Join Word in the W-9 Tax Form with ease

To join Word in the W-9 Tax Form using pdfFiller, simply upload your document, use the editing tools to seamlessly merge Word content into the form, and save your PDF for distribution. This streamlined process enhances your efficiency in tax-related documentation.

What is joining Word in the W-9 tax form?

Joining Word in the W-9 tax form refers to the process of combining information from a Word document into the structured fields of the IRS W-9 form. The W-9 form is used by US taxpayers to provide their correct taxpayer identification number (TIN) to individuals or entities who are required to file information returns with the IRS. When completing a W-9, users often need to input specific data that may already exist in Word documents, such as names, addresses, or other relevant details.

Why joining Word in the W-9 tax form matters in PDF workflows

Integrating information from Word into the W-9 form is crucial for time efficiency and accuracy. Users can easily transfer existing information without retyping, reducing the risk of errors. This process is especially important during tax season when timely submissions are necessary. Furthermore, having all information correctly formatted in a PDF aligns with IRS filing requirements, ensuring compliance.

Core capabilities of joining Word in the W-9 form in pdfFiller

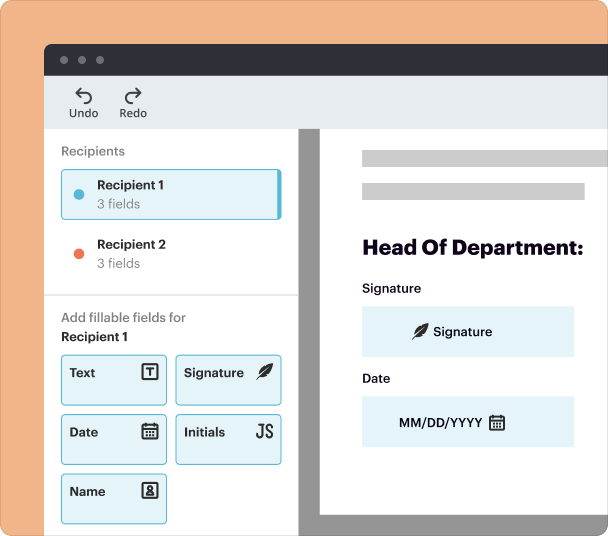

pdfFiller provides several core capabilities for joining Word content into the W-9 tax form, enhancing the user experience:

-

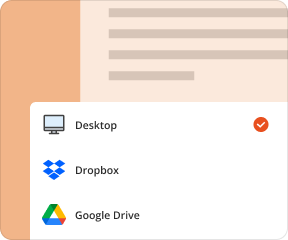

1.Seamless document uploading from multiple sources.

-

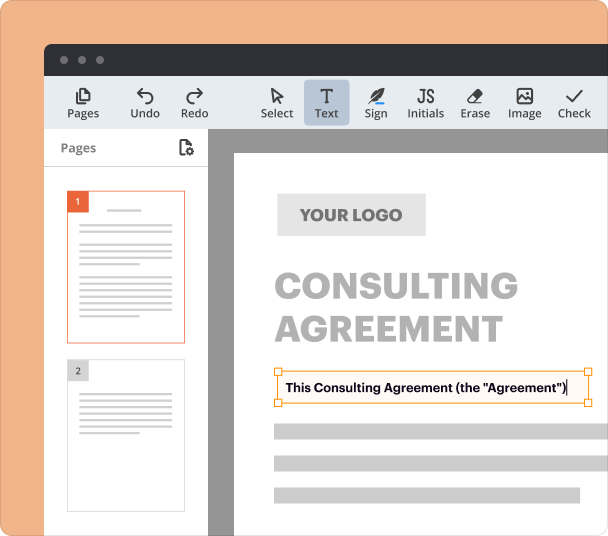

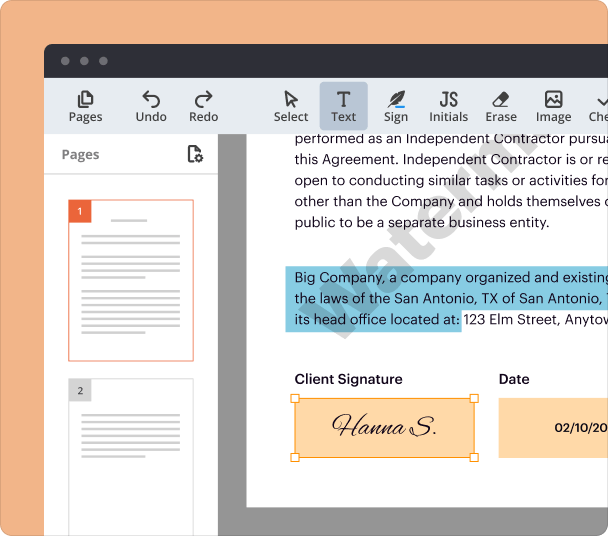

2.Advanced editing tools for precise text placement and formatting.

