Lock Up Date Document For Free

Join the world’s largest companies

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Lock Up Date Document Feature

The Lock Up Date Document feature provides a reliable way to manage important dates in your projects. You can keep track of critical deadlines and ensure everyone is aligned on what needs to be done and when.

Key Features

Potential Use Cases and Benefits

By using the Lock Up Date Document feature, you can solve the problem of chaotic schedules and missed deadlines. This tool keeps your team organized, informed, and focused on the right tasks. You can minimize confusion and improve productivity while ensuring that everyone knows their responsibilities.

Instructions and Help about Lock Up Date Document For Free

Lock Update Document: make editing documents online a breeze

Since PDF is the most widely used document format in business transactions, having the best PDF editing tool is essential.

If you aren't using PDF as a general file format, you can convert any other type into it very easily. You can also create just one PDF file to replace multiple documents of different formats. The Portable Document Format is perfect for comprehensive presentations and easy-to-read reports.

Though numerous online solutions provide PDF editing features, only a few of them allow adding signatures, collaborating with others etc.

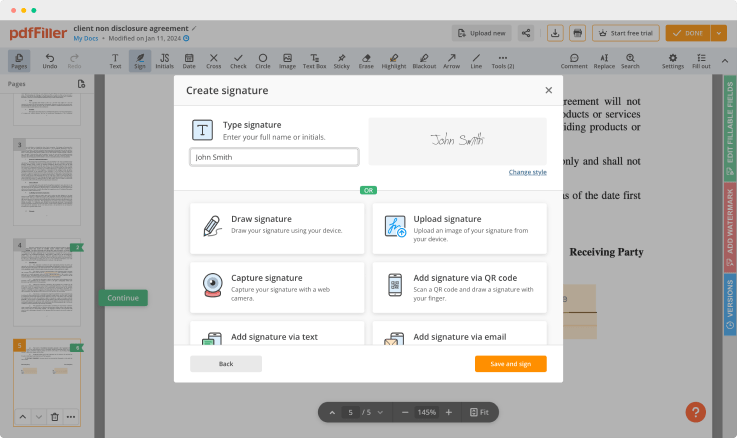

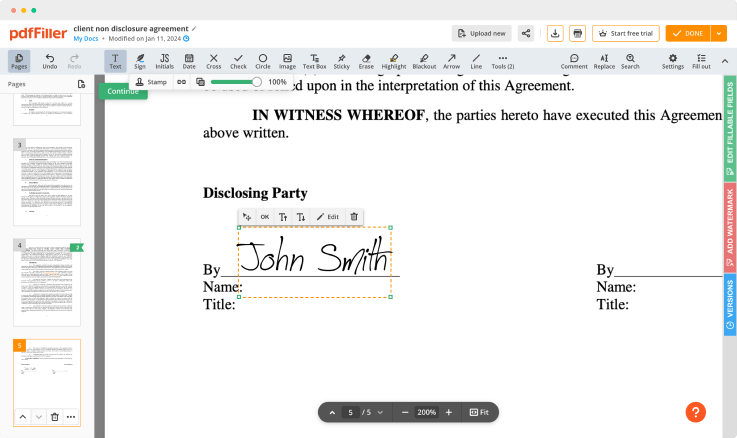

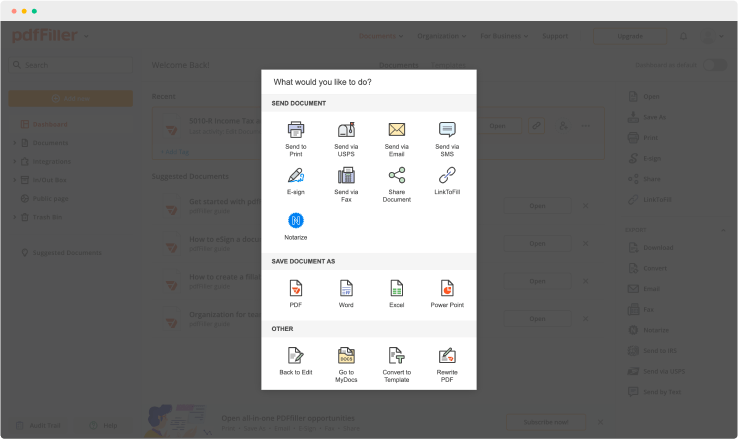

pdfFiller’s editor has features for editing, annotating, converting PDFs to other formats, adding digital signatures, and filling PDF forms. pdfFiller is an online PDF editing solution available via a web browser. You don’t have to install any applications.

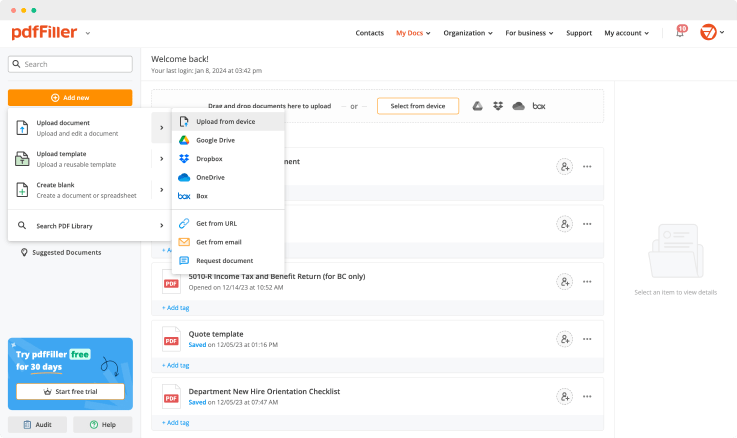

Create a document yourself or upload a form using the following methods:

Once you uploaded the document, it’s saved in the cloud and can be found in the “My Documents” folder.

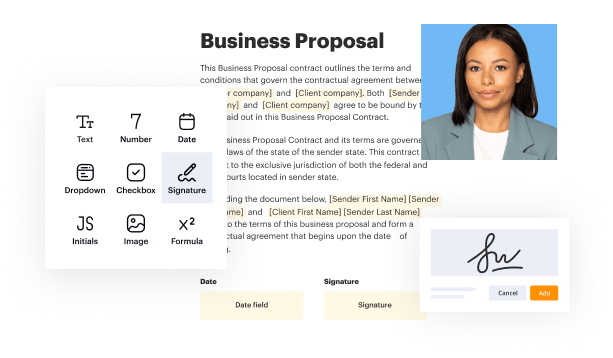

Use powerful editing features to type in text, annotate and highlight. Change a page order. Once a document is completed, download it to your device or save it to cloud. Collaborate with people to fill out the document and request an attachment. Add images to your PDF and edit its layout. Add fillable fields and send for signing.

For pdfFiller’s FAQs

Ready to try pdfFiller's? Lock Up Date Document