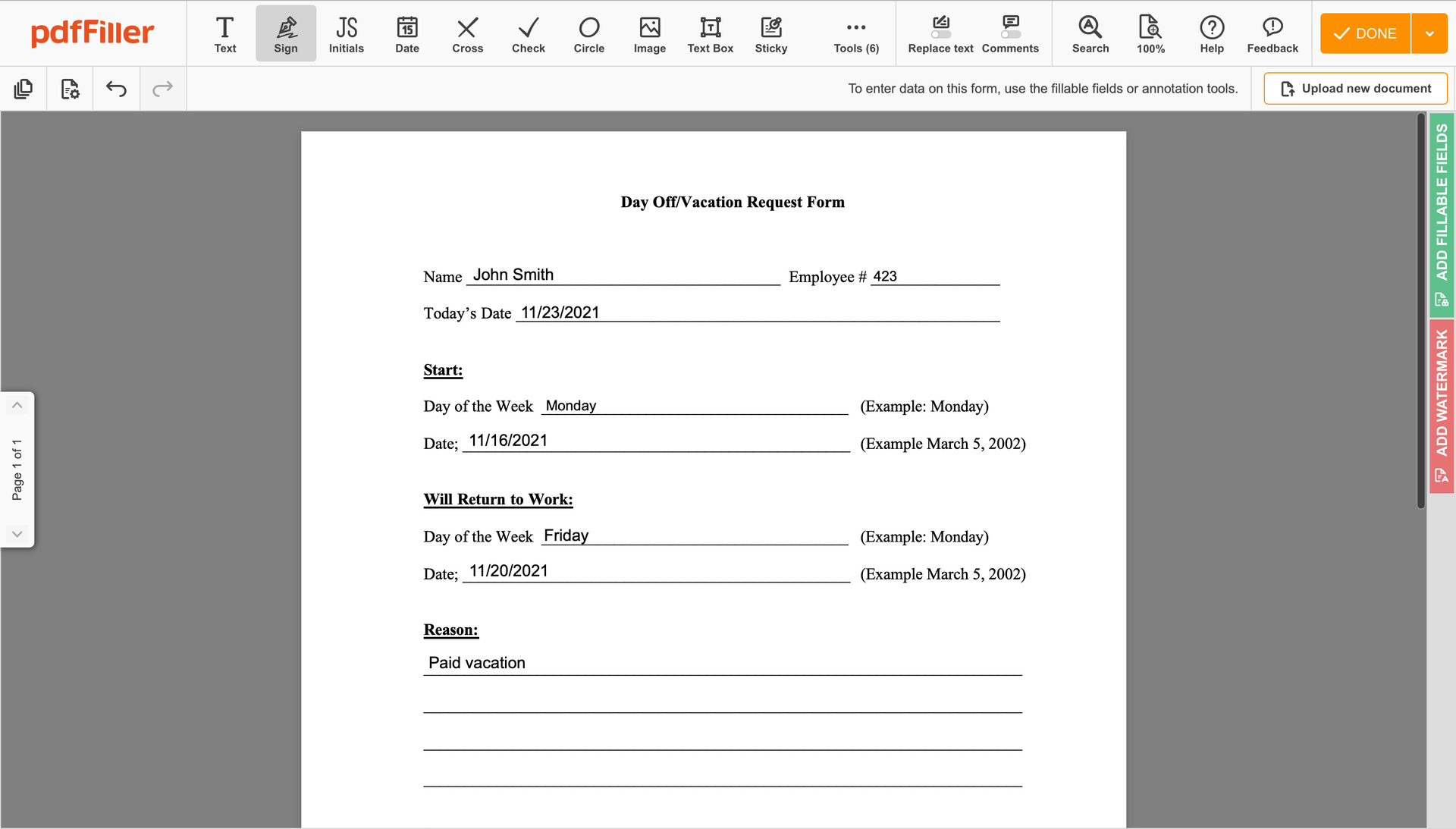

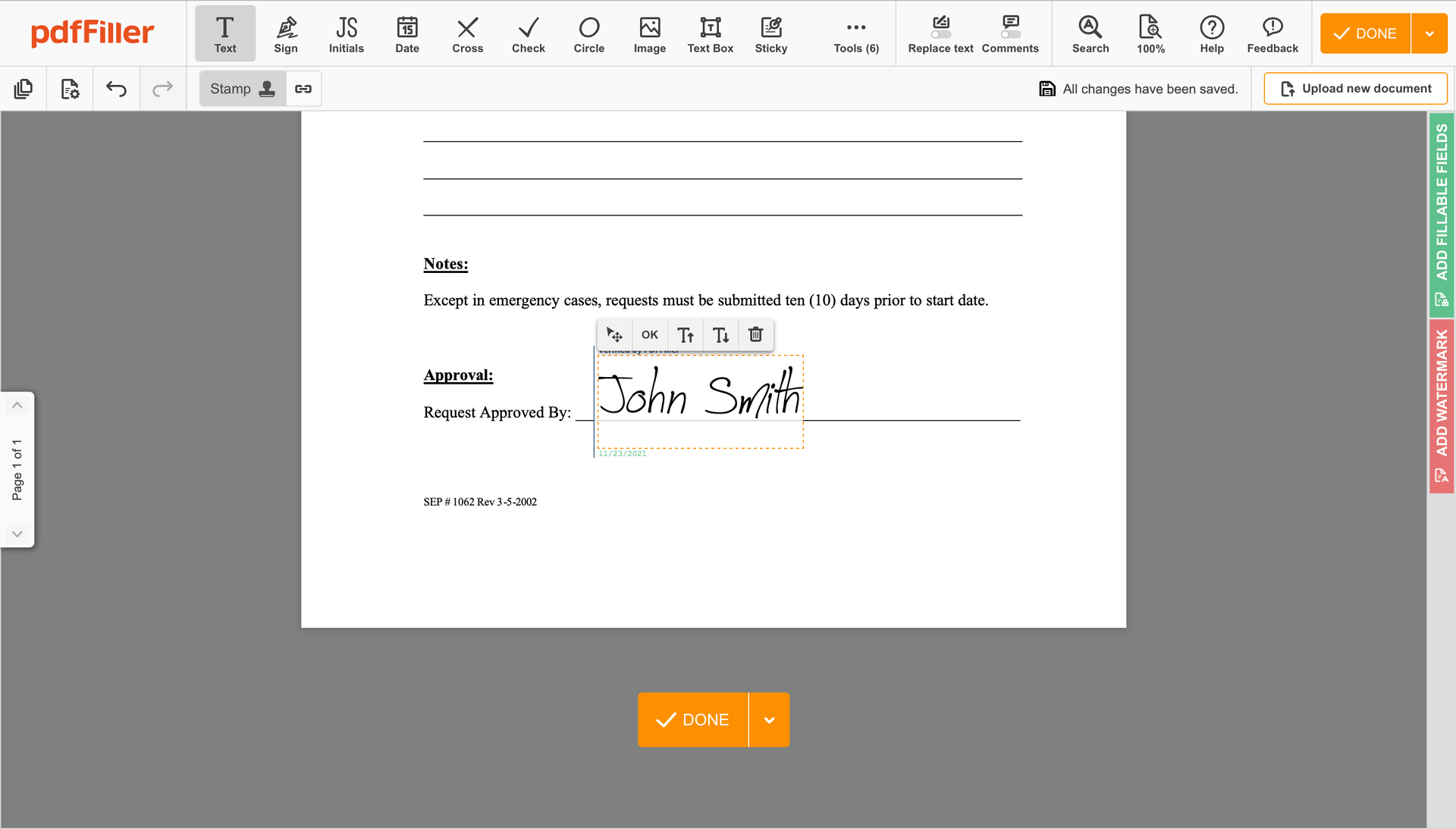

Use the toolbar at the top of the page and select the Sign option.

