Lock Up Company Release For Free

Join the world’s largest companies

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Unlock Your Potential with Lock Up Company Release Feature

The Lock Up Company Release feature empowers businesses to manage their projects and resources effectively. This solution streamlines the process of releasing lock-up securities, enabling smoother operations.

Key Features

Potential Use Cases and Benefits

This feature simplifies your lock-up release process, reducing the stress of managing deadlines and paperwork. With tools designed for clarity and efficiency, you can focus on your core business tasks, knowing that your releases are handled with accuracy and security.

Instructions and Help about Lock Up Company Release For Free

Lock Up Company Release: full-featured PDF editor

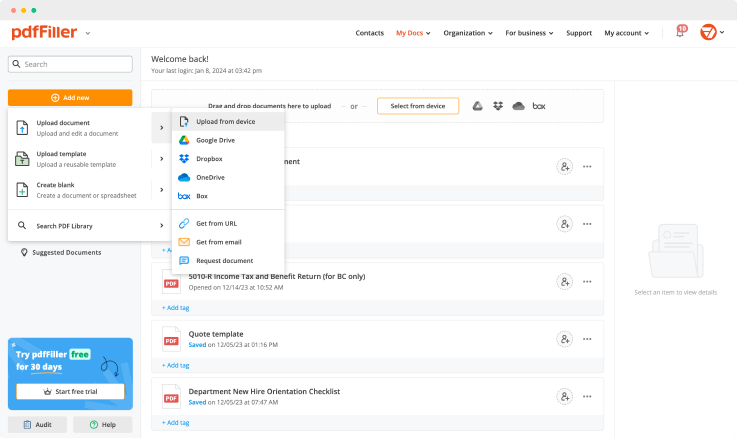

If you have ever needed to fill out an application form or affidavit in really short terms, you already know that doing it online using PDF documents is the simplest way. In case share PDFs with others, and if you want to ensure the accuracy of the information you are sharing, try using PDF editing tools. You only need a PDF editor to make any changes to your document: rewrite the text or add some more, attach media or fillable fields.

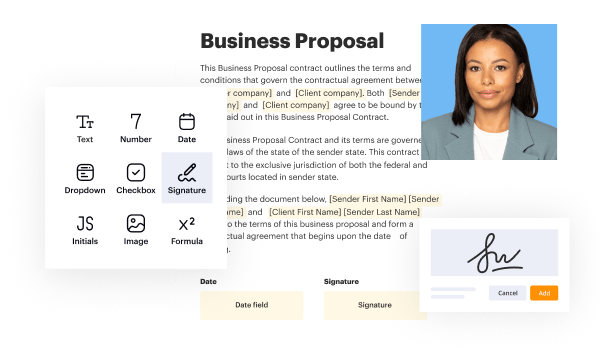

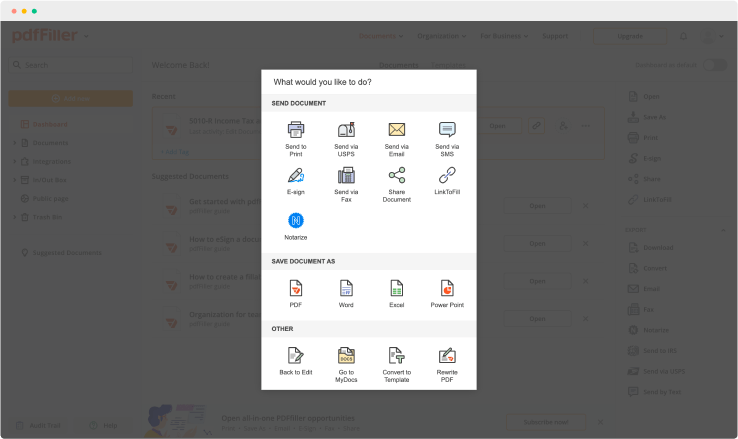

Using pdfFiller, add text, spreadsheets, pictures, checkmarks, edit existing content or create entirely new documents. When finished, save it as a PDF file, or export to the platform you're using with built-in integration's features. Convert PDFs into Excel sheets, pictures, Word files and much more.

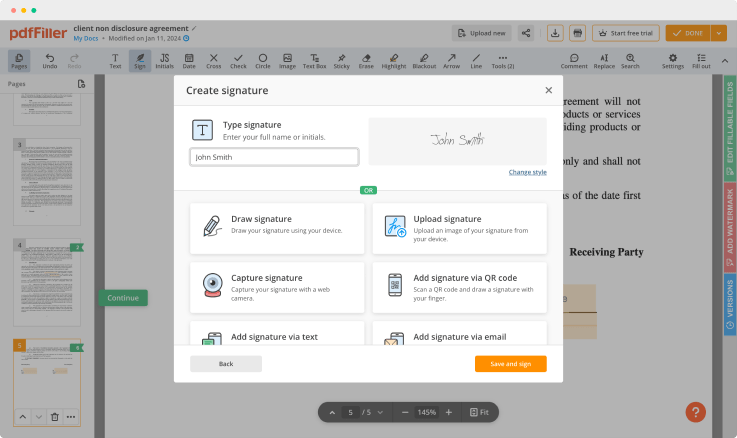

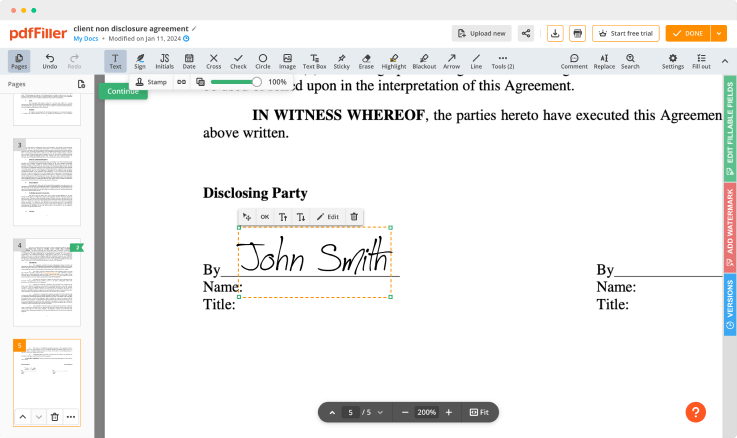

Sign documents digitally using e-signature, which you can create with your mouse or touchpad, or scan from a photograph. Get access to this from all your devices, your signature will be verified all across the United States according to the DESIGN Act. Use an existing digital signature (upload it from your device, or take a photo), write it down, or verify documents with QR codes.

Discover powerful editing features to make your documents look professional. Store your data securely and access across all your devices using cloud storage.

Edit. Change the content or mix it up with images, apply watermarks or add checkboxes

Create documents from scratch. Add and edit text, signature field, checkboxes and much more

Fill out forms. Select from the range of ready-made templates and select the one you are looking for

Provide safety. Prevent third parties from unauthorized access to your data

Change the format. Convert PDF files to any format including Word, Excel, Google Docs, Pages and more

For pdfFiller’s FAQs

Ready to try pdfFiller's? Lock Up Company Release