-

3.Interactive fields that adhere to W-9 standards.

-

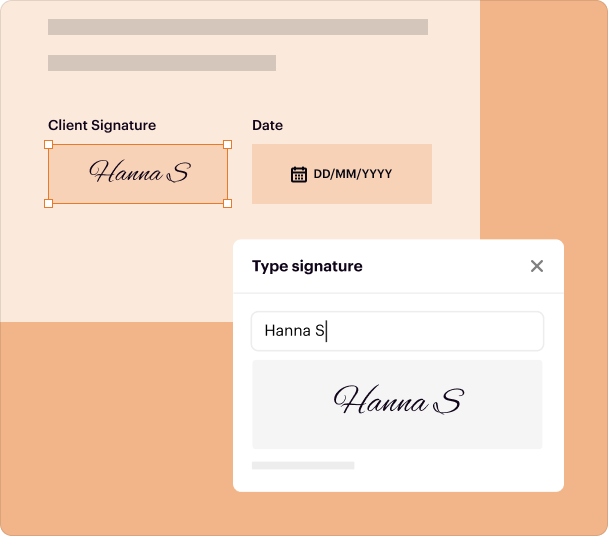

4.Options to save, share, and eSign the final document.

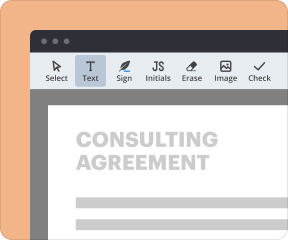

Formatting text in the W-9 form: fonts, size, color, alignment

When merging text into the W-9 form, pdfFiller allows users to customize fonts, sizes, colors, and alignment. This flexibility ensures that all text appears professional and aligns well within the designated fields of the form. Users can choose standard fonts for coherence or apply specific styles to highlight critical information, thus ensuring that the form is both functional and visually appealing.

Erasing and redacting content through joining Word

It’s essential to remove or redact any unnecessary information from the W-9 before submission. pdfFiller offers straightforward tools for erasing and redacting content directly within the document. Users can quickly select areas for deletion or redact sensitive information to maintain privacy while ensuring that the remaining information is complete and accurate for the IRS.

Applying styles: bold, italic, underline in the W-9 form

pdfFiller makes it easy to enhance the visibility of important data by applying text styles such as bold, italic, or underline. This functionality allows users to emphasize essential sections of the W-9 form, drawing attention to critical details that may be required during tax processing. Utilizing these styles not only beautifies the document but also improves clarity and organization.

How to join Word in the W-9 form step-by-step using pdfFiller

Joining Word content into the W-9 form on pdfFiller is straightforward. Follow these steps:

-

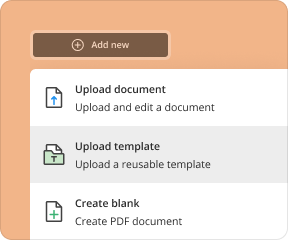

1.Log into your pdfFiller account.

-

2.Upload the W-9 form from your computer or cloud storage.

-

3.Use the document editing tools to insert text from your Word document.

-

4.Format the text as needed (fonts, color, alignment).

-

5.Save your changes and download or eSign the document.

Typical use-cases and industries applying joining Word in the W-9

Various industries rely on the ability to join Word documents into the W-9 form, including:

-

1.Freelancers and contractors who need to submit W-9 forms to clients.

-

2.Accountants managing multiple clients’ tax forms.

-

3.Business owners who require efficient management of contractor documentation.

-

4.Non-profit organizations utilizing W-9s for vendor payments.

Alternatives compared to pdfFiller's joining Word in the W-9 form

While pdfFiller offers a robust platform for joining Word documents into the W-9 form, other alternatives exist. Some popular options include:

-

1.Adobe Acrobat: Another strong PDF editing tool, but with a steeper learning curve.

-

2.Smallpdf: A more straightforward PDF editor, but lacks advanced form-filling features.

-

3.JotForm: Focused more on form creation than editing existing PDFs.

Conclusion

Joining Word in the W-9 tax form using pdfFiller is a simple yet vital process for anyone managing tax information. With user-friendly editing features, extensive formatting options, and compliance measures, pdfFiller stands out as an excellent platform for this task. Whether you are an independent contractor, a business owner, or part of an organization, utilizing pdfFiller ensures that your W-9 forms are completed accurately and efficiently.

How to edit PDFs with pdfFiller

Who needs this?

PDF editing is just the beginning

More than a PDF editor

Your productivity booster

Your documents—secured

pdfFiller scores top ratings on review platforms