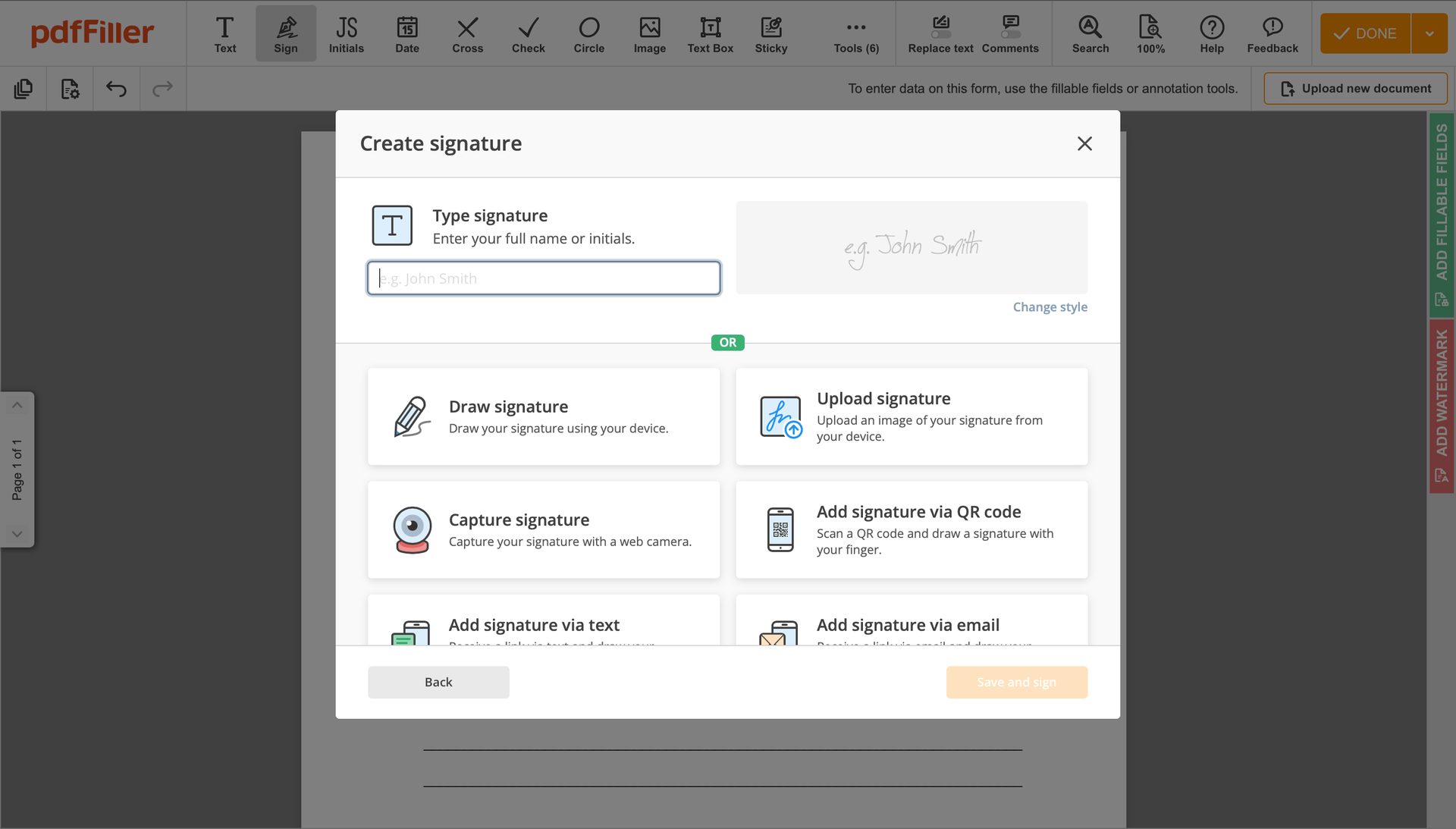

You can mouse-draw your signature, type it or upload a photo of it - our tool will digitize it in a blink of an eye. As soon as your signature is created, hit Save and sign.

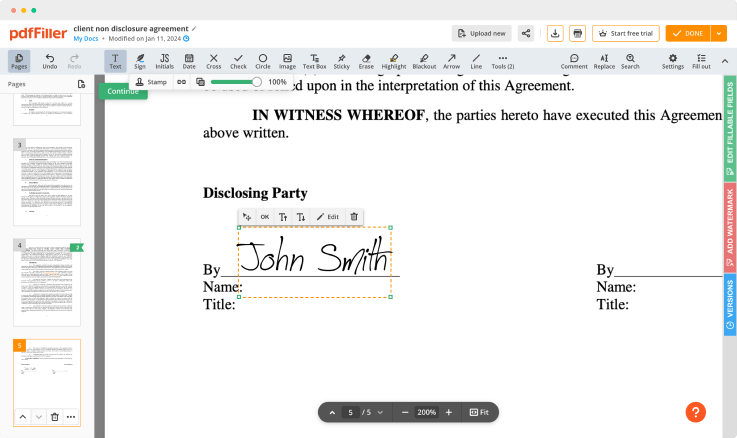

Click on the form area where you want to put an Initial Accounts Receivable Purchase Agreement. You can move the newly created signature anywhere on the page you want or change its settings. Click OK to save the adjustments.

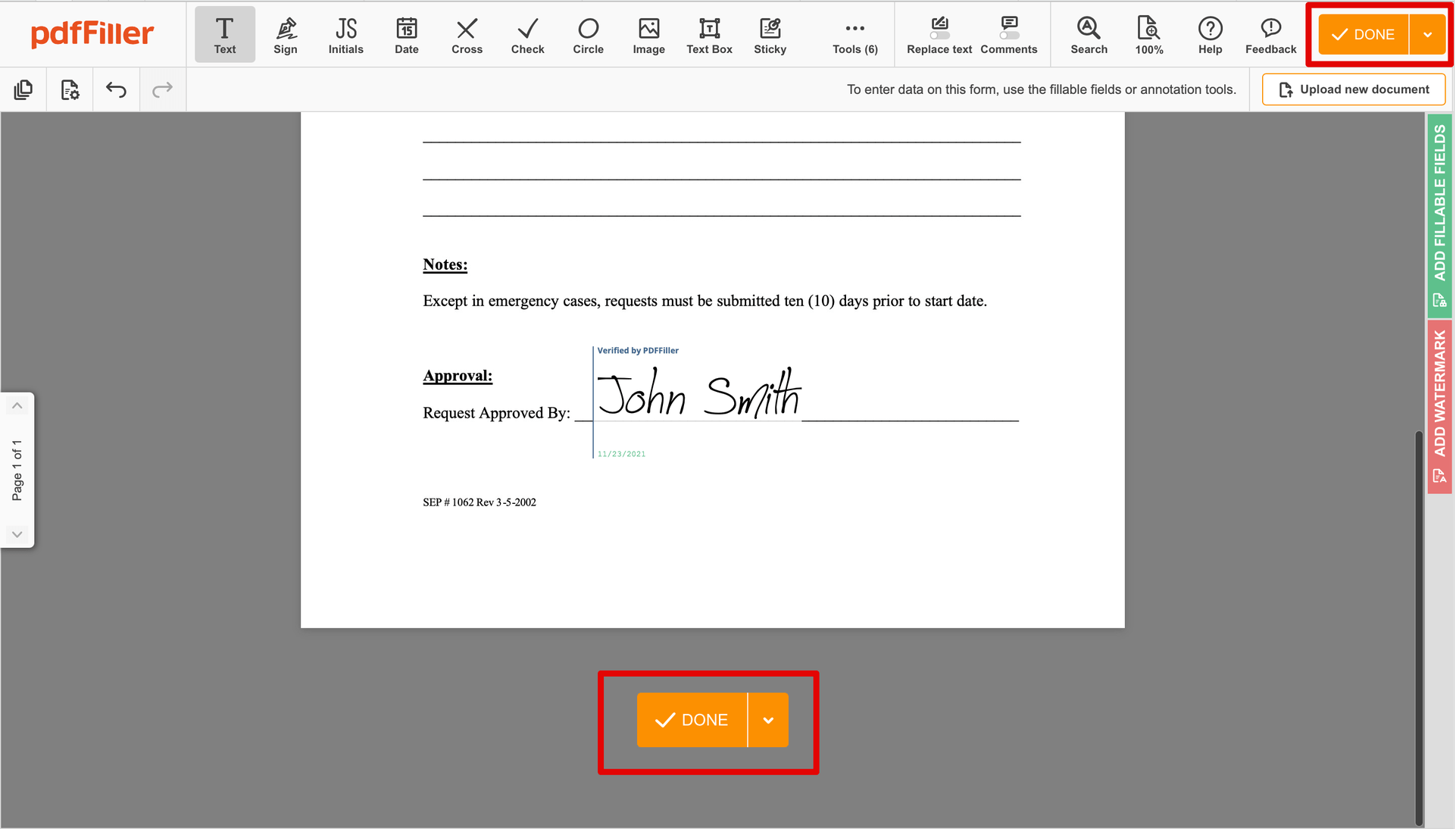

Once your form is good to go, click on the DONE button in the top right area.

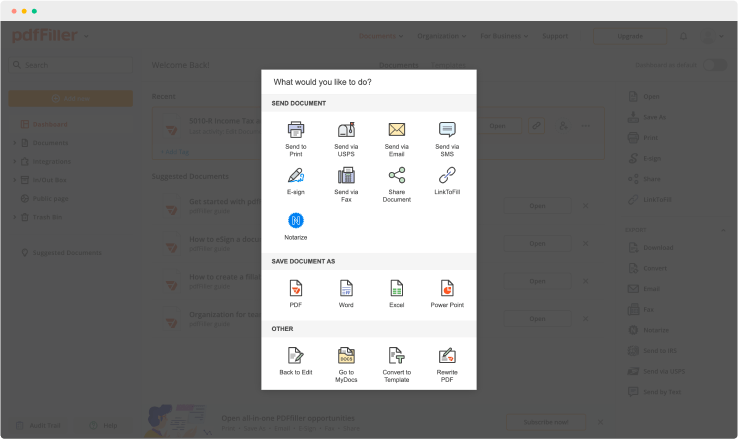

Once you're through with signing, you will be redirected to the Dashboard.

Use the Dashboard settings to get the completed form, send it for further review, or print it out.

Still using different programs to manage and modify your documents? We've got the perfect all-in-one solution for you. Use our document management tool for the fast and efficient workflow. Create document templates from scratch, modify existing form sand other useful features, without leaving your account. Plus, the opportunity to use Initial Accounts Receivable Purchase Agreement and add high-quality professional features like signing orders, reminders, requests, easier than ever. Get the value of full featured tool, for the cost of a lightweight basic app.

How to edit a PDF document using the pdfFiller editor:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Initial Accounts Receivable Purchase Agreement